Question

Bed bath and beyond information: Pier 1 information c. Provide the financial statement that shows the amount of dividends paid in the current year and

Bed bath and beyond information:

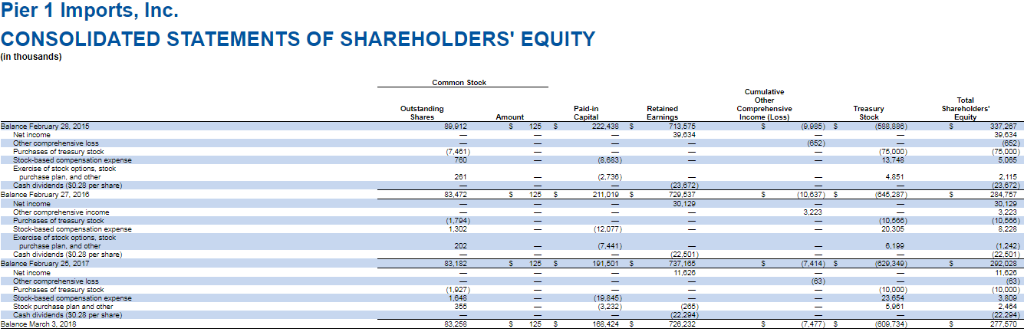

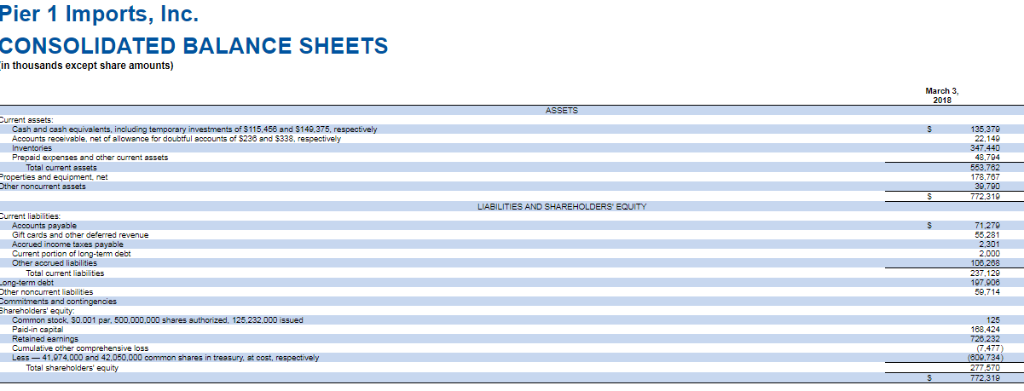

Pier 1 information

Pier 1 information

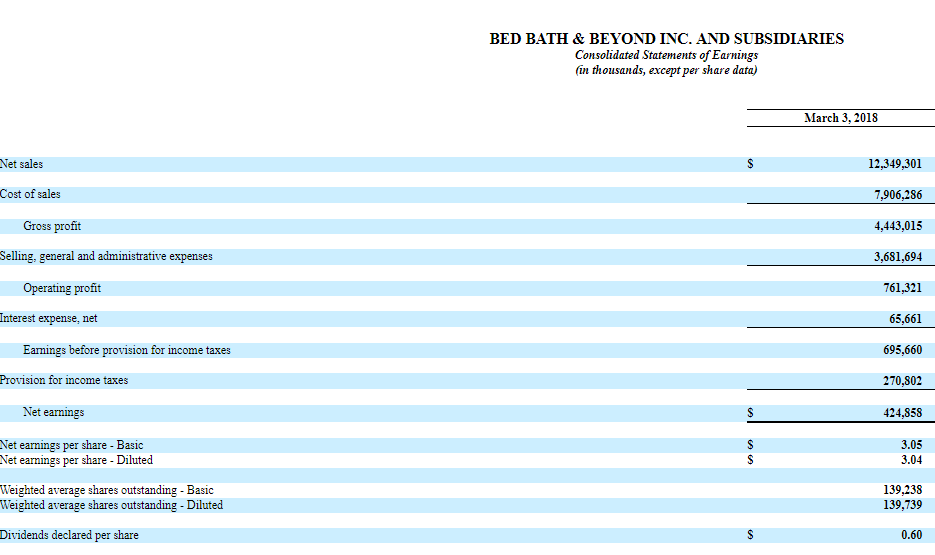

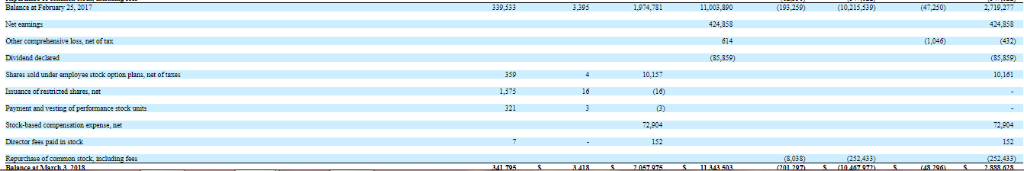

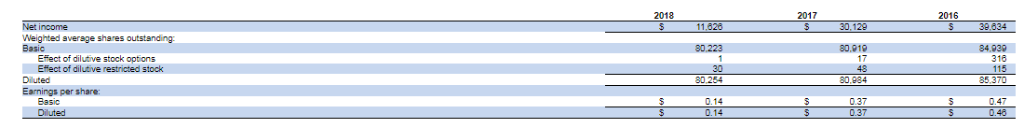

c. Provide the financial statement that shows the amount of dividends paid in the current year and the section name that dividends paid shows on the statement if applicable. What was the amount of the dividends paid if the company paid dividends? Compute the dividend payout for the current year and explain what does it represent? Please review Page 8-17 to read the discussion on the dividend payout ratio. In Thousands Name the financial statement that list out dividends paid if applicable and the section name that dividends paid shows on the statement if applicable. Amount of Dividends paid in dollar amount BBBY PIR Dividend Payout should be shown as a percentage. Show your computation. The calculation is Common stock dividends per share/Basic earnings per share. Hint: to find this per share amount go to the bottom of the statement of earnings. BBBY PIR What does the Dividend Payout mean?

| In Thousands | Name the financial statement that list out dividends paid if applicable and the section name that dividends paid shows on the statement if applicable. | Amount of Dividends paid in dollar amount |

| BBBY |

|

|

| PIR |

|

|

|

| Dividend Payout should be shown as a percentage. Show your computation. The calculation is Common stock dividends per share/Basic earnings per share. Hint: to find this per share amount go to the bottom of the statement of earnings. |

| BBBY |

|

| PIR |

|

What does the Dividend Payout mean?

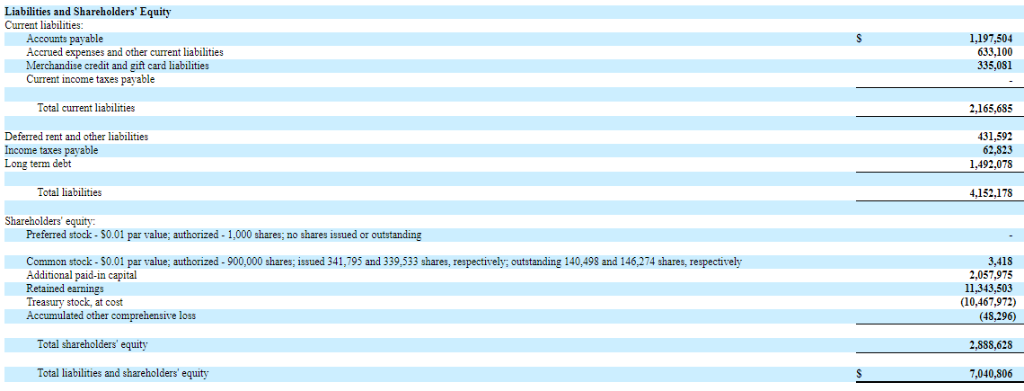

Liabilities and Shareholders' Equity Current liabilities: 1,197,504 633,100 335,081 Accounts payable Accrued expenses Merchandise credit and gift card liabilities Current income taxes payable and other current liabilities Total current liabilities 2,165,685 Deferred rent and other liabilities 431,592 62,823 1,492,078 Income taxes payable Long term debt Total liabilities 4,152,178 Shareholders' equity Preferred stock- $0.01 par value; authorized- 1,000 shares; no shares issued or oututanding 3,418 2,057,975 11,343,503 (10,467,972) (45,296 Common stock-$0.01 par value; authorized- 900,000 shares; issued 341,795 and 339,533 shares, respectively, outstanding 140,498 and 146,274 shares, respectively Additional paid-in capital Retained earnings Treasury stock at cost Total shareholders' equity 2,888,628 Total liabilities and shareholders' equity 7,040,806 BED BATH & BEYOND INC. AND SUBSIDIARIES Consolidated Statements of Earnings in thousands, except per share data,) March 3,2018 Net sales 12,349,301 Cost of sales 7,906,286 4,443,015 Gross profit general and administrative expenses 3,681,694 Operating profit 761,321 Interest expense, net 65,661 Eamings before provision for income taxes 695,660 Provision for income taxes 270,802 Net earnings 424,858 3.05 Net earnings per share - Basic Net earnings per share - Diluted 3.04 139,238 139,739 Weighted average shares outstanding - Basic Weighted average shares outstanding - Diluted Dividends declared per share 0.60 10415539 Balm a Fabruary2, 2017 1,974,781 47.30) Net earmings 424,358 Other comprehensive loes, net ofeax 614 Dividand dected 10,161 Shuras aald undar !.plora.tock option plana nat of tanas 359 uance af rauictod shares nat 1575 Payment and vesting of peformance stock mits Stock-based compensation epense, ner Dsector Sees paid .teck 152 152 apuuchaan of comemon 2018 2017 2016 Weighted average shares outstanding 80.010 17 84.930 318 115 80.223 Effect of dilutive stock options Option Effect of dilutive restricted stock 0,884 Earnings per share: 0.14 0.37 0.47 Pier 1 Imports, Ind. CONSOLIDATED BALANCE SHEETS in thousands except share amounts) March 3, 2018 urrent assets Cash and cash equivalents, indluding temporary investments of 3115,458 and 3149,375, respectively Accounts receivable. net of allowance for doubtful sccounts of $238 and $338, respectively Inventonies 135,370 22.140 347.440 48,704 Prepaid expenses and other current assets Total current assets Properties and equipment, net 178,707 20,700 LITIES AND SHAREHOLDERS urrent lisbilities 1.270 5281 2.301 2.000 100 Accounts payabla Gift cards and other de ered revenue Accrued income taxes payable Current portion of long-term debt Other accrued liabilities Total current liabilites 237.120 197.906 ,714 hareholders' equity Common stock, 50.001 per, 500.000,000 shares authorized, 125,232.000 issued Paid-in captal Retained eanings Cumulative other comprehensive los:s Less- 41,074 000 and 42.050,000 common shares in treasury, at cost, respectively Total shareholders' equity 125 188,424 720.232 7.477 734 Liabilities and Shareholders' Equity Current liabilities: 1,197,504 633,100 335,081 Accounts payable Accrued expenses Merchandise credit and gift card liabilities Current income taxes payable and other current liabilities Total current liabilities 2,165,685 Deferred rent and other liabilities 431,592 62,823 1,492,078 Income taxes payable Long term debt Total liabilities 4,152,178 Shareholders' equity Preferred stock- $0.01 par value; authorized- 1,000 shares; no shares issued or oututanding 3,418 2,057,975 11,343,503 (10,467,972) (45,296 Common stock-$0.01 par value; authorized- 900,000 shares; issued 341,795 and 339,533 shares, respectively, outstanding 140,498 and 146,274 shares, respectively Additional paid-in capital Retained earnings Treasury stock at cost Total shareholders' equity 2,888,628 Total liabilities and shareholders' equity 7,040,806 BED BATH & BEYOND INC. AND SUBSIDIARIES Consolidated Statements of Earnings in thousands, except per share data,) March 3,2018 Net sales 12,349,301 Cost of sales 7,906,286 4,443,015 Gross profit general and administrative expenses 3,681,694 Operating profit 761,321 Interest expense, net 65,661 Eamings before provision for income taxes 695,660 Provision for income taxes 270,802 Net earnings 424,858 3.05 Net earnings per share - Basic Net earnings per share - Diluted 3.04 139,238 139,739 Weighted average shares outstanding - Basic Weighted average shares outstanding - Diluted Dividends declared per share 0.60 10415539 Balm a Fabruary2, 2017 1,974,781 47.30) Net earmings 424,358 Other comprehensive loes, net ofeax 614 Dividand dected 10,161 Shuras aald undar !.plora.tock option plana nat of tanas 359 uance af rauictod shares nat 1575 Payment and vesting of peformance stock mits Stock-based compensation epense, ner Dsector Sees paid .teck 152 152 apuuchaan of comemon 2018 2017 2016 Weighted average shares outstanding 80.010 17 84.930 318 115 80.223 Effect of dilutive stock options Option Effect of dilutive restricted stock 0,884 Earnings per share: 0.14 0.37 0.47 Pier 1 Imports, Ind. CONSOLIDATED BALANCE SHEETS in thousands except share amounts) March 3, 2018 urrent assets Cash and cash equivalents, indluding temporary investments of 3115,458 and 3149,375, respectively Accounts receivable. net of allowance for doubtful sccounts of $238 and $338, respectively Inventonies 135,370 22.140 347.440 48,704 Prepaid expenses and other current assets Total current assets Properties and equipment, net 178,707 20,700 LITIES AND SHAREHOLDERS urrent lisbilities 1.270 5281 2.301 2.000 100 Accounts payabla Gift cards and other de ered revenue Accrued income taxes payable Current portion of long-term debt Other accrued liabilities Total current liabilites 237.120 197.906 ,714 hareholders' equity Common stock, 50.001 per, 500.000,000 shares authorized, 125,232.000 issued Paid-in captal Retained eanings Cumulative other comprehensive los:s Less- 41,074 000 and 42.050,000 common shares in treasury, at cost, respectively Total shareholders' equity 125 188,424 720.232 7.477 734Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started