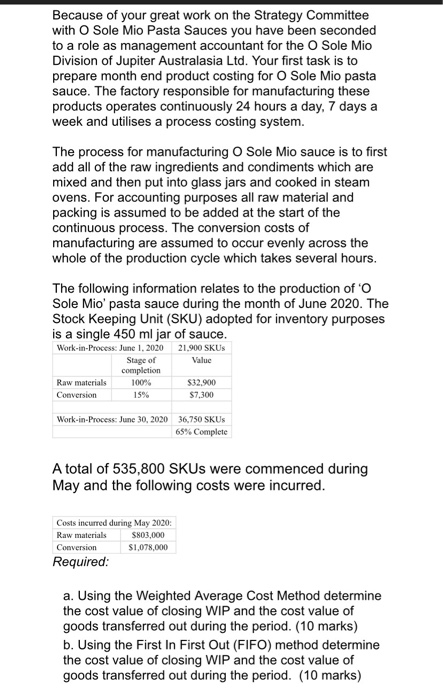

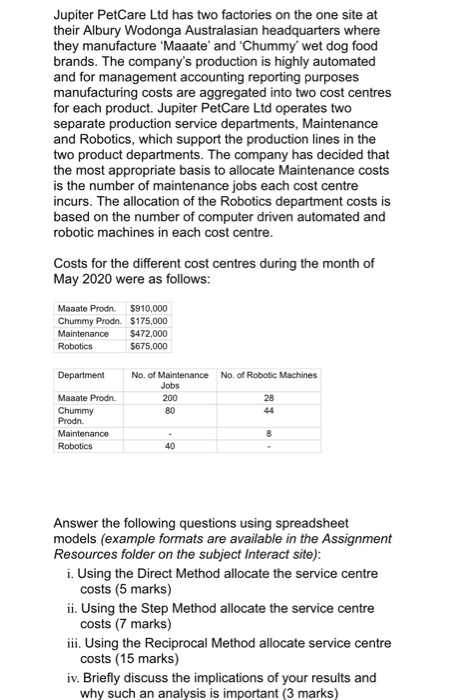

Because of your great work on the Strategy Committee with O Sole Mio Pasta Sauces you have been seconded to a role as management accountant for the O Sole Mio Division of Jupiter Australasia Ltd. Your first task is to prepare month end product costing for O Sole Mio pasta sauce. The factory responsible for manufacturing these products operates continuously 24 hours a day, 7 days a week and utilises a process costing system. The process for manufacturing O Sole Mio sauce is to first add all of the raw ingredients and condiments which are mixed and then put into glass jars and cooked in steam ovens. For accounting purposes all raw material and packing is assumed to be added at the start of the continuous process. The conversion costs of manufacturing are assumed to occur evenly across the whole of the production cycle which takes several hours. The following information relates to the production of 'O Sole Mio' pasta sauce during the month of June 2020. The Stock Keeping Unit (SKU) adopted for inventory purposes is a single 450 ml jar of sauce. Work-in-Process: June 1.2020 21.900 SKUS Stage of completion Raw materials 100% $32.900 Conversion $7.300 Value 15% Work-in-Process: June 30, 2020 36,750 SKUS 65% Complete A total of 535,800 SKUs were commenced during May and the following costs were incurred. Costs incurred during May 2020: Raw materials $803,000 Conversion $1,078,000 Required: a. Using the Weighted Average Cost Method determine the cost value of closing WIP and the cost value of goods transferred out during the period. (10 marks) b. Using the First In First Out (FIFO) method determine the cost value of closing WIP and the cost value of goods transferred out during the period. (10 marks) Jupiter PetCare Ltd has two factories on the one site at their Albury Wodonga Australasian headquarters where they manufacture 'Maaate' and 'Chummy' wet dog food brands. The company's production is highly automated and for management accounting reporting purposes manufacturing costs are aggregated into two cost centres for each product. Jupiter PetCare Ltd operates two separate production service departments, Maintenance and Robotics, which support the production lines in the two product departments. The company has decided that the most appropriate basis to allocate Maintenance costs is the number of maintenance jobs each cost centre incurs. The allocation of the Robotics department costs is based on the number of computer driven automated and robotic machines in each cost centre. Costs for the different cost centres during the month of May 2020 were as follows: Maaate Prodn. $910,000 Chummy Prodn. $175,000 Maintenance $472,000 Robotics $675,000 Department No. of Maintenance No. of Robotic Machines Jobs 200 28 80 Maaate Prodn. Chummy Prodn. Maintenance Robotics 8 40 Answer the following questions using spreadsheet models (example formats are available in the Assignment Resources folder on the subject Interact site): i. Using the Direct Method allocate the service centre costs (5 marks) ii. Using the Step Method allocate the service centre costs (7 marks) iii. Using the Reciprocal Method allocate service centre costs (15 marks) iv. Briefly discuss the implications of your results and why such an analysis is important