Answered step by step

Verified Expert Solution

Question

1 Approved Answer

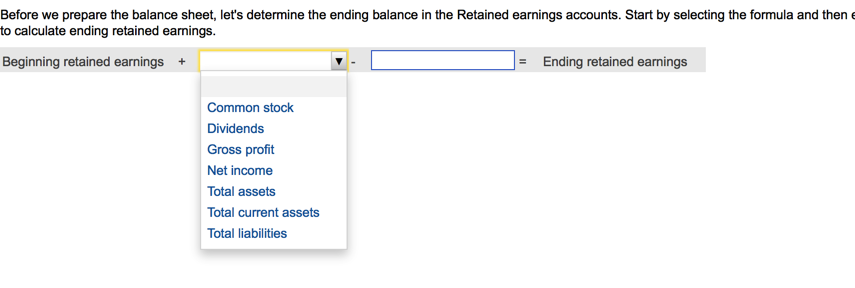

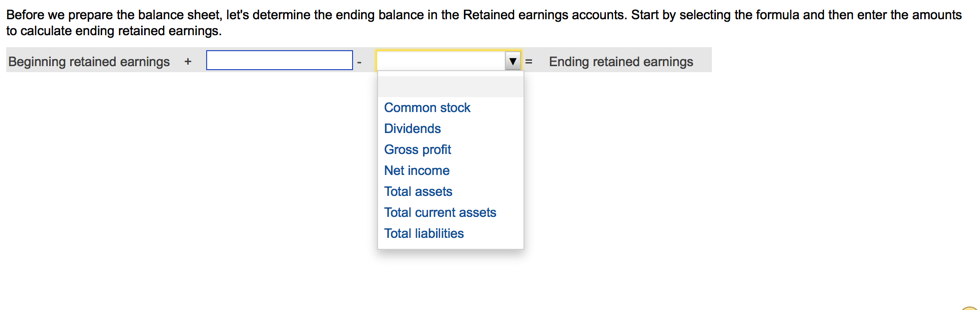

Before we prepare the balance sheet, let's determine the ending balance in the Retained earnings accounts. Start by selecting the formula and then to

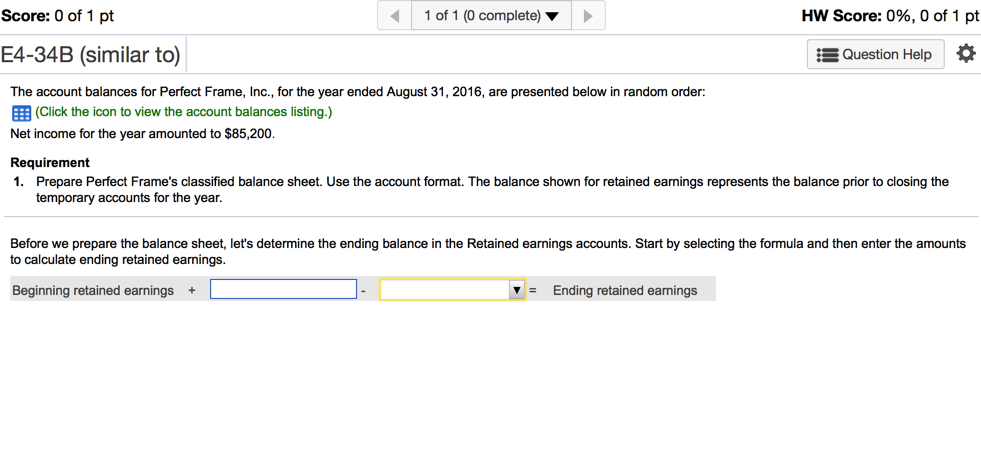

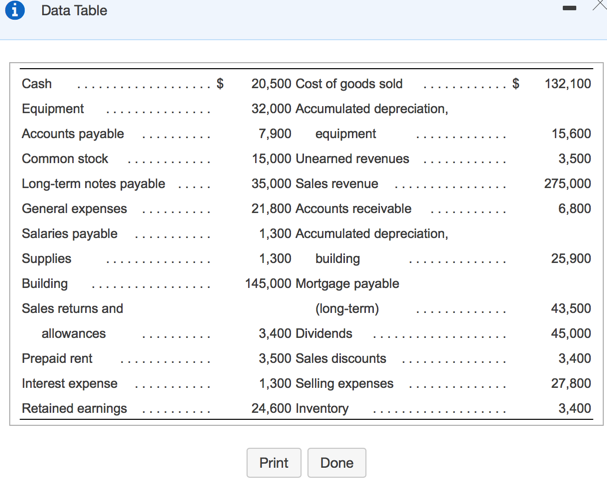

Before we prepare the balance sheet, let's determine the ending balance in the Retained earnings accounts. Start by selecting the formula and then to calculate ending retained earnings. Beginning retained earnings + = Ending retained earnings Common stock Dividends Gross profit Net income Total assets Total current assets Total liabilities Before we prepare the balance sheet, let's determine the ending balance in the Retained earnings accounts. Start by selecting the formula and then enter the amounts to calculate ending retained earnings. Beginning retained earnings + =Ending retained earnings Common stock Dividends Gross profit Net income Total assets Total current assets Total liabilities Score: 0 of 1 pt E4-34B (similar to) 1 of 1 (0 complete) The account balances for Perfect Frame, Inc., for the year ended August 31, 2016, are presented below in random order: (Click the icon to view the account balances listing.) Net income for the year amounted to $85,200. Requirement HW Score: 0%, 0 of 1 pt Question Help 1. Prepare Perfect Frame's classified balance sheet. Use the account format. The balance shown for retained earnings represents the balance prior to closing the temporary accounts for the year. Before we prepare the balance sheet, let's determine the ending balance in the Retained earnings accounts. Start by selecting the formula and then enter the amounts to calculate ending retained earnings. Beginning retained earnings + Ending retained earnings i Data Table Cash Equipment Accounts payable Common stock $ 20,500 Cost of goods sold $ 132,100 32,000 Accumulated depreciation, 7,900 equipment 15,600 15,000 Unearned revenues 3,500 Long-term notes payable 35,000 Sales revenue 275,000 General expenses Salaries payable 21,800 Accounts receivable 6,800 1,300 Accumulated depreciation, Supplies 1,300 building 25,900 Building Sales returns and allowances Prepaid rent 145,000 Mortgage payable (long-term) 43,500 3,400 Dividends 45,000 3,500 Sales discounts 3,400 Interest expense 1,300 Selling expenses 27,800 Retained earnings 24,600 Inventory 3,400 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started