Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Beethoven Music Company started business in March 2018. Sales for its first year were $350,000. Beethoven priced its merchandise to yield a 45% gross

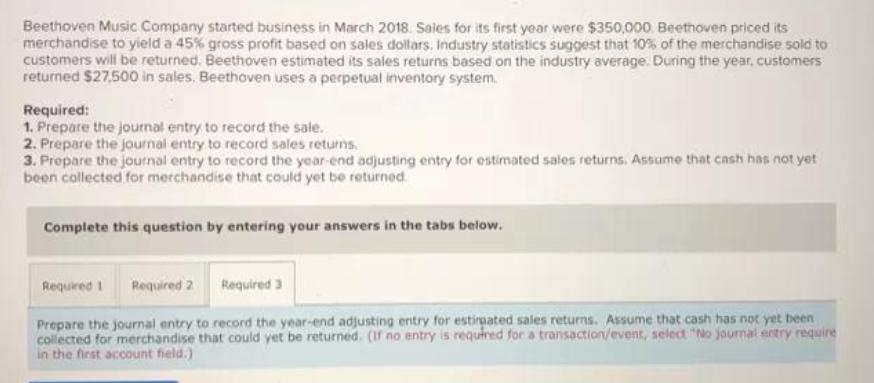

Beethoven Music Company started business in March 2018. Sales for its first year were $350,000. Beethoven priced its merchandise to yield a 45% gross profit based on sales dollars. Industry statistics suggest that 10% of the merchandise sold to customers will be returned. Beethoven estimated its sales returns based on the industry average. During the year, customers returned $27,500 in sales. Beethoven uses a perpetual inventory system. Required: 1. Prepare the journal entry to record the sale. 2. Prepare the journal entry to record sales returns. 3. Prepare the journal entry to record the year-end adjusting entry for estimated sales returns. Assume that cash has not yet been collected for merchandise that could yet be returned. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entry to record the year-end adjusting entry for estirpated sales returns. Assume that cash has not yet been collected for merchandise that could yet be returned. (If no entry is required for a transaction/event, select "No journal entry require in the first account field.)

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Account titles and Explanation No 1 Accounts receivable Sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started