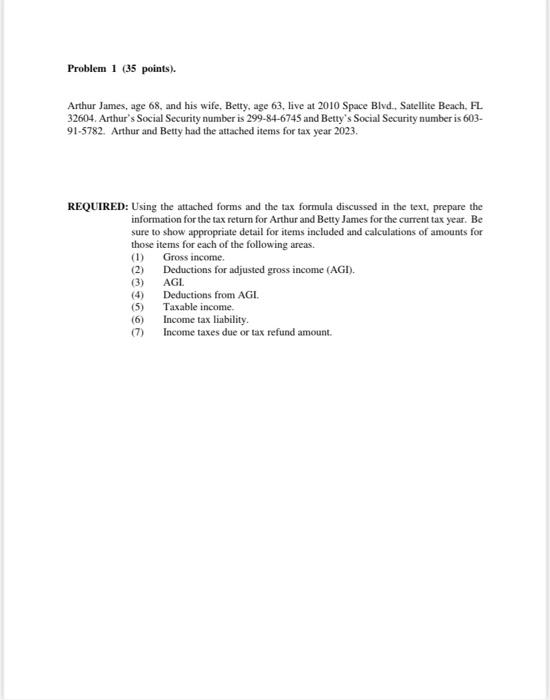

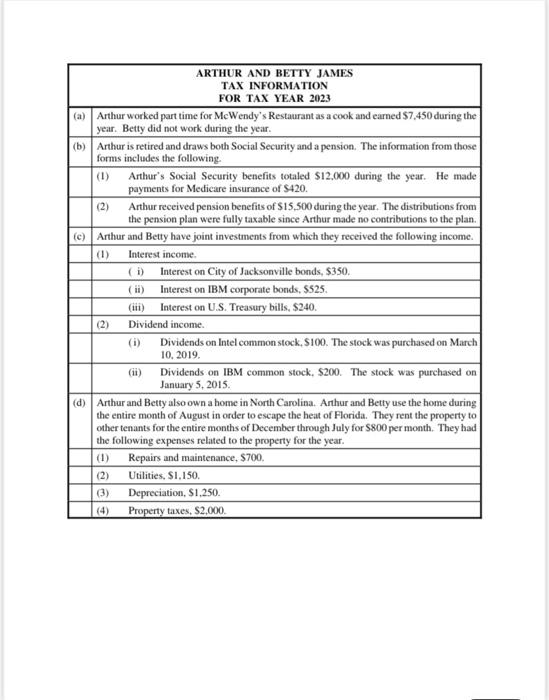

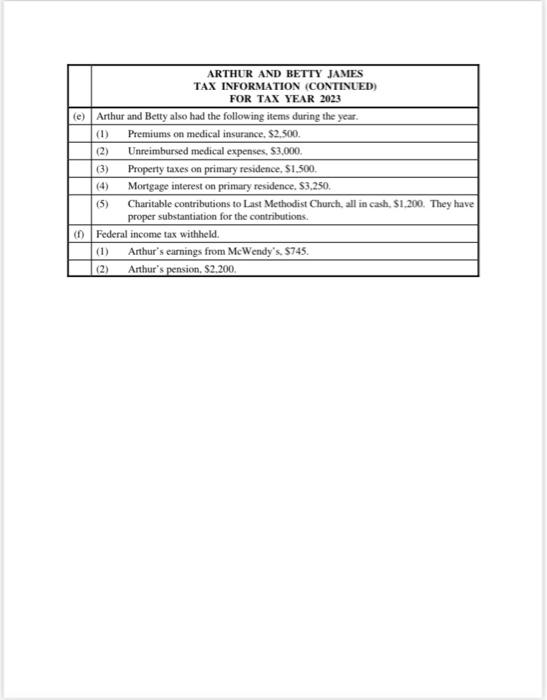

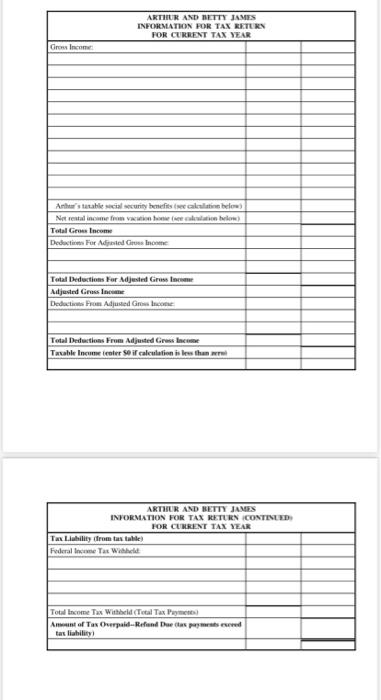

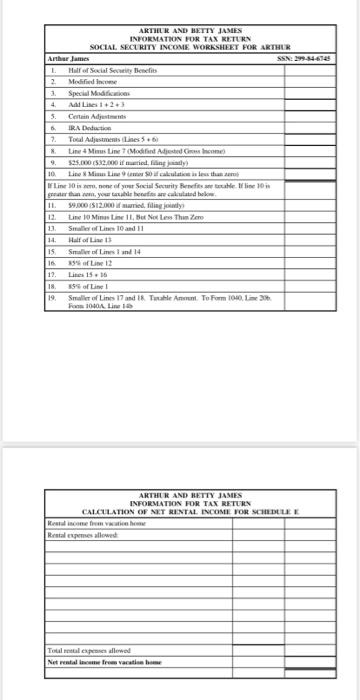

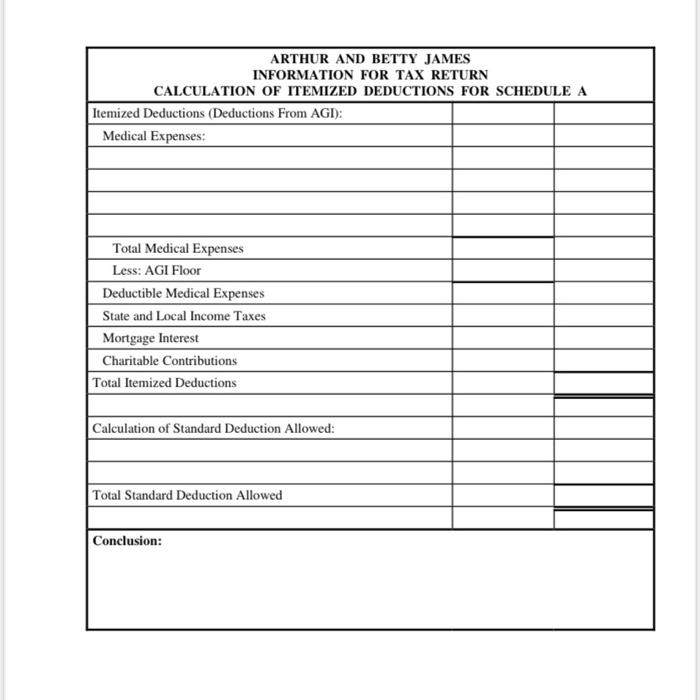

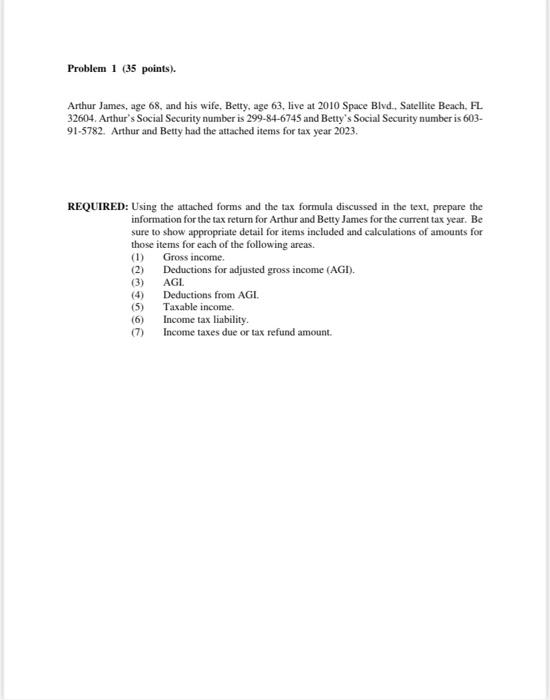

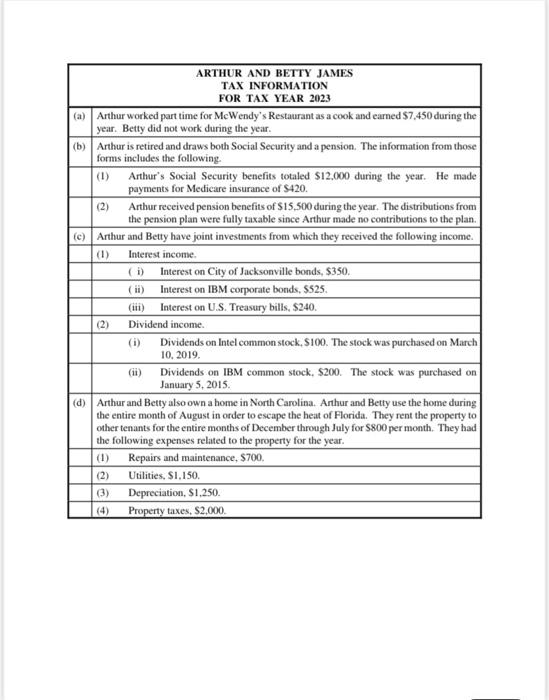

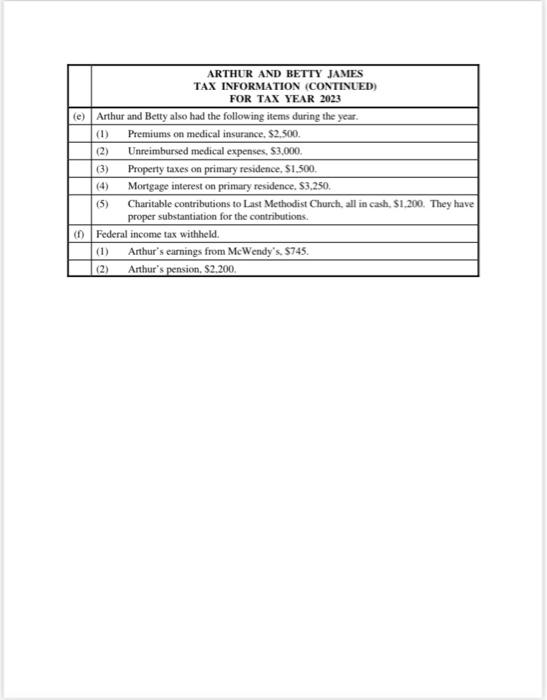

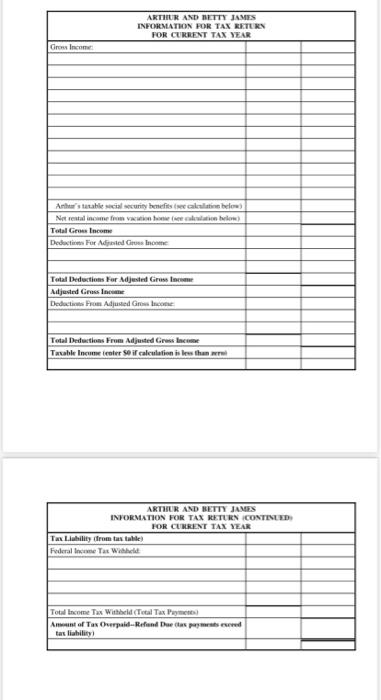

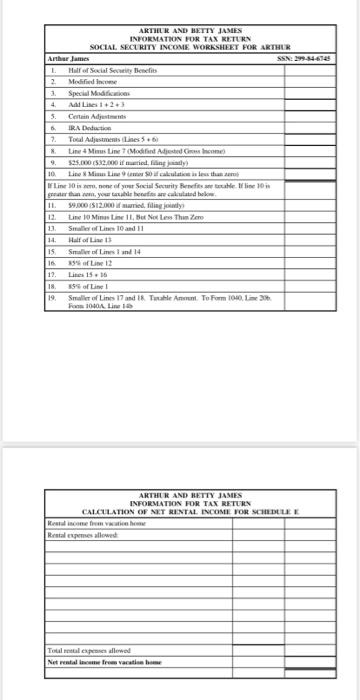

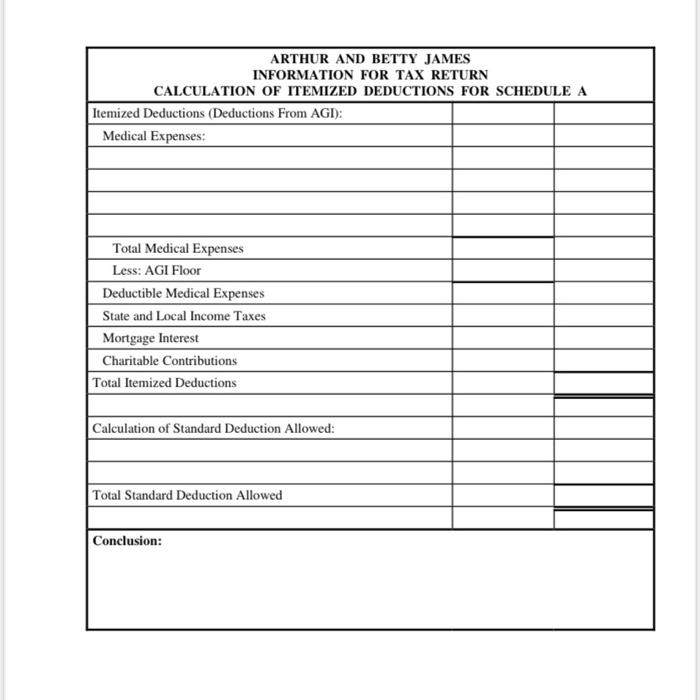

\begin{tabular}{|c|c|c|} \hline & & ARTHURANDBETTYJAMESTAXINFORMATION(CONTINUED)FORTAXYEAR2023 \\ \hline \multirow[t]{6}{*}{ (e) } & \multicolumn{2}{|r|}{ Arthur and Betty also had the following items during the year. } \\ \hline & & Premiums on medical insurance, $2,500. \\ \hline & (2) & Unreimbursed medical expenses, $3,000. \\ \hline & (3) & Property taxes on primary residence, $1,500. \\ \hline & (4) & Mortgage interest on primary residence, $3,250. \\ \hline & (5) & CharitablecontributionstoLastMethodistChurch,allincash,$1.200.Theyhavepropersubstantiationforthecontributions. \\ \hline \multirow[t]{3}{*}{ (f) } & \multicolumn{2}{|c|}{ Federal income tax withheld. } \\ \hline & (1) & Arthur's earnings from McWendy's, $745. \\ \hline & (2) & Arthur's pension, $2,200 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|r|}{ARTHURANDBETTYJAMESTAXINFORMATIONFORTAXYEAR2023} \\ \hline (a) & \multicolumn{3}{|c|}{ArthurworkedparttimeforMcWendysRestaurantasacookandearned$7,450duringtheyear.Bettydidnotworkduringtheyear.} \\ \hline \multirow[t]{3}{*}{ (b) } & \multicolumn{3}{|c|}{ArthurisretiredanddrawsbothSocialSecurityandapension.Theinformationfromthoseformsincludesthefollowing.} \\ \hline & & \multicolumn{2}{|r|}{ArthursSocialSecuritybenefitstotaled$12,000duringtheyear.HemadepaymentsforMedieareinsuranceof$420.} \\ \hline & (2) & \multicolumn{2}{|r|}{Arthurreceivedpensionbenefitsof$15,500duringtheyear.ThedistributionsfromthepensionplanwerefullytaxablesinceArthurmadenocontributionstotheplan.} \\ \hline \multirow[t]{8}{*}{ (c) } & \multicolumn{3}{|r|}{ Arthur and Betty have joint investments from which they received the following income. } \\ \hline & (1) & \multicolumn{2}{|c|}{ Interest income. } \\ \hline & & (i) & Interest on City of Jacksonville bonds, $350. \\ \hline & & ( ii) & Interest on IBM corporate bonds, \$525. \\ \hline & & (iii) & Interest on U.S. Treasury bills, \$240. \\ \hline & (2) & \multicolumn{2}{|c|}{ Dividend income. } \\ \hline & & & DividendsonIntelcommonstock,$100.ThestockwaspurchasedonMarch10,2019. \\ \hline & & (ii) & DividendsonIBMcommonstock,$200.ThestockwaspurchasedonJanuary5,2015. \\ \hline \multirow[t]{5}{*}{ (d) } & \multicolumn{3}{|c|}{ArthurandBettyalsoownahomeinNorthCarolina.ArthurandBettyusethehomeduringtheentiremonthofAugustinordertoescapetheheatofFlorida.TheyrentthepropertytoothertenantsfortheentiremonthsofDecemberthroughJulyfor$800permonth.Theyhadthefollowingexpensesrelatedtothepropertyfortheyear.} \\ \hline & (1) & Rep & rs and maintenance, $700. \\ \hline & & Utili & es, $1,150. \\ \hline & (3) & Dep & ciation, $1,250. \\ \hline & & Prop & rty taxes, $2,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline & HIR \\ \hline Anthar James & sin2:29844674 \\ \hline & \\ \hline 2. Modifind insume & \\ \hline 3. Special Modificriones & \\ \hline 4. Aad Lise: 1+2+3 & \\ \hline 5. Centen Adyestrmems & \\ \hline B. IRAS Deduction & \\ \hline 2. Toual Adjustonenis (Lhes 5+6 & \\ \hline 8. Line 4 Miass Line 7 (Modifind Adjected Crous hones & \\ \hline & \\ \hline & \\ \hline & \\ \hline 11. 99500 is I2000 if mamed, faling jounty & \\ \hline 12. Line io Minas tine 11, Ber Nes Less Thin Zem & \\ \hline 13. Smaller of Lims 10 and 11 & \\ \hline 14. Half of Lua it? & \\ \hline 15. Sinalive of Lines I and 14 & \\ \hline 16. 35% aftime i2 & \\ \hline 12. Lites 15,15 & \\ \hline 18. ISs of Line I & \\ \hline & \\ \hline \end{tabular} Arthur James, age 68 , and his wife, Betty, age 63, live at 2010 Space Blvd., Satellite Beach, FL. 32604. Arthur's Social Security number is 299-84-6745 and Betty's Social Security number is 60391-5782. Arthur and Betty had the attached items for tax year 2023. REQUIRED: Using the attached forms and the tax formula discussed in the text, prepare the information for the tax return for Arthur and Betty James for the current tax year. Be sure to show appropriate detail for items included and calculations of amounts for those items for each of the following areas. (1) Gross income. (2) Deductions for adjusted gross income (AGI). (3) AGL (4) Deductions from AGI. (5) Taxable income. (6) Income tax liability. (7) Income taxes due or tax refund amount