Question

Beck Construction Company began work on a new building project on January 1, 2023. The project is to be completed by December 31, 2025, for

Beck Construction Company began work on a new building project on January 1, 2023. The project is to be completed by December 31, 2025, for a fixed price of $111 million. The following are the actual costs incurred and estimates of remaining costs to complete the project that were made by Beck's accounting staff:

| Years | Actual costs incurred in each year | Estimated remaining costs to complete the project (measured at December 31 of each year) |

|---|---|---|

| 2023 | $ 31 million | $ 62 million |

| 2024 | $ 47 million | $ 47 million |

| 2025 | $ 36 million | $ 0 million |

Required:

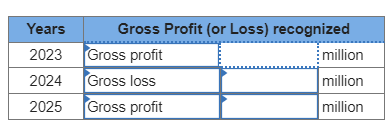

What amount of gross profit (or loss) would Beck record on this project in each year, assuming that Beck recognizes revenue for this project upon completion of the project?

Note: Enter "None" if there is no requirement of recognizing profit or loss. Loss amounts should be indicated with a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started