Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Becky's comprehensive major medical health insurance plan at work has a deductible of $800. The policy pays 85 percent of any amount above the deductible.

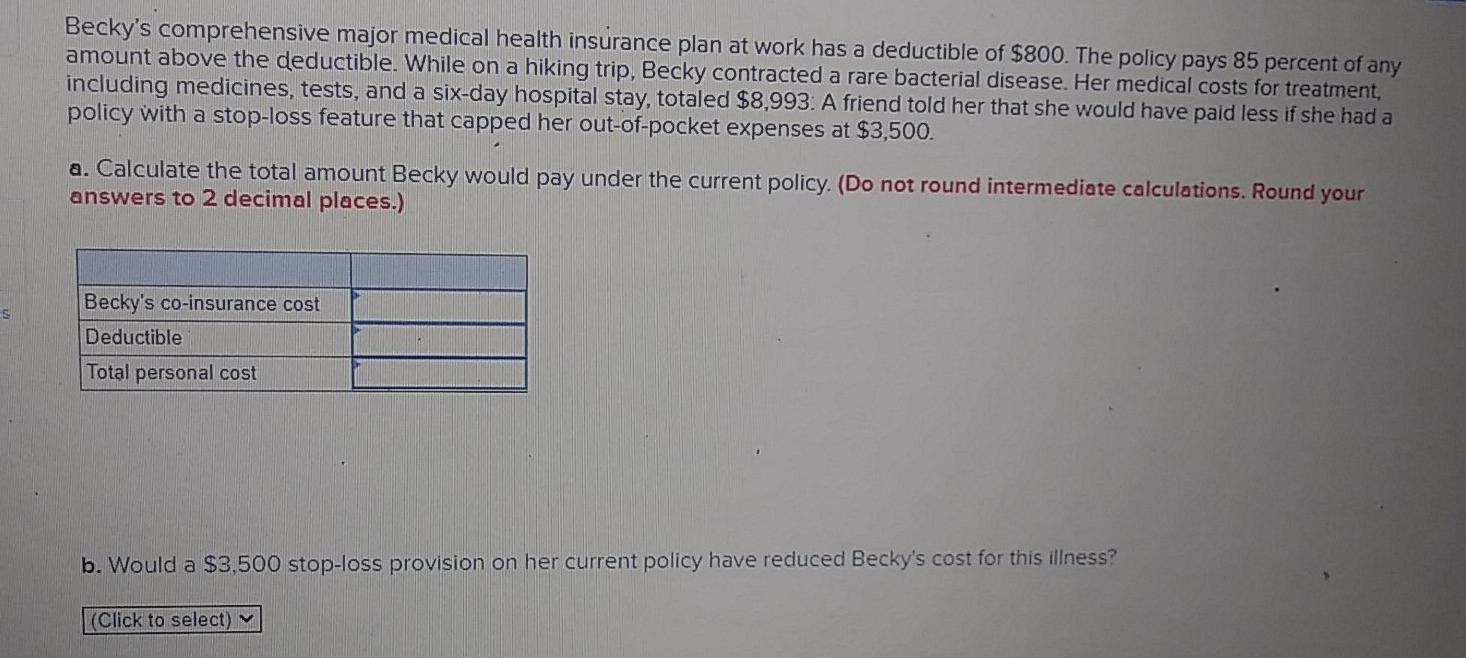

Becky's comprehensive major medical health insurance plan at work has a deductible of $800. The policy pays 85 percent of any amount above the deductible. While on a hiking trip, Becky contracted a rare bacterial disease. Her medical costs for treatment, including medicines, tests, and a six-day hospital stay, totaled $8,993. A friend told her that she would have paid less if she had a policy with a stop-loss feature that capped her out-of-pocket expenses at $3,500. a. Calculate the total amount Becky would pay under the current policy. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Becky's co-insurance cost Deductible Total personal cost b. Would a $3,500 stop-loss provision on her current policy have reduced Becky's cost for this illness? (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started