Question

Bed Bath and Beyond Case Study. References are in the attachments. This case allows us to consider the problem of excess cash faced by many

Bed Bath and Beyond Case Study. References are in the attachments.

This case allows us to consider the problem of "excess cash" faced by many companies these days

Cash balances are on the rise: Large U.S. firms hold $3 Tri in cash today, 5 the amount held 10 years earlier

Investors often see this as "inefficient balance sheets" and demand stock repurchases

CFOs must decide what to do with excess cash and modulate firms' capital structure

The case allows us to consider factors that are important when setting capital structure: Tax shields, costs of financial distress, credit ratings, etc.

Put yourself in the shoes of BBBY's CEO, Steven Temares

It's April 2004 and you're about to decide what to do with the $400 million "excess cash" in the firm:

1. Keep it? 2. Pay it out? 3. Issue debt? 4. All of the above?

What factors should you consider when choosing the "optimal capital structure"?

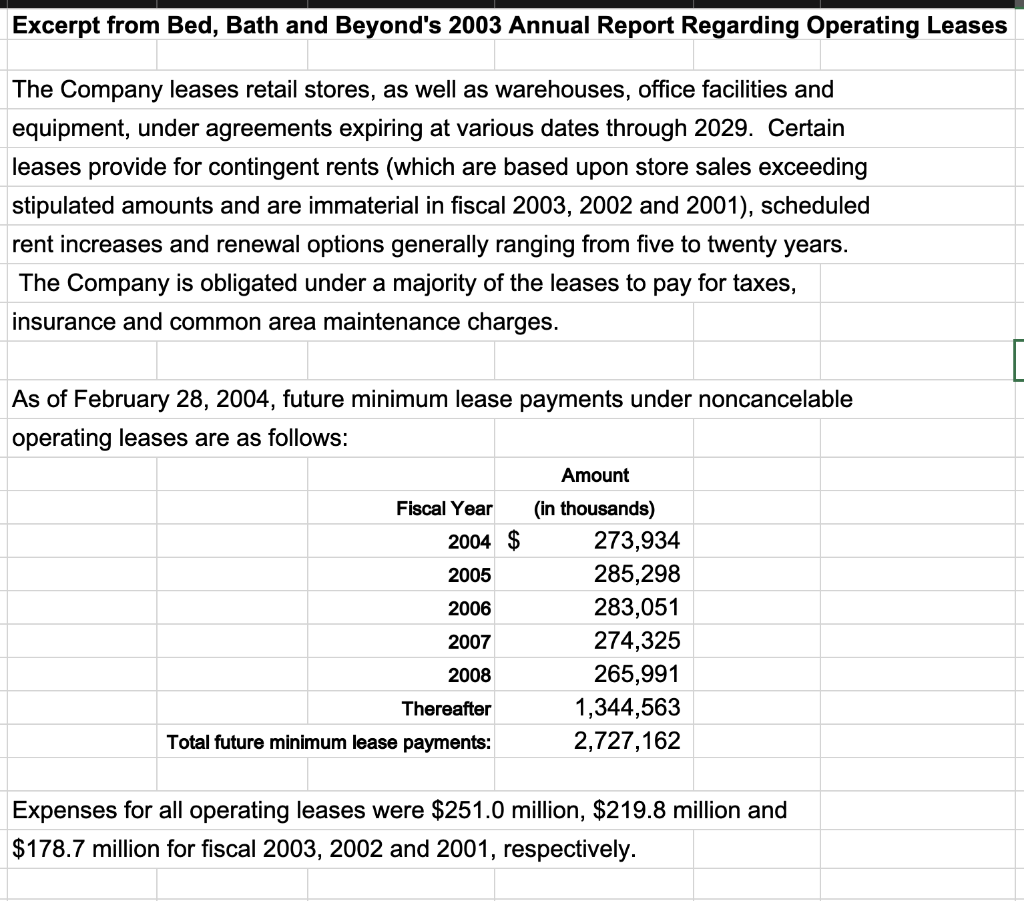

Note BBBY's non-cancellable leases (tax-deductible pmts) - They look and behave a lot like "secured debt" claims

An excel spreadsheet is provided to help you with the case (check attachments)

Consider a concrete program...BBBY combines:

1. Use $400 million excess cash, and 2. Borrow funds (at 4.5%) to conduct a share repurchase

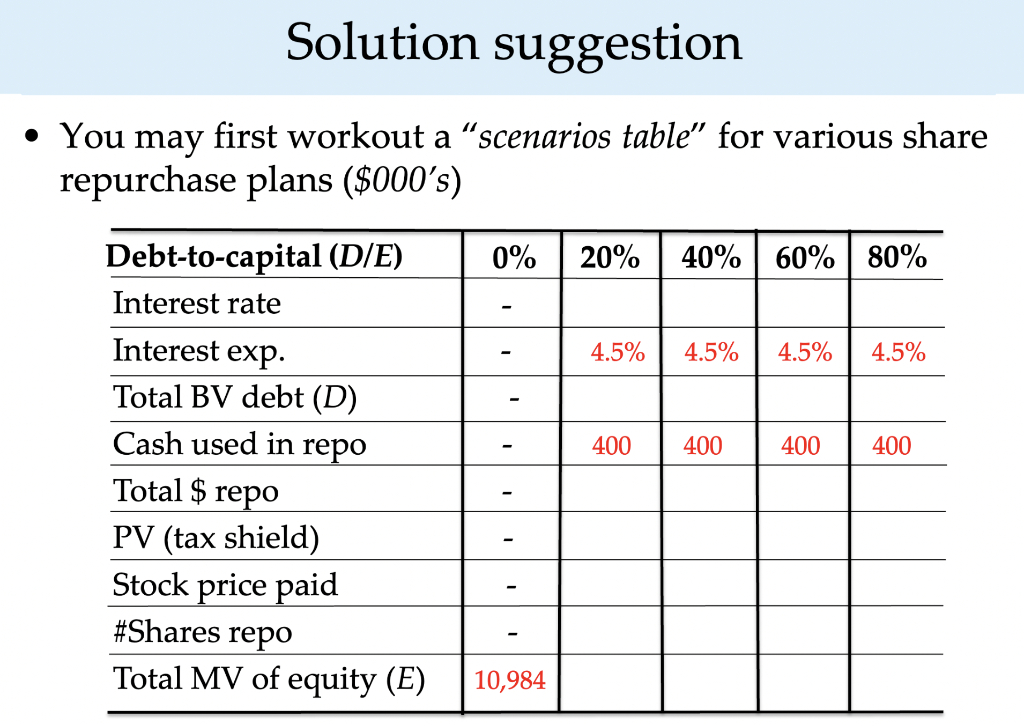

Under the above program, compute the PV of tax shields and estimate the bond ratings for the following D/E ratios: 20%, 40%, 60%, and 80%

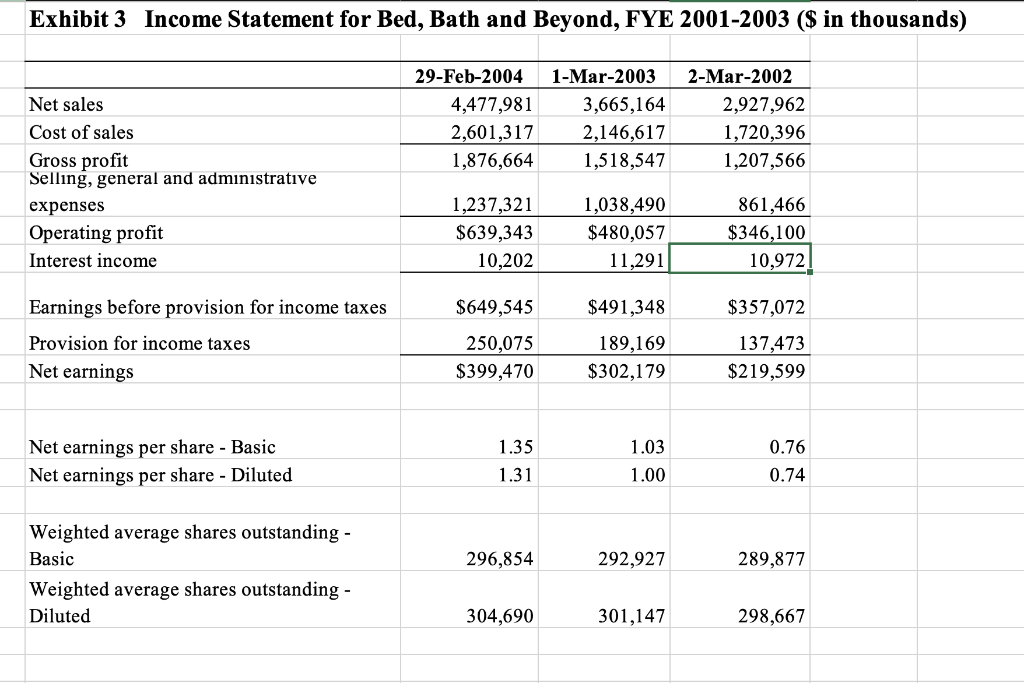

- The corporate tax faced by BBBY is 38.5%

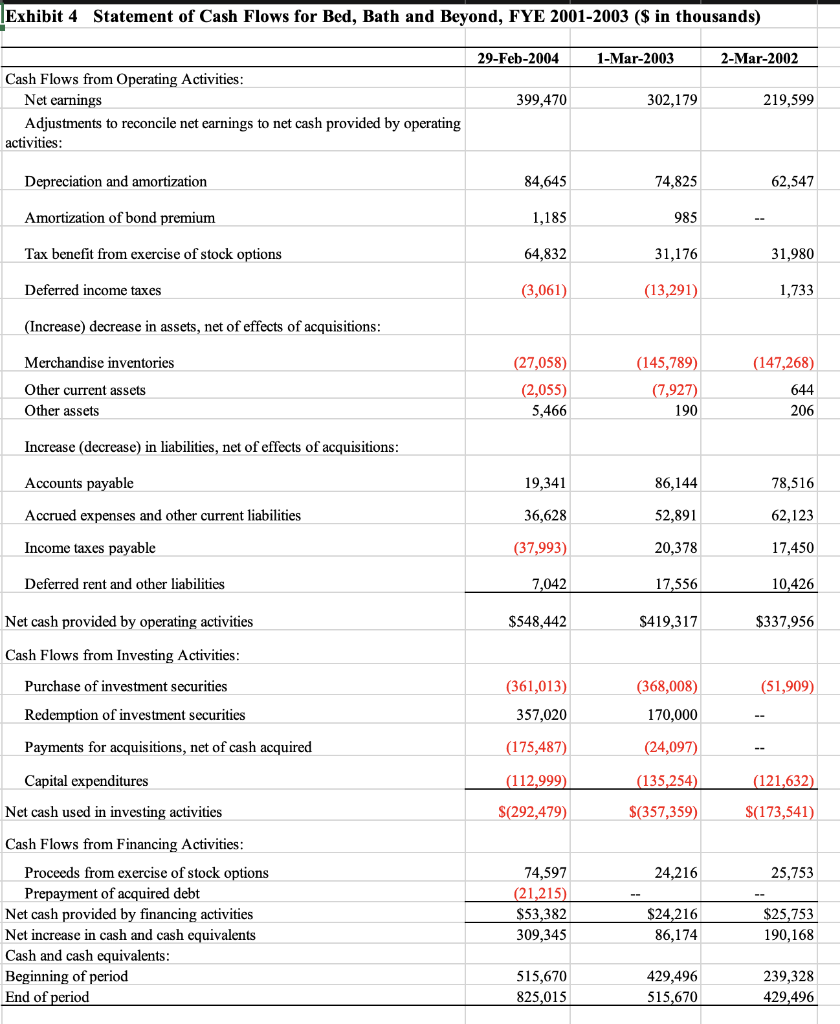

Solution suggestion You may first workout a "scenarios table" for various share repurchase plans ($000 s) Exhibit 3 Income Statement for Bed, Bath and Beyond, FYE 2001-2003 (\$ in thousands) Earnings befo Provision for Net earnings Net earnings per share - Basic Net earnings per share - Diluted Exhibit 4 Statement of Cash Flows for Bed, Bath and Beyond, FYE 2001-2003 ( $ in thousands) Excerpt from Bed, Bath and Beyond's 2003 Annual Report Regarding Operating Leases The Company leases retail stores, as well as warehouses, office facilities and equipment, under agreements expiring at various dates through 2029. Certain leases provide for contingent rents (which are based upon store sales exceeding stipulated amounts and are immaterial in fiscal 2003, 2002 and 2001), scheduled rent increases and renewal options generally ranging from five to twenty years. The Company is obligated under a majority of the leases to pay for taxes, insurance and common area maintenance charges. As of February 28, 2004, future minimum lease payments under noncancelable operating leases are as follows: Expenses for all operating leases were $251.0 million, $219.8 million and $178.7 million for fiscal 2003, 2002 and 2001, respectively. Solution suggestion You may first workout a "scenarios table" for various share repurchase plans ($000 s) Exhibit 3 Income Statement for Bed, Bath and Beyond, FYE 2001-2003 (\$ in thousands) Earnings befo Provision for Net earnings Net earnings per share - Basic Net earnings per share - Diluted Exhibit 4 Statement of Cash Flows for Bed, Bath and Beyond, FYE 2001-2003 ( $ in thousands) Excerpt from Bed, Bath and Beyond's 2003 Annual Report Regarding Operating Leases The Company leases retail stores, as well as warehouses, office facilities and equipment, under agreements expiring at various dates through 2029. Certain leases provide for contingent rents (which are based upon store sales exceeding stipulated amounts and are immaterial in fiscal 2003, 2002 and 2001), scheduled rent increases and renewal options generally ranging from five to twenty years. The Company is obligated under a majority of the leases to pay for taxes, insurance and common area maintenance charges. As of February 28, 2004, future minimum lease payments under noncancelable operating leases are as follows: Expenses for all operating leases were $251.0 million, $219.8 million and $178.7 million for fiscal 2003, 2002 and 2001, respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started