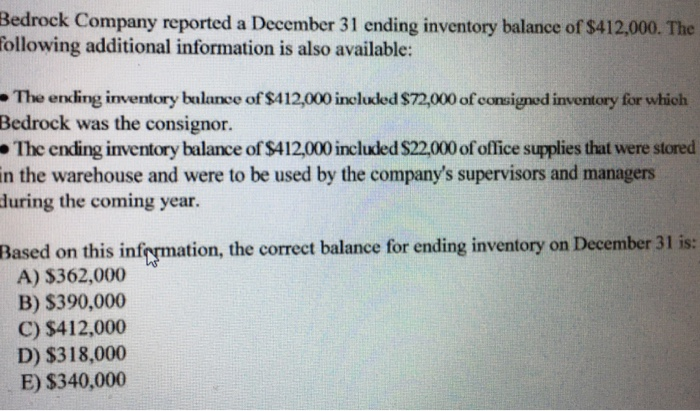

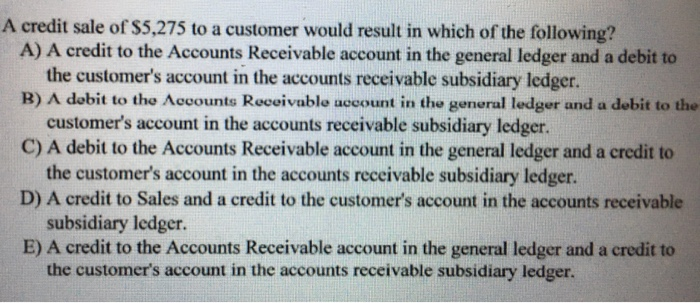

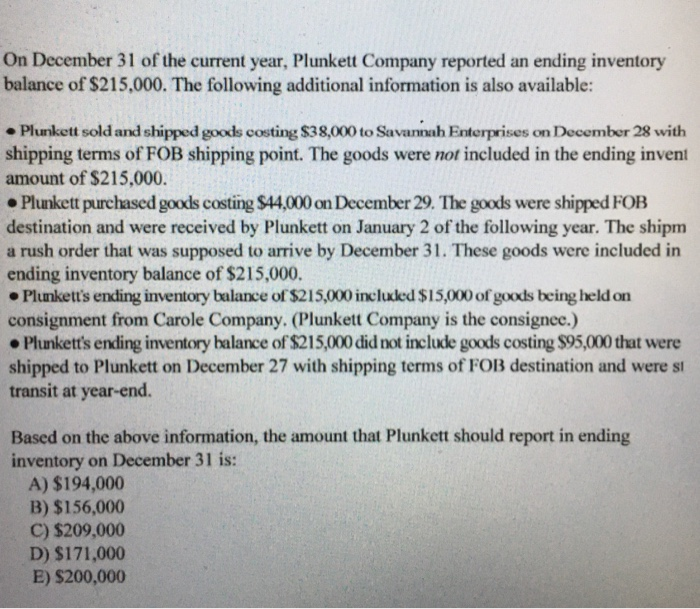

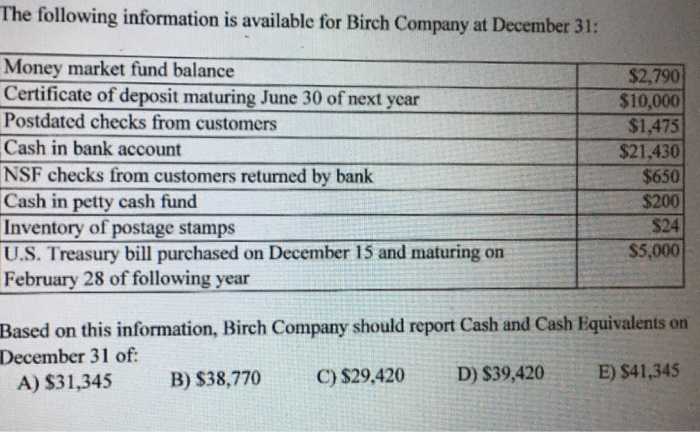

Bedrock Company reported a December 31 ending inventory balance of $412,000. The following additional information is also available: The ending inventory balance of $412,000 included $72,000 of consigned inventory for which Bedrock was the consignor. The ending inventory balance of $412,000 included $22,000 of office supplies that were stored in the warehouse and were to be used by the company's supervisors and managers during the coming year. Based on this information, the correct balance for ending inventory on December 31 is: A) $362,000 B) $390,000 C) $412,000 D) $318,000 E) $340,000 A credit sale of $5,275 to a customer would result in which of the following? A) A credit to the Accounts Receivable account in the general ledger and a debit to the customer's account in the accounts receivable subsidiary ledger. B) A dobit to the Accounts Receivable account in the general ledger and a dobit to the customer's account in the accounts receivable subsidiary ledger. C) A debit to the Accounts Receivable account in the general ledger and a credit to the customer's account in the accounts receivable subsidiary ledger. D) A credit to Sales and a credit to the customer's account in the accounts receivable subsidiary ledger. E) A credit to the Accounts Receivable account in the general ledger and a credit to the customer's account in the accounts receivable subsidiary ledger. On December 31 of the current year, Plunkett Company reported an ending inventory balance of $215,000. The following additional information is also available: Plunkett sold and shipped goods costing $38,000 to Savannah Enterprises on December 28 with shipping terms of FOB shipping point. The goods were not included in the ending invent amount of $215,000. Plunkett purchased goods costing $44,000 on December 29. The goods were shipped FOB destination and were received by Plunkett on January 2 of the following year. The shipm a rush order that was supposed to arrive by December 31. These goods were included in ending inventory balance of $215,000. Plumkett's ending inventory balance of $215,000 included $15,000 of goods being held on consignment from Carole Company. (Plunkett Company is the consignee.) . Plunkett's ending inventory balance of $215,000 did not include goods costing $95,000 that were shipped to Plunkett on December 27 with shipping terms of FOB destination and were si transit at year-end. Based on the above information, the amount that Plunkett should report in ending inventory on December 31 is: A) $194,000 B) $156,000 C) $209,000 D) $171,000 E) $200,000 The following information is available for Birch Company at December 31: Money market fund balance Certificate of deposit maturing June 30 of next year Postdated checks from customers Cash in bank account NSF checks from customers returned by bank Cash in petty cash fund Inventory of postage stamps U.S. Treasury bill purchased on December 15 and maturing on February 28 of following year $2,790 $10,000) $1,475 $21,430 $650 $200 $241 $5,000 Based on this information, Birch Company should report Cash and Cash Equivalents on December 31 of: A) $31,345 B) $38,770 C) $29,420 D) $39,420 E) $41,345