Answered step by step

Verified Expert Solution

Question

1 Approved Answer

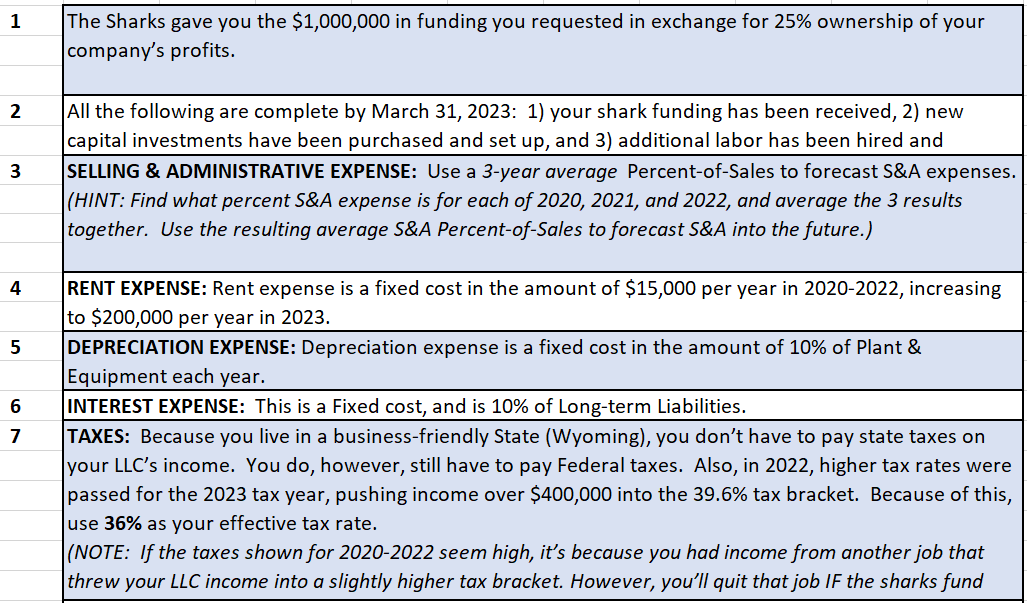

begin{tabular}{|c|c|} hline 1 & begin{tabular}{l} The Sharks gave you the $1,000,000 in funding you requested in exchange for 25% ownership of your company's profits.

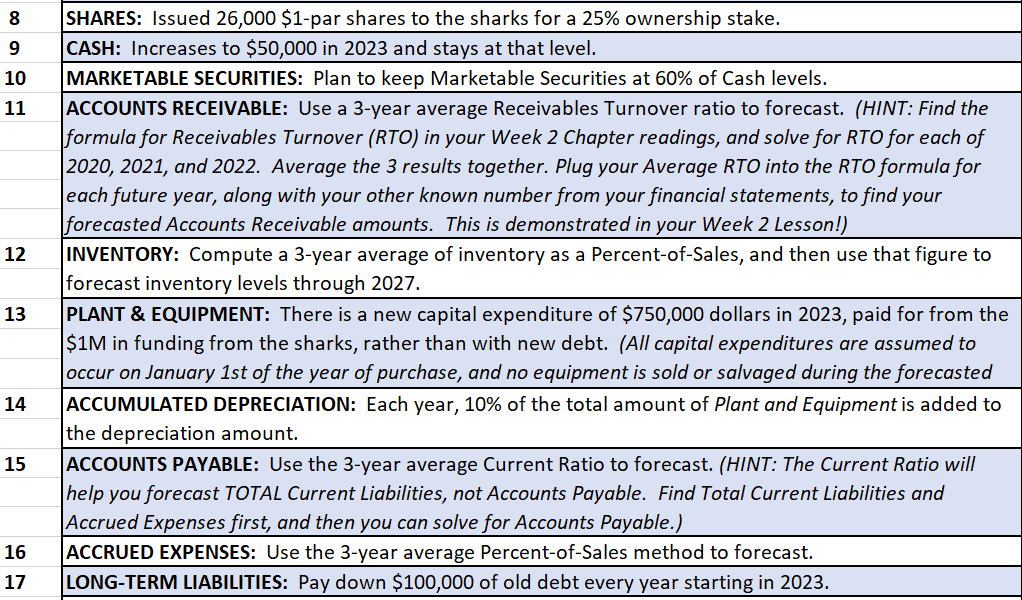

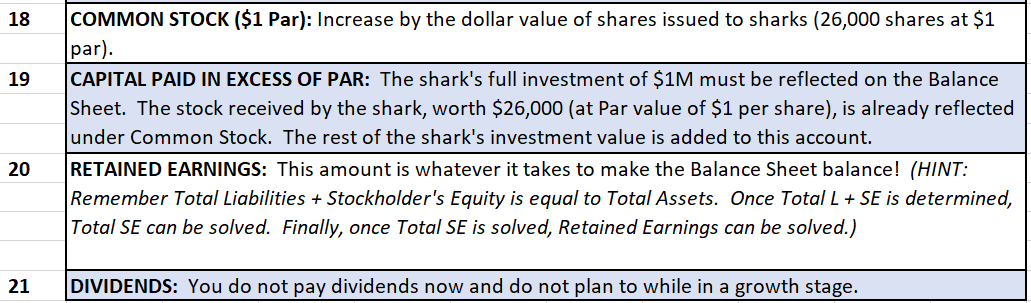

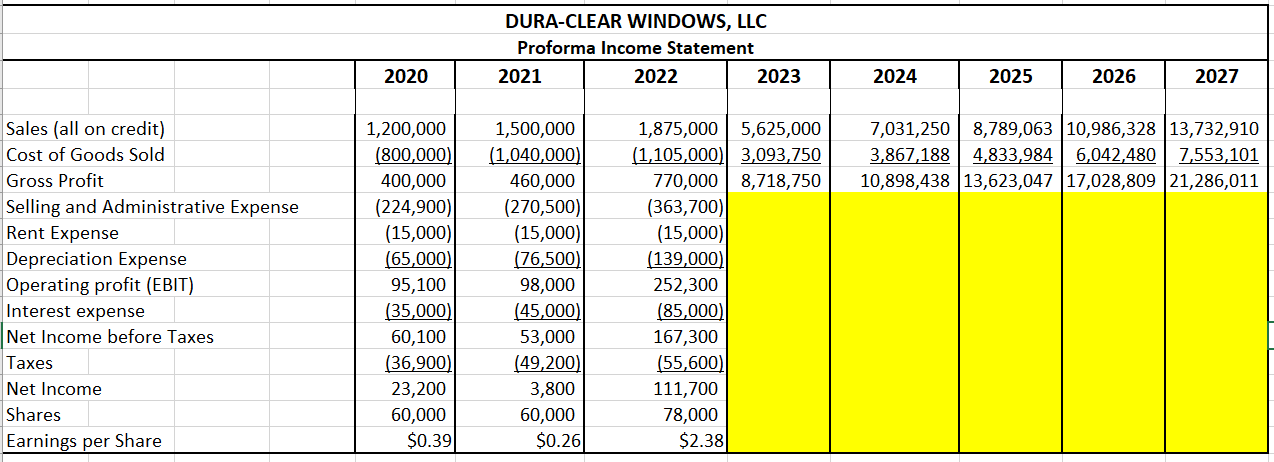

\begin{tabular}{|c|c|} \hline 1 & \begin{tabular}{l} The Sharks gave you the $1,000,000 in funding you requested in exchange for 25% ownership of your \\ company's profits. \end{tabular} \\ \hline 2 & \begin{tabular}{l} All the following are complete by March 31, 2023: 1) your shark funding has been received, 2) new \\ capital investments have been purchased and set up, and 3) additional labor has been hired and \end{tabular} \\ \hline 3 & \begin{tabular}{l} SELLING \& ADMINISTRATIVE EXPENSE: Use a 3-year average Percent-of-Sales to forecast S\&A expenses. \\ (HINT: Find what percent S\&A expense is for each of 2020, 2021, and 2022, and average the 3 results \\ together. Use the resulting average S\&A Percent-of-Sales to forecast S\&A into the future.) \end{tabular} \\ \hline 4 & \begin{tabular}{l} RENT EXPENSE: Rent expense is a fixed cost in the amount of $15,000 per year in 20202022, increasing \\ to $200,000 per year in 2023 . \end{tabular} \\ \hline 5 & \begin{tabular}{l} DEPRECIATION EXPENSE: Depreciation expense is a fixed cost in the amount of 10% of Plant \& \\ Equipment each year. \end{tabular} \\ \hline 6 & INTEREST EXPENSE: This is a Fixed cost, and is 10% of Long-term Liabilities. \\ \hline 7 & \begin{tabular}{l} TAXES: Because you live in a business-friendly State (Wyoming), you don't have to pay state taxes on \\ your LLC's income. You do, however, still have to pay Federal taxes. Also, in 2022, higher tax rates were \\ passed for the 2023 tax year, pushing income over $400,000 into the 39.6% tax bracket. Because of this, \\ use 36% as your effective tax rate. \\ (NOTE: If the taxes shown for 20202022 seem high, it's because you had income from another job that \\ threw your LLC income into a slightly higher tax bracket. However, you'll quit that job IF the sharks fund \end{tabular} \\ \hline \end{tabular} \begin{tabular}{l|l|} \hline 18 & \begin{tabular}{l} COMMON STOCK (\$1 Par): Increase by the dollar value of shares issued to sharks (26,000 shares at \$1 \\ par). \end{tabular} \\ \hline 20 & \begin{tabular}{l} CAPITAL PAID IN EXCESS OF PAR: The shark's full investment of \$1M must be reflected on the Balance \\ Sheet. The stock received by the shark, worth \$26,000 (at Par value of \$1 per share), is already reflected \\ under Common Stock. The rest of the shark's investment value is added to this account. \end{tabular} \\ \hline \begin{tabular}{l} RETAINED EARNINGS: This amount is whatever it takes to make the Balance Sheet balance! (HINT: \\ Remember Total Liabilities + Stockholder's Equity is equal to Total Assets. Once Total L + SE is determined, \\ Total SE can be solved. Finally, once Total SE is solved, Retained Earnings can be solved.) \end{tabular} & DIVIDENDS: You do not pay dividends now and do not plan to while in a growth stage. \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started