Answered step by step

Verified Expert Solution

Question

1 Approved Answer

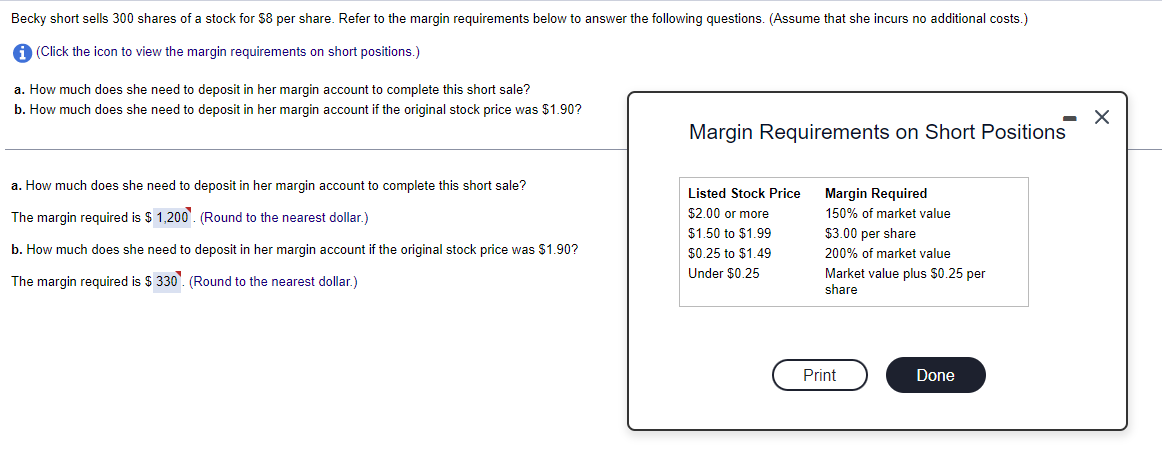

Becky short sells 300 shares of a stock for $8 per share. Refer to the margin requirements below to answer the following questions. (Assume

Becky short sells 300 shares of a stock for $8 per share. Refer to the margin requirements below to answer the following questions. (Assume that she incurs no additional costs.) i (Click the icon to view the margin requirements on short positions.) a. How much does she need to deposit in her margin account to complete this short sale? b. How much does she need to deposit in her margin account if the original stock price was $1.90? Margin Requirements on Short Positions a. How much does she need to deposit in her margin account to complete this short sale? The margin required is $ 1,200. (Round to the nearest dollar.) b. How much does she need to deposit in her margin account if the original stock price was $1.90? The margin required is $ 330. (Round to the nearest dollar.) Listed Stock Price $2.00 or more $1.50 to $1.99 $0.25 to $1.49 Under $0.25 Margin Required 150% of market value $3.00 per share 200% of market value Market value plus $0.25 per share Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started