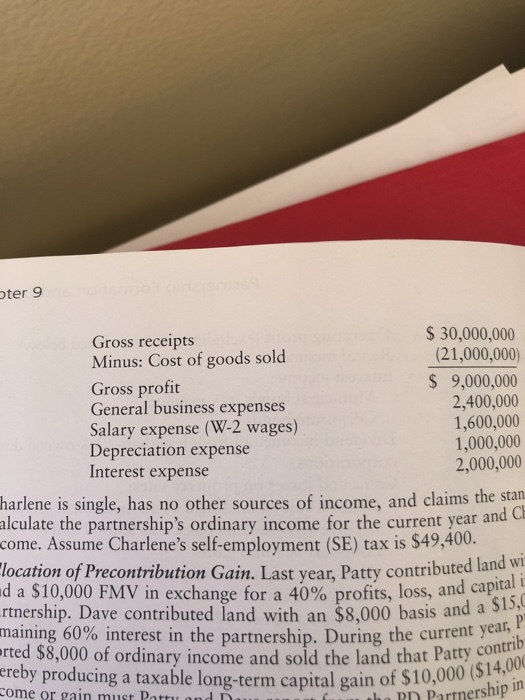

becky and Chuck each own 25% fromthat date through the end of the year. What are Becky and Chuck's distributive shares for the current year? Qualified Business Income Deduction and Net Business Interest Limitation. Charlene is an equal partner in the CD Partnership. The partnership does not qualify as a small business under the $25 million gross receipts text. The partnership incurred the following items for the current year. ter 9 Gross receipts Minus: Cost of goods sold Gross profit General business expenses Salary expense (W-2 wages) Depreciation expense Interest expense $ 30,000,000 (21,000,000) S 9,000,000 2,400,000 1,600,000 1,000,000 2,000,000 harlene is single, has no other sources of income, and cdlaims the stan alculate the partnership's ordinary income for the current year an come. Assume Charlene's self-employment (SE) tax is $49,400 location of Precontribution Gain. Last vear, Patty contributed land wi d a $10,000 FMV in exchange for a 40% profits, loss, and,capital rtnership. Dave contributed land with an $8,000 basis and a i maining 60% interest in the partnership. During the current year rted $8,000 of ordinary income and sold the land that Patty cont ereby producing a taxable long-term capital gain of $10,000(517 ome or gain must Patty ondD in becky and Chuck each own 25% fromthat date through the end of the year. What are Becky and Chuck's distributive shares for the current year? Qualified Business Income Deduction and Net Business Interest Limitation. Charlene is an equal partner in the CD Partnership. The partnership does not qualify as a small business under the $25 million gross receipts text. The partnership incurred the following items for the current year. ter 9 Gross receipts Minus: Cost of goods sold Gross profit General business expenses Salary expense (W-2 wages) Depreciation expense Interest expense $ 30,000,000 (21,000,000) S 9,000,000 2,400,000 1,600,000 1,000,000 2,000,000 harlene is single, has no other sources of income, and cdlaims the stan alculate the partnership's ordinary income for the current year an come. Assume Charlene's self-employment (SE) tax is $49,400 location of Precontribution Gain. Last vear, Patty contributed land wi d a $10,000 FMV in exchange for a 40% profits, loss, and,capital rtnership. Dave contributed land with an $8,000 basis and a i maining 60% interest in the partnership. During the current year rted $8,000 of ordinary income and sold the land that Patty cont ereby producing a taxable long-term capital gain of $10,000(517 ome or gain must Patty ondD in