Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Begin with the partial model in the file Ch02 P20 Build a Model.xlsx on the textbook's Web site a. Britton String Corp. manufactures specialty strings

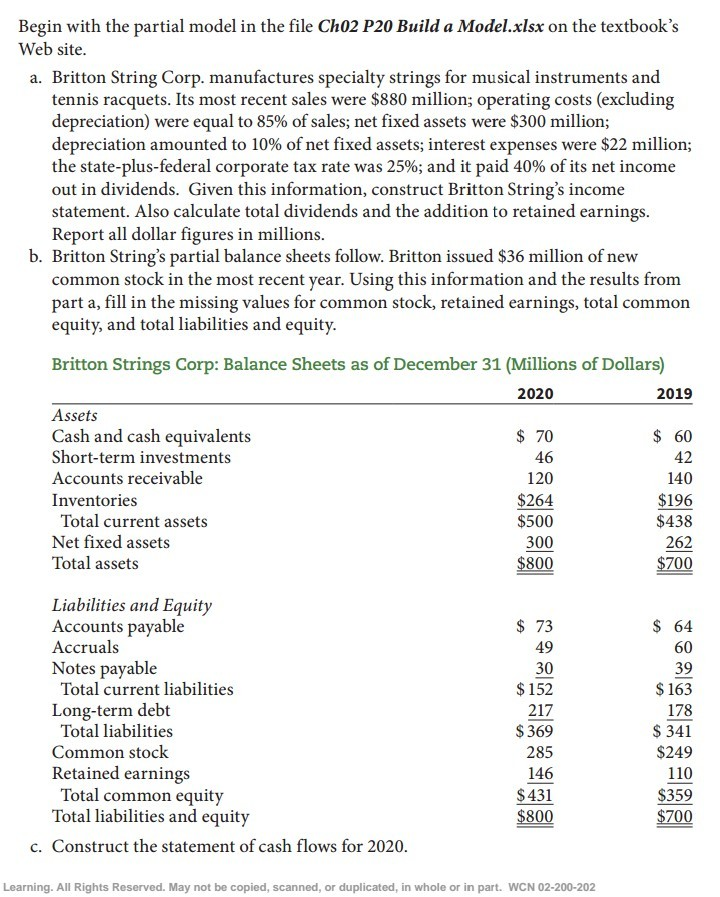

Begin with the partial model in the file Ch02 P20 Build a Model.xlsx on the textbook's Web site a. Britton String Corp. manufactures specialty strings for musical instruments and tennis racquets. Its most recent sales were $880 million; operating costs (excluding depreciation) were equal to 85% of sales; net fixed assets were $300 million; depreciation amounted to 10% of net fixed assets, interest expenses were $22 million; the state-plus-federal corporate tax rate was 25%; and it paid 40% of its net income out in dividends. Given this information, construct Britton String's income statement. Also calculate total dividends and the addition to retained earnings Report all dollar figures in millions b. Britton String's partial balance sheets follow. Britton issued $36 million of new common stock in the most recent year. Using this information and the results from part a, fill in the missing values for common stock, retained earnings, total common equity, and total liabilities and equity Britton Strings Corp: Balance Sheets as of December 31 (Millions of Dollars) 2020 2019 Assets Cash and cash equivalents Short-term investments Accounts receivable Inventories $ 70 46 120 $264 $500 300 800 $ 60 42 140 $196 $438 262 700 Total current assets Net fixed assets Total assets Liabilities and Equity Accounts payable Accruals Notes payable $ 73 49 30 $152 217 $369 285 146 $431 $800 64 60 39 $163 178 341 $249 110 $359 $700 Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity c. Construct the statement of cash flows for 2020 Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. WCN 02-200-202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started