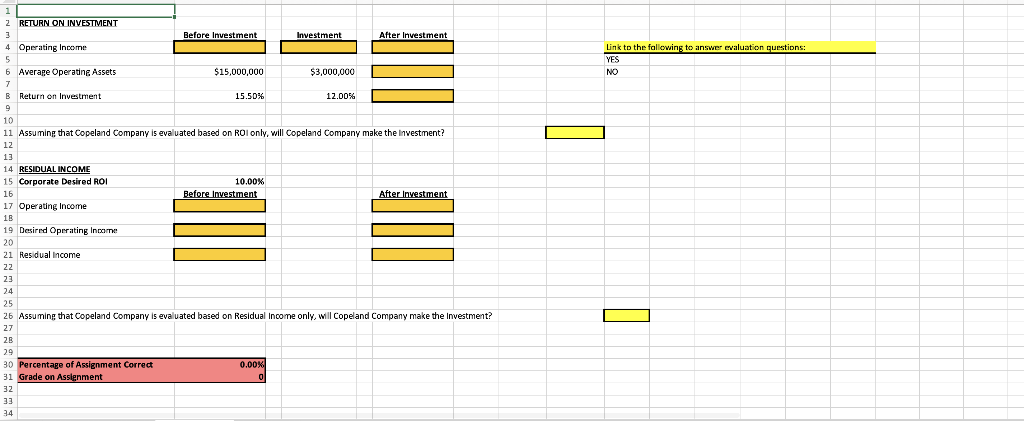

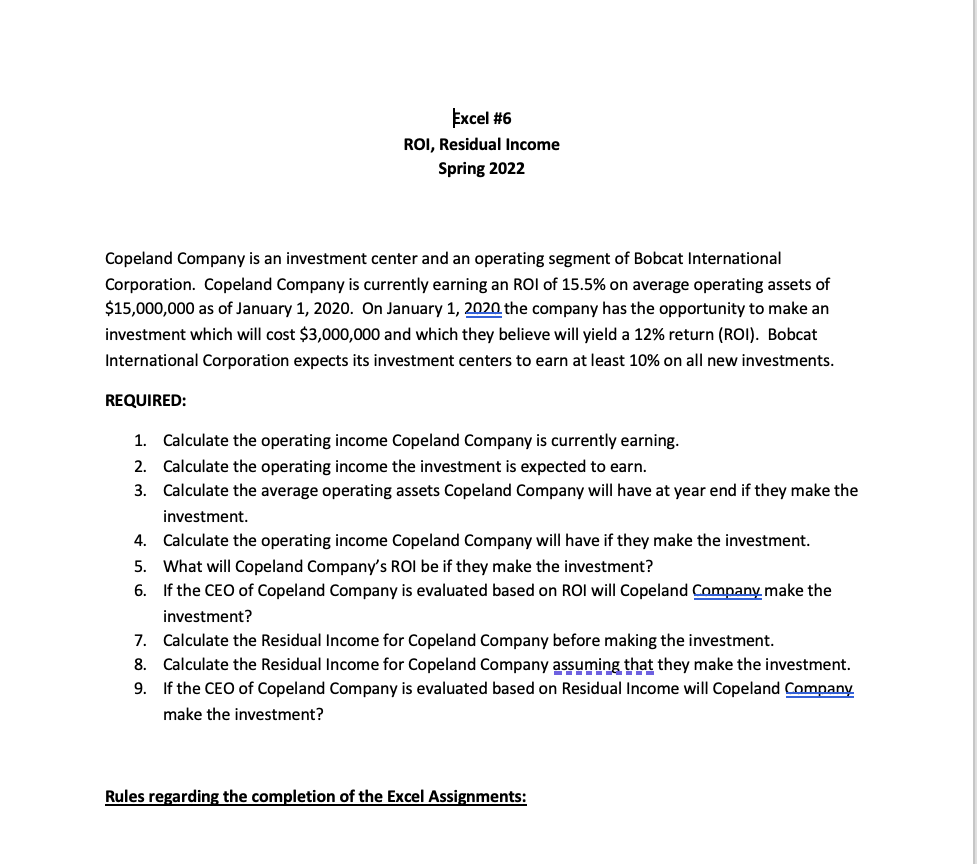

Before Investment Investment After Investment 1 1 2 RETURN ON INVESTMENT 3 4 Operating Income 5 6 Average Operating Assets 7 B Return on Investment Link to the following to answer evaluation questions: YES NO $15,000,000 $3,000,000 15.50% 12.00% 10 11 Assuming that Copeland Company is evaluated based on ROI only, will Copeland Company make the investment? 12 13 14 RESIDUAL INCOME 15 Corporate Desired ROI 10.00% 16 Before Investment After Investment 17 Operating Income 18 19 Desired Operating Income 20 21 Residual income 22 23 24 25 26 Assuming that Copeland Company is evaluated based on Residual income only, will Copeland Company make the Investment? 27 2B 29 30 Percentage of Assignment Correct 0.00% % 31 Grade on Asslenment 0 32 33 34 D Excel #6 ROI, Residual Income Spring 2022 Copeland Company is an investment center and an operating segment of Bobcat International Corporation. Copeland Company is currently earning an ROI of 15.5% on average operating assets of $15,000,000 as of January 1, 2020. On January 1, 2020 the company has the opportunity to make an investment which will cost $3,000,000 and which they believe will yield a 12% return (ROI). Bobcat International Corporation expects its investment centers to earn at least 10% on all new investments. REQUIRED: 1. Calculate the operating income Copeland Company is currently earning. 2. Calculate the operating income the investment is expected to earn. 3. Calculate the average operating assets Copeland Company will have at year end if they make the investment. 4. Calculate the operating income Copeland Company will have if they make the investment. 5. What will Copeland Company's ROI be if they make the investment? 6. If the CEO of Copeland Company is evaluated based on ROI will Copeland Company make the investment? 7. Calculate the Residual Income for Copeland Company before making the investment. 8. Calculate the Residual Income for Copeland Company assuming that they make the investment. 9. If the CEO of Copeland Company is evaluated based on Residual Income will Copeland Company make the investment? Rules regarding the completion of the Excel Assignments