Question

Before the pandemic, bars and restaurants accounted for most liquor revenue on the continent. Now companies are using influencers to get consumers drinking at home.

Before the pandemic, bars and restaurants accounted for most liquor revenue on the continent. Now companies are using influencers to get consumers drinking at home.

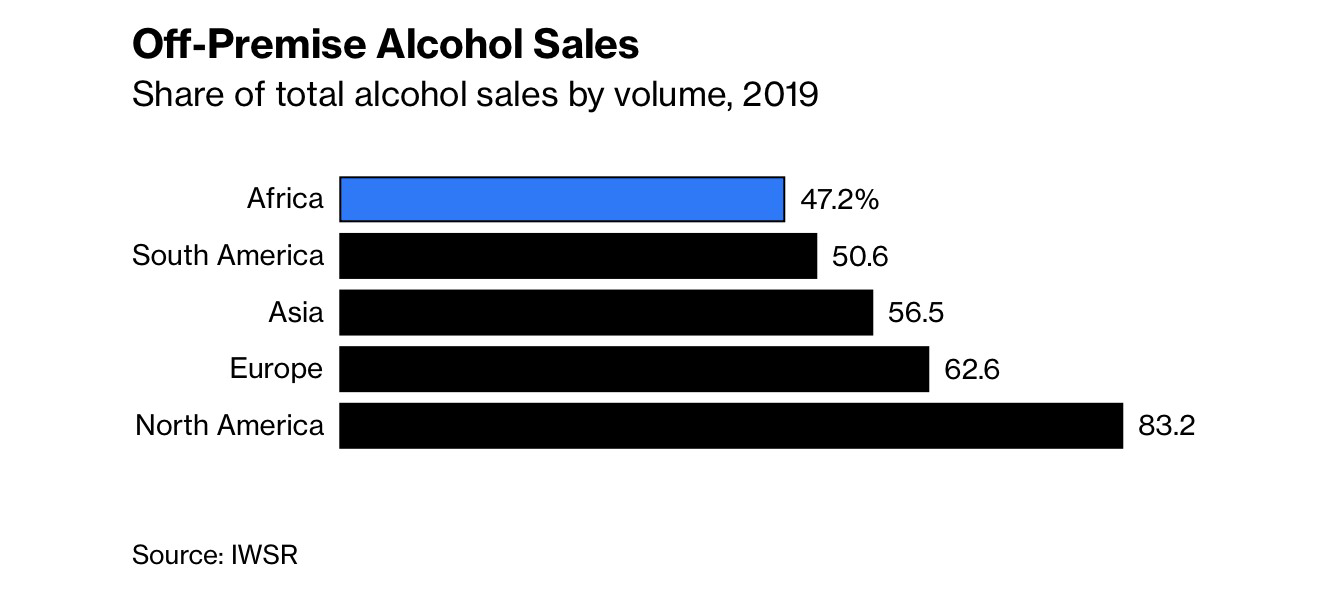

When Val Nasubo wanted a drink, she did what most people in Kenya do: headed out to a bar to share a round with friends. But now the 31-year-old data analyst from Nairobi has discovered she prefers having a drink at home. "I love the comfort of fixing myself a drink after a long day at work," she says. "I'm always searching for new cocktail recipes." Alcohol producers in Africa hope that Nasubo's stay-at-home approach is part of a trend that could solve a tricky problem. The pandemic proved especially difficult for makers of drinks there. Diageo Plc has said that 75% of its alcohol revenue in Africa came from drinking establishments and restaurants before the pandemic. So, when the spread of Covid-19 kept patrons away from crowded social settings, consumers didn't readily shift to at-home drinking.

As sales missed expectations, the industry responded by trying to get Africans to warm to the idea of buying booze for home consumption. It wasn't easy. Most people associate alcohol with hanging out at a local watering hole or storefront, where there are usually tables and chairs. And many thought they didn't have the space to host gatherings in their homes, according to Daniel Mettyear, head of research for Europe, the Middle East, and Africa at alcohol market researcher IWSR. Advertising also proved a challenge, because a lot of marketing had been targeted at customers of those very same bars and restaurants that were now empty.

Enter paid influencers like thirtysomething Julia "Jules" Gaitho. Her Instagram account is filled with posts about Gordon's, a Diageo gin brand. There are photos of her sipping a cocktail on a patio and a park bench. In one video she shows off her mixology skills, pouring ice cubes, gin, ginger ale, cranberry juice, and raspberries into a glass to make a red Gordon's Ruby Cooler cocktail at home, then inviting her followers to re-create similar drink.

"Word of mouth remains one of the most powerful marketing tools," says Gaitho, who has more than 100,000 Instagram followers. "Those who follow me feel like my friends and can relate to my life experiences."

Social media influencing had been around for more than a decade, but in Africa it hadn't become as popular a marketing tool. Many big brands still focused on entertainers or sports stars to pitch their quaffs, or they bought television ads and billboard space. The pandemic upended that strategy. Hours spent online surged as people avoided away-from-home gatherings or observed curfews. To capture the attention of the continent's young, rising middle class, alcohol brands poured resources into social media. Soon influencers were being paid to promote big booze brands and the pleasures of drinking away from a bar or club.

Even the use of so-called nano-influencers, who have only a couple thousand followers, boomed. They were initially popular with small businesses but are now favored by global brands, according to Wowzi, a Kenya-based startup that helped Diageo with its social media campaigns. These small influencers can earn from $300 to $2,000 a month through paid posts. "We've found that there is more trust at the nano level," says Mike Otieno, a Wowzi co-founder.

Since the start of the pandemic, Diageo has doubled its spending on digital media advertising in East Africa, helping it reach more people without relying on expensive media such as television. Advertising on TV presents other challenges as well, since most African markets, including Kenya and Nigeria, restrict the airing of alcohol ads to after 10 p.m.

The shift to influencer marketing helped boost alcohol consumption outside drinking establishments by 22% in 2020, according to IWSR, dwarfing the 2.3% rise recorded in 2019. While the pandemic accounts for much of that increase, further growth is likely, with alcohol consumption in Africa expected to grow by 18% in volume from 2021 to 2025, and by 20% in value, according to IWSR.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started