Answered step by step

Verified Expert Solution

Question

1 Approved Answer

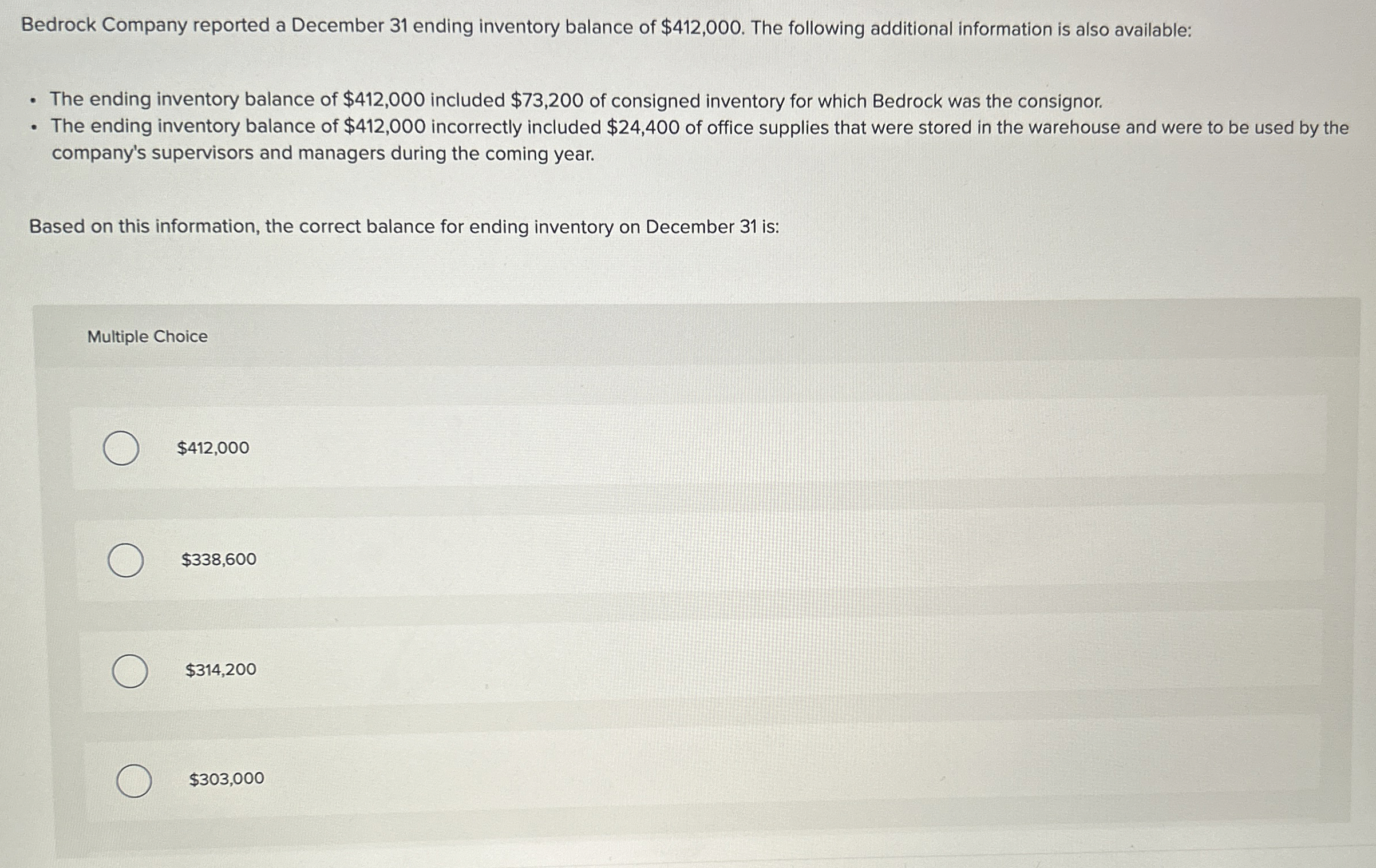

Bedrock company reported a December 3 1 ending inventory balance of $ 4 1 2 , 0 0 0 . The ending inventory balance of

Bedrock company reported a December ending inventory balance of $ The ending inventory balance of $ included of cosigned inventory for which bedrock was the cosignor The ending inventory balance of $ incorrectly included $ of office supplies that were stored in the warehouse and were to be used by the companys supervisor and managers during the coming year. Based on this information the correct balance for ending inventory on December is

Bedrock Company reported a December ending inventory balance of $ The following additional information is also available:

The ending inventory balance of $ included $ of consigned inventory for which Bedrock was the consignor.

The ending inventory balance of $ incorrectly included $ of office supplies that were stored in the warehouse and were to be used by the company's supervisors and managers during the coming year.

Based on this information, the correct balance for ending inventory on December is:

Multiple Choice

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started