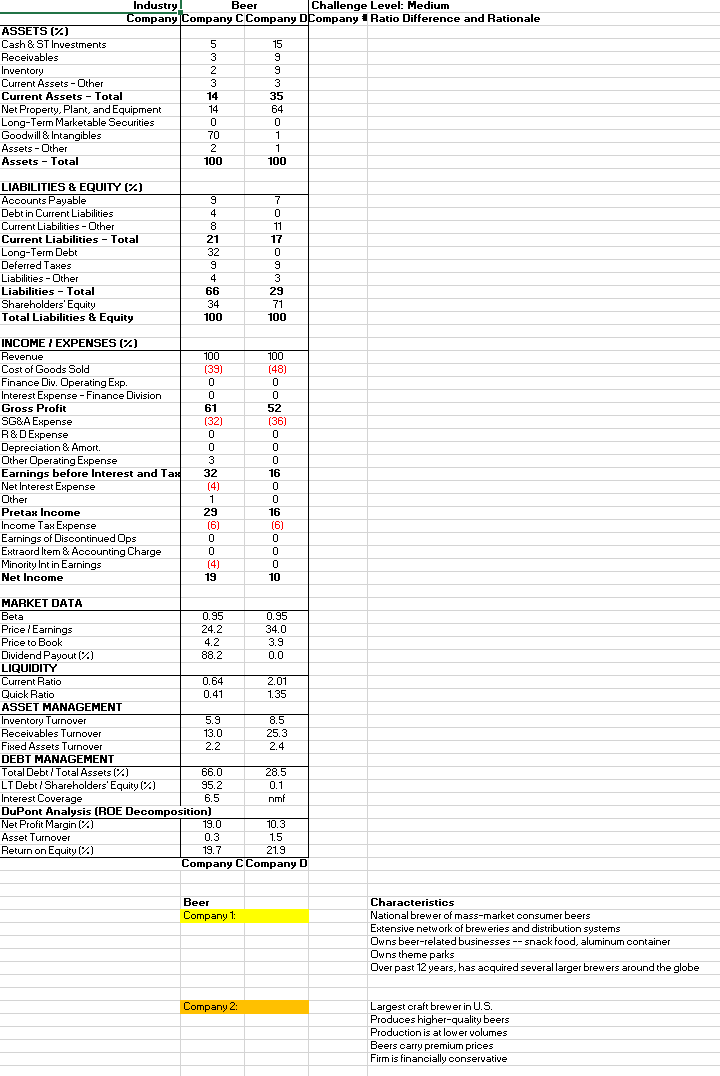

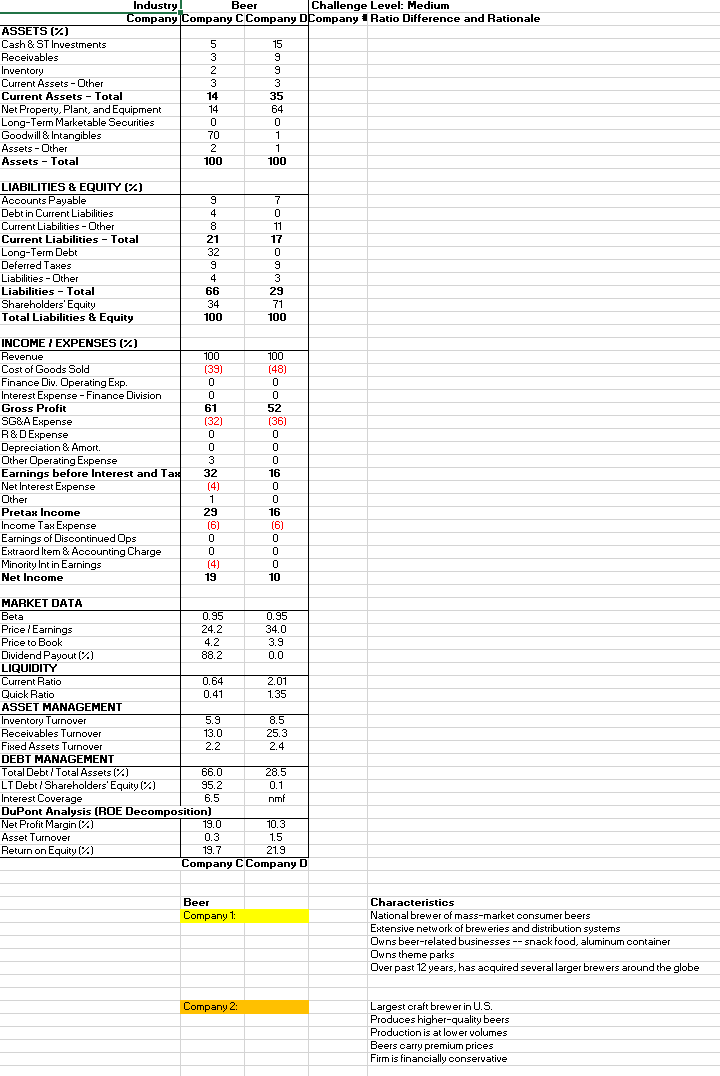

Beer

Match each characteristic (At bottom of page) with the ratio in the table. Put your characteristic in the "Ratio difference and Rational" column. All characteristics may not be used, only use each characteristic once. Under "Company #" column put the corresponding number from the Airlines column at the bottom of the page

Industry Beer Challenge Level: Medium Company Company C Company DCompany Ratio Difference and Rationale ASSETS (2) Cash & ST Investments 5 15 Receivables 3 9 9 Inventory 2 9 Current Assets - Other 3 3 Current Assets - Total 14 35 Net Property, Plant, and Equipment 14 64 Long-Term Marketable Securities 0 0 Goodwill & Intangibles 70 1 Assets - Other 2 1 1 Assets - Total 100 100 --- 7 0 11 17 LIABILITIES & EQUITY (Z) Accounts Payable Debt in Current Liabilities Current Liabilities - Other Current Liabilities - Total Long-Term Debt Deferred Taxes Liabilities - Other Liabilities - Total Shareholders' Equity Total Liabilities & Equity 9 4 8 21 32 9 4 66 34 100 9 3 29 71 100 INCOME / EXPENSES (Z) Revenue Cost of Goods Sold Finance Div. Operating Exp. Interest Expense - Finance Division Gross Profit SG&A Expense R&D Expense Depreciation & Amort. Other Operating Expense Earnings before Interest and Tax Net Interest Expense Other Pretax Income Income Tax Expense Earnings of Discontinued Ops Extraord Item & Accounting Charge Minority Int in Earnings Net Income 100 (39) 0 0 61 (32) 0 0 0 3 32 (4) 1 29 (6) 0 0 (4) 19 100 (48) 0 0 52 (36) 0 0 0 16 0 0 16 (6) 0 0 0 10 MARKET DATA Beta 0.95 0.95 Price / Earnings 24.2 34.0 Price to Book 4.2 3.9 Dividend Payout (%) 88.2 0.0 LIQUIDITY Current Ratio 0.64 2.01 Quick Ratio 0.41 1.35 ASSET MANAGEMENT Inventory Turnover 5.9 8.5 Receivables Turnover 13.0 25.3 Fixed Assets Turnover 2.2 2.4 DEBT MANAGEMENT Total Debt / Total Assets (7) 66.0 28.5 LT Debt/ Shareholders' Equity (%) 95.2 0.1 Interest Coverage 6.5 nmf DuPont Analysis (ROE Decomposition) Net Profit Margin (2) 19.0 10.3 Asset Turnover 0.3 1.5 Return on Equity (%) 19.7 21.9 Company C Company D Beer Company 1: Characteristics National brewer of mass-market consumer beers Extensive network of breweries and distribution systems Owns beer-related businesses -- snack food, aluminum container Owns theme parks Over past 12 years, has acquired several larger brewers around the globe Company 2: Largest craft brewer in U.S. Produces higher-quality beers Production is at lower volumes Beers carry premium prices Firm is financially conservative Industry Beer Challenge Level: Medium Company Company C Company DCompany Ratio Difference and Rationale ASSETS (2) Cash & ST Investments 5 15 Receivables 3 9 9 Inventory 2 9 Current Assets - Other 3 3 Current Assets - Total 14 35 Net Property, Plant, and Equipment 14 64 Long-Term Marketable Securities 0 0 Goodwill & Intangibles 70 1 Assets - Other 2 1 1 Assets - Total 100 100 --- 7 0 11 17 LIABILITIES & EQUITY (Z) Accounts Payable Debt in Current Liabilities Current Liabilities - Other Current Liabilities - Total Long-Term Debt Deferred Taxes Liabilities - Other Liabilities - Total Shareholders' Equity Total Liabilities & Equity 9 4 8 21 32 9 4 66 34 100 9 3 29 71 100 INCOME / EXPENSES (Z) Revenue Cost of Goods Sold Finance Div. Operating Exp. Interest Expense - Finance Division Gross Profit SG&A Expense R&D Expense Depreciation & Amort. Other Operating Expense Earnings before Interest and Tax Net Interest Expense Other Pretax Income Income Tax Expense Earnings of Discontinued Ops Extraord Item & Accounting Charge Minority Int in Earnings Net Income 100 (39) 0 0 61 (32) 0 0 0 3 32 (4) 1 29 (6) 0 0 (4) 19 100 (48) 0 0 52 (36) 0 0 0 16 0 0 16 (6) 0 0 0 10 MARKET DATA Beta 0.95 0.95 Price / Earnings 24.2 34.0 Price to Book 4.2 3.9 Dividend Payout (%) 88.2 0.0 LIQUIDITY Current Ratio 0.64 2.01 Quick Ratio 0.41 1.35 ASSET MANAGEMENT Inventory Turnover 5.9 8.5 Receivables Turnover 13.0 25.3 Fixed Assets Turnover 2.2 2.4 DEBT MANAGEMENT Total Debt / Total Assets (7) 66.0 28.5 LT Debt/ Shareholders' Equity (%) 95.2 0.1 Interest Coverage 6.5 nmf DuPont Analysis (ROE Decomposition) Net Profit Margin (2) 19.0 10.3 Asset Turnover 0.3 1.5 Return on Equity (%) 19.7 21.9 Company C Company D Beer Company 1: Characteristics National brewer of mass-market consumer beers Extensive network of breweries and distribution systems Owns beer-related businesses -- snack food, aluminum container Owns theme parks Over past 12 years, has acquired several larger brewers around the globe Company 2: Largest craft brewer in U.S. Produces higher-quality beers Production is at lower volumes Beers carry premium prices Firm is financially conservative