Answered step by step

Verified Expert Solution

Question

1 Approved Answer

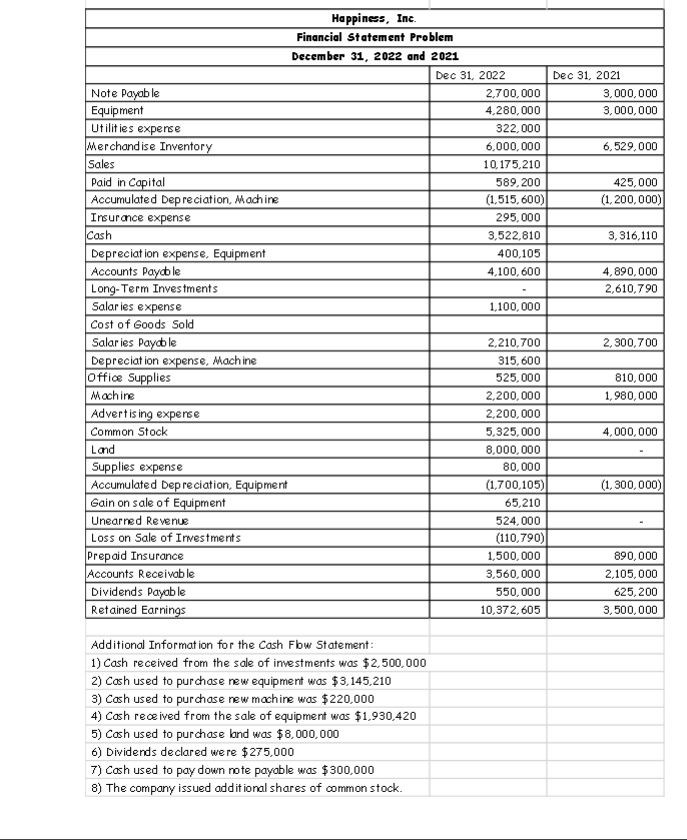

begin{tabular}{|c|c|c|} hline multicolumn{3}{|l|}{ Happiness, Inc. } hline multicolumn{3}{|c|}{ Financial Statement Problem } hline multicolumn{3}{|c|}{ December 31, 2022 and 2021} hline & Dec

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Happiness, Inc. } \\ \hline \multicolumn{3}{|c|}{ Financial Statement Problem } \\ \hline \multicolumn{3}{|c|}{ December 31, 2022 and 2021} \\ \hline & Dec 31, 2022 & Dec 31, 2021 \\ \hline Note Payable & 2,700,000 & 3,000,000 \\ \hline Equipment & 4,280,000 & 3,000,000 \\ \hline Utilities experse & 322,000 & \\ \hline Merchand ise Inventory & 6,000,000 & 6,529,000 \\ \hline Sales & 10,175,210 & \\ \hline Paid in Copital & 589,200 & 425,000 \\ \hline Accumulated Depreciation, Mach ine & (1,515,600) & (1,200,000) \\ \hline Irsurance expense & 295,000 & \\ \hline Cash & 3,522,810 & 3,316,110 \\ \hline Depreciation expense, Equipment & 400,105 & \\ \hline Accounts Paydole & 4,100,600 & 4,890,000 \\ \hline Long-Term Investments & & 2,610,790 \\ \hline Salar ies expense & 1,100,000 & \\ \hline \multicolumn{3}{|l|}{ Cost of Goods Sold } \\ \hline Salar ies Paydo le & 2,210,700 & 2,300,700 \\ \hline Depreciat ion expense, Mach ine & 315,600 & \\ \hline Office Supplies & 525,000 & 810,000 \\ \hline Machine & 2,200,000 & 1,980,000 \\ \hline Advertising experse & 2,200,000 & \\ \hline Common Stock & 5,325,000 & 4,000,000 \\ \hline Land & 8,000,000 & - \\ \hline Supplies expense & 80,000 & \\ \hline Accumulated Depreciation, Equipment & (1,700,105) & (1,300,000) \\ \hline Gain on sale of Equipment & 65,210 & \\ \hline Unearned Revenue & 524,000 & - \\ \hline Loss on Sale of Irvestments & (110,790) & \\ \hline Prepaid Insurance & 1,500,000 & 890,000 \\ \hline Accounts Receivable & 3,560,000 & 2,105,000 \\ \hline Dividends Payable & 550,000 & 625,200 \\ \hline Retained Earnings & 10,372,605 & 3,500,000 \\ \hline \multicolumn{3}{|l|}{ Additional Information for the Cash Fbw Statement: } \\ \hline \multicolumn{3}{|l|}{ 1) Cash received from the sale of investments was $2,500,000} \\ \hline \multicolumn{3}{|l|}{ 2) Cash used to purchase new equipment was $3,145,210} \\ \hline \multicolumn{3}{|l|}{ 3) Cash used to purchase new machine was $220,000} \\ \hline \multicolumn{3}{|l|}{ 4) Cash received from the sale of equipment was $1,930,420} \\ \hline \multicolumn{3}{|l|}{ 5) Cash used to purchase land was $8,000,000} \\ \hline \multicolumn{3}{|l|}{ 6) Dividends declared were $275,000} \\ \hline \multicolumn{3}{|l|}{ 7) Cash used to pay down note payable was $300,000} \\ \hline 8) The company issued add it ional shares of common stock. & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Happiness, Inc. } \\ \hline \multicolumn{3}{|c|}{ Financial Statement Problem } \\ \hline \multicolumn{3}{|c|}{ December 31, 2022 and 2021} \\ \hline & Dec 31, 2022 & Dec 31, 2021 \\ \hline Note Payable & 2,700,000 & 3,000,000 \\ \hline Equipment & 4,280,000 & 3,000,000 \\ \hline Utilities experse & 322,000 & \\ \hline Merchand ise Inventory & 6,000,000 & 6,529,000 \\ \hline Sales & 10,175,210 & \\ \hline Paid in Copital & 589,200 & 425,000 \\ \hline Accumulated Depreciation, Mach ine & (1,515,600) & (1,200,000) \\ \hline Irsurance expense & 295,000 & \\ \hline Cash & 3,522,810 & 3,316,110 \\ \hline Depreciation expense, Equipment & 400,105 & \\ \hline Accounts Paydole & 4,100,600 & 4,890,000 \\ \hline Long-Term Investments & & 2,610,790 \\ \hline Salar ies expense & 1,100,000 & \\ \hline \multicolumn{3}{|l|}{ Cost of Goods Sold } \\ \hline Salar ies Paydo le & 2,210,700 & 2,300,700 \\ \hline Depreciat ion expense, Mach ine & 315,600 & \\ \hline Office Supplies & 525,000 & 810,000 \\ \hline Machine & 2,200,000 & 1,980,000 \\ \hline Advertising experse & 2,200,000 & \\ \hline Common Stock & 5,325,000 & 4,000,000 \\ \hline Land & 8,000,000 & - \\ \hline Supplies expense & 80,000 & \\ \hline Accumulated Depreciation, Equipment & (1,700,105) & (1,300,000) \\ \hline Gain on sale of Equipment & 65,210 & \\ \hline Unearned Revenue & 524,000 & - \\ \hline Loss on Sale of Irvestments & (110,790) & \\ \hline Prepaid Insurance & 1,500,000 & 890,000 \\ \hline Accounts Receivable & 3,560,000 & 2,105,000 \\ \hline Dividends Payable & 550,000 & 625,200 \\ \hline Retained Earnings & 10,372,605 & 3,500,000 \\ \hline \multicolumn{3}{|l|}{ Additional Information for the Cash Fbw Statement: } \\ \hline \multicolumn{3}{|l|}{ 1) Cash received from the sale of investments was $2,500,000} \\ \hline \multicolumn{3}{|l|}{ 2) Cash used to purchase new equipment was $3,145,210} \\ \hline \multicolumn{3}{|l|}{ 3) Cash used to purchase new machine was $220,000} \\ \hline \multicolumn{3}{|l|}{ 4) Cash received from the sale of equipment was $1,930,420} \\ \hline \multicolumn{3}{|l|}{ 5) Cash used to purchase land was $8,000,000} \\ \hline \multicolumn{3}{|l|}{ 6) Dividends declared were $275,000} \\ \hline \multicolumn{3}{|l|}{ 7) Cash used to pay down note payable was $300,000} \\ \hline 8) The company issued add it ional shares of common stock. & & \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Happiness, Inc. } \\ \hline \multicolumn{3}{|c|}{ Financial Statement Problem } \\ \hline \multicolumn{3}{|c|}{ December 31, 2022 and 2021} \\ \hline & Dec 31, 2022 & Dec 31, 2021 \\ \hline Note Payable & 2,700,000 & 3,000,000 \\ \hline Equipment & 4,280,000 & 3,000,000 \\ \hline Utilities experse & 322,000 & \\ \hline Merchand ise Inventory & 6,000,000 & 6,529,000 \\ \hline Sales & 10,175,210 & \\ \hline Paid in Copital & 589,200 & 425,000 \\ \hline Accumulated Depreciation, Mach ine & (1,515,600) & (1,200,000) \\ \hline Irsurance expense & 295,000 & \\ \hline Cash & 3,522,810 & 3,316,110 \\ \hline Depreciation expense, Equipment & 400,105 & \\ \hline Accounts Paydole & 4,100,600 & 4,890,000 \\ \hline Long-Term Investments & & 2,610,790 \\ \hline Salar ies expense & 1,100,000 & \\ \hline \multicolumn{3}{|l|}{ Cost of Goods Sold } \\ \hline Salar ies Paydo le & 2,210,700 & 2,300,700 \\ \hline Depreciat ion expense, Mach ine & 315,600 & \\ \hline Office Supplies & 525,000 & 810,000 \\ \hline Machine & 2,200,000 & 1,980,000 \\ \hline Advertising experse & 2,200,000 & \\ \hline Common Stock & 5,325,000 & 4,000,000 \\ \hline Land & 8,000,000 & - \\ \hline Supplies expense & 80,000 & \\ \hline Accumulated Depreciation, Equipment & (1,700,105) & (1,300,000) \\ \hline Gain on sale of Equipment & 65,210 & \\ \hline Unearned Revenue & 524,000 & - \\ \hline Loss on Sale of Irvestments & (110,790) & \\ \hline Prepaid Insurance & 1,500,000 & 890,000 \\ \hline Accounts Receivable & 3,560,000 & 2,105,000 \\ \hline Dividends Payable & 550,000 & 625,200 \\ \hline Retained Earnings & 10,372,605 & 3,500,000 \\ \hline \multicolumn{3}{|l|}{ Additional Information for the Cash Fbw Statement: } \\ \hline \multicolumn{3}{|l|}{ 1) Cash received from the sale of investments was $2,500,000} \\ \hline \multicolumn{3}{|l|}{ 2) Cash used to purchase new equipment was $3,145,210} \\ \hline \multicolumn{3}{|l|}{ 3) Cash used to purchase new machine was $220,000} \\ \hline \multicolumn{3}{|l|}{ 4) Cash received from the sale of equipment was $1,930,420} \\ \hline \multicolumn{3}{|l|}{ 5) Cash used to purchase land was $8,000,000} \\ \hline \multicolumn{3}{|l|}{ 6) Dividends declared were $275,000} \\ \hline \multicolumn{3}{|l|}{ 7) Cash used to pay down note payable was $300,000} \\ \hline 8) The company issued add it ional shares of common stock. & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Happiness, Inc. } \\ \hline \multicolumn{3}{|c|}{ Financial Statement Problem } \\ \hline \multicolumn{3}{|c|}{ December 31, 2022 and 2021} \\ \hline & Dec 31, 2022 & Dec 31, 2021 \\ \hline Note Payable & 2,700,000 & 3,000,000 \\ \hline Equipment & 4,280,000 & 3,000,000 \\ \hline Utilities experse & 322,000 & \\ \hline Merchand ise Inventory & 6,000,000 & 6,529,000 \\ \hline Sales & 10,175,210 & \\ \hline Paid in Copital & 589,200 & 425,000 \\ \hline Accumulated Depreciation, Mach ine & (1,515,600) & (1,200,000) \\ \hline Irsurance expense & 295,000 & \\ \hline Cash & 3,522,810 & 3,316,110 \\ \hline Depreciation expense, Equipment & 400,105 & \\ \hline Accounts Paydole & 4,100,600 & 4,890,000 \\ \hline Long-Term Investments & & 2,610,790 \\ \hline Salar ies expense & 1,100,000 & \\ \hline \multicolumn{3}{|l|}{ Cost of Goods Sold } \\ \hline Salar ies Paydo le & 2,210,700 & 2,300,700 \\ \hline Depreciat ion expense, Mach ine & 315,600 & \\ \hline Office Supplies & 525,000 & 810,000 \\ \hline Machine & 2,200,000 & 1,980,000 \\ \hline Advertising experse & 2,200,000 & \\ \hline Common Stock & 5,325,000 & 4,000,000 \\ \hline Land & 8,000,000 & - \\ \hline Supplies expense & 80,000 & \\ \hline Accumulated Depreciation, Equipment & (1,700,105) & (1,300,000) \\ \hline Gain on sale of Equipment & 65,210 & \\ \hline Unearned Revenue & 524,000 & - \\ \hline Loss on Sale of Irvestments & (110,790) & \\ \hline Prepaid Insurance & 1,500,000 & 890,000 \\ \hline Accounts Receivable & 3,560,000 & 2,105,000 \\ \hline Dividends Payable & 550,000 & 625,200 \\ \hline Retained Earnings & 10,372,605 & 3,500,000 \\ \hline \multicolumn{3}{|l|}{ Additional Information for the Cash Fbw Statement: } \\ \hline \multicolumn{3}{|l|}{ 1) Cash received from the sale of investments was $2,500,000} \\ \hline \multicolumn{3}{|l|}{ 2) Cash used to purchase new equipment was $3,145,210} \\ \hline \multicolumn{3}{|l|}{ 3) Cash used to purchase new machine was $220,000} \\ \hline \multicolumn{3}{|l|}{ 4) Cash received from the sale of equipment was $1,930,420} \\ \hline \multicolumn{3}{|l|}{ 5) Cash used to purchase land was $8,000,000} \\ \hline \multicolumn{3}{|l|}{ 6) Dividends declared were $275,000} \\ \hline \multicolumn{3}{|l|}{ 7) Cash used to pay down note payable was $300,000} \\ \hline 8) The company issued add it ional shares of common stock. & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started