Answered step by step

Verified Expert Solution

Question

1 Approved Answer

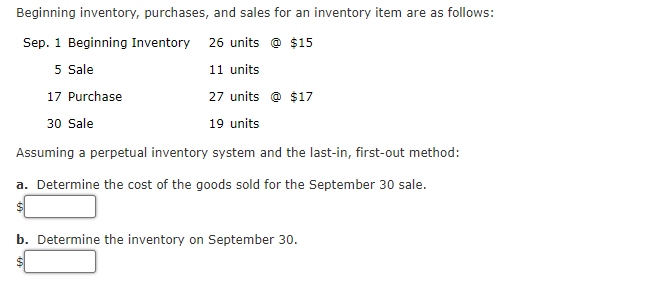

Beginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inventory 26 units @ $15 5 Sale 11 units

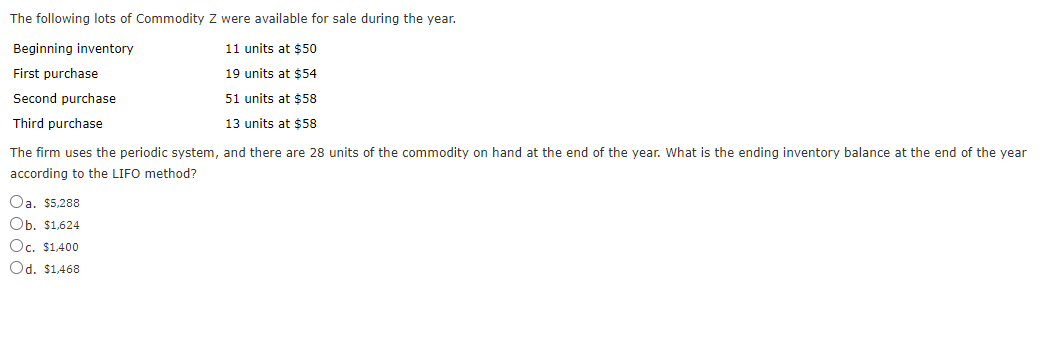

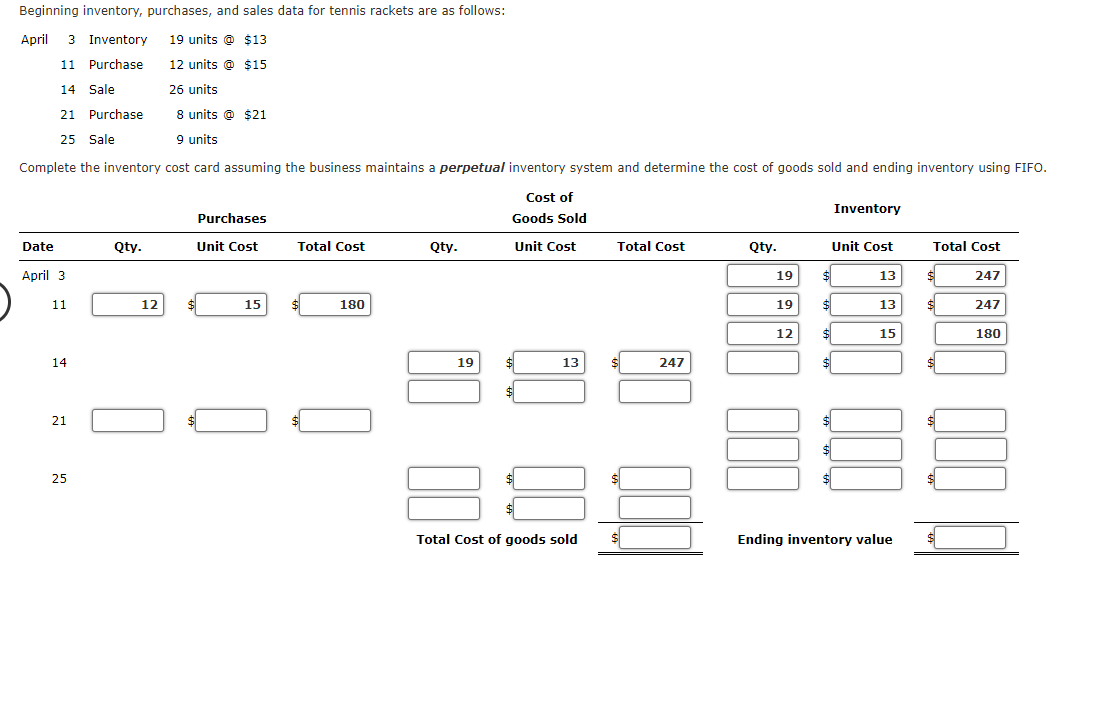

Beginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inventory 26 units @ $15 5 Sale 11 units 17 Purchase 27 units @ $17 30 Sale 19 units Assuming a perpetual inventory system and the last-in, first-out method: a. Determine the cost of the goods sold for the September 30 sale. $1 b. Determine the inventory on September 30. The following lots of Commodity Z were available for sale during the year. Beginning inventory 11 units at $50 First purchase 19 units at $54 Second purchase 51 units at $58 Third purchase 13 units at $58 The firm uses the periodic system, and there are 28 units of the commodity on hand at the end of the year. What is the ending inventory balance at the end of the year according to the LIFO method? Oa. $5,288 Ob. $1,624 Oc, $1,400 Od. $1.468 Beginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory 19 units @ $13 11 Purchase 12 units @ $15 14 Sale 26 units 21 Purchase 8 units @ $21 25 Sale 9 units Complete the inventory cost card assuming the business maintains a perpetual inventory system and determine the cost of goods sold and ending inventory using FIFO. Cost of Inventory Purchases Goods Sold Date Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost Qty. Unit Cost Total Cost April 3 19 $1 13 247 11 12 15 180 19 $1 13 247 12 15 180 14 19 13 247 $ 21 25 Total Cost of goods sold Ending inventory value

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Determine the cost of the goods sold for the september 30 sale 323 b Determine the In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started