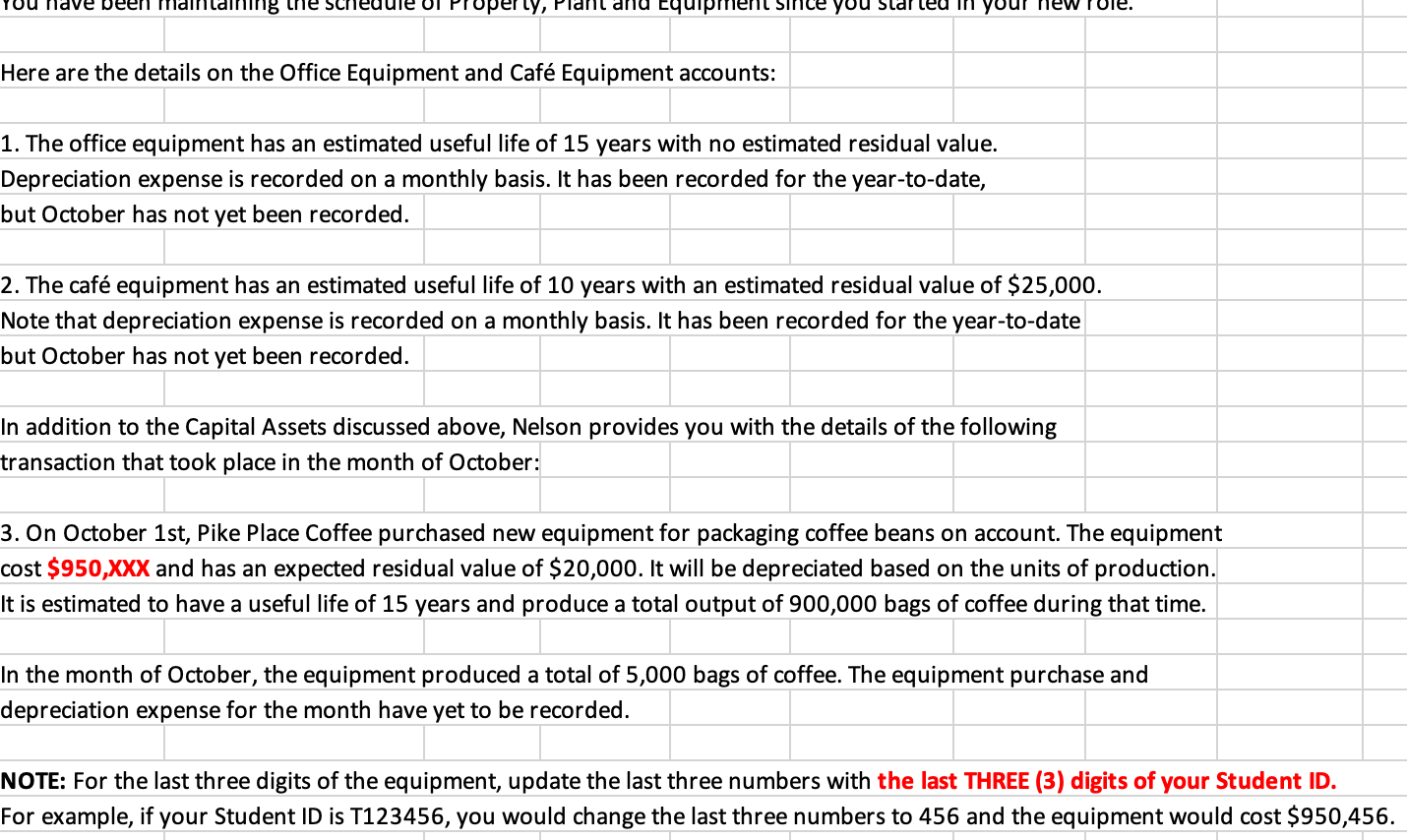

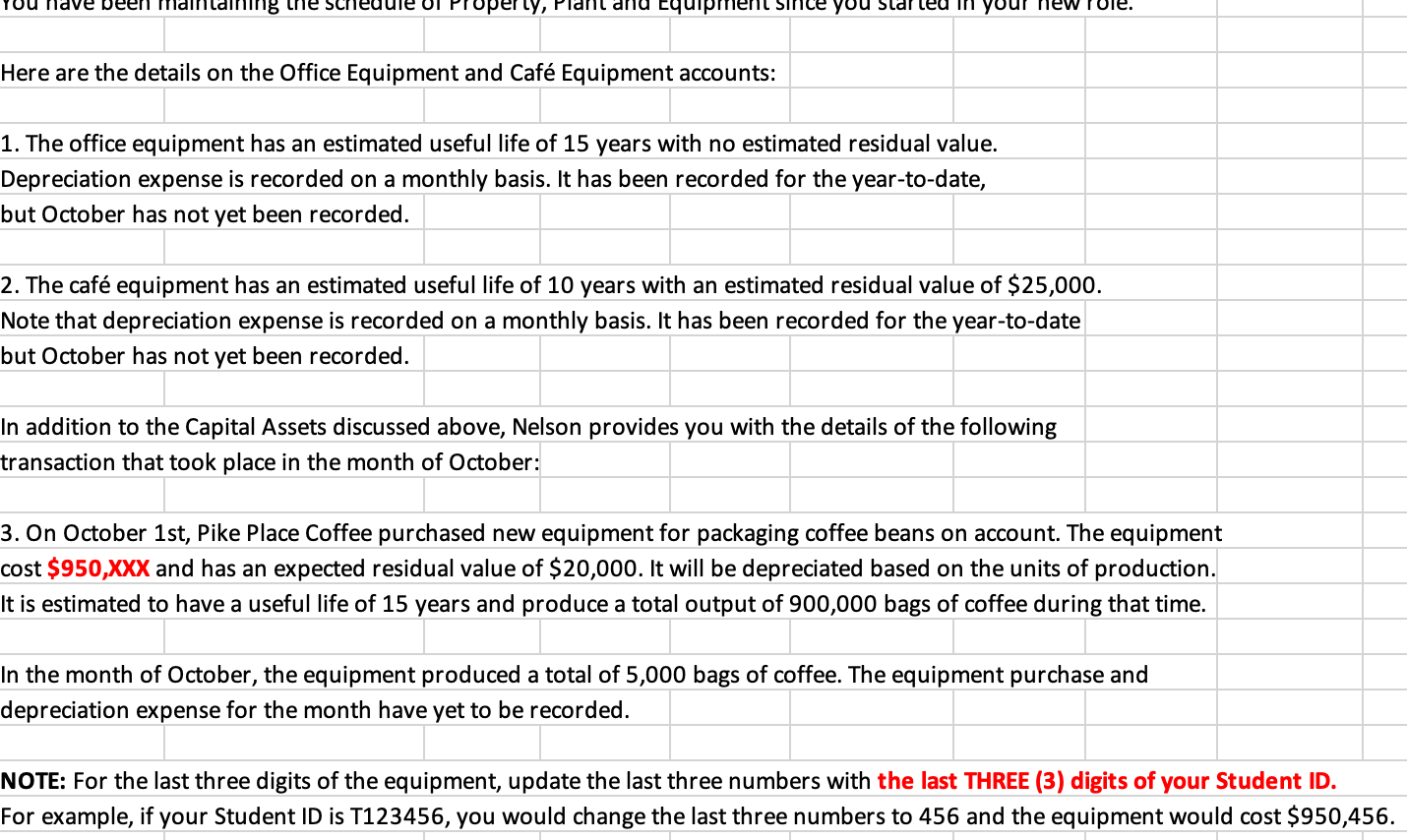

been Ilaining the scrie perly, Pidril dniu led Here are the details on the Office Equipment and Caf Equipment accounts: 1. The office equipment has an estimated useful life of 15 years with no estimated residual value. Depreciation expense is recorded on a monthly basis. It has been recorded for the year-to-date, but October has not yet been recorded. 2. The caf equipment has an estimated useful life of 10 years with an estimated residual value of $25,000. Note that depreciation expense is recorded on a monthly basis. It has been recorded for the year-to-date but October has not yet been recorded. In addition to the Capital Assets discussed above, Nelson provides you with the details of the following transaction that took place in the month of October: 3. On October 1st, Pike Place Coffee purchased new equipment for packaging coffee beans on account. The equipment cost $950,XXX and has an expected residual value of $20,000. It will be depreciated based on the units of production. It is estimated to have a useful life of 15 years and produce a total output of 900,000 bags of coffee during that time. In the month of October, the equipment produced a total of 5,000 bags of coffee. The equipment purchase and depreciation expense for the month have yet to be recorded. NOTE: For the last three digits of the equipment, update the last three numbers with the last THREE (3) digits of your Student ID. For example, if your Student ID is T123456, you would change the last three numbers to 456 and the equipment would cost $950,456. been Ilaining the scrie perly, Pidril dniu led Here are the details on the Office Equipment and Caf Equipment accounts: 1. The office equipment has an estimated useful life of 15 years with no estimated residual value. Depreciation expense is recorded on a monthly basis. It has been recorded for the year-to-date, but October has not yet been recorded. 2. The caf equipment has an estimated useful life of 10 years with an estimated residual value of $25,000. Note that depreciation expense is recorded on a monthly basis. It has been recorded for the year-to-date but October has not yet been recorded. In addition to the Capital Assets discussed above, Nelson provides you with the details of the following transaction that took place in the month of October: 3. On October 1st, Pike Place Coffee purchased new equipment for packaging coffee beans on account. The equipment cost $950,XXX and has an expected residual value of $20,000. It will be depreciated based on the units of production. It is estimated to have a useful life of 15 years and produce a total output of 900,000 bags of coffee during that time. In the month of October, the equipment produced a total of 5,000 bags of coffee. The equipment purchase and depreciation expense for the month have yet to be recorded. NOTE: For the last three digits of the equipment, update the last three numbers with the last THREE (3) digits of your Student ID. For example, if your Student ID is T123456, you would change the last three numbers to 456 and the equipment would cost $950,456