Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bedrock Quarries Ltd . ( Bedrock ) , wholly owned by Betty Rubble, has operated a sand and gravel pit since 2 0 0 3

Bedrock Quarries LtdBedrock wholly owned by Betty Rubble, has operated a sand and gravel pit since During that time, its revenues have increased moderately. On March after almost two years of negotiation, a purchase and sale agreement between Flintstone Sand and Gravel LtdFlintstone and Betty Rubble was completed whereby Ms Rubble sold Bedrock to Flintstone. Mr Flintstone, sole shareholder of Flintstone, was optimistic about the synergistic benefits that would accrue to the combined operations.

Mr Harrison, the senior partner of Harrison, Longo, and Chan HLC Chartered Accountants, and a cousin of Ms Rubble, has recently been informed that a complaint was made to the Provincial Institute of Chartered Accountants PICA regarding his involvement with Bedrock. In February Mr Flintstone submitted a complaint to the PICA alleging that HLC and Mr Harrison in particular, were associated with financial statements of Bedrock that were false and materially misleading. Apparently, Mr Flintstone has retained counsel and is preparing to commence legal action against HLC for negligence in its work on the Bedrock engagements.

For each of the fiscal years ended January and January HLC prepared audited reports, and for the fiscal years ended January and January HLC prepared review engagement reports on the financial statements of Bedrock. Mr Harrison is adamant that Bedrock's financial statements were prepared in accordance with International Financial Reporting Standards.

The PICA does not have the staff available at the moment and has asked Chapman & Partner CP Chartered Accountants, to investigate Mr Flintstone's omplaint You are employed by CP Jim Chapman, partner in charge of CPs litigation department, has asked you to prepare a memo discussing all relevant matters regarding the engagement. He will use it as a basis for discussion in a meeting he has scheduled for next week, on May with staff from the PICA.

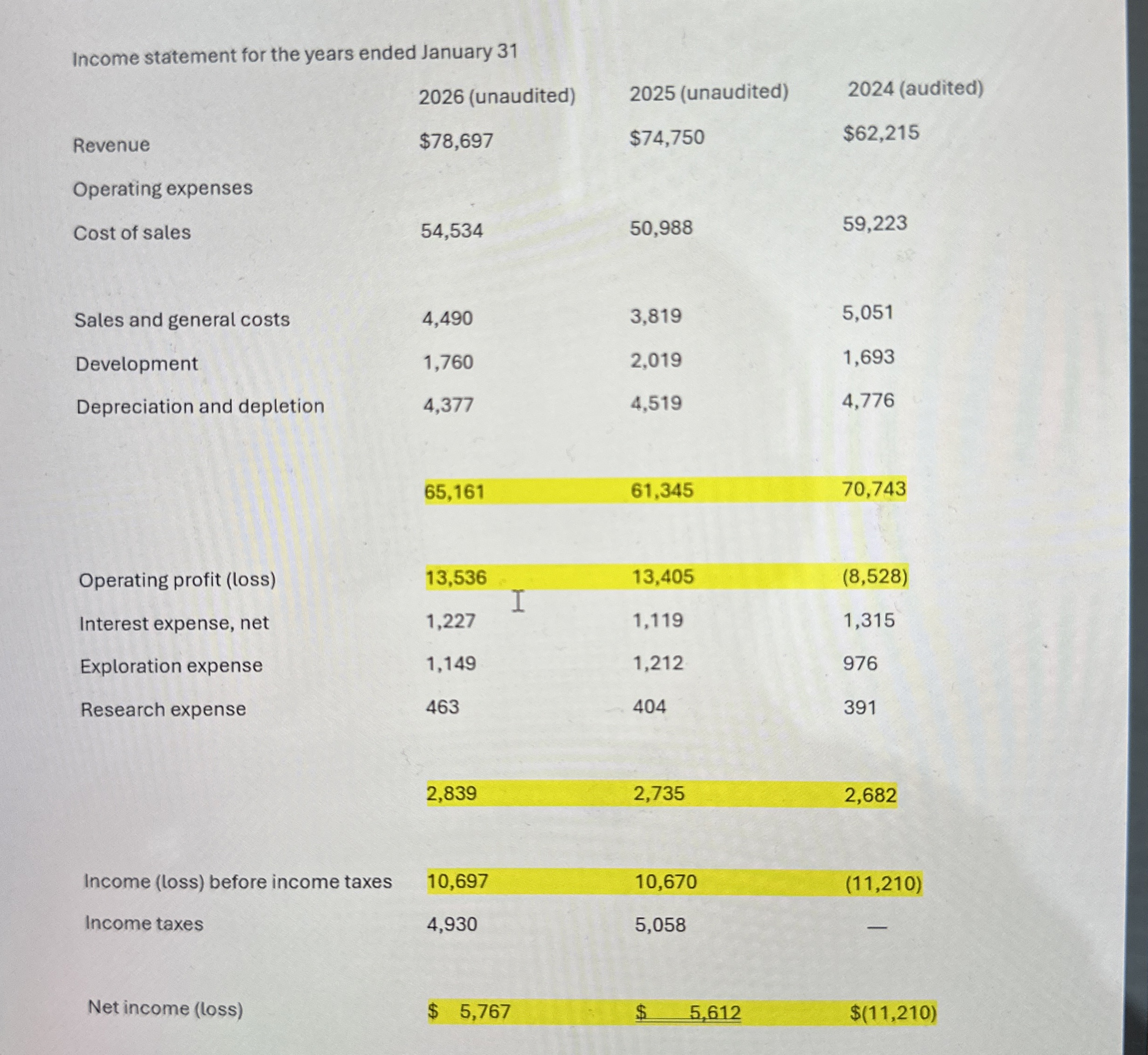

In order to prepare your memo, you have been provided with extracts from Bedrock's financial statements for the years to see Exhibit IExhibit I

Extracts from financial statements for Bedrock Quarries Ltdin $s

Balance sheet as at January

auditedunauditedunaudited

Assets

Cash and cash equivalents

Accounts receivable

Inventory

Land at cost

Plant and equipment at cost

Accumulated depreciation and depletion

Investment in and advances to associated company

$

Liabilities and shareholder's equity

Bank indebtedness

Accounts payable

Longterm debt

Deferred taxes

Common shares

Retained earnings

$

$

$

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started