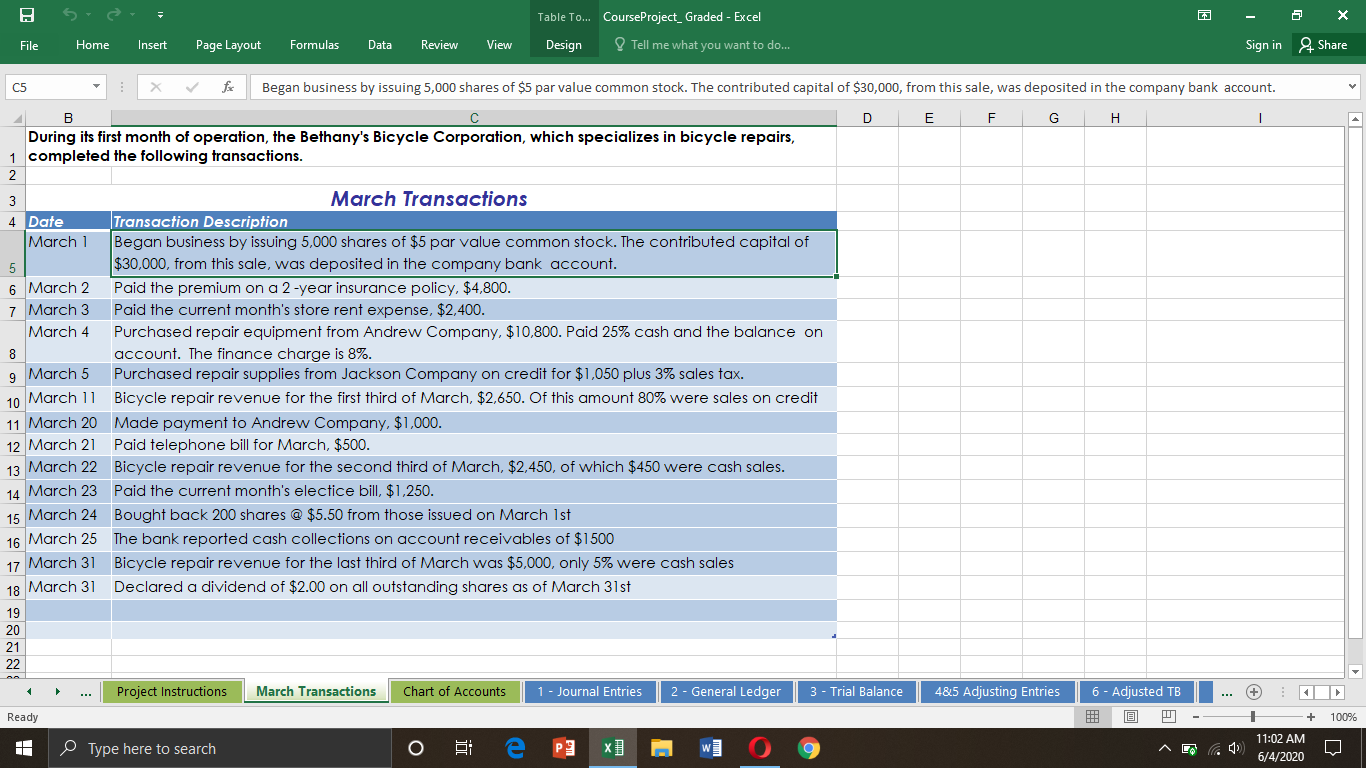

Began business by issuing 5,000 shares of $5 par value common stock. The contributed capital of $30,000, from this sale, was deposited in the company bank account.

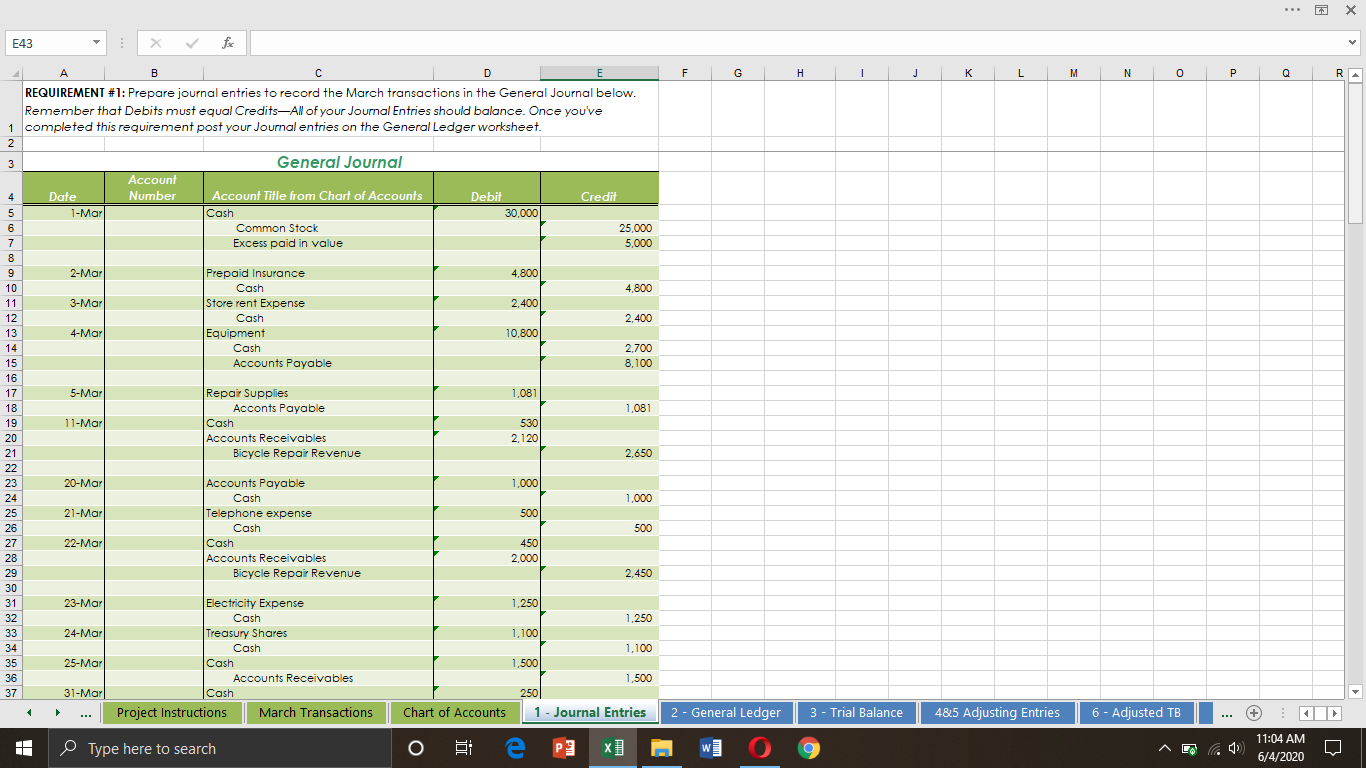

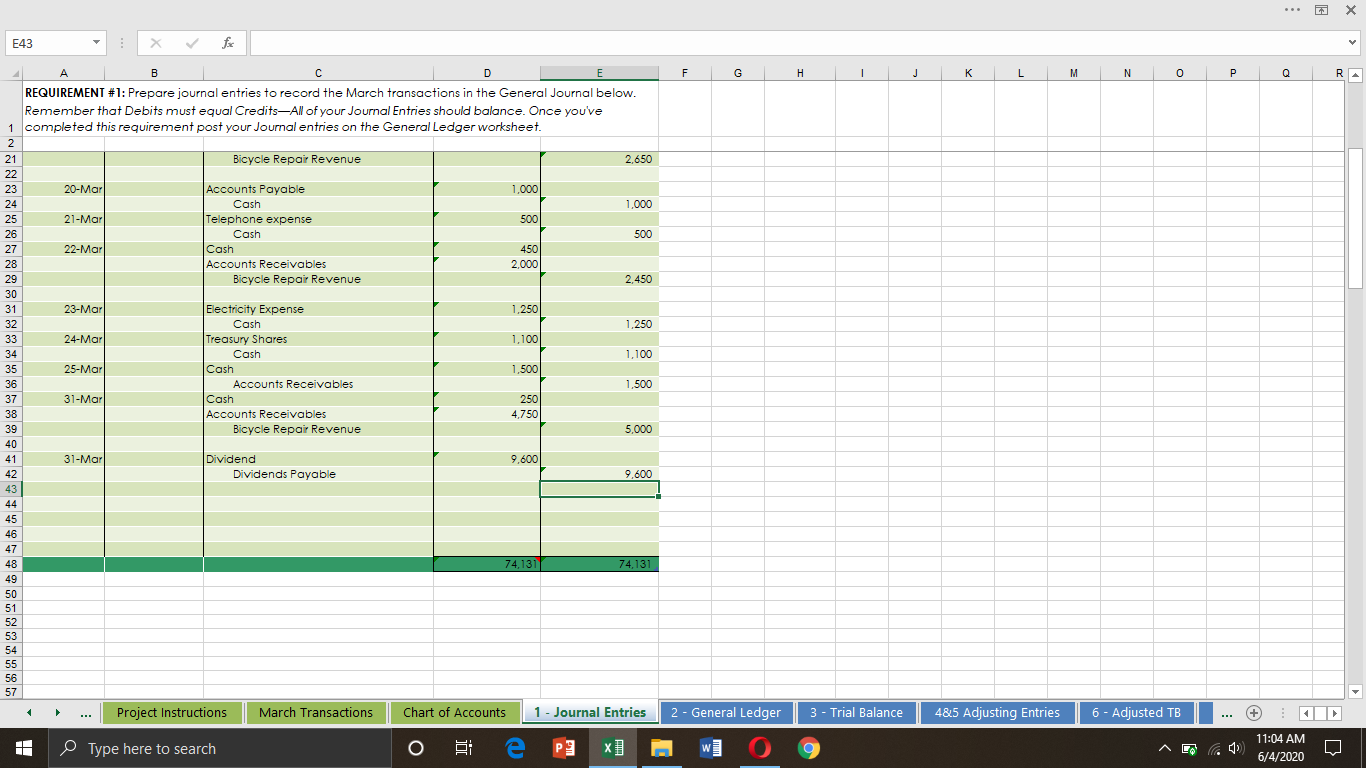

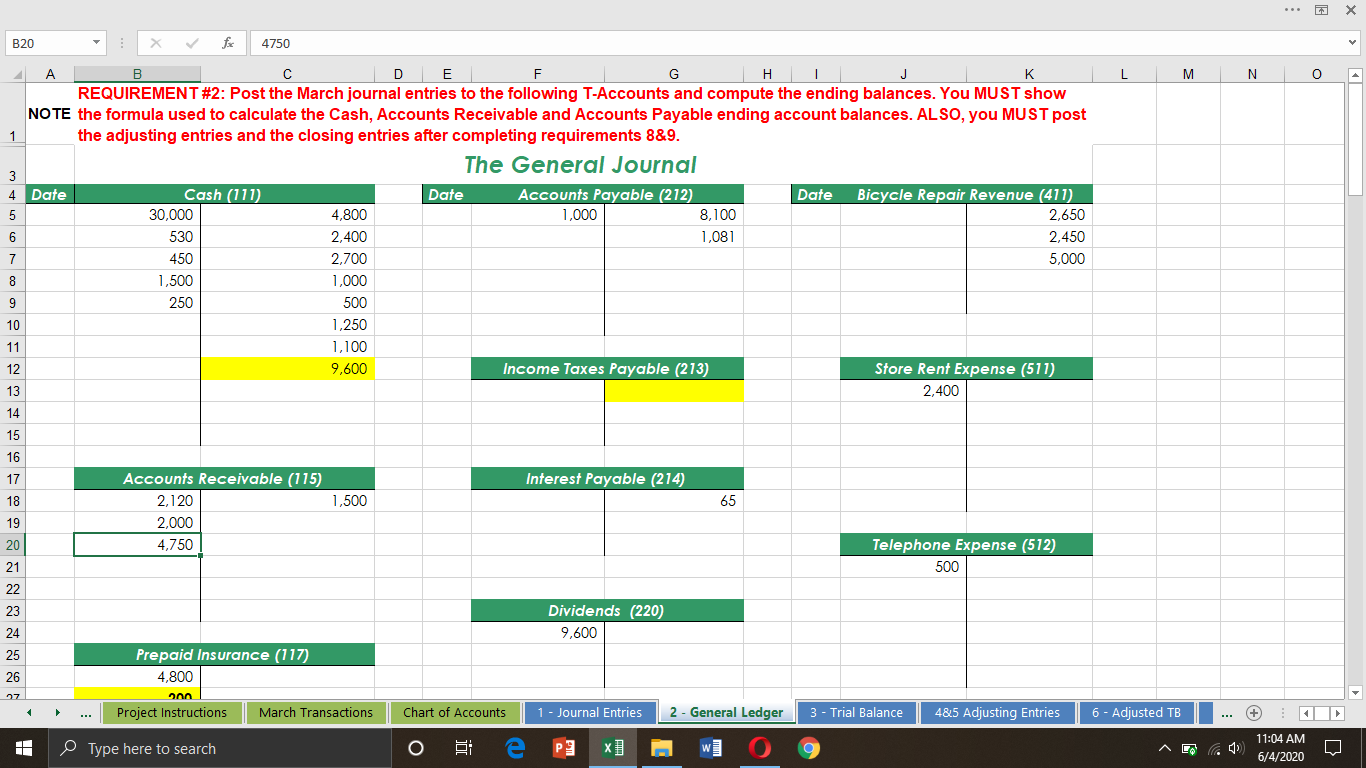

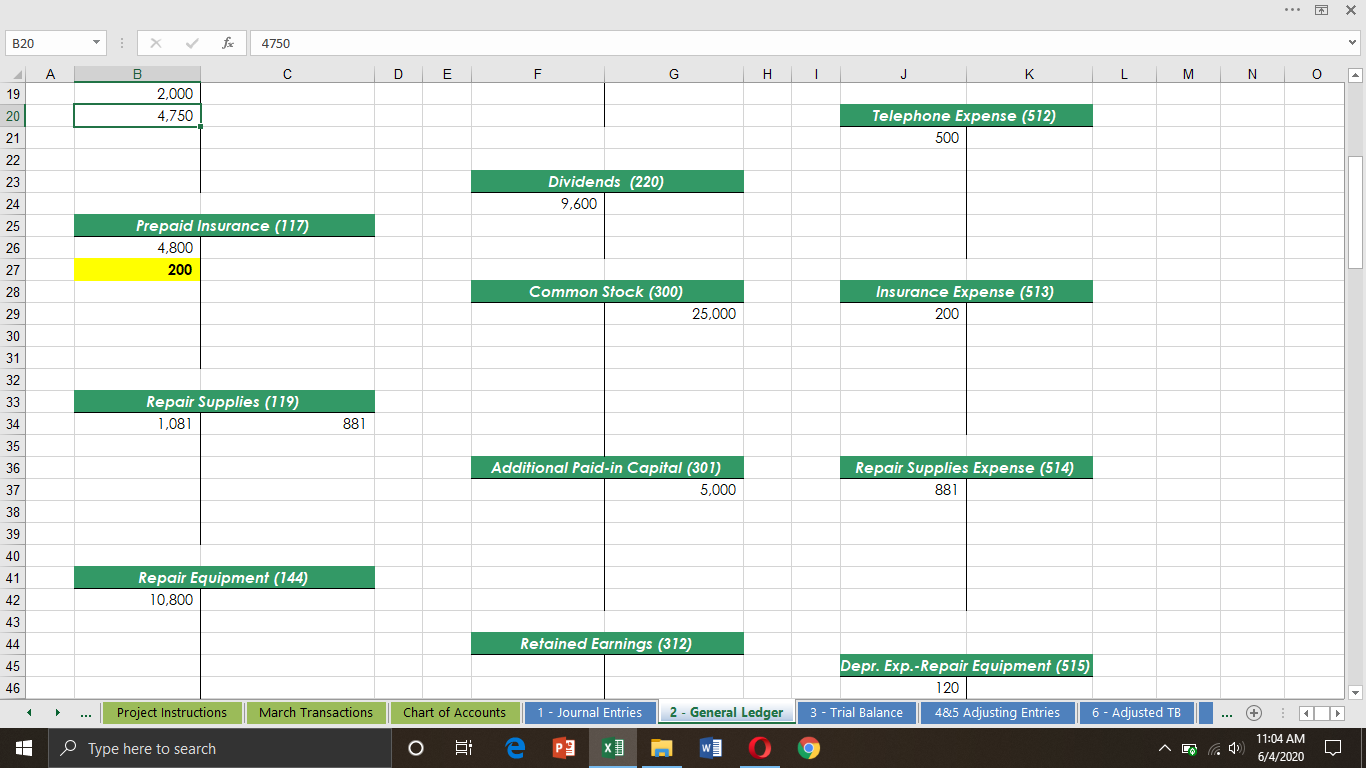

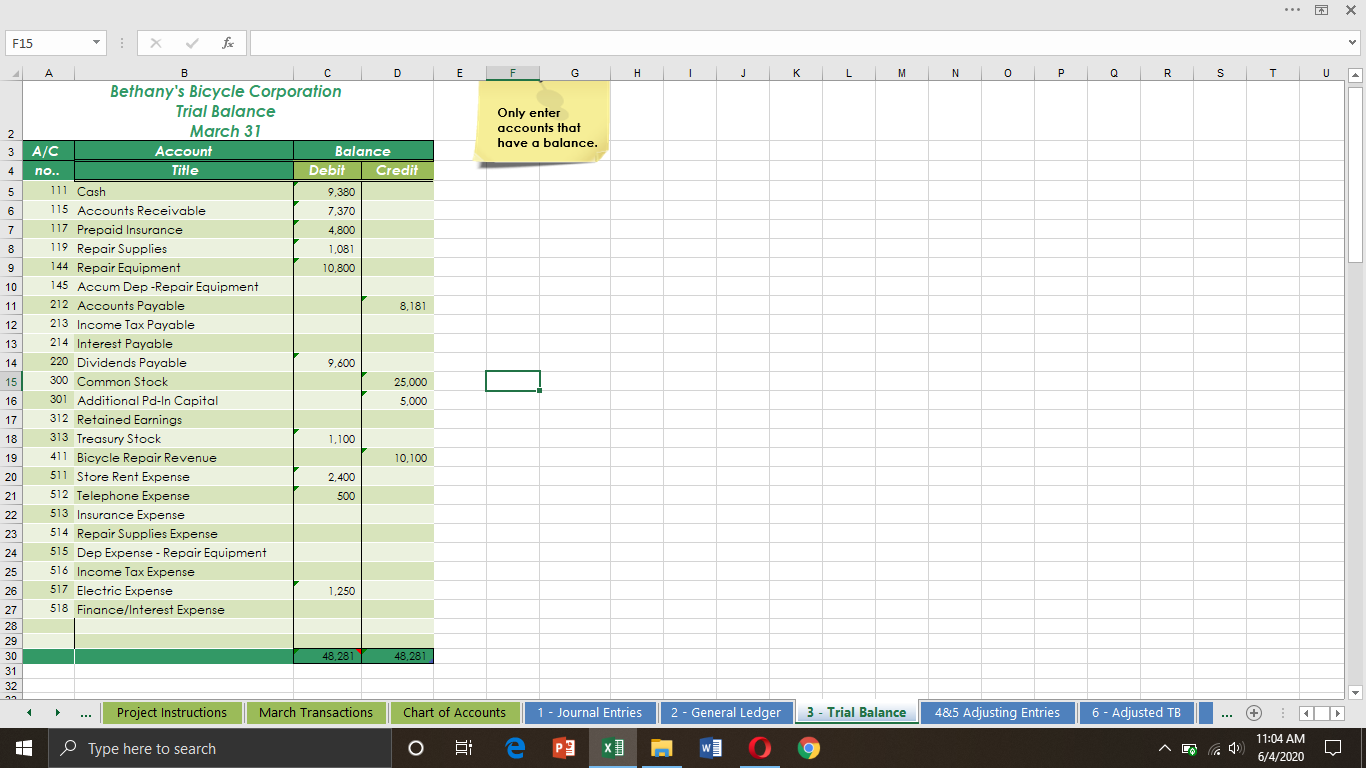

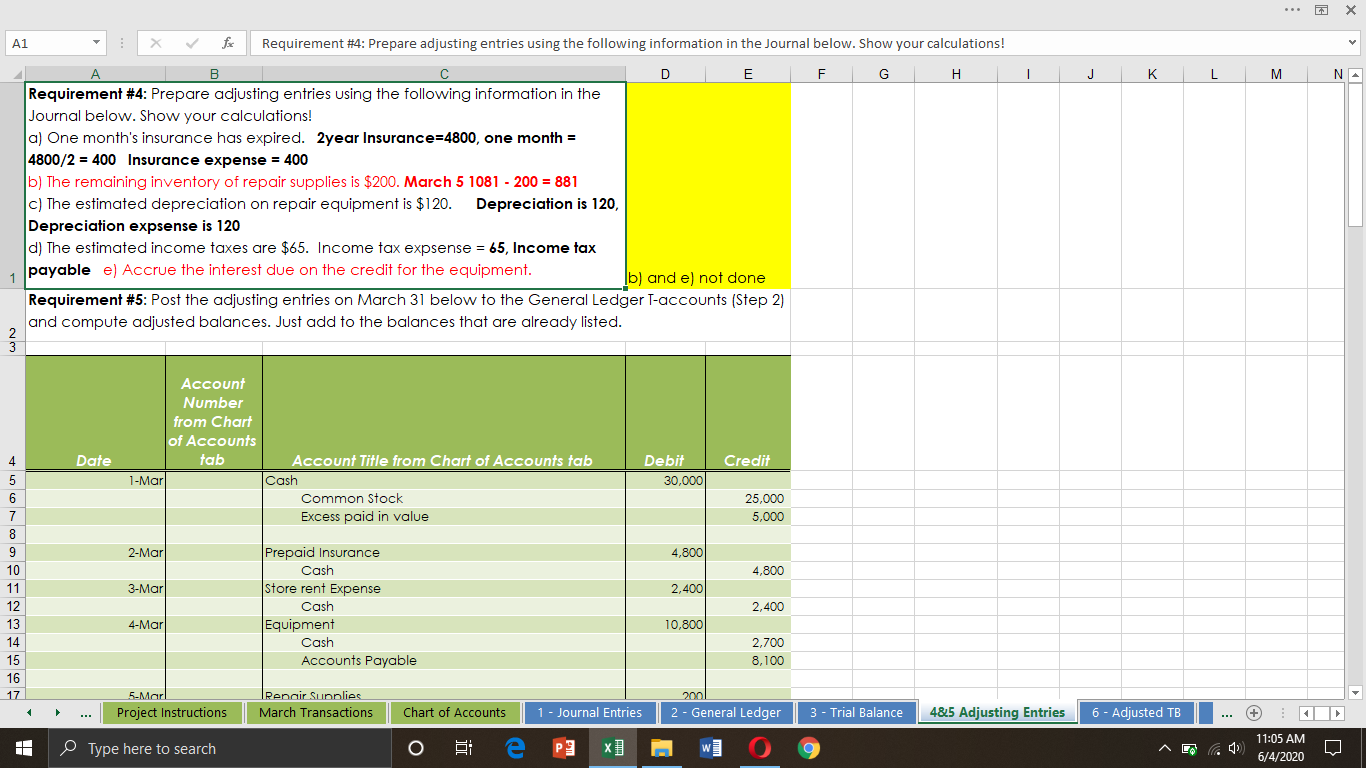

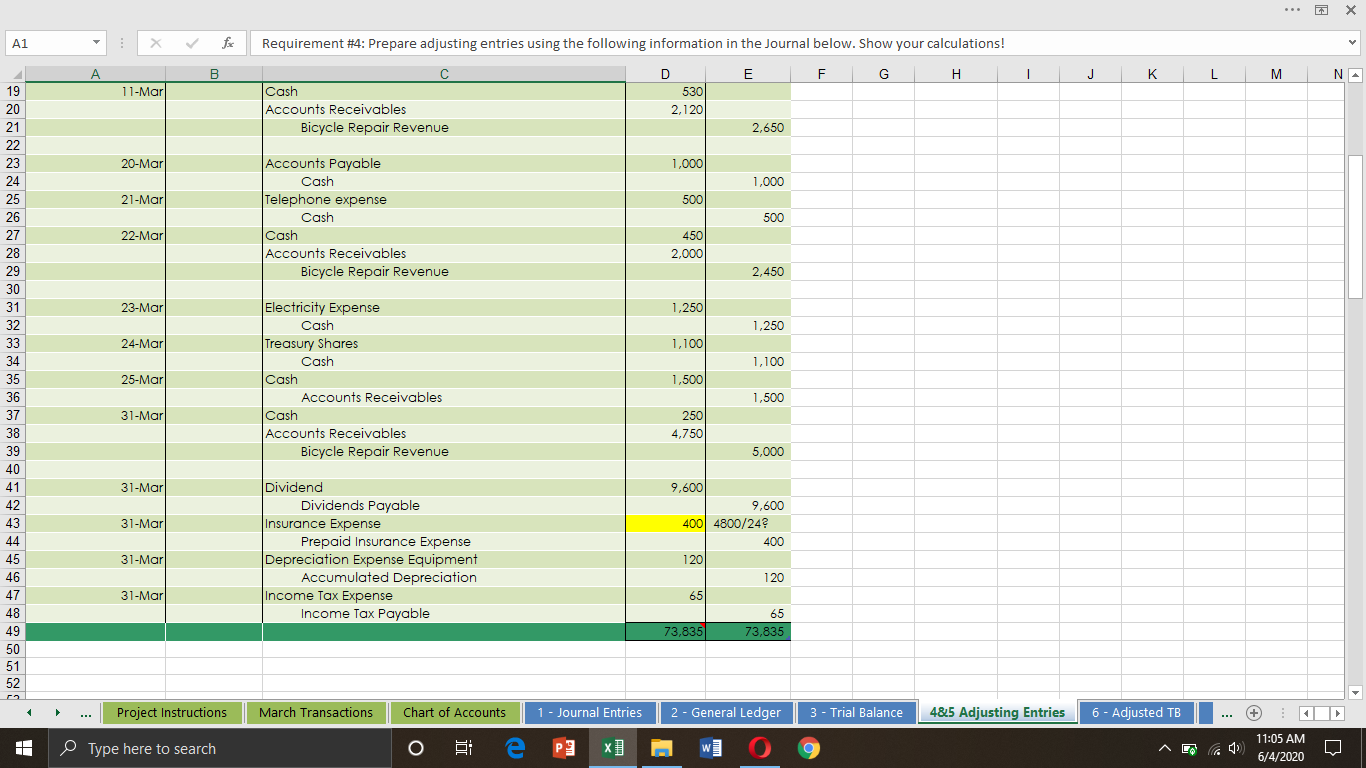

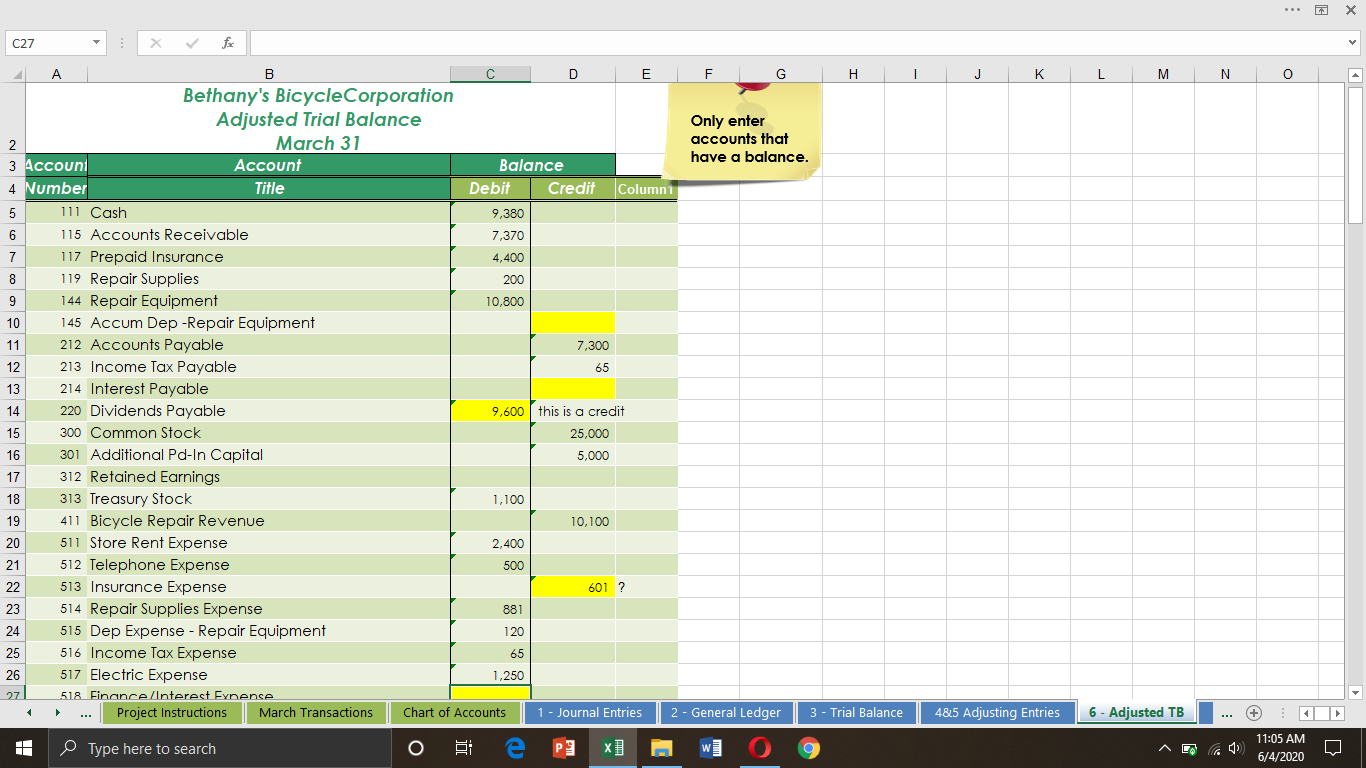

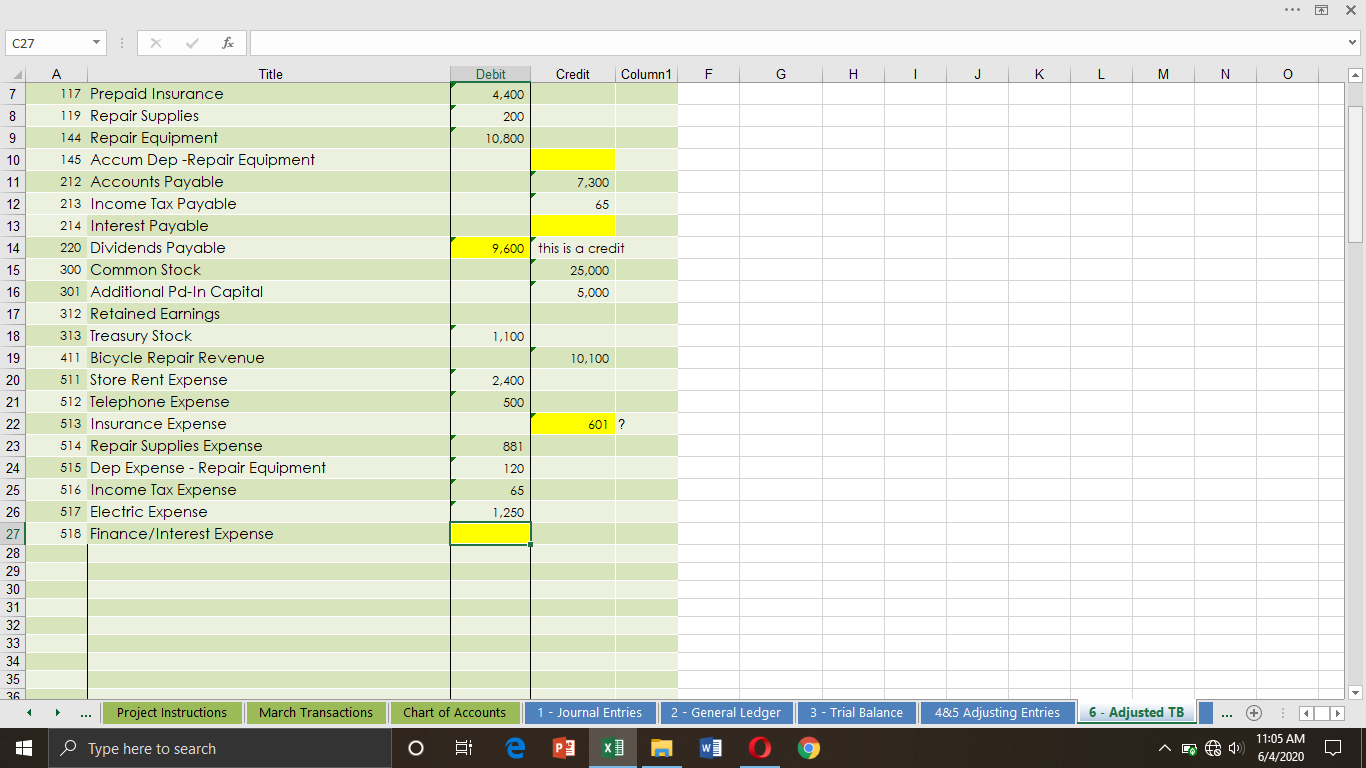

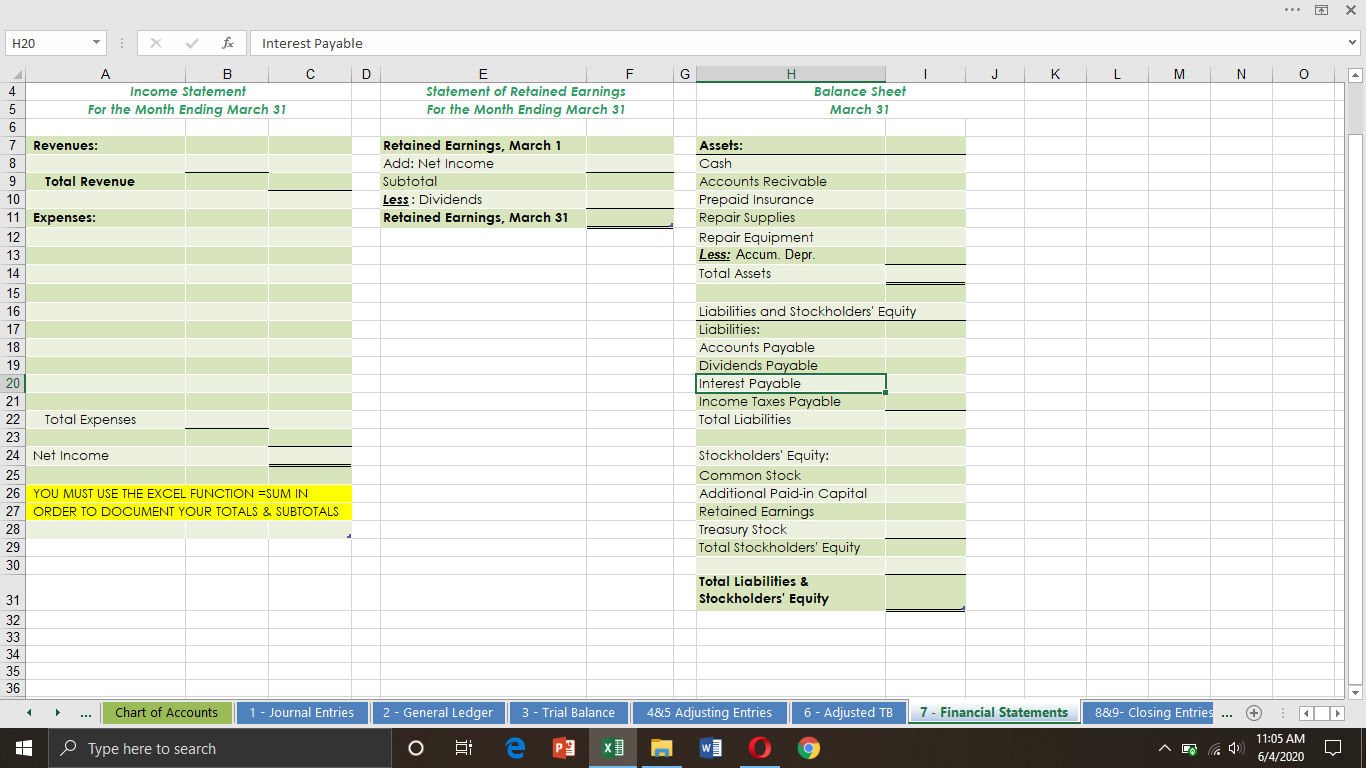

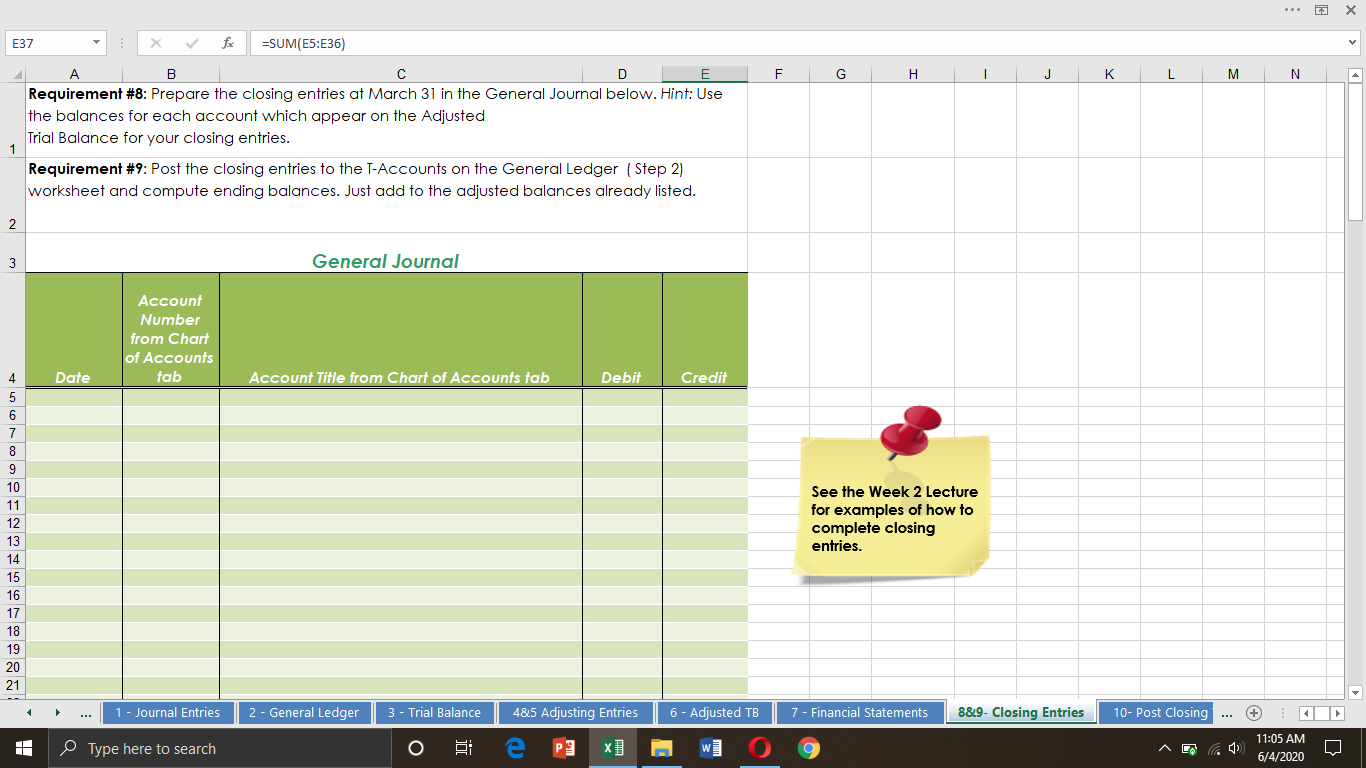

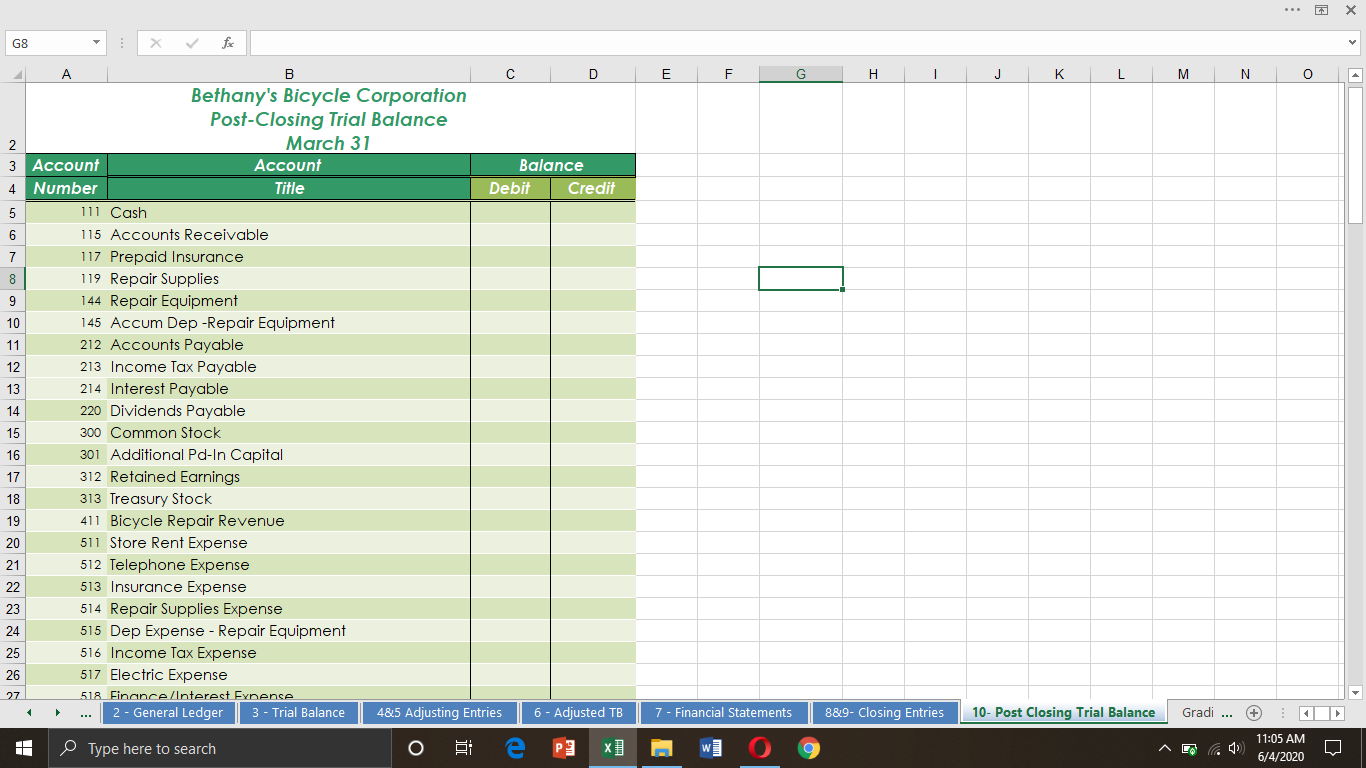

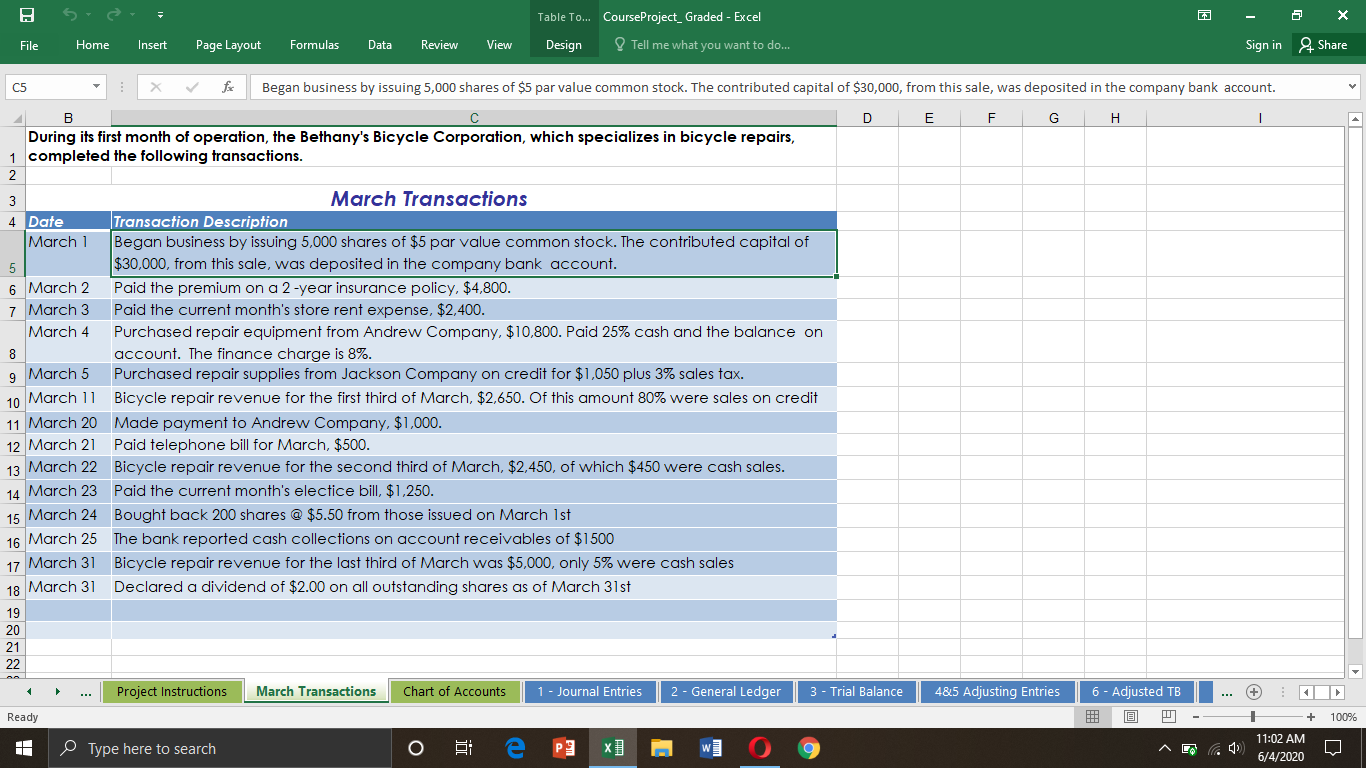

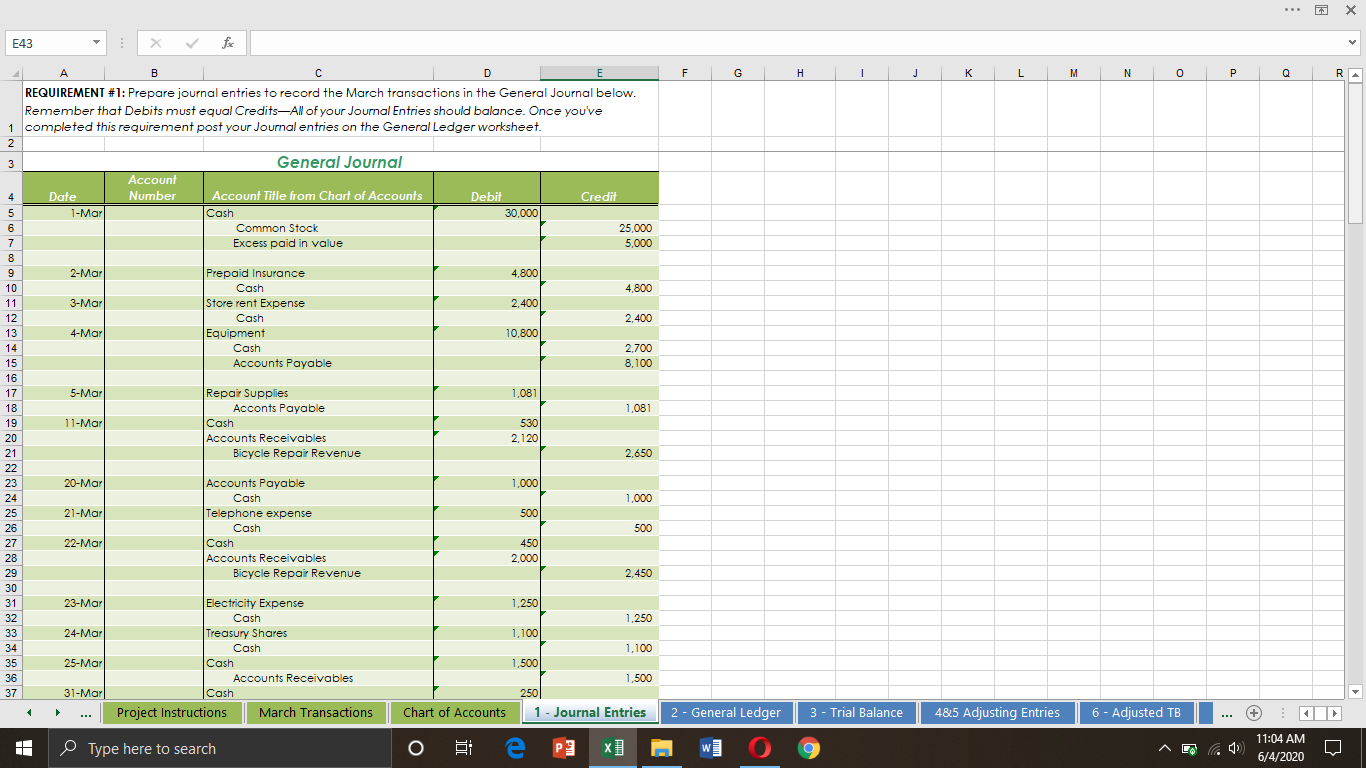

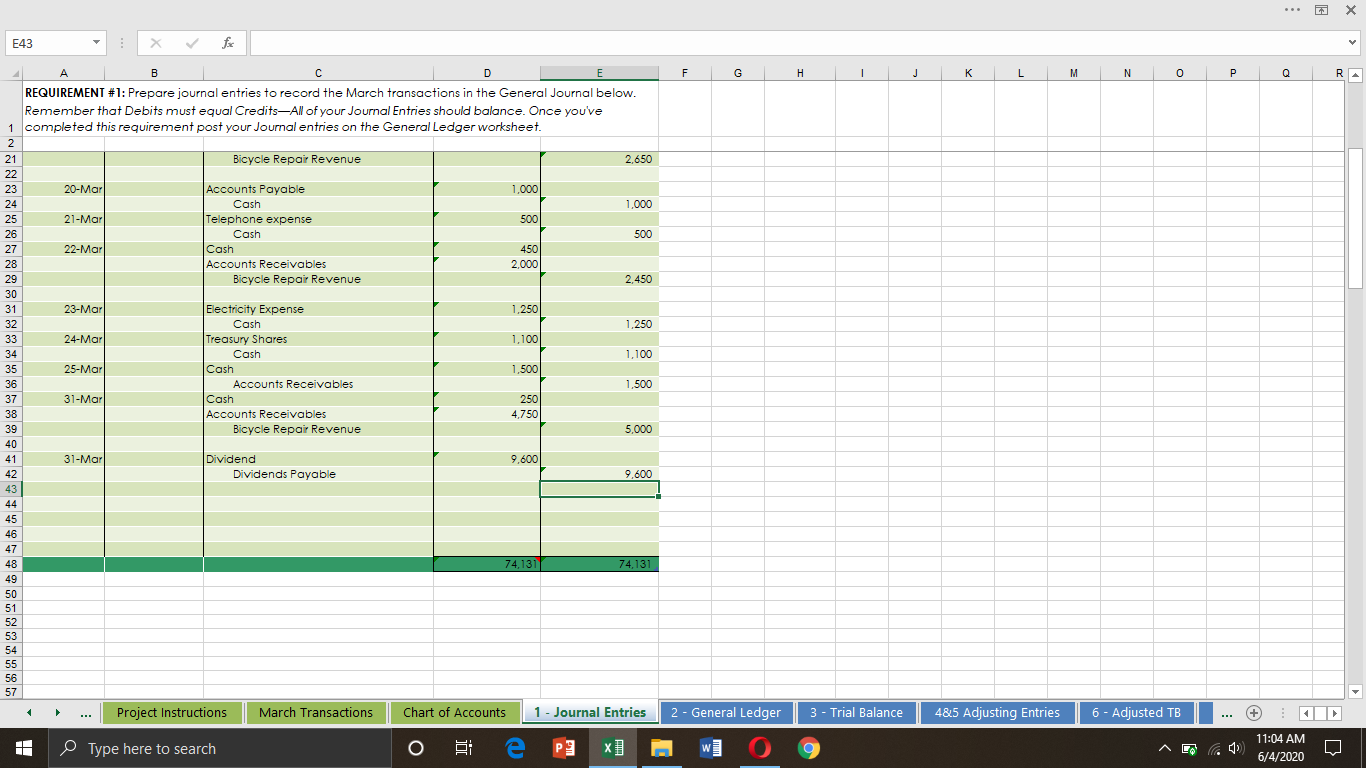

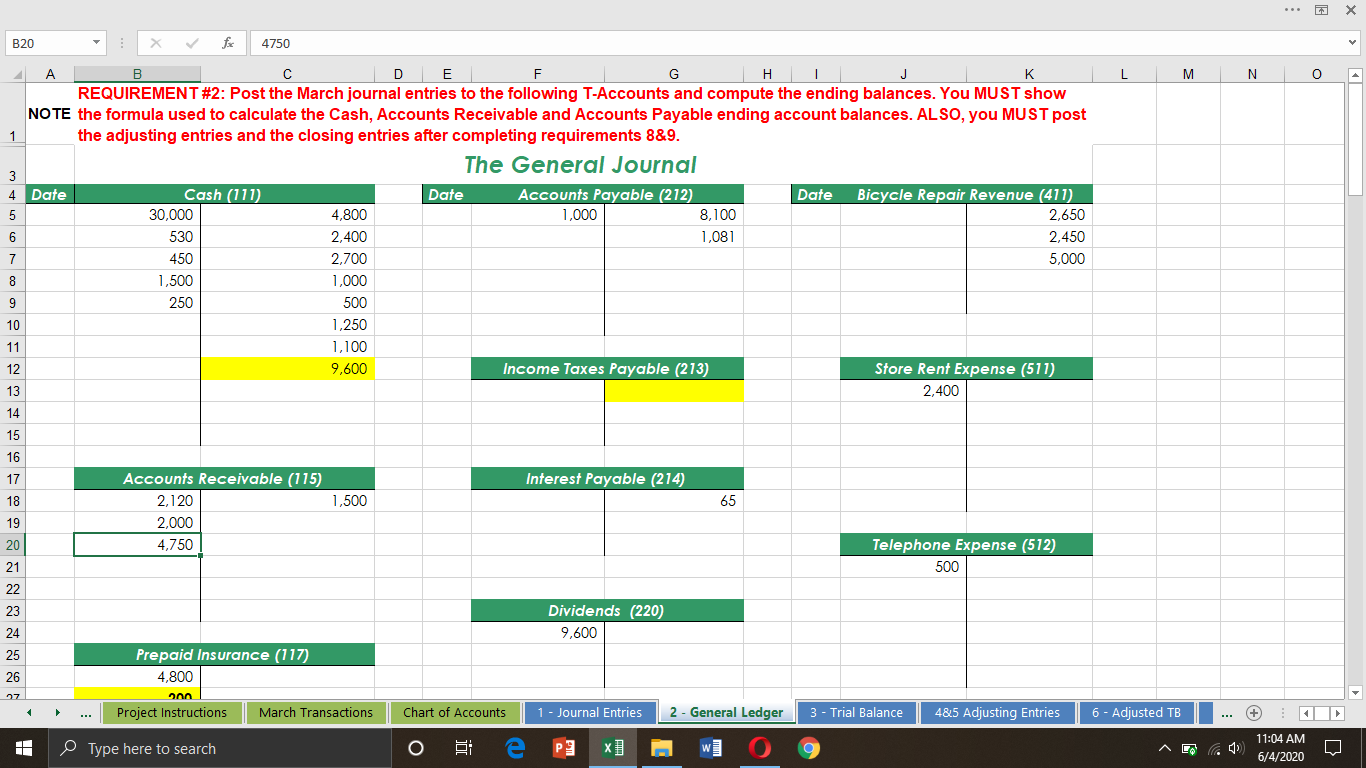

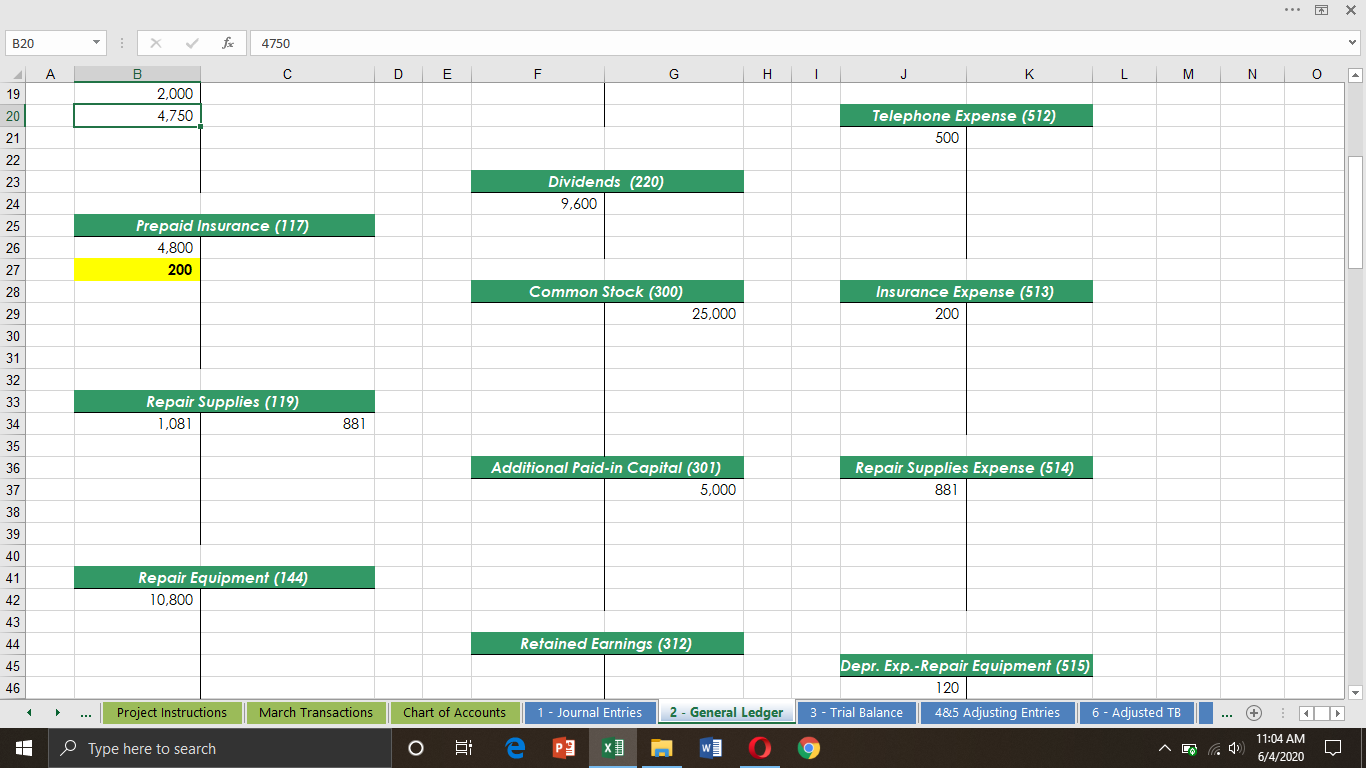

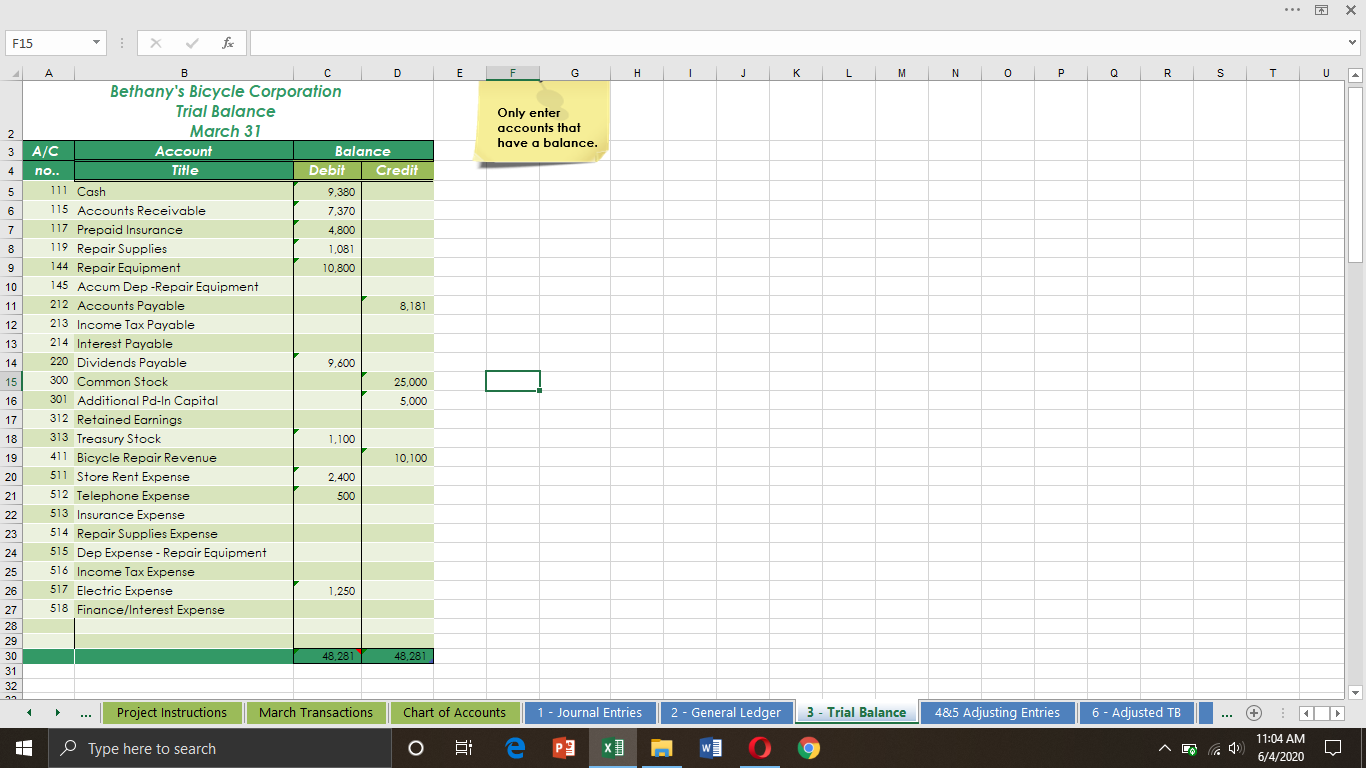

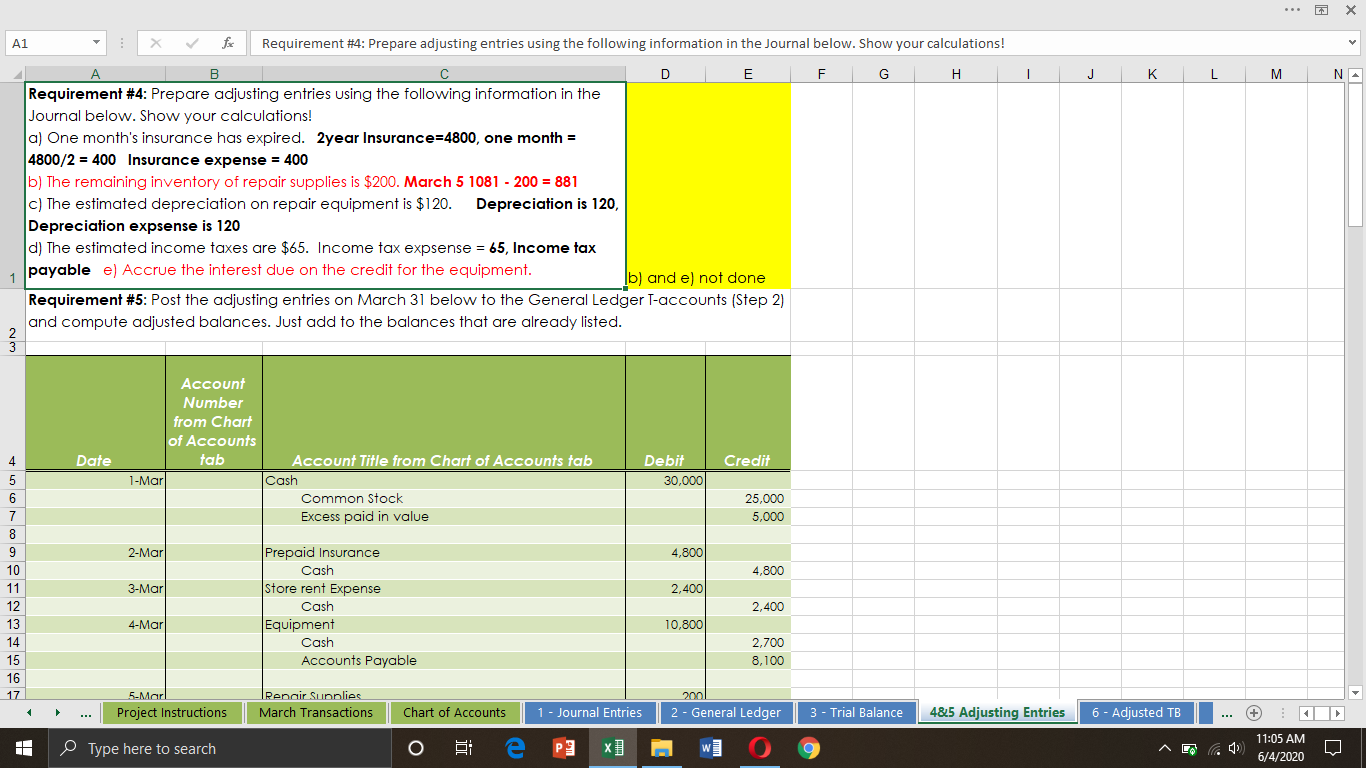

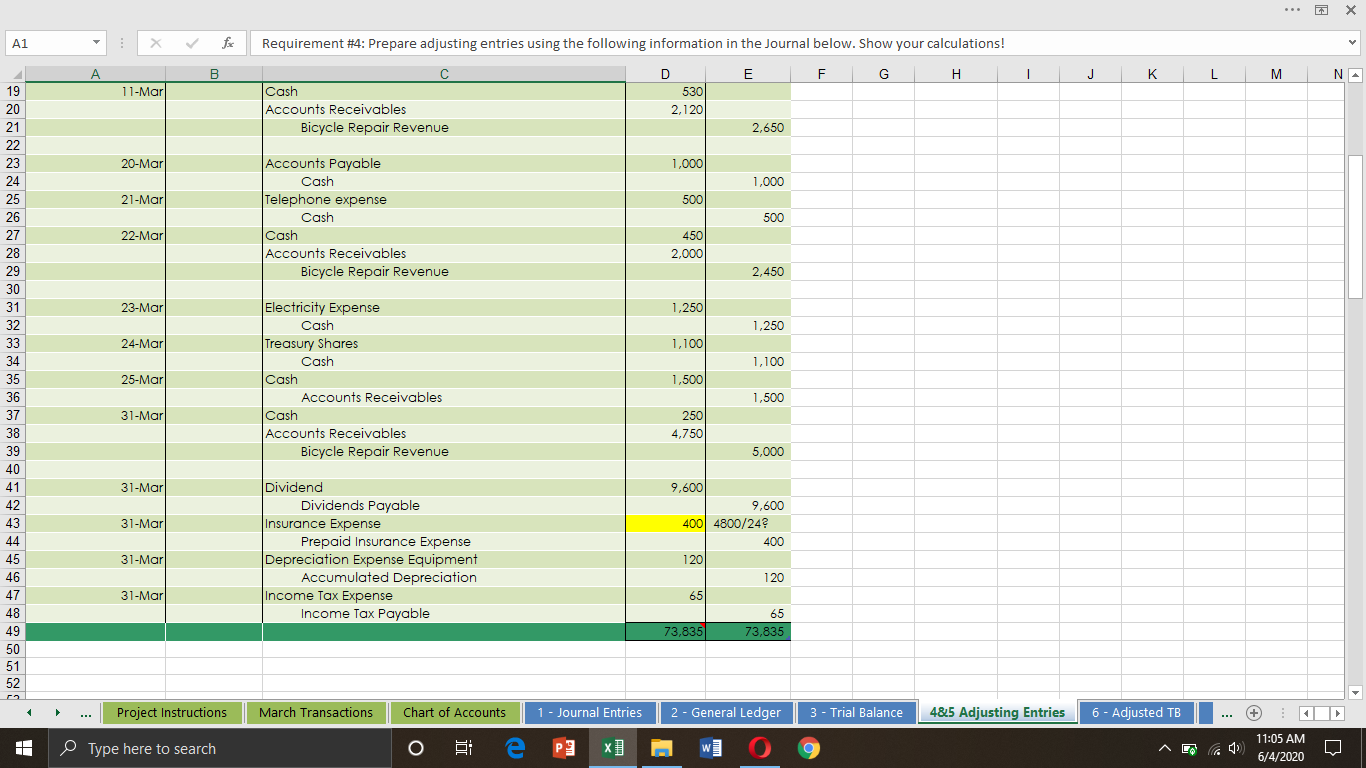

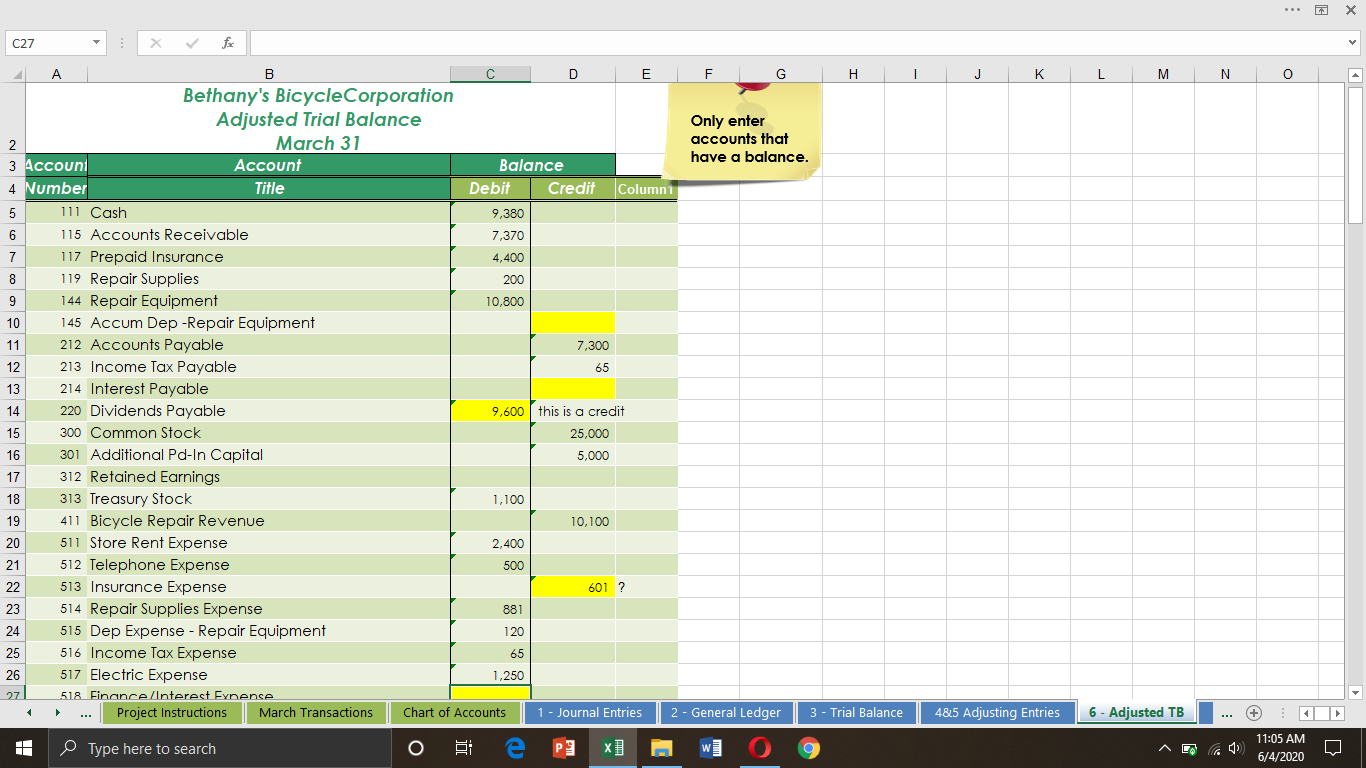

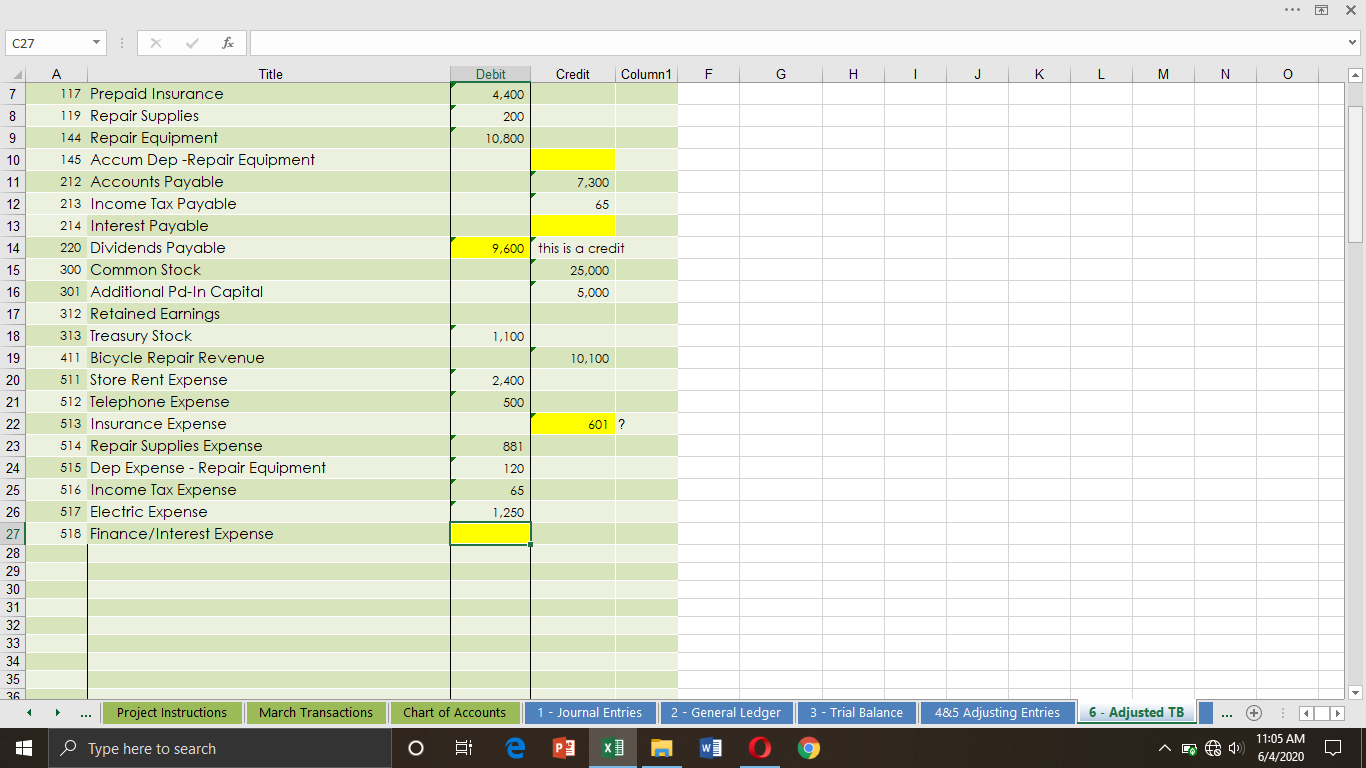

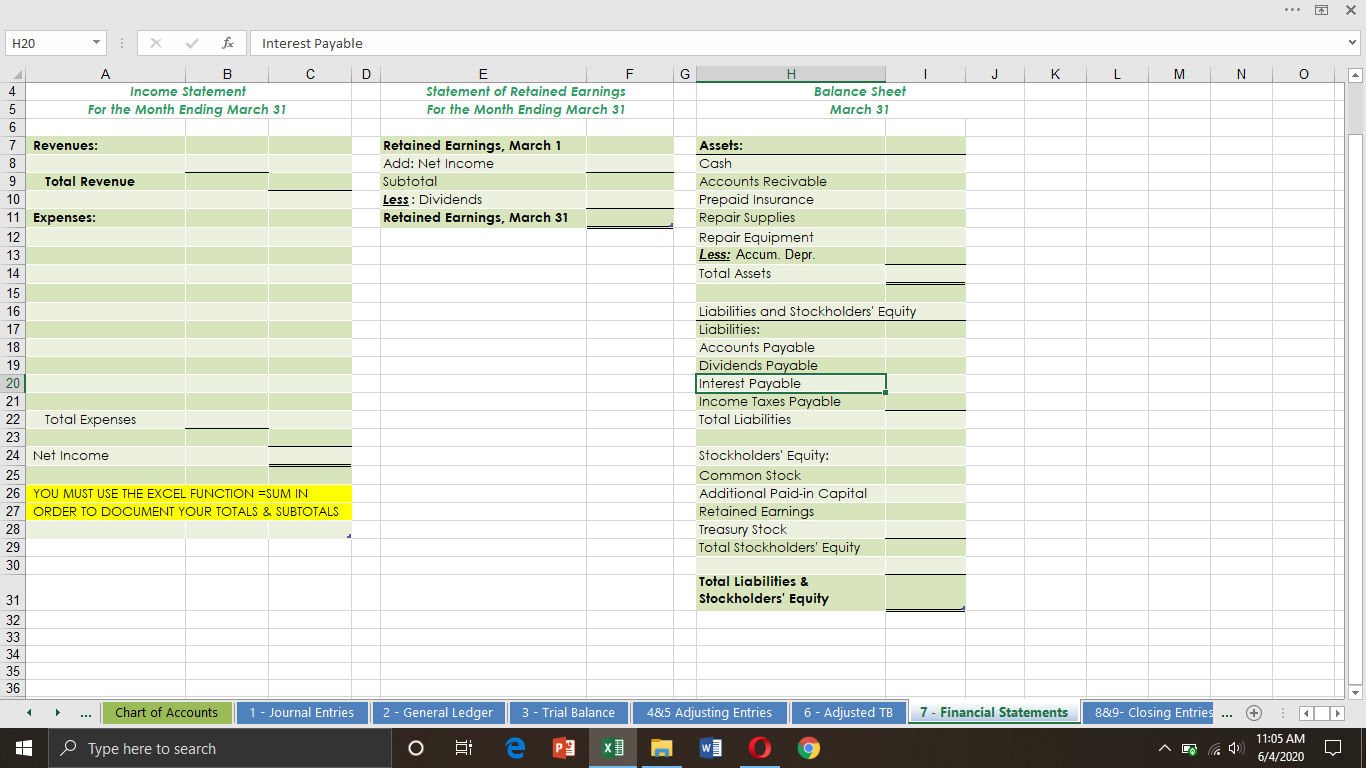

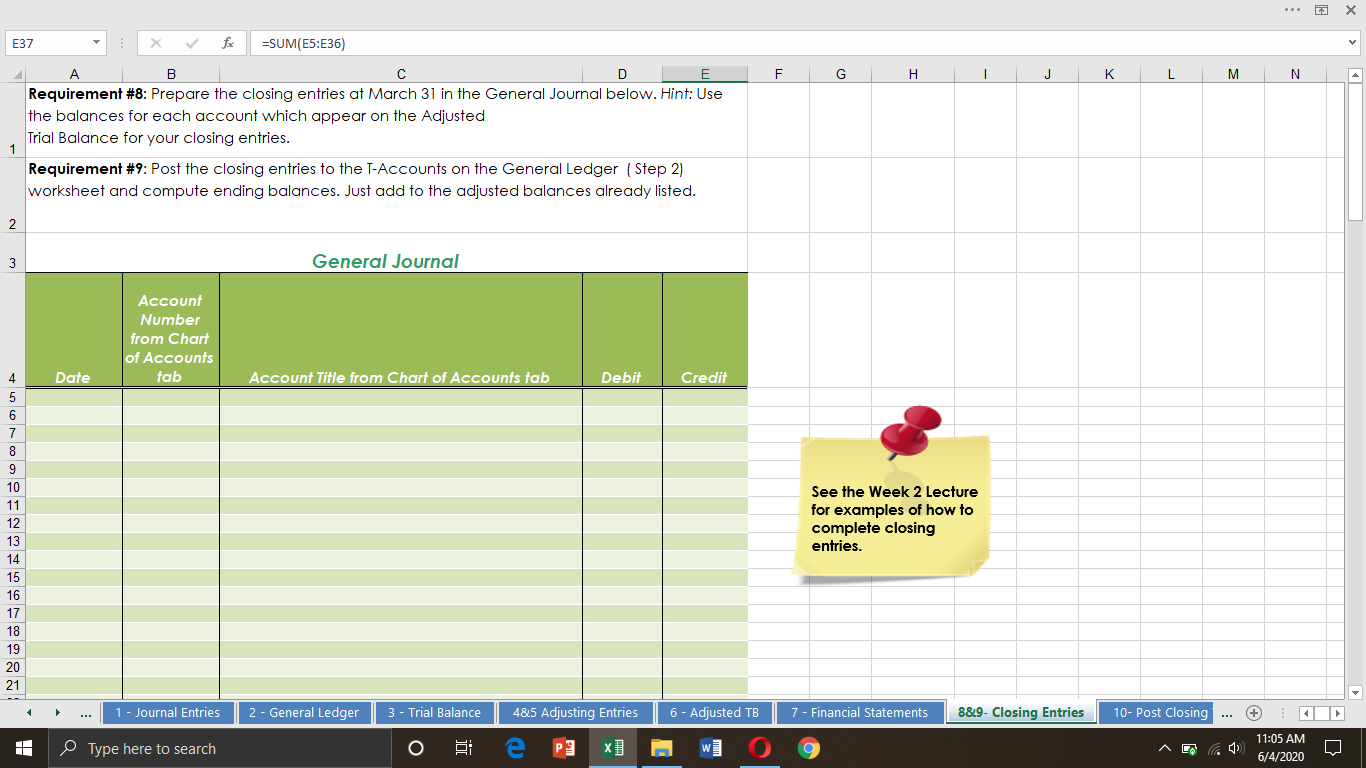

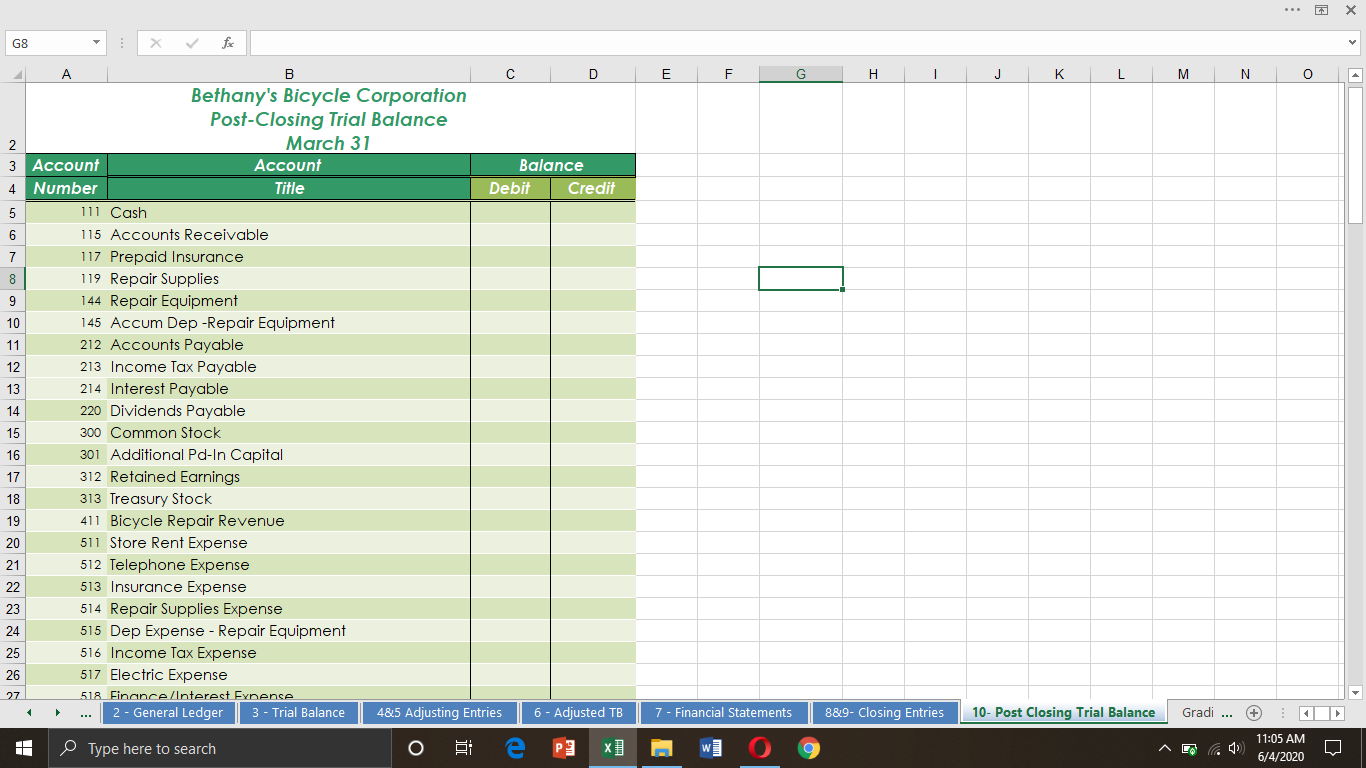

X Table To... CourseProject_ Graded - Excel Design Tell me what you want to do... File Home Insert Page Layout Formulas Data Review View Sign in Share C5 Began business by issuing 5,000 shares of $5 par value common stock. The contributed capital of $30,000, from this sale, was deposited in the company bank account. D E F G . - 3 5 During its first month of operation, the Bethany's Bicycle Corporation, which specializes in bicycle repairs, 1 completed the following transactions. 2 March Transactions 4 Date Transaction Description March 1 Began business by issuing 5,000 shares of $5 par value common stock. The contributed capital of $30,000, from this sale, was deposited in the company bank account. 6 March 2 Paid the premium on a 2-year insurance policy, $4,800. 7 March 3 Paid the current month's store rent expense, $2,400. March 4 Purchased repair equipment from Andrew Company, $10,800. Paid 25% cash and the balance on 8 account. The finance charge is 8%. 9 March 5 Purchased repair supplies from Jackson Company on credit for $1,050 plus 3% sales tax. 10 March 11 Bicycle repair revenue for the first third of March, $2,650. Of this amount 80% were sales on credit 11 March 20 Made payment to Andrew Company, $1,000. 12 March 21 Paid telephone bill for March, $500. 13 March 22 Bicycle repair revenue for the second third of March, $2,450, of which $450 were cash sales. 14 March 23 Paid the current month's electice bill, $1,250. 15 March 24 Bought back 200 shares @ $5.50 from those issued on March 1st 16 March 25 The bank reported cash collections on account receivables of $1500 17 March 31 Bicycle repair revenue for the last third of March was $5,000, only 5% were cash sales 18 March 31 Declared a dividend of $2.00 on all outstanding shares as of March 31st 19 20 21 22 Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries (+ 6 - Adjusted TB @ Ready + 100% Type here to search pun x] LA 3 11:02 AM 6/4/2020 X E43 F G . 1 j L M N 0 Q R 4 Cash 4.800 A D E REQUIREMENT #1: Prepare journal entries to record the March transactions in the General Journal below. Remember that Debits must equal Credits-All of your Journal Entries should balance. Once you've 1 completed this requirement post your Journal entries on the General Ledger worksheet. 2 3 General Journal Account Date Number Account Title from Chart of Accounts Debit Credit 5 1-Mar Cash 30.000 6 Common Stock 25,000 7 Excess paid in value 5,000 8 9 2-Mar Prepaid Insurance 4,800 10 11 3-Mar Store rent Expense 2,400 12 Cash 2.400 13 4-Mar Equipment 10,800 14 Cash 2,700 15 Accounts Payable 8,100 16 17 5-Mar Repair Supplies 1,081 18 Acconts Payable 1,081 19 11-Mar Cash 530 20 Accounts Receivables 2,120 21 Bicycle Repair Revenue 2,650 22 23 20-Mar Accounts Payable 1,000 24 Cash 1,000 25 21-Mar Telephone expense 500 26 Cash 500 27 22-Mar Cash 450 28 Accounts Receivables 2,000 29 Bicycle Repair Revenue 2,450 30 31 23-Mar Electricity Expense 1,2501 32 Cash 1,250 33 24-Mar Treasury Shares 1,1001 34 Cash 1,100 35 25-Mar Cash 1,500 36 Accounts Receivables 1,500 37 31-Mar Cash 250 Project Instructions March Transactions Chart of Accounts 1 Journal Entries 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB (+ I Type here to search o BI e Kd x] W L 11:04 AM 6/4/2020 X E43 F G H - j L M N 0 P Q RA A B D E REQUIREMENT #1: Prepare journal entries to record the March transactions in the General Journal below. Remember that Debits must equal Credits-All of your Journal Entries should balance. Once you've 1 completed this requirement post your Journal entries on the General Ledger worksheet. 2 21 Bicycle Repair Revenue 2,650 22 23 20-Mar Accounts Payable 1,000 24 Cash 1,000 25 21-Mar Telephone expense 5001 26 Cash 500 27 22-Mar Cash 450 28 Accounts Receivables 2,000 29 Bicycle Repair Revenue 2,450 30 31 23-Mar Electricity Expense 1,250 32 Cash 1,250 33 24-Mar Treasury Shares 1,100 34 Cash 1.100 35 25-Mar Cash 1,500 36 Accounts Receivables 1,500 37 31-Mar Cash 250 38 Accounts Receivables 4,750 39 Bicycle Repair Revenue 5.000 40 41 31-Mar Dividend 9,600 42 Dividends Payable 9.600 43 44 45 46 47 48 74.131 74.131 49 50 51 52 53 54 55 56 57 Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB (+ I Type here to search o e PE x] . W L 11:04 AM 6/4/2020 x B20 x 4750 L M N 0 A B C DE F G . J K REQUIREMENT #2: Post the March journal entries to the following T-Accounts and compute the ending balances. You MUST show NOTE the formula used to calculate the Cash, Accounts Receivable and Accounts Payable ending account balances. ALSO, you MUST post 1 the adjusting entries and the closing entries after completing requirements 8&9. The General Journal 3 4 Date Cash (111) Date Accounts Payable (212) Date Bicycle Repair Revenue (411) 5 30,000 4,800 1,000 8,100 2,650 6 530 2,400 1,081 2,450 7 450 2,700 5,000 8 1,500 1,000 9 250 500 10 1,250 11 1,100 12 9,600 Income Taxes Payable (213) Store Rent Expense (511) 13 2,400 14 15 16 17 Interest Payable (214) 1,500 65 18 19 Accounts Receivable (115) 2,120 2,000 4,750 20 21 22 Telephone Expense (512) 500 23 Dividends (220) 9,600 24 25 26 Prepaid Insurance (117) 4,800 on Project Instructions March Transactions 27 Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 485 Adjusting Entries 6 - Adjusted TB (+ I Type here to search O j e PE x] W L 11:04 AM 6/4/2020 x B20 X 4750 A D E F G - H J K L M N 0 19 2,000 4,750 20 Telephone Expense (512) 500 21 22 23 Dividends (220) 9,600 24 25 Prepaid Insurance (117) 4,800 26 27 200 28 Common Stock (300) Insurance Expense (513) 200 25,000 29 30 31 32 Repair Supplies (119) 1,081 881 33 34 35 36 37 Additional Paid-in Capital (301) 5,000 Repair Supplies Expense (514) 881 38 39 40 41 Repair Equipment (144) 10,800 42 43 44 Retained Earnings (312) 45 46 Depr. Exp.-Repair Equipment (515) 120 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger (+ I Type here to search o PE x] W L 42 11:04 AM 6/4/2020 X F15 x E G H 1 J L M N 0 P Q R S T U Only enter accounts that have a balance. B C D Bethany's Bicycle Corporation Trial Balance 2 March 31 3 A/C Account Balance 4 no.. Title Debit Credit 5 111 Cash 9,380 6 115 Accounts Receivable 7.370 7 117 Prepaid Insurance 4,800 8 119 Repair Supplies 1,081 9 144 Repair Equipment 10,800 10 145 Accum Dep-Repair Equipment 11 212 Accounts Payable 8,181 12 213 Income Tax Payable 13 214 Interest Payable 14 220 Dividends Payable 9,600 15 300 Common Stock 25,000 16 301 Additional Pd-In Capital 5,000 17 312 Retained Earnings 18 313 Treasury Stock 1,100 19 411 Bicycle Repair Revenue 10,100 20 511 Store Rent Expense 2.400 21 512 Telephone Expense 500 22 513 Insurance Expense 23 514 Repair Supplies Expense 24 515 Dep Expense - Repair Equipment 25 516 Income Tax Expense 26 517 Electric Expense 1,250 27 518 Finance/Interest Expense 28 29 30 48,281 48,281 31 32 Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 485 Adjusting Entries 6 - Adjusted TB (+ I j Type here to search PE x] E W L 11:04 AM 6/4/2020 x A1 - J L K M NA fi Requirement #4: Prepare adjusting entries using the following information in the Journal below. Show your calculations! A B C D E F. G . Requirement #4: Prepare adjusting entries using the following information in the Journal below. Show your calculations! a) One month's insurance has expired. 2year Insurance=4800, one month = 4800/2 = 400 Insurance expense = 400 b) The remaining inventory of repair supplies is $200. March 5 1081 - 200 = 881 c) The estimated depreciation on repair equipment is $120. Depreciation is 120, Depreciation expsense is 120 d) The estimated income taxes are $65. Income tax expsense = 65, Income tax payable e) Accrue the interest due on the credit for the equipment. b) and e) not done Requirement #5: Post the adjusting entries on March 31 below to the General Ledger T-accounts (Step 2) and compute adjusted balances. Just add to the balances that are already listed. 1 2 Account Number from Chart of Accounts tab Account Title from Chart of Accounts tab 1-Mar Cash Common Stock Excess paid in value Date Credit 4 5 Debit 30,000 25,000 5,000 6 7 8 9 2-Mar 4,800 4,800 3- Mar 2,400 Prepaid Insurance Cash Store rent Expense Cash Equipment Cash Accounts Payable 2,400 4-Mar 10 11 12 13 14 15 16 17 10,800 2,700 8,100 5-Mar Project Instructions Renoir Sunnlies March Transactions 2001 2 - General Ledger Chart of Accounts 1 - Journal Entries 3 - Trial Balance 48,5 Adjusting Entries 6 - Adjusted TB (+ I Type here to search O PE E W L 11:05 AM 6/4/2020 x A1 Requirement #4: Prepare adjusting entries using the following information in the Journal below. Show your calculations! A B E F . G - J K L M NA 11-Mar Cash Accounts Receivables Bicycle Repair Revenue D 530 2,120 2,650 20-Mar 1,000 1,000 21-Mar 500 Accounts Payable Cash Telephone expense Cash Cash Accounts Receivables Bicycle Repair Revenue 500 22-Mar 450 2,000 2,450 23-Mar 1,250 1,250 24-Mar 1,100 1,100 25-Mar 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 Electricity Expense Cash Treasury Shares Cash Cash Accounts Receivables Cash Accounts Receivables Bicycle Repair Revenue 1,500 1,500 31-Mar 250 4,750 5,000 31-Mar 31-Mar Dividend Dividends Payable Insurance Expense Prepaid Insurance Expense Depreciation Expense Equipment Accumulated Depreciation Income Tax Expense Income Tax Payable 31-Mar 9,600 9,600 400 4800/24 400 120 120 65 65 73,835 73,835 31-Mar Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 48,5 Adjusting Entries 6 - Adjusted TB + I j Type here to search PE W L 11:05 AM 6/4/2020 X C27 J K L M N o A E F G Bethany's BicycleCorporation Adjusted Trial Balance Only enter 2 March 31 accounts that have a balance. 3 Accouni Account Balance 4 Number Title Debit Credit Columni 5 111 Cash 9,380 6 115 Accounts Receivable 7,370 7 117 Prepaid Insurance 4,400 8 119 Repair Supplies 200 9 144 Repair Equipment 10.800 10 145 Accum Dep-Repair Equipment 11 212 Accounts Payable 7,300 12 213 Income Tax Payable 65 13 214 Interest Payable 14 220 Dividends Payable 9,600 this is a credit 15 300 Common Stock 25,000 16 301 Additional Pd-In Capital 17 312 Retained Earnings 18 313 Treasury Stock 1,100 19 411 Bicycle Repair Revenue 10,100 20 511 Store Rent Expense 2,400 21 512 Telephone Expense 500 22 513 Insurance Expense 601 2 23 514 Repair Supplies Expense 881 24 515 Dep Expense - Repair Equipment 120 25 516 Income Tax Expense 65 26 517 Electric Expense 1,250 518 Finance/Interest Eynense Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 5,000 27 4&5 Adjusting Entries 6 - Adjusted TB (+ 11:05 AM Type here to search o BI pun x] LA 42 6/4/2020 x C27 x Credit Column 1 F G - K L M N o Debit 4,400 7 8 200 9 10,800 10 11 7,300 12 65 13 14 15 9,600 | this is a credit 25,000 5,000 16 A Title 117 Prepaid Insurance 119 Repair Supplies 144 Repair Equipment 145 Accum Dep-Repair Equipment 212 Accounts Payable 213 Income Tax Payable 214 Interest Payable 220 Dividends Payable 300 Common Stock 301 Additional Pd-In Capital 312 Retained Earnings 313 Treasury Stock 411 Bicycle Repair Revenue 511 Store Rent Expense 512 Telephone Expense 513 Insurance Expense 514 Repair Supplies Expense 515 Dep Expense - Repair Equipment 516 Income Tax Expense 517 Electric Expense 518 Finance/Interest Expense 17 18 1,100 19 10,100 20 2,400 21 500 22 601 ? 23 881 24 120 25 65 26 1,250 27 28 29 30 31 32 33 34 35 36 Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4&25 Adjusting Entries 6 - Adjusted TB (+ I Type here to search o BI e PE W L A 11:05 AM 6/4/2020 X H20 x fx Interest Payable D G J K L M - N o E F Statement of Retained Earnings For the Month Ending March 31 Balance Sheet March 31 7 Retained Earnings, March 1 Add: Net Income Subtotal Less : Dividends Retained Earnings, March 31 Assets: Cash Accounts Recivable Prepaid Insurance Repair Supplies Repair Equipment Less: Accum. Depr. Total Assets A B 4 Income Statement 5 For the Month Ending March 31 6 Revenues: 8 9 Total Revenue 10 11 Expenses: 12 13 14 15 16 17 18 19 20 21 22 Total Expenses 23 24 Net Income 25 26 YOU MUST USE THE EXCEL FUNCTION =SUM IN 27 ORDER TO DOCUMENT YOUR TOTALS & SUBTOTALS 28 29 30 Liabilities and Stockholders' Equity Liabilities: Accounts Payable Dividends Payable Interest Payable Income Taxes Payable Total Liabilities Stockholders' Equity: Common Stock Additional Paid-in Capital Retained Earnings Treasury Stock Total Stockholders' Equity Total Liabilities & Stockholders' Equity 31 32 33 34 35 36 Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB 7 - Financial Statements 88,9- Closing Entries ... + I Type here to search o j e PE x] E W LA 11:05 AM 6/4/2020 X E37 for =SUM(E5:E36) 2 F G H 1 J K L M N A B D E Requirement #8: Prepare the closing entries at March 31 in the General Journal below. Hint: Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement #9: Post the closing entries to the T-Accounts on the General Ledger (Step 2) worksheet and compute ending balances. Just add to the adjusted balances already listed. 1 2 3 General Journal Account Number from Chart of Accounts tab Date Account Title from Chart of Accounts tab Debit Credit 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 See the Week 2 Lecture for examples of how to complete closing entries. 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB 7 - Financial Statements 88.9- Closing Entries 10- Post Closing II. (+ I Type here to search O e PE x] W 11:05 AM 6/4/2020 X G8 E F G H J - L M N 0 A B C D Bethany's Bicycle Corporation Post-Closing Trial Balance 2 March 31 Account Account Balance 4 Number Title Debit Credit 5 111 Cash 6 115 Accounts Receivable 7 117 Prepaid Insurance 8 119 Repair Supplies 9 144 Repair Equipment 10 145 Accum Dep-Repair Equipment 11 212 Accounts Payable 12 213 Income Tax Payable 13 214 Interest Payable 14 220 Dividends Payable 15 300 Common Stock 16 301 Additional Pd-In Capital 17 312 Retained Earnings 18 313 Treasury Stock 19 411 Bicycle Repair Revenue 20 511 Store Rent Expense 21 512 Telephone Expense 22 513 Insurance Expense 23 514 Repair Supplies Expense 24 515 Dep Expense - Repair Equipment 25 516 Income Tax Expense 26 517 Electric Expense 518 Finance/Interest Eynense 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB 27 7 - Financial Statements 8&9- Closing Entries 10- Post Closing Trial Balance Gradi ... + I Type here to search o pun x] 11:05 AM 6/4/2020 X Table To... CourseProject_ Graded - Excel Design Tell me what you want to do... File Home Insert Page Layout Formulas Data Review View Sign in Share C5 Began business by issuing 5,000 shares of $5 par value common stock. The contributed capital of $30,000, from this sale, was deposited in the company bank account. D E F G . - 3 5 During its first month of operation, the Bethany's Bicycle Corporation, which specializes in bicycle repairs, 1 completed the following transactions. 2 March Transactions 4 Date Transaction Description March 1 Began business by issuing 5,000 shares of $5 par value common stock. The contributed capital of $30,000, from this sale, was deposited in the company bank account. 6 March 2 Paid the premium on a 2-year insurance policy, $4,800. 7 March 3 Paid the current month's store rent expense, $2,400. March 4 Purchased repair equipment from Andrew Company, $10,800. Paid 25% cash and the balance on 8 account. The finance charge is 8%. 9 March 5 Purchased repair supplies from Jackson Company on credit for $1,050 plus 3% sales tax. 10 March 11 Bicycle repair revenue for the first third of March, $2,650. Of this amount 80% were sales on credit 11 March 20 Made payment to Andrew Company, $1,000. 12 March 21 Paid telephone bill for March, $500. 13 March 22 Bicycle repair revenue for the second third of March, $2,450, of which $450 were cash sales. 14 March 23 Paid the current month's electice bill, $1,250. 15 March 24 Bought back 200 shares @ $5.50 from those issued on March 1st 16 March 25 The bank reported cash collections on account receivables of $1500 17 March 31 Bicycle repair revenue for the last third of March was $5,000, only 5% were cash sales 18 March 31 Declared a dividend of $2.00 on all outstanding shares as of March 31st 19 20 21 22 Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries (+ 6 - Adjusted TB @ Ready + 100% Type here to search pun x] LA 3 11:02 AM 6/4/2020 X E43 F G . 1 j L M N 0 Q R 4 Cash 4.800 A D E REQUIREMENT #1: Prepare journal entries to record the March transactions in the General Journal below. Remember that Debits must equal Credits-All of your Journal Entries should balance. Once you've 1 completed this requirement post your Journal entries on the General Ledger worksheet. 2 3 General Journal Account Date Number Account Title from Chart of Accounts Debit Credit 5 1-Mar Cash 30.000 6 Common Stock 25,000 7 Excess paid in value 5,000 8 9 2-Mar Prepaid Insurance 4,800 10 11 3-Mar Store rent Expense 2,400 12 Cash 2.400 13 4-Mar Equipment 10,800 14 Cash 2,700 15 Accounts Payable 8,100 16 17 5-Mar Repair Supplies 1,081 18 Acconts Payable 1,081 19 11-Mar Cash 530 20 Accounts Receivables 2,120 21 Bicycle Repair Revenue 2,650 22 23 20-Mar Accounts Payable 1,000 24 Cash 1,000 25 21-Mar Telephone expense 500 26 Cash 500 27 22-Mar Cash 450 28 Accounts Receivables 2,000 29 Bicycle Repair Revenue 2,450 30 31 23-Mar Electricity Expense 1,2501 32 Cash 1,250 33 24-Mar Treasury Shares 1,1001 34 Cash 1,100 35 25-Mar Cash 1,500 36 Accounts Receivables 1,500 37 31-Mar Cash 250 Project Instructions March Transactions Chart of Accounts 1 Journal Entries 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB (+ I Type here to search o BI e Kd x] W L 11:04 AM 6/4/2020 X E43 F G H - j L M N 0 P Q RA A B D E REQUIREMENT #1: Prepare journal entries to record the March transactions in the General Journal below. Remember that Debits must equal Credits-All of your Journal Entries should balance. Once you've 1 completed this requirement post your Journal entries on the General Ledger worksheet. 2 21 Bicycle Repair Revenue 2,650 22 23 20-Mar Accounts Payable 1,000 24 Cash 1,000 25 21-Mar Telephone expense 5001 26 Cash 500 27 22-Mar Cash 450 28 Accounts Receivables 2,000 29 Bicycle Repair Revenue 2,450 30 31 23-Mar Electricity Expense 1,250 32 Cash 1,250 33 24-Mar Treasury Shares 1,100 34 Cash 1.100 35 25-Mar Cash 1,500 36 Accounts Receivables 1,500 37 31-Mar Cash 250 38 Accounts Receivables 4,750 39 Bicycle Repair Revenue 5.000 40 41 31-Mar Dividend 9,600 42 Dividends Payable 9.600 43 44 45 46 47 48 74.131 74.131 49 50 51 52 53 54 55 56 57 Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB (+ I Type here to search o e PE x] . W L 11:04 AM 6/4/2020 x B20 x 4750 L M N 0 A B C DE F G . J K REQUIREMENT #2: Post the March journal entries to the following T-Accounts and compute the ending balances. You MUST show NOTE the formula used to calculate the Cash, Accounts Receivable and Accounts Payable ending account balances. ALSO, you MUST post 1 the adjusting entries and the closing entries after completing requirements 8&9. The General Journal 3 4 Date Cash (111) Date Accounts Payable (212) Date Bicycle Repair Revenue (411) 5 30,000 4,800 1,000 8,100 2,650 6 530 2,400 1,081 2,450 7 450 2,700 5,000 8 1,500 1,000 9 250 500 10 1,250 11 1,100 12 9,600 Income Taxes Payable (213) Store Rent Expense (511) 13 2,400 14 15 16 17 Interest Payable (214) 1,500 65 18 19 Accounts Receivable (115) 2,120 2,000 4,750 20 21 22 Telephone Expense (512) 500 23 Dividends (220) 9,600 24 25 26 Prepaid Insurance (117) 4,800 on Project Instructions March Transactions 27 Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 485 Adjusting Entries 6 - Adjusted TB (+ I Type here to search O j e PE x] W L 11:04 AM 6/4/2020 x B20 X 4750 A D E F G - H J K L M N 0 19 2,000 4,750 20 Telephone Expense (512) 500 21 22 23 Dividends (220) 9,600 24 25 Prepaid Insurance (117) 4,800 26 27 200 28 Common Stock (300) Insurance Expense (513) 200 25,000 29 30 31 32 Repair Supplies (119) 1,081 881 33 34 35 36 37 Additional Paid-in Capital (301) 5,000 Repair Supplies Expense (514) 881 38 39 40 41 Repair Equipment (144) 10,800 42 43 44 Retained Earnings (312) 45 46 Depr. Exp.-Repair Equipment (515) 120 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger (+ I Type here to search o PE x] W L 42 11:04 AM 6/4/2020 X F15 x E G H 1 J L M N 0 P Q R S T U Only enter accounts that have a balance. B C D Bethany's Bicycle Corporation Trial Balance 2 March 31 3 A/C Account Balance 4 no.. Title Debit Credit 5 111 Cash 9,380 6 115 Accounts Receivable 7.370 7 117 Prepaid Insurance 4,800 8 119 Repair Supplies 1,081 9 144 Repair Equipment 10,800 10 145 Accum Dep-Repair Equipment 11 212 Accounts Payable 8,181 12 213 Income Tax Payable 13 214 Interest Payable 14 220 Dividends Payable 9,600 15 300 Common Stock 25,000 16 301 Additional Pd-In Capital 5,000 17 312 Retained Earnings 18 313 Treasury Stock 1,100 19 411 Bicycle Repair Revenue 10,100 20 511 Store Rent Expense 2.400 21 512 Telephone Expense 500 22 513 Insurance Expense 23 514 Repair Supplies Expense 24 515 Dep Expense - Repair Equipment 25 516 Income Tax Expense 26 517 Electric Expense 1,250 27 518 Finance/Interest Expense 28 29 30 48,281 48,281 31 32 Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 485 Adjusting Entries 6 - Adjusted TB (+ I j Type here to search PE x] E W L 11:04 AM 6/4/2020 x A1 - J L K M NA fi Requirement #4: Prepare adjusting entries using the following information in the Journal below. Show your calculations! A B C D E F. G . Requirement #4: Prepare adjusting entries using the following information in the Journal below. Show your calculations! a) One month's insurance has expired. 2year Insurance=4800, one month = 4800/2 = 400 Insurance expense = 400 b) The remaining inventory of repair supplies is $200. March 5 1081 - 200 = 881 c) The estimated depreciation on repair equipment is $120. Depreciation is 120, Depreciation expsense is 120 d) The estimated income taxes are $65. Income tax expsense = 65, Income tax payable e) Accrue the interest due on the credit for the equipment. b) and e) not done Requirement #5: Post the adjusting entries on March 31 below to the General Ledger T-accounts (Step 2) and compute adjusted balances. Just add to the balances that are already listed. 1 2 Account Number from Chart of Accounts tab Account Title from Chart of Accounts tab 1-Mar Cash Common Stock Excess paid in value Date Credit 4 5 Debit 30,000 25,000 5,000 6 7 8 9 2-Mar 4,800 4,800 3- Mar 2,400 Prepaid Insurance Cash Store rent Expense Cash Equipment Cash Accounts Payable 2,400 4-Mar 10 11 12 13 14 15 16 17 10,800 2,700 8,100 5-Mar Project Instructions Renoir Sunnlies March Transactions 2001 2 - General Ledger Chart of Accounts 1 - Journal Entries 3 - Trial Balance 48,5 Adjusting Entries 6 - Adjusted TB (+ I Type here to search O PE E W L 11:05 AM 6/4/2020 x A1 Requirement #4: Prepare adjusting entries using the following information in the Journal below. Show your calculations! A B E F . G - J K L M NA 11-Mar Cash Accounts Receivables Bicycle Repair Revenue D 530 2,120 2,650 20-Mar 1,000 1,000 21-Mar 500 Accounts Payable Cash Telephone expense Cash Cash Accounts Receivables Bicycle Repair Revenue 500 22-Mar 450 2,000 2,450 23-Mar 1,250 1,250 24-Mar 1,100 1,100 25-Mar 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 Electricity Expense Cash Treasury Shares Cash Cash Accounts Receivables Cash Accounts Receivables Bicycle Repair Revenue 1,500 1,500 31-Mar 250 4,750 5,000 31-Mar 31-Mar Dividend Dividends Payable Insurance Expense Prepaid Insurance Expense Depreciation Expense Equipment Accumulated Depreciation Income Tax Expense Income Tax Payable 31-Mar 9,600 9,600 400 4800/24 400 120 120 65 65 73,835 73,835 31-Mar Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 48,5 Adjusting Entries 6 - Adjusted TB + I j Type here to search PE W L 11:05 AM 6/4/2020 X C27 J K L M N o A E F G Bethany's BicycleCorporation Adjusted Trial Balance Only enter 2 March 31 accounts that have a balance. 3 Accouni Account Balance 4 Number Title Debit Credit Columni 5 111 Cash 9,380 6 115 Accounts Receivable 7,370 7 117 Prepaid Insurance 4,400 8 119 Repair Supplies 200 9 144 Repair Equipment 10.800 10 145 Accum Dep-Repair Equipment 11 212 Accounts Payable 7,300 12 213 Income Tax Payable 65 13 214 Interest Payable 14 220 Dividends Payable 9,600 this is a credit 15 300 Common Stock 25,000 16 301 Additional Pd-In Capital 17 312 Retained Earnings 18 313 Treasury Stock 1,100 19 411 Bicycle Repair Revenue 10,100 20 511 Store Rent Expense 2,400 21 512 Telephone Expense 500 22 513 Insurance Expense 601 2 23 514 Repair Supplies Expense 881 24 515 Dep Expense - Repair Equipment 120 25 516 Income Tax Expense 65 26 517 Electric Expense 1,250 518 Finance/Interest Eynense Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 5,000 27 4&5 Adjusting Entries 6 - Adjusted TB (+ 11:05 AM Type here to search o BI pun x] LA 42 6/4/2020 x C27 x Credit Column 1 F G - K L M N o Debit 4,400 7 8 200 9 10,800 10 11 7,300 12 65 13 14 15 9,600 | this is a credit 25,000 5,000 16 A Title 117 Prepaid Insurance 119 Repair Supplies 144 Repair Equipment 145 Accum Dep-Repair Equipment 212 Accounts Payable 213 Income Tax Payable 214 Interest Payable 220 Dividends Payable 300 Common Stock 301 Additional Pd-In Capital 312 Retained Earnings 313 Treasury Stock 411 Bicycle Repair Revenue 511 Store Rent Expense 512 Telephone Expense 513 Insurance Expense 514 Repair Supplies Expense 515 Dep Expense - Repair Equipment 516 Income Tax Expense 517 Electric Expense 518 Finance/Interest Expense 17 18 1,100 19 10,100 20 2,400 21 500 22 601 ? 23 881 24 120 25 65 26 1,250 27 28 29 30 31 32 33 34 35 36 Project Instructions March Transactions Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4&25 Adjusting Entries 6 - Adjusted TB (+ I Type here to search o BI e PE W L A 11:05 AM 6/4/2020 X H20 x fx Interest Payable D G J K L M - N o E F Statement of Retained Earnings For the Month Ending March 31 Balance Sheet March 31 7 Retained Earnings, March 1 Add: Net Income Subtotal Less : Dividends Retained Earnings, March 31 Assets: Cash Accounts Recivable Prepaid Insurance Repair Supplies Repair Equipment Less: Accum. Depr. Total Assets A B 4 Income Statement 5 For the Month Ending March 31 6 Revenues: 8 9 Total Revenue 10 11 Expenses: 12 13 14 15 16 17 18 19 20 21 22 Total Expenses 23 24 Net Income 25 26 YOU MUST USE THE EXCEL FUNCTION =SUM IN 27 ORDER TO DOCUMENT YOUR TOTALS & SUBTOTALS 28 29 30 Liabilities and Stockholders' Equity Liabilities: Accounts Payable Dividends Payable Interest Payable Income Taxes Payable Total Liabilities Stockholders' Equity: Common Stock Additional Paid-in Capital Retained Earnings Treasury Stock Total Stockholders' Equity Total Liabilities & Stockholders' Equity 31 32 33 34 35 36 Chart of Accounts 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB 7 - Financial Statements 88,9- Closing Entries ... + I Type here to search o j e PE x] E W LA 11:05 AM 6/4/2020 X E37 for =SUM(E5:E36) 2 F G H 1 J K L M N A B D E Requirement #8: Prepare the closing entries at March 31 in the General Journal below. Hint: Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement #9: Post the closing entries to the T-Accounts on the General Ledger (Step 2) worksheet and compute ending balances. Just add to the adjusted balances already listed. 1 2 3 General Journal Account Number from Chart of Accounts tab Date Account Title from Chart of Accounts tab Debit Credit 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 See the Week 2 Lecture for examples of how to complete closing entries. 1 - Journal Entries 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB 7 - Financial Statements 88.9- Closing Entries 10- Post Closing II. (+ I Type here to search O e PE x] W 11:05 AM 6/4/2020 X G8 E F G H J - L M N 0 A B C D Bethany's Bicycle Corporation Post-Closing Trial Balance 2 March 31 Account Account Balance 4 Number Title Debit Credit 5 111 Cash 6 115 Accounts Receivable 7 117 Prepaid Insurance 8 119 Repair Supplies 9 144 Repair Equipment 10 145 Accum Dep-Repair Equipment 11 212 Accounts Payable 12 213 Income Tax Payable 13 214 Interest Payable 14 220 Dividends Payable 15 300 Common Stock 16 301 Additional Pd-In Capital 17 312 Retained Earnings 18 313 Treasury Stock 19 411 Bicycle Repair Revenue 20 511 Store Rent Expense 21 512 Telephone Expense 22 513 Insurance Expense 23 514 Repair Supplies Expense 24 515 Dep Expense - Repair Equipment 25 516 Income Tax Expense 26 517 Electric Expense 518 Finance/Interest Eynense 2 - General Ledger 3 - Trial Balance 4&5 Adjusting Entries 6 - Adjusted TB 27 7 - Financial Statements 8&9- Closing Entries 10- Post Closing Trial Balance Gradi ... + I Type here to search o pun x] 11:05 AM 6/4/2020