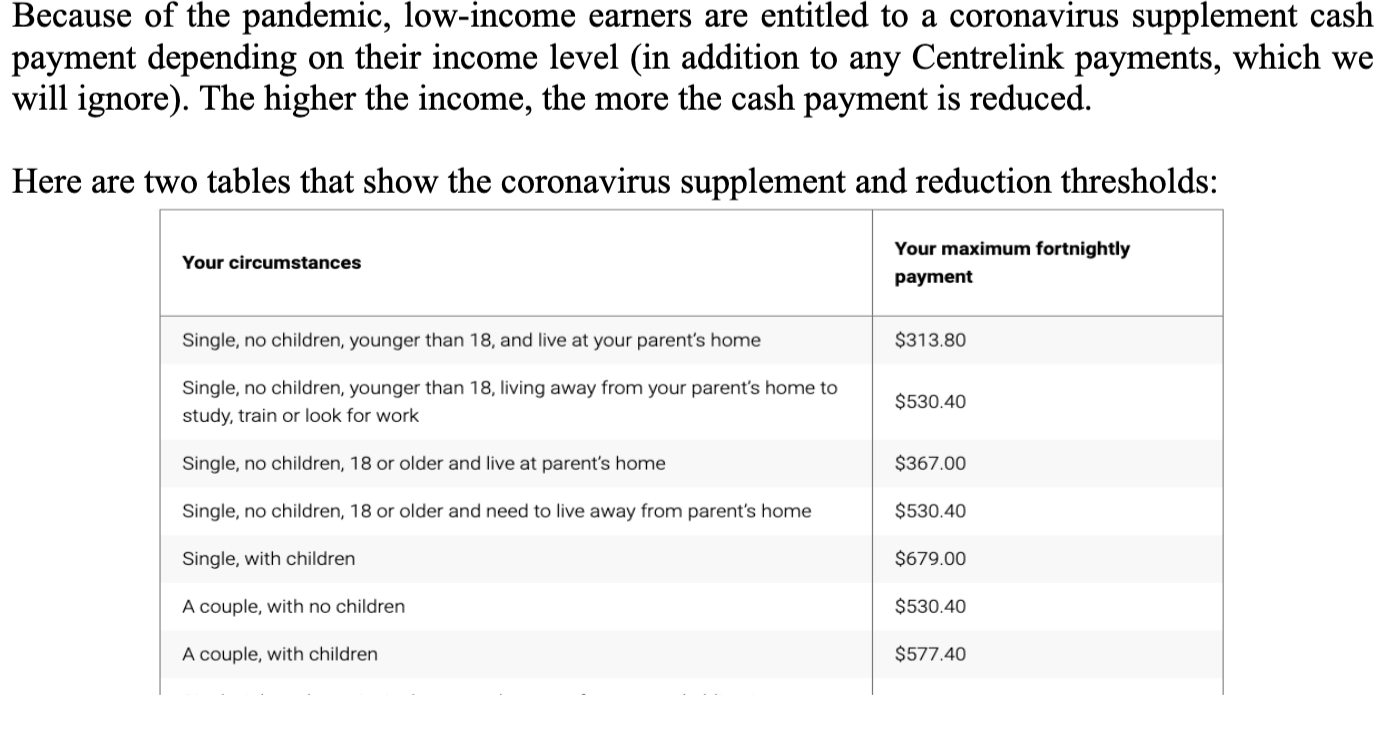

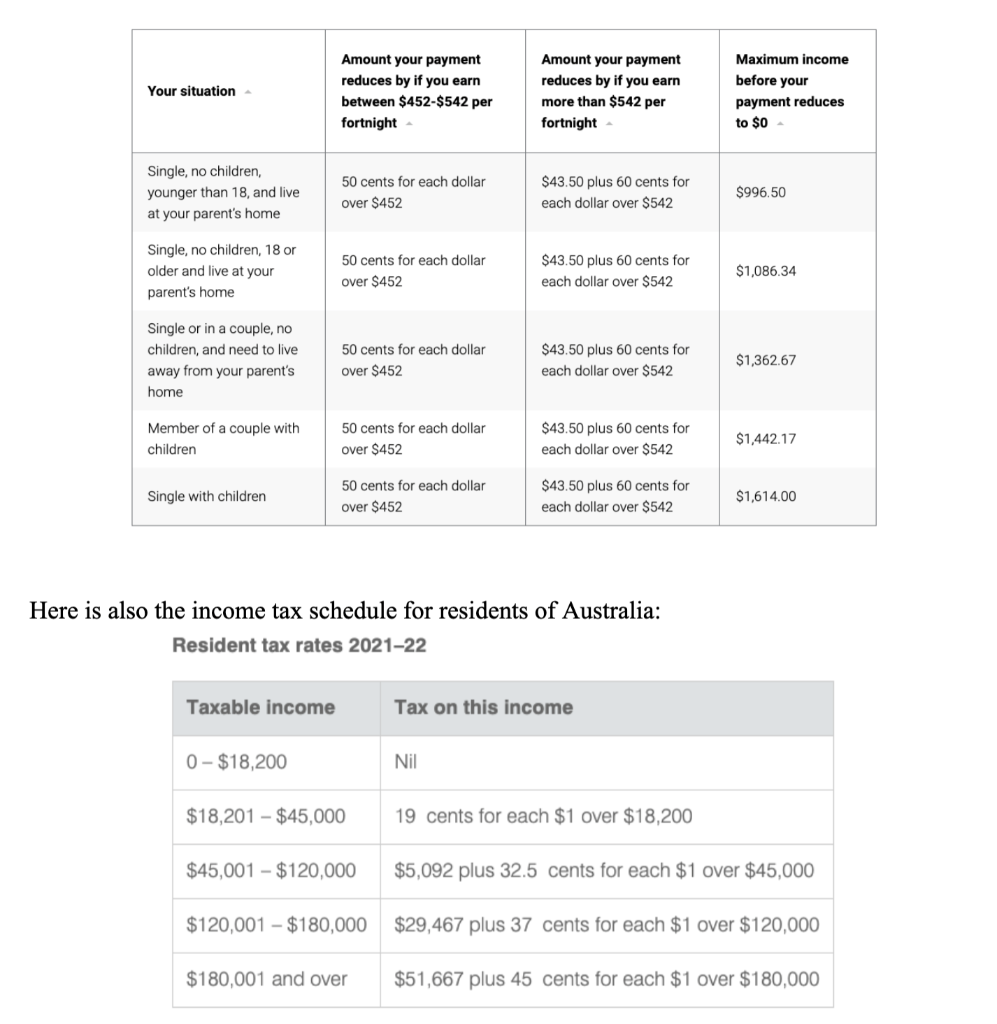

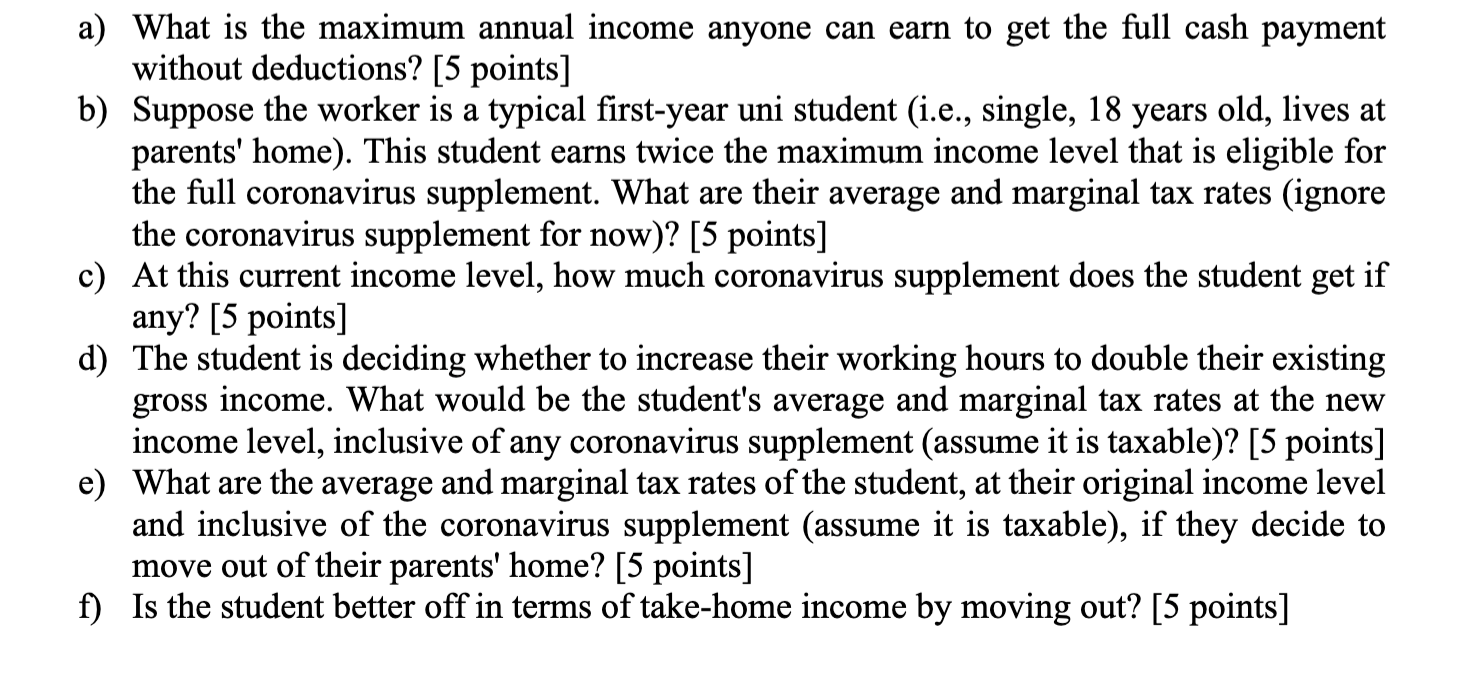

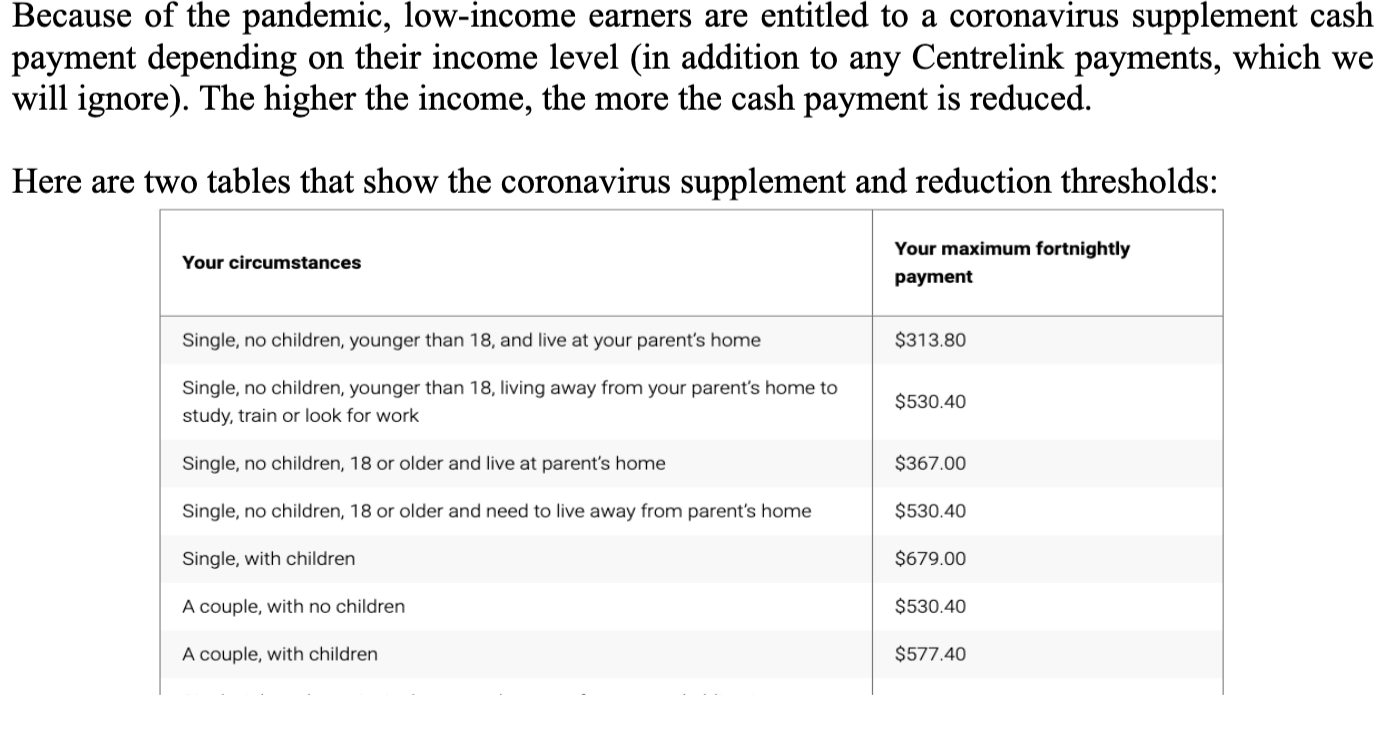

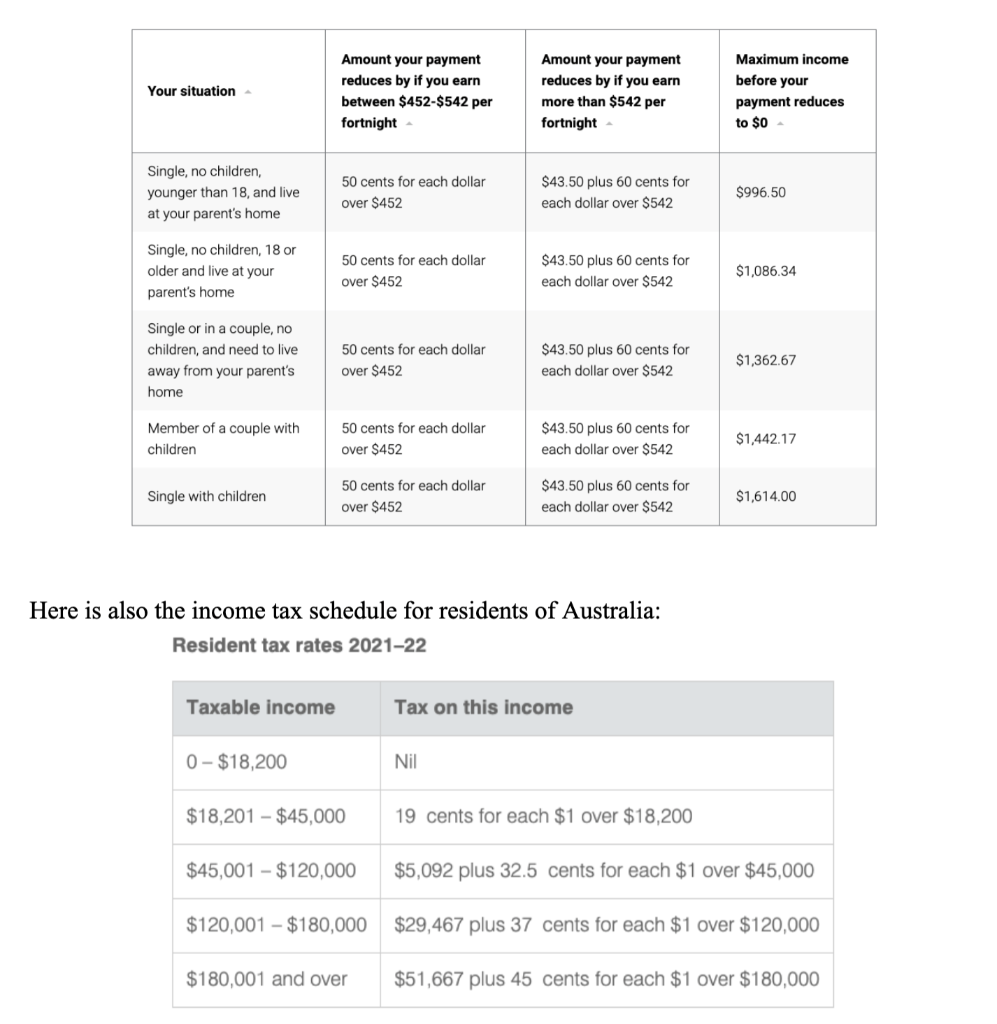

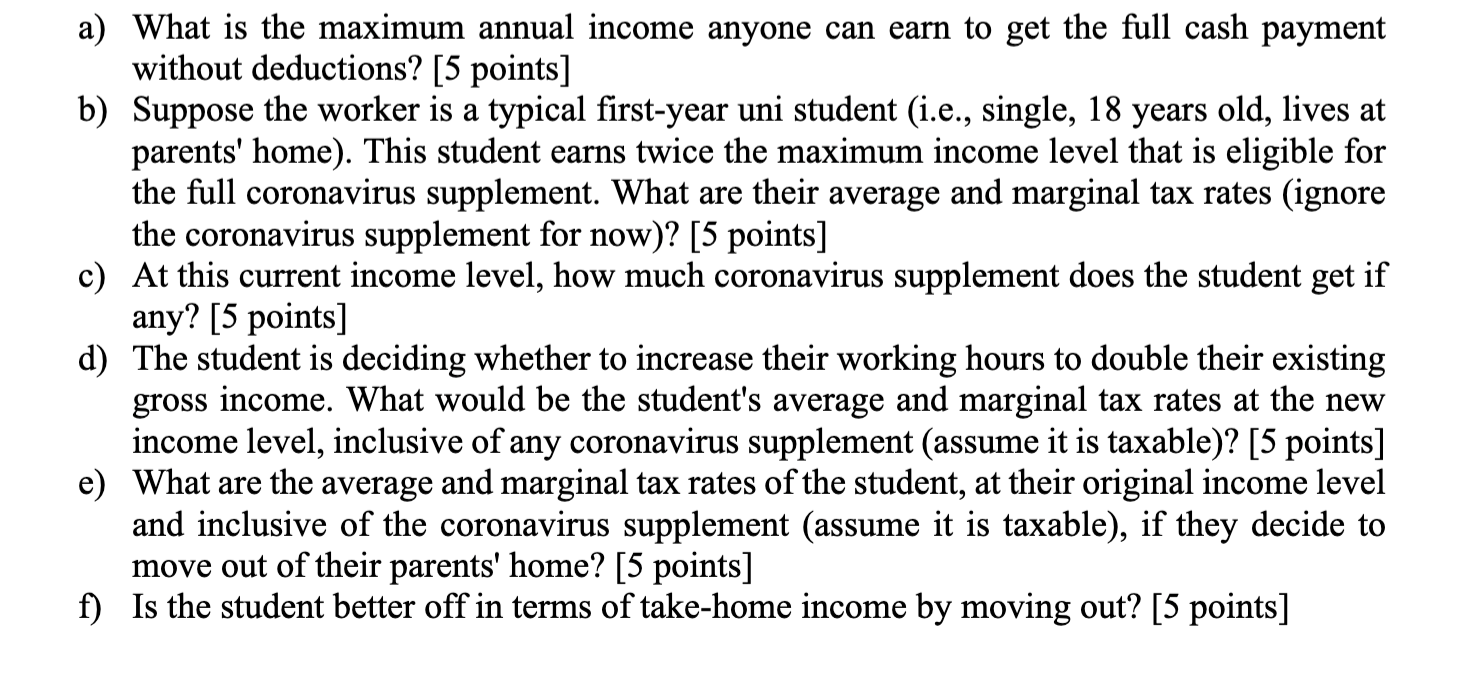

Because of the pandemic, low-income earners are entitled to a coronavirus supplement cash payment depending on their income level (in addition to any Centrelink payments, which we will ignore). The higher the income, the more the cash payment is reduced. Here are two tables that show the coronavirus supplement and reduction thresholds: Your circumstances Your maximum fortnightly payment Single, no children, younger than 18, and live at your parent's home $313.80 Single, no children, younger than 18, living away from your parent's home to study, train or look for work $530.40 Single, no children, 18 or older at parent's $367.00 Single, no children, 18 or older and need to live away from parent's home $530.40 Single, with children $679.00 A couple, with no children $530.40 A couple, with children $577.40 Your situation Amount your payment reduces by if you earn between $452-$542 per fortnight Amount your payment reduces by if you earn more than $542 per fortnight Maximum income before your payment reduces to $O Single, no children, younger than 18, and live at your parent's home 50 cents for each dollar over $452 $43.50 plus 60 cents for each dollar over $542 $996.50 Single, no children, 18 or older and live at your parent's home 50 cents for each dollar over $452 $43.50 plus 60 cents for each dollar over $542 $1,086.34 Single or in a couple, no children, and need to live away from your parent's home 50 cents for each dollar over $452 $43.50 plus 60 cents for each dollar over $542 $1,362.67 Member of a couple with children 50 cents for each dollar over $452 $43.50 plus 60 cents for each dollar over $542 $1,442.17 Single with children 50 cents for each dollar over $452 $43.50 plus 60 cents for each dollar over $542 $1,614.00 Here is also the income tax schedule for residents of Australia: Resident tax rates 2021-22 Taxable income Tax on this income 0-$18,200 Nil $18,201 - $45,000 19 cents for each $1 over $18,200 $45,001 - $120,000 $5,092 plus 32.5 cents for each $1 over $45,000 $120,001 - $180,000 $29,467 plus 37 cents for each $1 over $120,000 $180,001 and over $51,667 plus 45 cents for each $1 over $180,000 a) What is the maximum annual income anyone can earn to get the full cash payment without deductions? [5 points] b) Suppose the worker is a typical first-year uni student (i.e., single, 18 years old, lives at parents' home). This student earns twice the maximum income level that is eligible for the full coronavirus supplement. What are their average and marginal tax rates (ignore the coronavirus supplement for now)? [5 points] c) At this current income level, how much coronavirus supplement does the student get if any? [5 points] d) The student is deciding whether to increase their working hours to double their existing gross income. What would be the student's average and marginal tax rates at the new income level, inclusive of any coronavirus supplement (assume it is taxable)? [5 points] What are the average and marginal tax rates of the student, at their original income level and inclusive of the coronavirus supplement (assume it is taxable), if they decide to move out of their parents' home? [5 points] f) Is the student better off in terms of take-home income by moving out? [5 points] Because of the pandemic, low-income earners are entitled to a coronavirus supplement cash payment depending on their income level (in addition to any Centrelink payments, which we will ignore). The higher the income, the more the cash payment is reduced. Here are two tables that show the coronavirus supplement and reduction thresholds: Your circumstances Your maximum fortnightly payment Single, no children, younger than 18, and live at your parent's home $313.80 Single, no children, younger than 18, living away from your parent's home to study, train or look for work $530.40 Single, no children, 18 or older at parent's $367.00 Single, no children, 18 or older and need to live away from parent's home $530.40 Single, with children $679.00 A couple, with no children $530.40 A couple, with children $577.40 Your situation Amount your payment reduces by if you earn between $452-$542 per fortnight Amount your payment reduces by if you earn more than $542 per fortnight Maximum income before your payment reduces to $O Single, no children, younger than 18, and live at your parent's home 50 cents for each dollar over $452 $43.50 plus 60 cents for each dollar over $542 $996.50 Single, no children, 18 or older and live at your parent's home 50 cents for each dollar over $452 $43.50 plus 60 cents for each dollar over $542 $1,086.34 Single or in a couple, no children, and need to live away from your parent's home 50 cents for each dollar over $452 $43.50 plus 60 cents for each dollar over $542 $1,362.67 Member of a couple with children 50 cents for each dollar over $452 $43.50 plus 60 cents for each dollar over $542 $1,442.17 Single with children 50 cents for each dollar over $452 $43.50 plus 60 cents for each dollar over $542 $1,614.00 Here is also the income tax schedule for residents of Australia: Resident tax rates 2021-22 Taxable income Tax on this income 0-$18,200 Nil $18,201 - $45,000 19 cents for each $1 over $18,200 $45,001 - $120,000 $5,092 plus 32.5 cents for each $1 over $45,000 $120,001 - $180,000 $29,467 plus 37 cents for each $1 over $120,000 $180,001 and over $51,667 plus 45 cents for each $1 over $180,000 a) What is the maximum annual income anyone can earn to get the full cash payment without deductions? [5 points] b) Suppose the worker is a typical first-year uni student (i.e., single, 18 years old, lives at parents' home). This student earns twice the maximum income level that is eligible for the full coronavirus supplement. What are their average and marginal tax rates (ignore the coronavirus supplement for now)? [5 points] c) At this current income level, how much coronavirus supplement does the student get if any? [5 points] d) The student is deciding whether to increase their working hours to double their existing gross income. What would be the student's average and marginal tax rates at the new income level, inclusive of any coronavirus supplement (assume it is taxable)? [5 points] What are the average and marginal tax rates of the student, at their original income level and inclusive of the coronavirus supplement (assume it is taxable), if they decide to move out of their parents' home? [5 points] f) Is the student better off in terms of take-home income by moving out? [5 points]