Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Before making an unsecured loan to an individual, a bank orders a report on the applicant's credit history. To justify making the loan, the bank

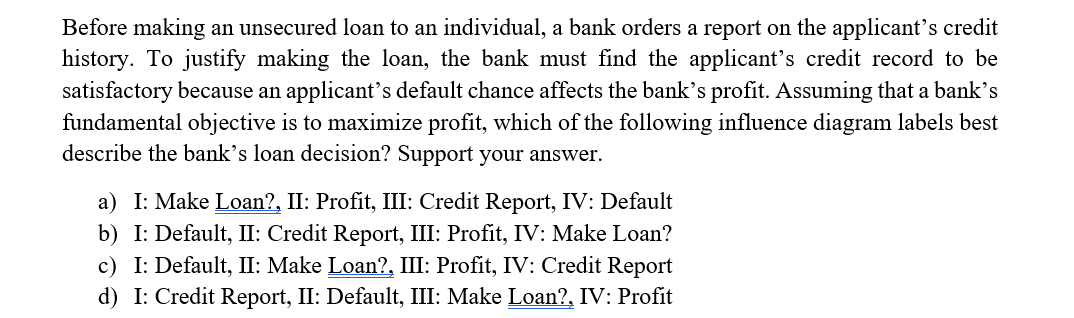

Before making an unsecured loan to an individual, a bank orders a report on the applicant's credit

history. To justify making the loan, the bank must find the applicant's credit record to be

satisfactory because an applicant's default chance affects the bank's profit. Assuming that a bank's

fundamental objective is to maximize profit, which of the following influence diagram labels best

describe the bank's loan decision? Support your answer.

a I: Make Loan?, II: Profit, III: Credit Report, IV: Default

b I: Default, II: Credit Report, III: Profit, IV: Make Loan?

c I: Default, II: Make Loan?, III: Profit, IV: Credit Report

d I: Credit Report, II: Default, III: Make Loan?, IV: Profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started