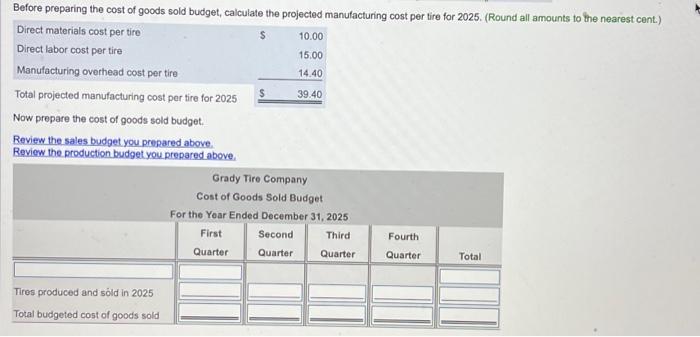

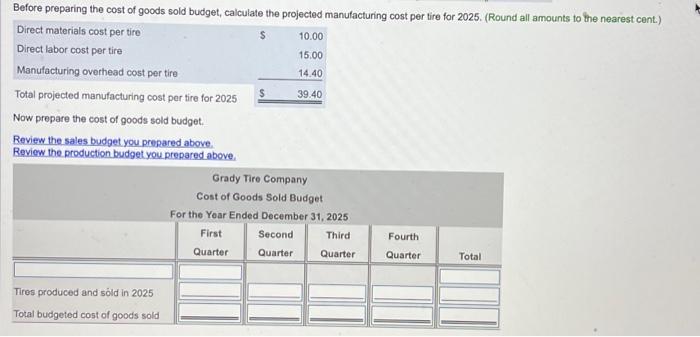

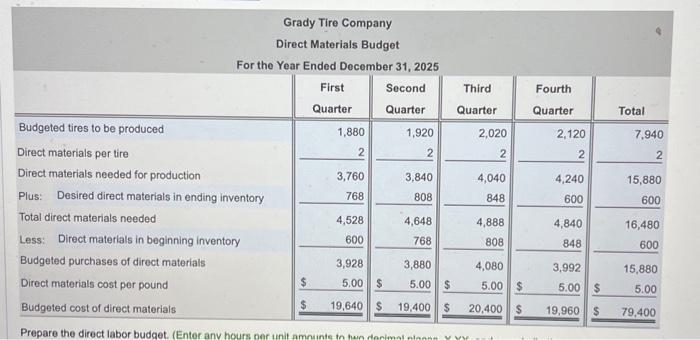

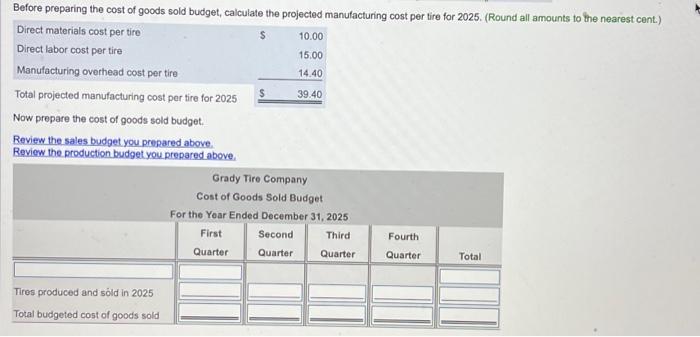

Before preparing the cost of goods sold budget, calculate the projected manufacturing cost per tire for 2025. (Round all amounts to the nearest cent.) Direct materials cost per tire $ Direct labor cost per tire Manufacturing overhead cost per tire Total projected manufacturing cost per tire for 2025 Now prepare the cost of goods sold budget. Review the sales budget you prepared above. Review the production budget you prepared above. Tires produced and sold in 2025 Total budgeted cost of goods sold $ 10.00 15.00 14.40 39.40 Grady Tire Company Cost of Goods Sold Budget For the Year Ended December 31, 2025 First Second Third Quarter Quarter Quarter Fourth Quarter Total

(I need the blank section answered)

(adding all other pictures incase needed)

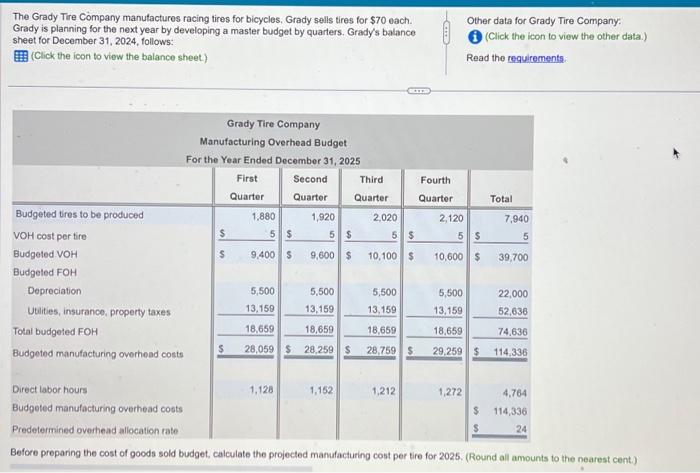

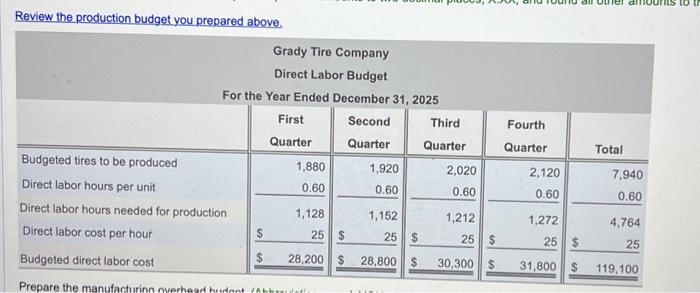

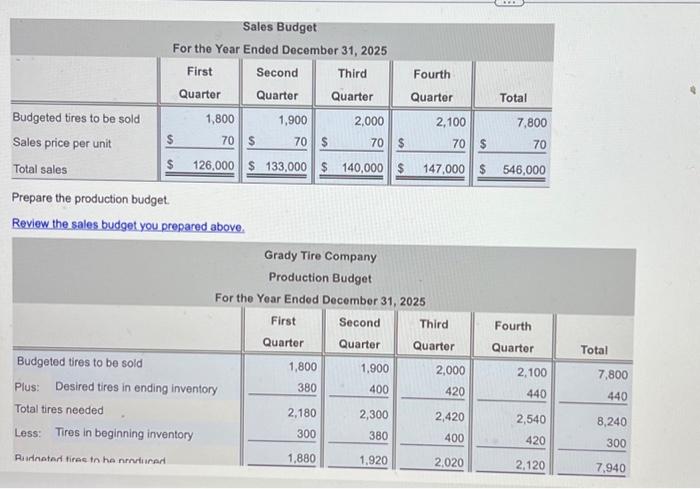

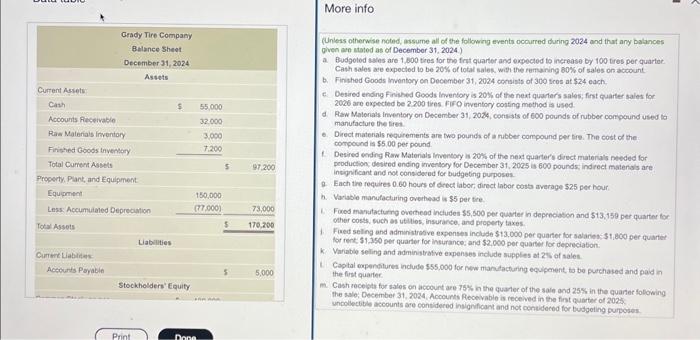

The Grady Tire Company manutactures racing tires for bicycles. Grady sells tires for $70 each. Grady is planning for the next year by developing a master budget by quarters. Grady's balance sheet for December 31, 2024, follows: I7) (Click the icon to view the balance sheet) Other data for Grady Tire Company: (Click the icon to view the other data.) Read the requirements. Before preparing the cost of goods sold budget, calculate the projected manufacturing cost per tire for 2025 . (Round all amounts to the nearest cent.) \begin{tabular}{|c|c|c|c|c|c|} \hline For the & \begin{tabular}{l} Grady Tire Comp \\ rect Materials B \\ ar Ended Decen \end{tabular} & \begin{tabular}{l} lany \\ udget \\ aber 31,2025 \end{tabular} & & & 8 \\ \hline t & \begin{tabular}{c} First \\ Quarter \end{tabular} & \begin{tabular}{l} Second \\ Quarter \end{tabular} & \begin{tabular}{c} Third \\ Quarter \end{tabular} & \begin{tabular}{l} Fourth \\ Quarter \end{tabular} & Total \\ \hline Budgeted tires to be produced & 1,880 & 1,920 & 2,020 & 2,120 & 7,940 \\ \hline Direct materials per tire & 2 & 2 & 2 & 2 & 2 \\ \hline Direct materials needed for production & 3,760 & 3,840 & 4,040 & 4,240 & 15,880 \\ \hline Plus: Desired direct materials in ending inventory & 768 & 808 & 848 & 600 & 600 \\ \hline Total direct materials needed & 4,528 & 4,648 & 4,888 & 4,840 & 16,480 \\ \hline Less: Direct materials in beginning inventory & 600 & 768 & 808 & 848 & 600 \\ \hline Budgeted purchases of direct materials & 3,928 & 3,880 & 4,080 & 3,992 & 15,880 \\ \hline Direct materials cost per pound & 5.00 & 5.00 & 5.00 & 5.00 & 5.00 \\ \hline Budgeted cost of direct materials & 19,640 & $19,400 & 20,400 & 19,960 & 79,400 \\ \hline \end{tabular} (Unless otherwse noted; assume all of the following events ocourred during 2024 and that any balances Given ave stated as of December 31,2024 .) a Budgolod whes are 1, 000 tires for the frat quarter and expected to increase by 100 bres per quarter. Cath sales ace expocted to be 20% of total sales. with the remaning b0\% of sales on account. b. Finshed Goods inventory on December 31, 2024 consists of 300 ticos at $24 each. c. Desired ending Finswed Goods leventory is 20 s of the next quarter's sales; fint cuarter sales for 2026 are expected be 2.200 tires. Fir O imventory conting method is used. d. Raw Matenals inventory on Desember 31,2024 , consists of 600 pounds of rubber conpound used lo manufaclate the lireat e. Direct materials requirements are two pounds of a nubber compound per tire. The cost of the compound is $5.00 per pound. 1. Desined ending Raw Matenats limentory is 20% of the next quartere dinct materals neteded for intignificant and not consideved for budgeting purposes. 9. Each the requires 0.60 hours of decet labor; direct laber costs average $25 per hour b. Warlable manufacturing overhead is $5 per tire. 1. Forod mandacturno overheod inctudes $5,500 per quarter in depreciation and 513,150 per quarter for other costs, woch os utlios, insurarse, and property taxes. Hor rent: $1,350 per quarter for insurance; and \$2,000 per quarter for decoveciabon: k. Variable seling and administrative expenses include supples at 2% of sales. 1. Captal expenditurea include $55,000 for new mandachuring equipenent to be purchased and paid in the frut quarfer. the sale, December 31, 2024, Accounts Recelvable is recelved in the first cubrer of 2025 . unpolbectite accounts are contidered insignflicant and not centideced for budgeting purposes. Review the sales budget you prepared above. Review the production budget you prepared above Review the production budget you prepared above. Prepare the production budget. Review the sales budget you prepared above