Answered step by step

Verified Expert Solution

Question

1 Approved Answer

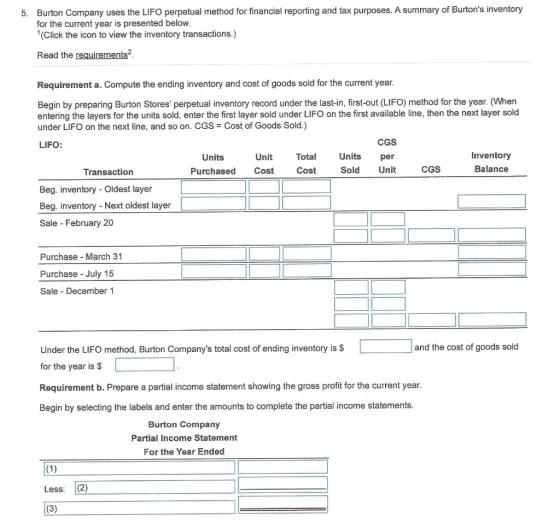

5. Burton Company uses the LIFO perpetual method for financial reporting and tax purposes. A summary of Burton's inventory for the current year is

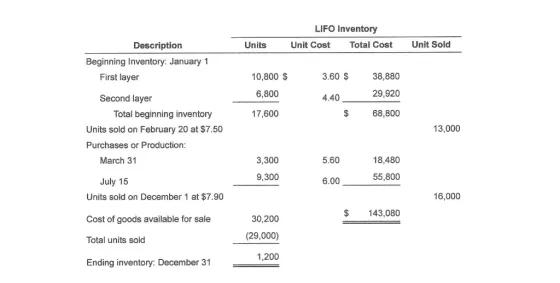

5. Burton Company uses the LIFO perpetual method for financial reporting and tax purposes. A summary of Burton's inventory for the current year is presented below. (Cick the icon to view the inventory transactions.) Read the raquirementa. Requirement a. Compute the ending inventory and cost of goods sold for the current year. Begin by preparing Burton Stores' perpetual inventory record under the last-in, first-out (LIFO) method for the year. (When entering the layers for the units sold, enter the first layer sold under LIFO on the first available line, then the next layer sold under LIFO on the next line, and so on. CGS = Cost of Goods Sold.) LIFO: CGS Units Unit Total Units per Inventory Transaction Purchased Cost Cost Sold Unit CGS Balance Beg, inventory - Oldest layer Beg. inventory - Next oldest layer Sale - February 20 Purchase - March 31 Purchase - July 15 Sale - December 1 Under the LIFO method, Burton Company's total cost of ending inventory is $ and the cost of goods sold for the year is $ Requirement b. Prepare a partial income statement showing the gross profit for the current year. Begin by selecting the labels and enter the amounts to complete the partial income statements. Burton Company Partial Income Statement For the Year Ended (1) Less (2) (3) LIFO Inventory Description Units Unit Cost Total Cost Unit Sold Beginning Inventory. January 1 First layer 10,800 S 3.60 S 38,880 6,800 29,920 Second layer 4.40 Total beginning inventory 17,600 68,B00 Units sold on February 20 at $7.50 13,000 Purchases or Production: March 31 3,300 5.60 18,480 9,300 55,800 July 15 6.00 Units sold on December 1 at $7.90 16,000 143,080 Cost of goods available for sale 30,200 (29,000) Total units sold 1,200 Ending inventory. December 31

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d797277657_175964.pdf

180 KBs PDF File

635d797277657_175964.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started