Question: Beginning Transactions on the first Excel worksheet will provide the Balance Sheet for 2019 and the Transactions for January 2020. On the second Excel worksheet,

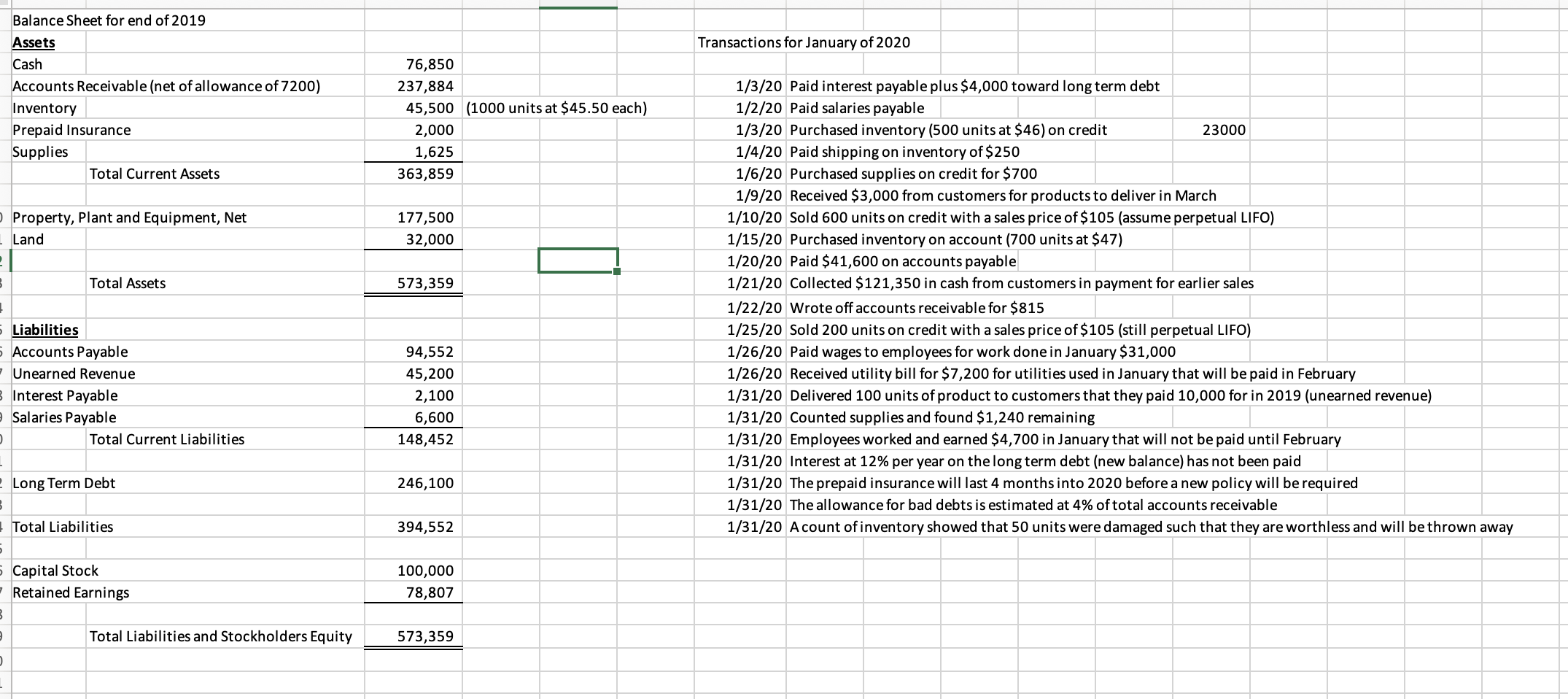

"Beginning Transactions" on the first Excel worksheet will provide the Balance Sheet for 2019 and the Transactions for January 2020.

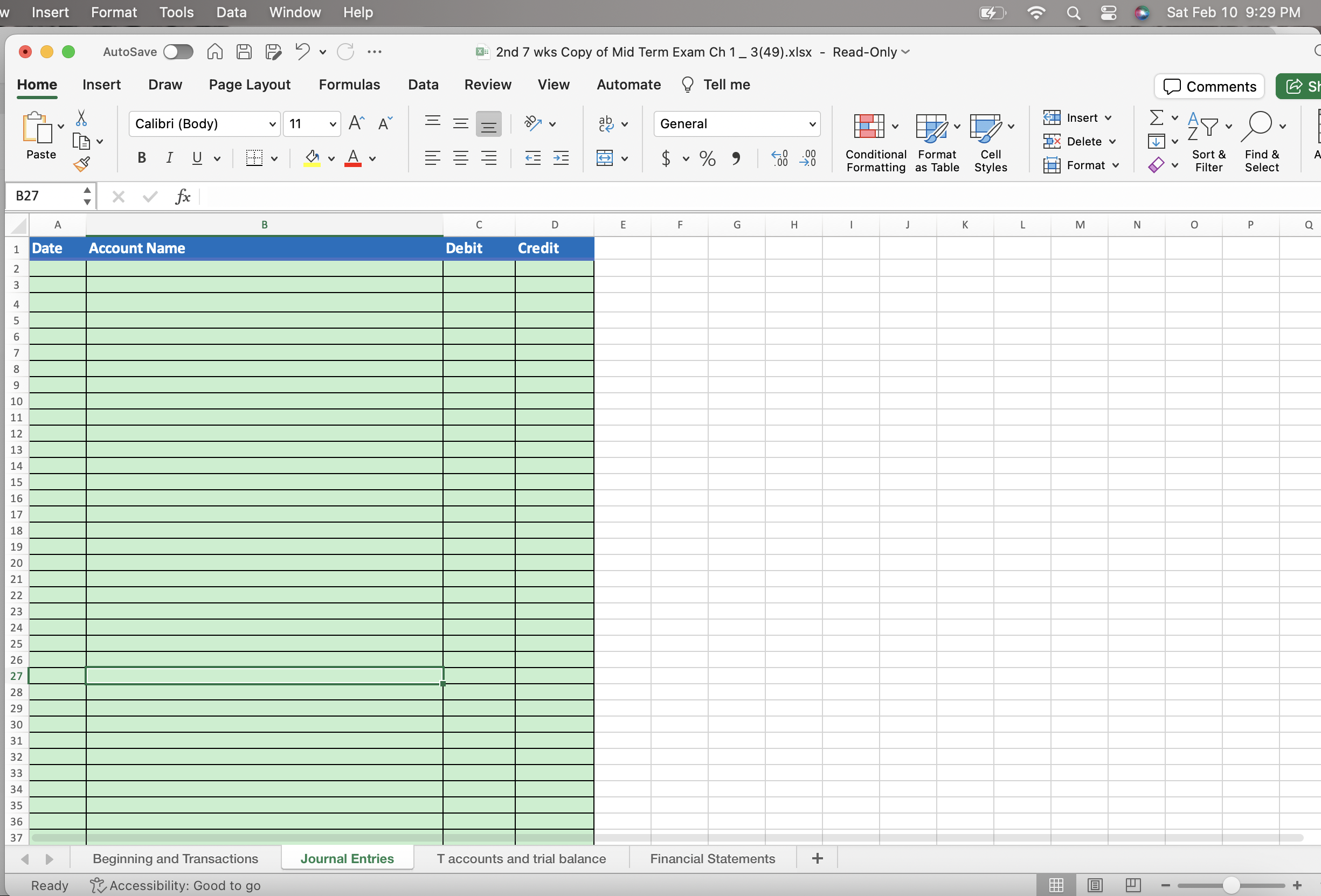

On the second Excel worksheet, "Journal Entries", you should record the transactions provided on the first Excel worksheet by creating Journal Entries with dates and descriptions.

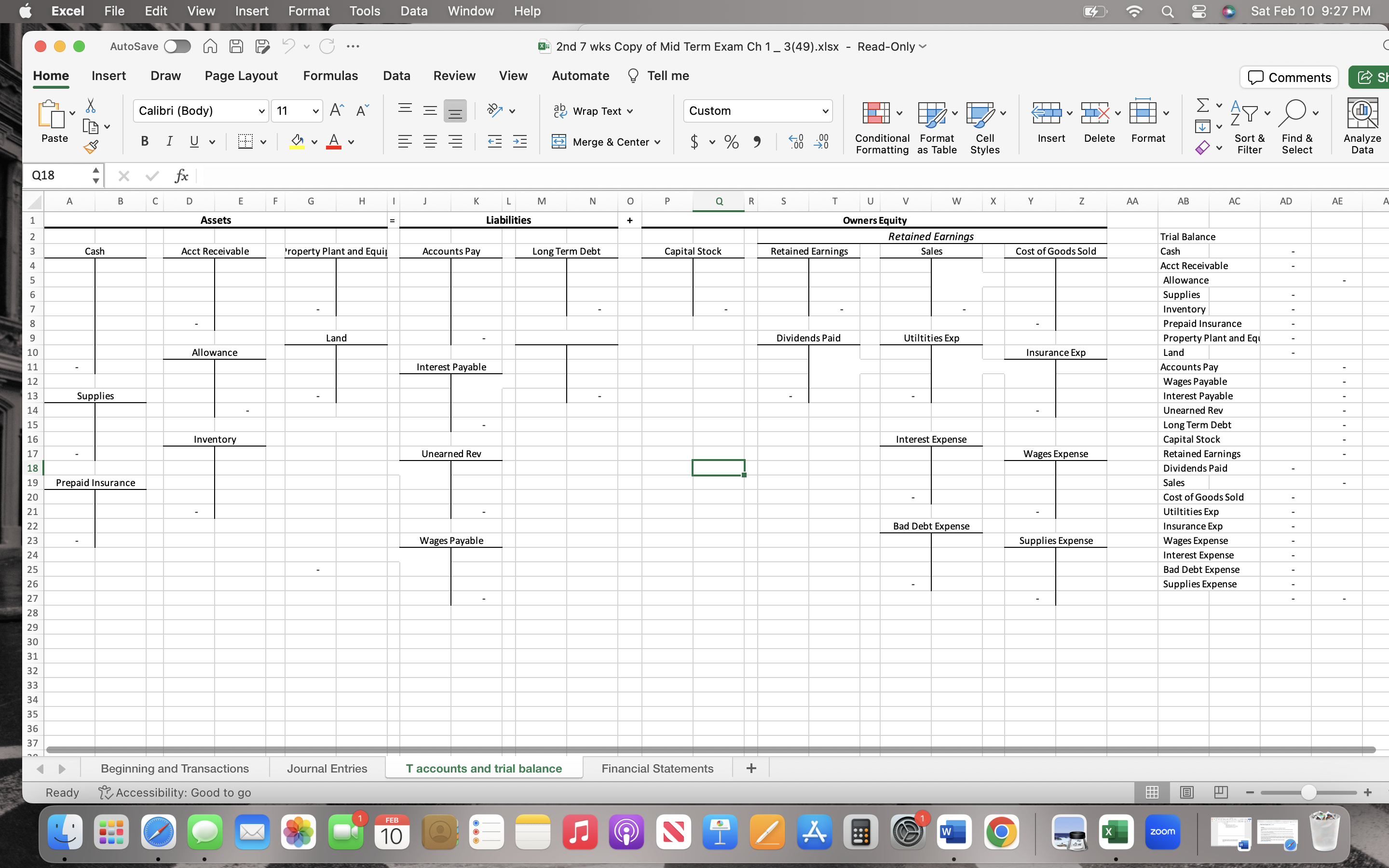

On the third Excel worksheet, "T-accounts and trial balance", you should record the required journal entries in the T-accounts and record an unadjusted trial balance.

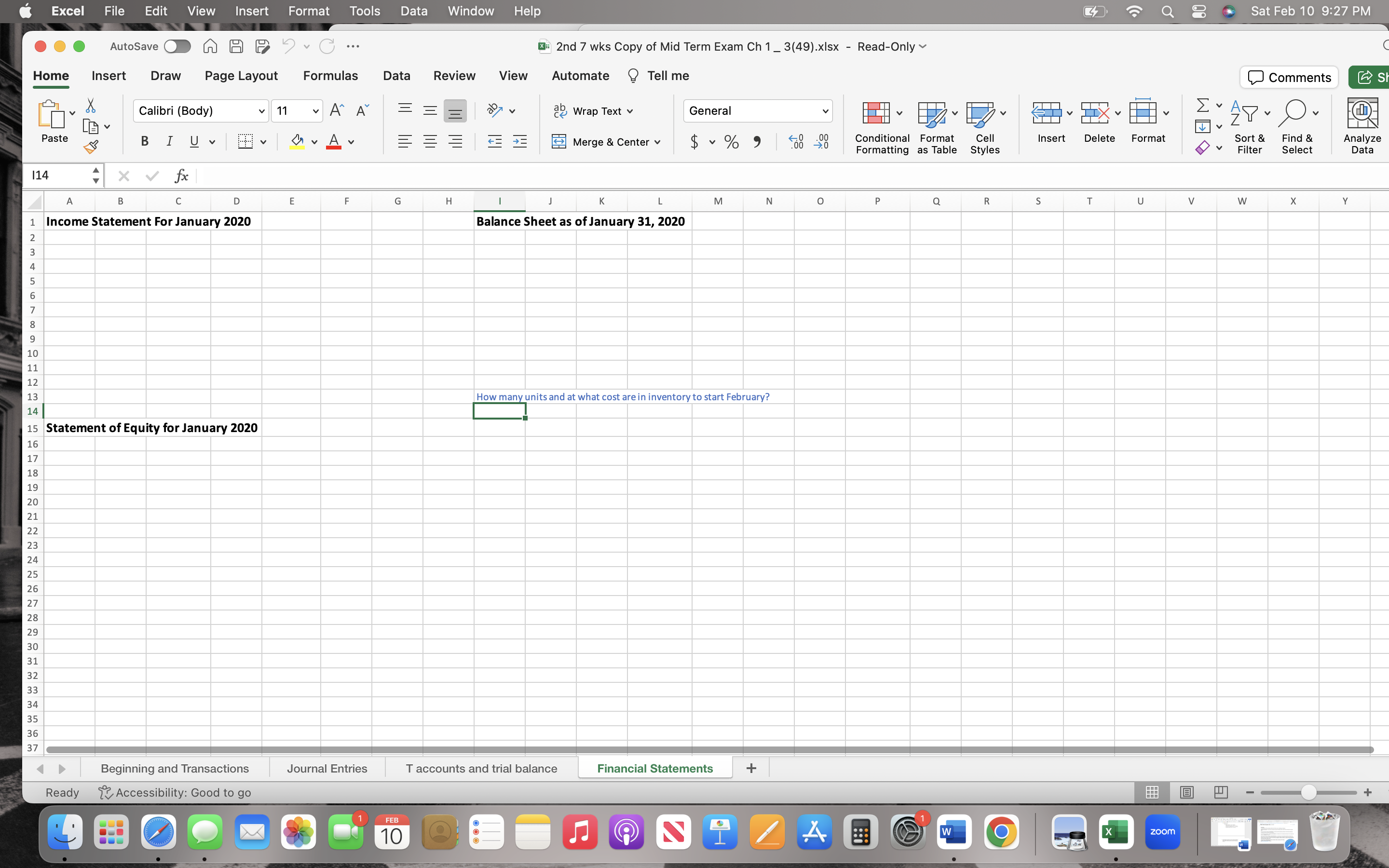

The fourth and final Excel worksheet, "Financial Statements", you will record an Income Statement, Statement of Equity and a Balance Sheet as of January 31, 2020 and answer the inventory question.

https://docs.google.com/spreadsheets/d/1oZm1Qx4CE7aRE6fcAys5lG6RLr_bvYmxxmn5rakSWhM/edit?usp=sharing

Balance Sheet for end of 2019 Assets Cash Accounts Receivable (net of allowance of 7200) Inventory Prepaid Insurance 76,850 237,884 Transactions for January of 2020 1/3/20 Paid interest payable plus $4,000 toward long term debt 45,500 (1000 units at $45.50 each) 2,000 1/2/20 Paid salaries payable 1/3/20 Purchased inventory (500 units at $46) on credit Supplies Total Current Assets 1,625 1/4/20 Paid shipping on inventory of $250 363,859 1/6/20 Purchased supplies on credit for $700 O Property, Plant and Equipment, Net 177,500 Land 32,000 Total Assets 573,359 5 Liabilities 5 Accounts Payable Unearned Revenue 3 Interest Payable 94,552 45,200 2,100 Salaries Payable 6,600 ) Total Current Liabilities 148,452 Long Term Debt 246,100 Total Liabilities 394,552 5 Capital Stock 100,000 Retained Earnings 78,807 3 9 Total Liabilities and Stockholders Equity 573,359 23000 1/9/20 Received $3,000 from customers for products to deliver in March 1/10/20 Sold 600 units on credit with a sales price of $105 (assume perpetual LIFO) 1/15/20 Purchased inventory on account (700 units at $47) 1/20/20 Paid $41,600 on accounts payable 1/21/20 Collected $121,350 in cash from customers in payment for earlier sales 1/22/20 Wrote off accounts receivable for $815 1/25/20 Sold 200 units on credit with a sales price of $105 (still perpetual LIFO) 1/26/20 Paid wages to employees for work done in January $31,000 1/26/20 Received utility bill for $7,200 for utilities used in January that will be paid in February 1/31/20 Delivered 100 units of product to customers that they paid 10,000 for in 2019 (unearned revenue) 1/31/20 Counted supplies and found $1,240 remaining 1/31/20 Employees worked and earned $4,700 in January that will not be paid until February 1/31/20 Interest at 12% per year on the long term debt (new balance) has not been paid 1/31/20 The prepaid insurance will last 4 months into 2020 before a new policy will be required 1/31/20 The allowance for bad debts is estimated at 4% of total accounts receivable 1/31/20 A count of inventory showed that 50 units were damaged such that they are worthless and will be thrown away

Step by Step Solution

There are 3 Steps involved in it

To complete this task you need to follow these steps 1 Record Journal Entries Based on the transactions provided in the Beginning Transactions worksheet we need to record them in the Journal Entries w... View full answer

Get step-by-step solutions from verified subject matter experts