Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Becker CPA Review 4- Bill and Jane Jones were divorced on January 1, 2018. They have no children. In accordance with the divorce decree, Bill

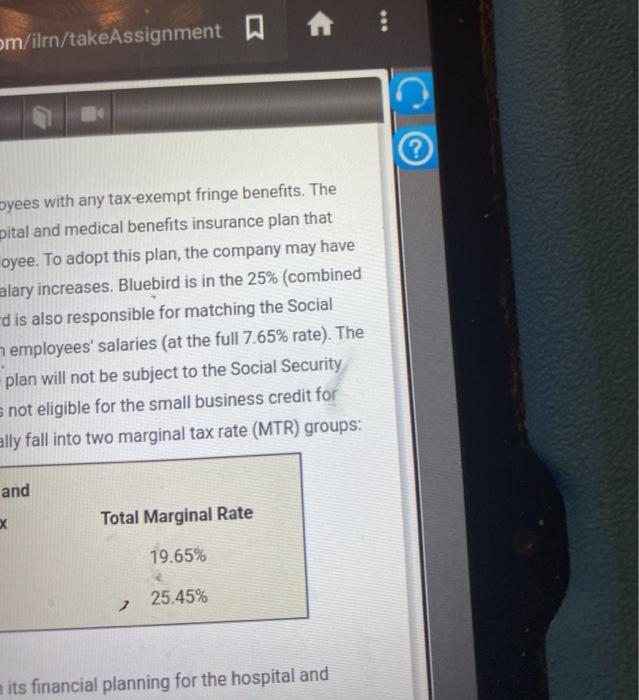

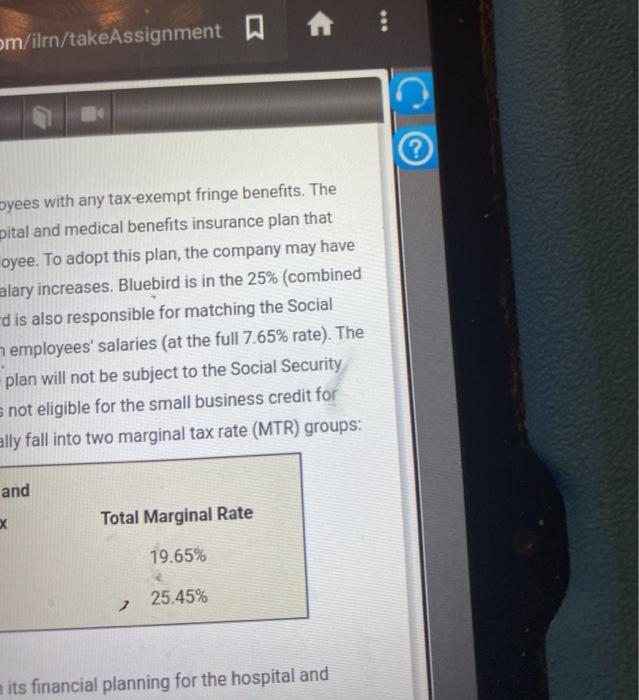

Becker CPA Review 4- Bill and Jane Jones were divorced on January 1, 2018. They have no children. In accordance with the divorce decree, Bill transferred the title of their house over to Jane. The home had a fair market value of $250,000 and was subject to a $100,000 mortgage. Under the divorce agreement, Bill is to make $1,000 monthly mortgage payments on the home for the remainder of the mortgage. In the current year, Bill made 12 mortgage payments. What amount is taxable to Jane in the current year? a. $12,000 Ob. $250,000 c. $100,000 d. $0 doo m/ilrn/takeAssignment D A ? byees with any tax-exempt fringe benefits. The pital and medical benefits insurance plan that oyee. To adopt this plan, the company may have alary increases. Bluebird is in the 25% (combined d is also responsible for matching the Social employees' salaries (at the full 7.65% rate). The plan will not be subject to the Social Security s not eligible for the small business credit for ally fall into two marginal tax rate (MTR) groups: and x Total Marginal Rate 19.65% 25.45% nits financial planning for the hospital and

Becker CPA Review 4- Bill and Jane Jones were divorced on January 1, 2018. They have no children. In accordance with the divorce decree, Bill transferred the title of their house over to Jane. The home had a fair market value of $250,000 and was subject to a $100,000 mortgage. Under the divorce agreement, Bill is to make $1,000 monthly mortgage payments on the home for the remainder of the mortgage. In the current year, Bill made 12 mortgage payments. What amount is taxable to Jane in the current year? a. $12,000 Ob. $250,000 c. $100,000 d. $0 doo m/ilrn/takeAssignment D A ? byees with any tax-exempt fringe benefits. The pital and medical benefits insurance plan that oyee. To adopt this plan, the company may have alary increases. Bluebird is in the 25% (combined d is also responsible for matching the Social employees' salaries (at the full 7.65% rate). The plan will not be subject to the Social Security s not eligible for the small business credit for ally fall into two marginal tax rate (MTR) groups: and x Total Marginal Rate 19.65% 25.45% nits financial planning for the hospital and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started