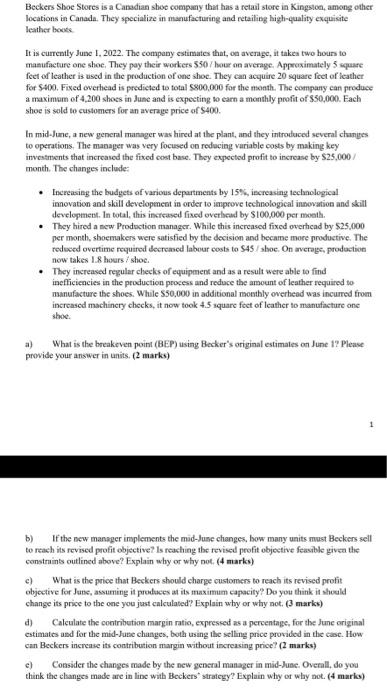

Beckers Shoe Stores is a Canadian shoe company that has a retail store in Kingston, among other locations in Canada. They specialize in manufacturing and retailing high-quality exquisite leather boots It is currently June 1, 2022. The company estimates that, on average, it takes two hours to manufacture one shoe. They pay their workers $50/hour on average. Approximately 5 square feet of leather is used in the production of one shoe. They can acquire 20 square feet of leather for $400. Fixed overhead is predicted to total $800,000 for the month. The company can produce a maximum of 4,200 shoes in June and is expecting to earn a monthly profit of $50,000. Each shoe is sold to customers for an average price of $400. In mid-June, a new general manager was hired at the plant, and they introduced several changes to operations. The manager was very focused on reducing variable costs by making key investments that increased the fixed cost base. They expected profit to increase by $25,000/ month. The changes include: Increasing the budgets of various departments by 15%, increasing technological innovation and skill development in order to improve technological innovation and skill development. In total, this increased fixed overhead by $100,000 per month. They hired a new Production manager. While this increased fixed overhead by $25,000 per month, shoemakers were satisfied by the decision and became more productive. The reduced overtime required decreased labour costs to $45/shoc. On average, production now takes 1.8 hours/shoc. They increased regular checks of equipment and as a result were able to find inefficiencies in the production process and reduce the amount of leather required to manufacture the shoes. While $50,000 in additional monthly overhead was incurred from increased machinery checks, it now took 4.5 square feet of leather to manufacture one shoe. a) What is the breakeven point (BEP) using Becker's original estimates on June 1? Please provide your answer in units. (2 marks) b) If the new manager implements the mid-June changes, how many units must Beckers sell to reach its revised profit objective? Is reaching the revised profit objective feasible given the constraints outlined above? Explain why or why not. (4 marks) c) What is the price that Beckers should charge customers to reach its revised profit objective for June, assuming it produces at its maximum capacity? Do you think it should change its price to the one you just calculated? Explain why or why not. (3 marks) d) Calculate the contribution margin ratio, expressed as a percentage, for the June original estimates and for the mid-June changes, both using the selling price provided in the case. How can Beckers increase its contribution margin without increasing price? (2 marks) 1 c) Consider the changes made by the new general manager in mid-June. Overall, do you think the changes made are in line with Beckers" strategy? Explain why or why not. (4 marks) Beckers Shoe Stores is a Canadian shoe company that has a retail store in Kingston, among other locations in Canada. They specialize in manufacturing and retailing high-quality exquisite leather boots It is currently June 1, 2022. The company estimates that, on average, it takes two hours to manufacture one shoe. They pay their workers $50/hour on average. Approximately 5 square feet of leather is used in the production of one shoe. They can acquire 20 square feet of leather for $400. Fixed overhead is predicted to total $800,000 for the month. The company can produce a maximum of 4,200 shoes in June and is expecting to earn a monthly profit of $50,000. Each shoe is sold to customers for an average price of $400. In mid-June, a new general manager was hired at the plant, and they introduced several changes to operations. The manager was very focused on reducing variable costs by making key investments that increased the fixed cost base. They expected profit to increase by $25,000/ month. The changes include: Increasing the budgets of various departments by 15%, increasing technological innovation and skill development in order to improve technological innovation and skill development. In total, this increased fixed overhead by $100,000 per month. They hired a new Production manager. While this increased fixed overhead by $25,000 per month, shoemakers were satisfied by the decision and became more productive. The reduced overtime required decreased labour costs to $45/shoc. On average, production now takes 1.8 hours/shoc. They increased regular checks of equipment and as a result were able to find inefficiencies in the production process and reduce the amount of leather required to manufacture the shoes. While $50,000 in additional monthly overhead was incurred from increased machinery checks, it now took 4.5 square feet of leather to manufacture one shoe. a) What is the breakeven point (BEP) using Becker's original estimates on June 1? Please provide your answer in units. (2 marks) b) If the new manager implements the mid-June changes, how many units must Beckers sell to reach its revised profit objective? Is reaching the revised profit objective feasible given the constraints outlined above? Explain why or why not. (4 marks) c) What is the price that Beckers should charge customers to reach its revised profit objective for June, assuming it produces at its maximum capacity? Do you think it should change its price to the one you just calculated? Explain why or why not. (3 marks) d) Calculate the contribution margin ratio, expressed as a percentage, for the June original estimates and for the mid-June changes, both using the selling price provided in the case. How can Beckers increase its contribution margin without increasing price? (2 marks) 1 c) Consider the changes made by the new general manager in mid-June. Overall, do you think the changes made are in line with Beckers" strategy? Explain why or why not. (4 marks)