Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|} hline multicolumn{3}{|c|}{ GENERAL LIGHTING CORPORATION } hline multicolumn{3}{|l|}{ Income Statement } hline multicolumn{3}{|c|}{ For the Year Ended December 31, 2024} hline

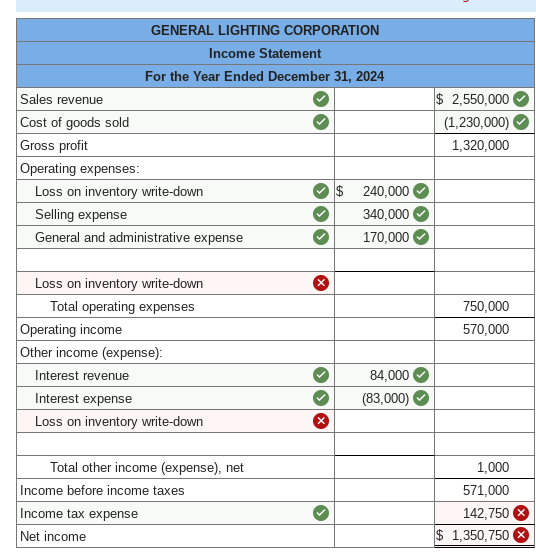

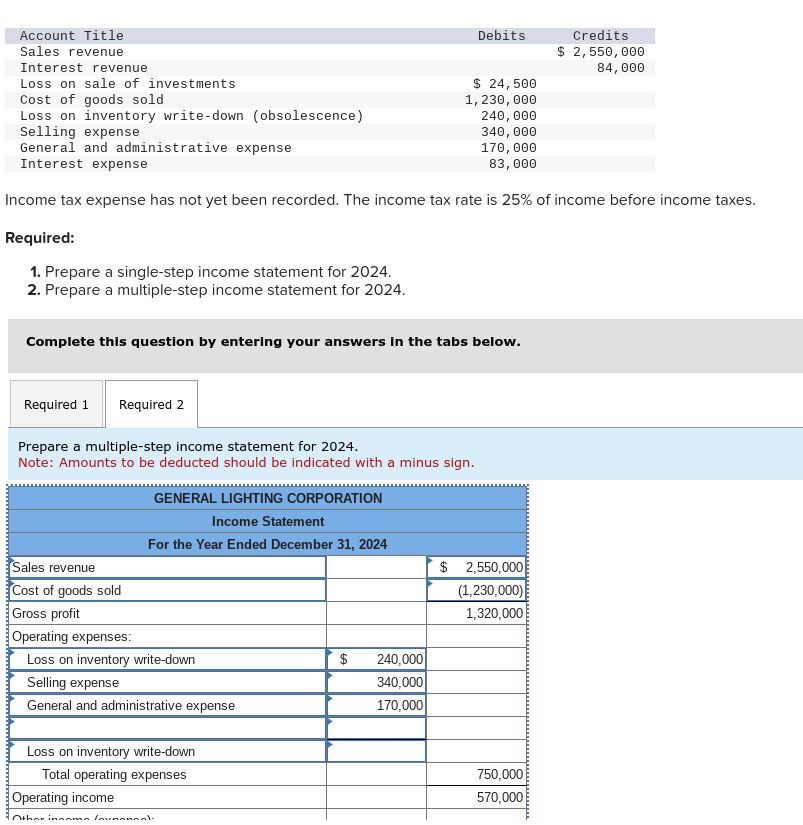

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ GENERAL LIGHTING CORPORATION } \\ \hline \multicolumn{3}{|l|}{ Income Statement } \\ \hline \multicolumn{3}{|c|}{ For the Year Ended December 31, 2024} \\ \hline Sales revenue & & $2,550,000 \\ \hline Cost of goods sold & & (1,230,000) \\ \hline Gross profit & & 1,320,000 \\ \hline \multicolumn{3}{|l|}{ Operating expenses: } \\ \hline Loss on inventory write-down & $240,000 & \\ \hline Selling expense & 340,000 & \\ \hline General and administrative expense & 170,000 & \\ \hline Loss on inventory write-down & & \\ \hline Total operating expenses & & 750,000 \\ \hline Operating income & & 570,000 \\ \hline \multicolumn{3}{|l|}{ Other income (expense): } \\ \hline Interest revenue & 84,000 & \\ \hline Interest expense & (83,000) & \\ \hline Loss on inventory write-down & & \\ \hline Total other income (expense), net & & 1,000 \\ \hline Income before income taxes & & 571,000 \\ \hline Income tax expense & & 142,750 \\ \hline Net income & & $1,350,750 \\ \hline \end{tabular} Income tax expense has not yet been recorded. The income tax rate is 25% of income before income taxes. Required: 1. Prepare a single-step income statement for 2024 . 2. Prepare a multiple-step income statement for 2024. Complete this question by entering your answers in the tabs below. Prepare a multiple-step income statement for 2024. Note: Amounts to be deducted should be indicated with a minus sign

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ GENERAL LIGHTING CORPORATION } \\ \hline \multicolumn{3}{|l|}{ Income Statement } \\ \hline \multicolumn{3}{|c|}{ For the Year Ended December 31, 2024} \\ \hline Sales revenue & & $2,550,000 \\ \hline Cost of goods sold & & (1,230,000) \\ \hline Gross profit & & 1,320,000 \\ \hline \multicolumn{3}{|l|}{ Operating expenses: } \\ \hline Loss on inventory write-down & $240,000 & \\ \hline Selling expense & 340,000 & \\ \hline General and administrative expense & 170,000 & \\ \hline Loss on inventory write-down & & \\ \hline Total operating expenses & & 750,000 \\ \hline Operating income & & 570,000 \\ \hline \multicolumn{3}{|l|}{ Other income (expense): } \\ \hline Interest revenue & 84,000 & \\ \hline Interest expense & (83,000) & \\ \hline Loss on inventory write-down & & \\ \hline Total other income (expense), net & & 1,000 \\ \hline Income before income taxes & & 571,000 \\ \hline Income tax expense & & 142,750 \\ \hline Net income & & $1,350,750 \\ \hline \end{tabular} Income tax expense has not yet been recorded. The income tax rate is 25% of income before income taxes. Required: 1. Prepare a single-step income statement for 2024 . 2. Prepare a multiple-step income statement for 2024. Complete this question by entering your answers in the tabs below. Prepare a multiple-step income statement for 2024. Note: Amounts to be deducted should be indicated with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started