Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bees Company Ltd produces and sells bottles of honey to retail distributors and is considering investing some of its profits. The company has three

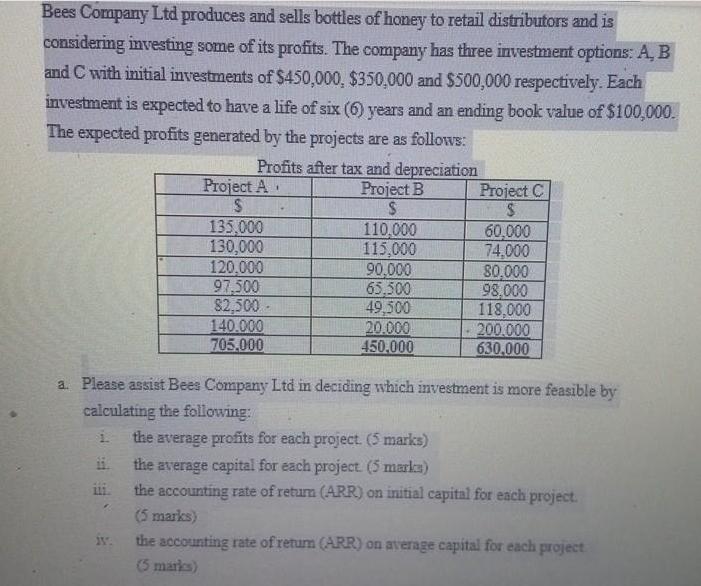

Bees Company Ltd produces and sells bottles of honey to retail distributors and is considering investing some of its profits. The company has three investment options: A, B and C with initial investments of $450,000, $350,000 and $500,000 respectively. Each investment is expected to have a life of six (6) years and an ending book value of $100,000. The expected profits generated by the projects are as follows: Profits after tax and depreciation Project B $ 111. Project A S 135,000 130,000 120,000 97,500 82,500- 140.000 705.000 1 110,000 115,000 90,000 65.500 49,500 20.000 450.000 Project C $ 60,000 74,000 80,000 98,000 118,000 200.000 630,000 a. Please assist Bees Company Ltd in deciding which investment is more feasible by calculating the following: i. the average profits for each project. (5 marks) the average capital for each project. (5 marks) the accounting rate of return (ARR) on initial capital for each project. (5 marks) the accounting rate of retum (ARR) on average capital for each project (5 marks)

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the average profits average capital accounting rate of return ARR on initial capital and ARR on average capital for each project well use the given information and formulas Lets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started