Answered step by step

Verified Expert Solution

Question

1 Approved Answer

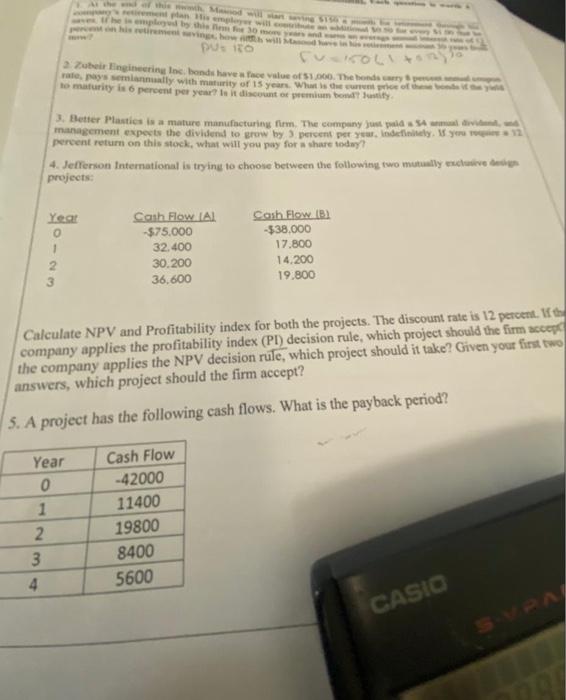

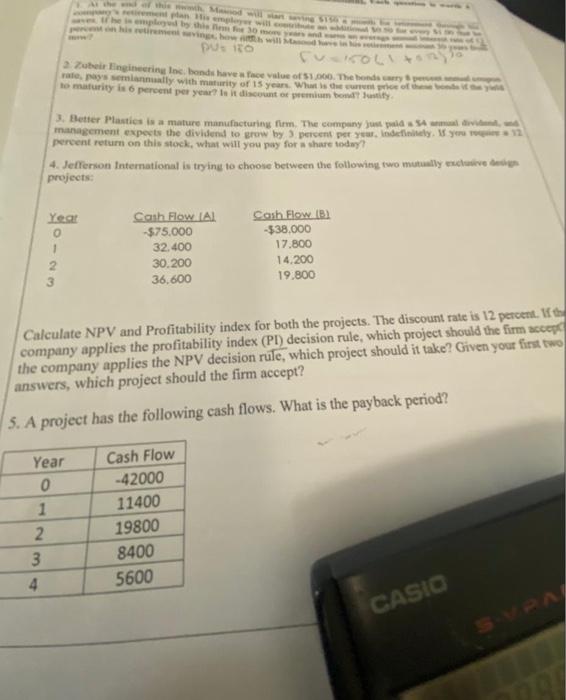

beeter ... my will hplatformand puso GOL Zuberingineering Inc bonds have a face value of 51.00. The body ray seminally with maturity of 15 years.

beeter

... my will hplatformand puso GOL Zuberingineering Inc bonds have a face value of 51.00. The body ray seminally with maturity of 15 years. What is the room to maturity is 6 percent per year is it discount o premium bowlity 3. Better Plastics is a mature manufacturing firm. The company just pula SA management experts the dividend to grow by 5 percent per year. Indeny you percent return on this stock, what will you pay for a share today! 4. Jefferson International is trying to choose between the following two mutually exclusieve projects Yes 1 2 3 Cash Flow IAI -$75,000 32.400 30.200 36,600 Cash Flow (B2 -$38.000 17.800 14.200 19.800 Calculate NPV and Profitability index for both the projects. The discount rate is 12 percent. company applies the profitability index (PI) decision rule, which project should the firm accept the company applies the NPV decision rule, which project should it take? Given your first two answers, which project should the firm accept? 5. A project has the following cash flows. What is the payback period? Year 0 1 2. 3 4 Cash Flow -42000 11400 19800 8400 5600 CASIO ... my will hplatformand puso GOL Zuberingineering Inc bonds have a face value of 51.00. The body ray seminally with maturity of 15 years. What is the room to maturity is 6 percent per year is it discount o premium bowlity 3. Better Plastics is a mature manufacturing firm. The company just pula SA management experts the dividend to grow by 5 percent per year. Indeny you percent return on this stock, what will you pay for a share today! 4. Jefferson International is trying to choose between the following two mutually exclusieve projects Yes 1 2 3 Cash Flow IAI -$75,000 32.400 30.200 36,600 Cash Flow (B2 -$38.000 17.800 14.200 19.800 Calculate NPV and Profitability index for both the projects. The discount rate is 12 percent. company applies the profitability index (PI) decision rule, which project should the firm accept the company applies the NPV decision rule, which project should it take? Given your first two answers, which project should the firm accept? 5. A project has the following cash flows. What is the payback period? Year 0 1 2. 3 4 Cash Flow -42000 11400 19800 8400 5600 CASIO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started