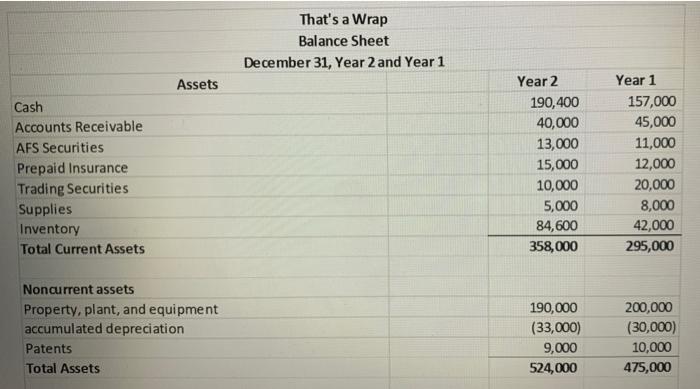

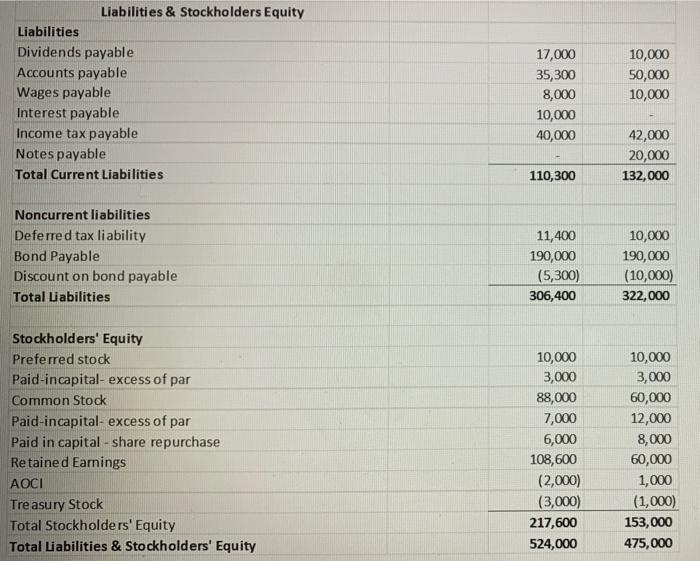

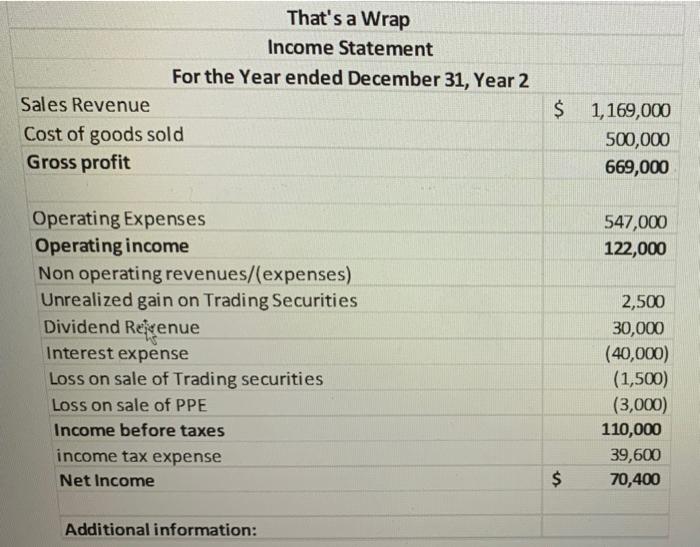

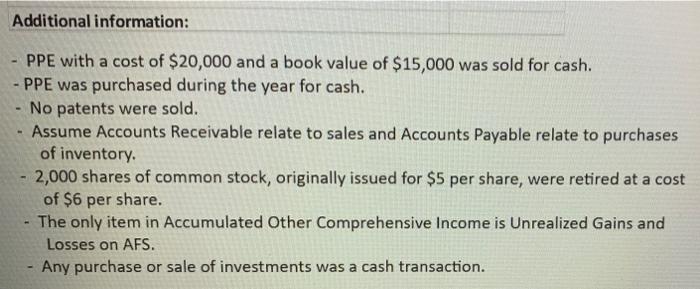

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ That's a Wrap } \\ \hline \multicolumn{3}{|c|}{ Balance Sheet } \\ \hline \multicolumn{3}{|c|}{ December 31, Year 2 and Year 1} \\ \hline Assets & Year 2 & Year 1 \\ \hline Cash & 190,400 & 157,000 \\ \hline Accounts Receivable & 40,000 & 45,000 \\ \hline AFS Securities & 13,000 & 11,000 \\ \hline Prepaid Insurance & 15,000 & 12,000 \\ \hline Trading Securities & 10,000 & 20,000 \\ \hline Supplies & 5,000 & 8,000 \\ \hline Inventory & 84,600 & 42,000 \\ \hline Total Current Assets & 358,000 & 295,000 \\ \hline \multicolumn{3}{|l|}{ Noncurrent assets } \\ \hline Property, plant, and equipment & 190,000 & 200,000 \\ \hline accumulated depreciation & (33,000) & (30,000) \\ \hline Patents & 9,000 & 10,000 \\ \hline Total Assets & 524,000 & 475,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Liabilities \& Stockholders Equity } \\ \hline \multicolumn{3}{|l|}{ Liabilities } \\ \hline Dividends payable & 17,000 & 10,000 \\ \hline Accounts payable & 35,300 & 50,000 \\ \hline Wages payable & 8,000 & 10,000 \\ \hline Interest payable & 10,000 & - \\ \hline Income tax payable & 40,000 & 42,000 \\ \hline Notes payable & - & 20,000 \\ \hline Total Current Liabilities & 110,300 & 132,000 \\ \hline \multicolumn{3}{|l|}{ Noncurrent liabilities } \\ \hline Deferred tax liability & 11,400 & 10,000 \\ \hline Bond Payable & 190,000 & 190,000 \\ \hline Discount on bond payable & (5,300) & (10,000) \\ \hline Total Liabilities & 306,400 & 322,000 \\ \hline \multicolumn{3}{|l|}{ Stockholders' Equity } \\ \hline Preferred stock & 10,000 & 10,000 \\ \hline Paid-incapital- excess of par & 3,000 & 3,000 \\ \hline Common Stock & 88,000 & 60,000 \\ \hline Paid-incapital- excess of par & 7,000 & 12,000 \\ \hline Paid in capital - share repurchase & 6,000 & 8,000 \\ \hline Retained Earnings & 108,600 & 60,000 \\ \hline AOCI & (2,000) & 1,000 \\ \hline Treasury Stock & (3,000) & (1,000) \\ \hline Total Stockholders' Equity & 217,600 & 153,000 \\ \hline Total Liabilities \& Stockholders' Equity & 524,000 & 475,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ That's a Wrap } \\ \hline \multicolumn{3}{|c|}{ Income Statement } \\ \hline \multicolumn{3}{|c|}{ For the Year ended December 31, Year 2} \\ \hline Sales Revenue & $ & 1,169,000 \\ \hline Cost of goods sold & & 500,000 \\ \hline Gross profit & & 669,000 \\ \hline Operating Expenses & & 547,000 \\ \hline Operating income & & 122,000 \\ \hline \multicolumn{3}{|l|}{ Non operating revenues/(expenses) } \\ \hline Unrealized gain on Trading Securities & & 2,500 \\ \hline Dividend Rejigenue & & 30,000 \\ \hline Interest expense & & (40,000) \\ \hline Loss on sale of Trading securities & & (1,500) \\ \hline Loss on sale of PPE & & (3,000) \\ \hline Income before taxes & & 110,000 \\ \hline income tax expense & & 39,600 \\ \hline Net Income & $ & 70,400 \\ \hline Additional information: & & \\ \hline \end{tabular} Additional information: - PPE with a cost of $20,000 and a book value of $15,000 was sold for cash. - PPE was purchased during the year for cash. - No patents were sold. - Assume Accounts Receivable relate to sales and Accounts Payable relate to purchases of inventory. - 2,000 shares of common stock, originally issued for $5 per share, were retired at a cost of $6 per share. - The only item in Accumulated Other Comprehensive Income is Unrealized Gains and Losses on AFS. - Any purchase or sale of investments was a cash transaction. 1. Required: Prepare a statement of cash flows for "That's a Wrap" using the direct method