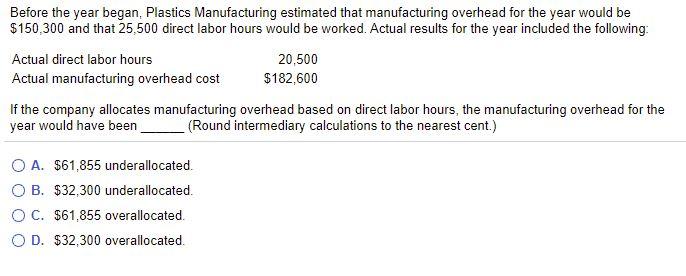

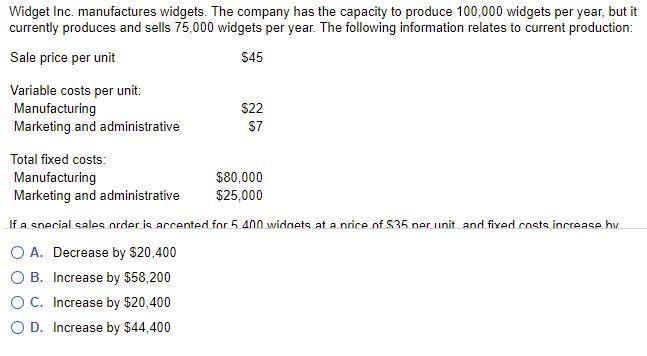

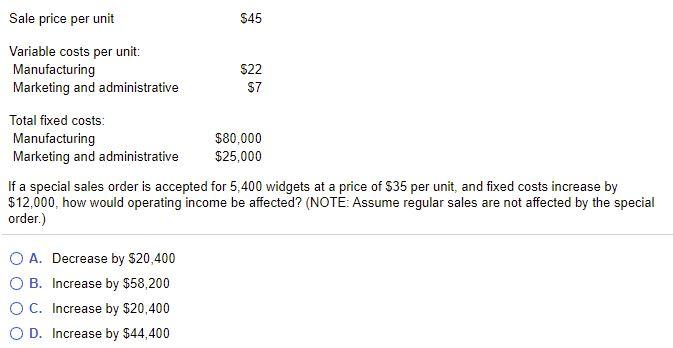

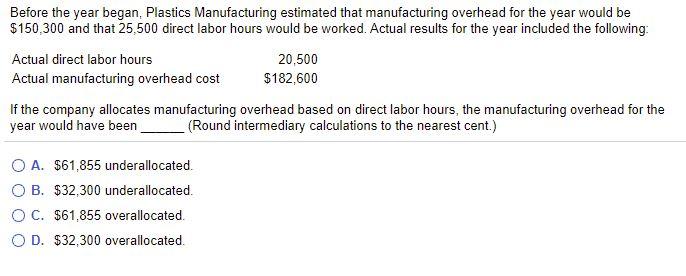

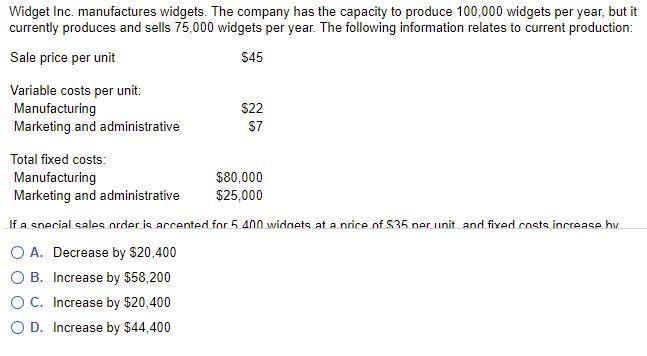

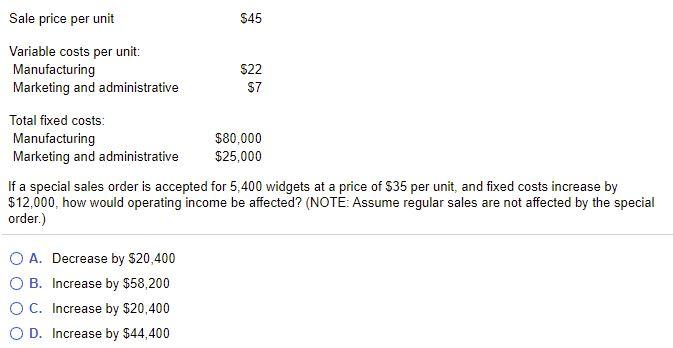

Before the year began, Plastics Manufacturing estimated that manufacturing overhead for the year would be $150.300 and that 25,500 direct labor hours would be worked. Actual results for the year included the following: Actual direct labor hours 20,500 Actual manufacturing overhead cost $182,600 If the company allocates manufacturing overhead based on direct labor hours, the manufacturing overhead for the year would have been (Round intermediary calculations to the nearest cent.) O A. $61,855 underallocated. OB. $32,300 underallocated. OC. $61,855 overallocated. OD. $32,300 overallocated. Widget Inc. manufactures widgets. The company has the capacity to produce 100,000 widgets per year, but it currently produces and sells 75,000 widgets per year. The following information relates to current production: Sale price per unit $45 $22 Variable costs per unit: Manufacturing Marketing and administrative $7 Total fixed costs: Manufacturing $80,000 Marketing and administrative $25,000 If a special sales order is accented for 5.400 widaets at a nrice nf S35 per unit and fixed costs increase hw O A. Decrease by $20,400 OB. Increase by $58,200 OC. Increase by $20,400 OD. Increase by $44,400 Sale price per unit $45 Variable costs per unit: Manufacturing $22 Marketing and administrative $7 Total fixed costs Manufacturing $80,000 Marketing and administrative $25,000 If a special sales order is accepted for 5,400 widgets at a price of $35 per unit, and fixed costs increase by $12,000, how would operating income be affected? (NOTE: Assume regular sales are not affected by the special order.) O A. Decrease by $20,400 O B. Increase by $58,200 O C. Increase by $20,400 OD. Increase by $44,400 Before the year began, Plastics Manufacturing estimated that manufacturing overhead for the year would be $150.300 and that 25,500 direct labor hours would be worked. Actual results for the year included the following: Actual direct labor hours 20,500 Actual manufacturing overhead cost $182,600 If the company allocates manufacturing overhead based on direct labor hours, the manufacturing overhead for the year would have been (Round intermediary calculations to the nearest cent.) O A. $61,855 underallocated. OB. $32,300 underallocated. OC. $61,855 overallocated. OD. $32,300 overallocated. Widget Inc. manufactures widgets. The company has the capacity to produce 100,000 widgets per year, but it currently produces and sells 75,000 widgets per year. The following information relates to current production: Sale price per unit $45 $22 Variable costs per unit: Manufacturing Marketing and administrative $7 Total fixed costs: Manufacturing $80,000 Marketing and administrative $25,000 If a special sales order is accented for 5.400 widaets at a nrice nf S35 per unit and fixed costs increase hw O A. Decrease by $20,400 OB. Increase by $58,200 OC. Increase by $20,400 OD. Increase by $44,400 Sale price per unit $45 Variable costs per unit: Manufacturing $22 Marketing and administrative $7 Total fixed costs Manufacturing $80,000 Marketing and administrative $25,000 If a special sales order is accepted for 5,400 widgets at a price of $35 per unit, and fixed costs increase by $12,000, how would operating income be affected? (NOTE: Assume regular sales are not affected by the special order.) O A. Decrease by $20,400 O B. Increase by $58,200 O C. Increase by $20,400 OD. Increase by $44,400