Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|} hline & A & B & C hline 1 & multicolumn{3}{|l|}{ THE KROGER CO. } hline 2 & multicolumn{3}{|l|}{ CONSOLIDATED BALANCE SHEETS

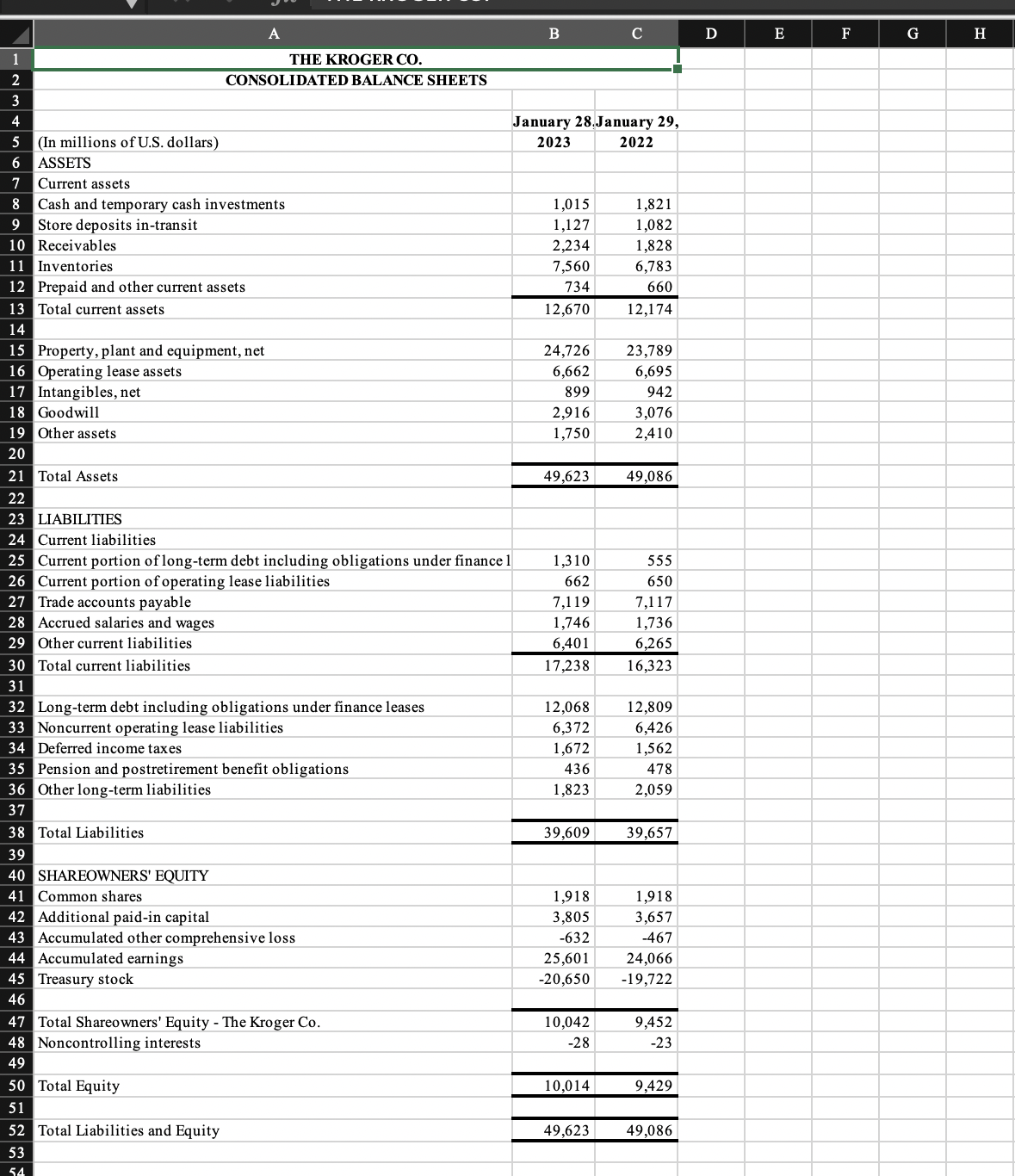

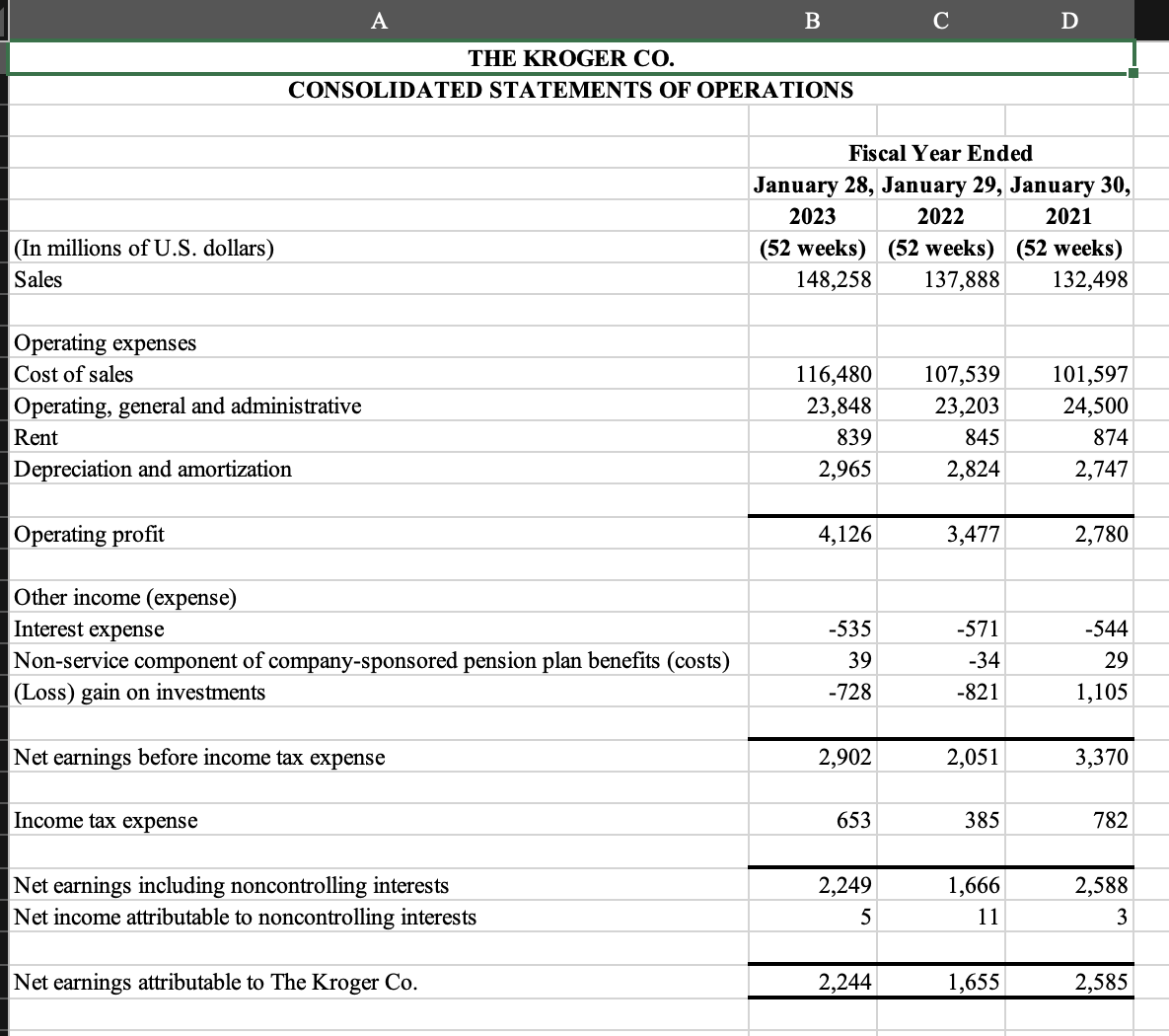

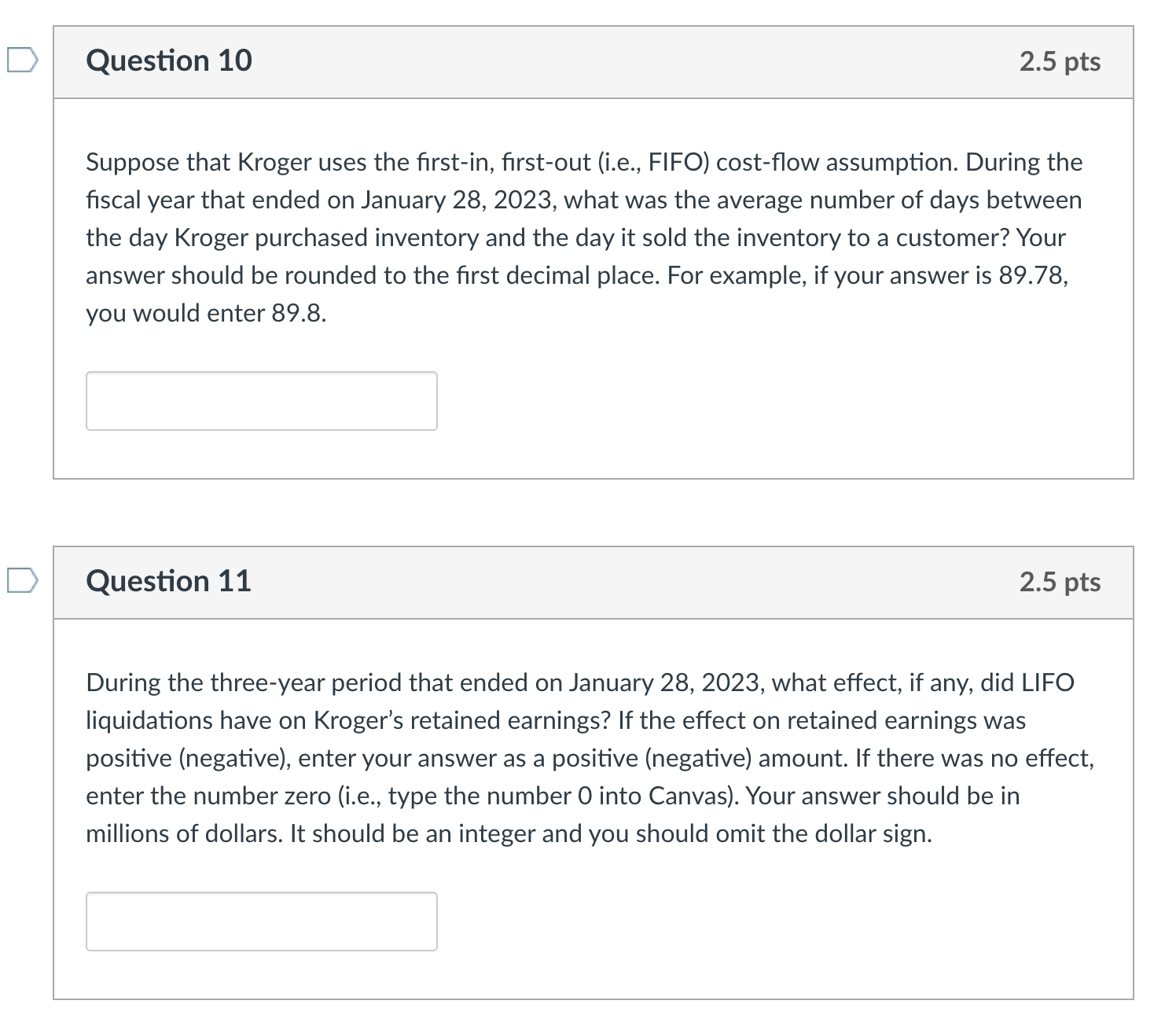

\begin{tabular}{|c|c|c|c|} \hline & A & B & C \\ \hline 1 & \multicolumn{3}{|l|}{ THE KROGER CO. } \\ \hline 2 & \multicolumn{3}{|l|}{ CONSOLIDATED BALANCE SHEETS } \\ \hline 3 & & & \\ \hline 4 & & \multicolumn{2}{|c|}{ January 28.January 29} \\ \hline 5 & (In millions of U.S. dollars) & 2023 & 2022 \\ \hline 6 & ASSETS & & \\ \hline 7 & Current assets & & \\ \hline 8 & Cash and temporary cash investments & 1,015 & 1,821 \\ \hline 9 & Store deposits in-transit & 1,127 & 1,082 \\ \hline 10 & Receivables & 2,234 & 1,828 \\ \hline 11 & Inventories & 7,560 & 6,783 \\ \hline 12 & Prepaid and other current assets & 734 & 660 \\ \hline 13 & Total current assets & 12,670 & 12,174 \\ \hline \multicolumn{4}{|l|}{14} \\ \hline 15 & Property, plant and equipment, net & 24,726 & 23,789 \\ \hline 16 & Operating lease assets & 6,662 & 6,695 \\ \hline 17 & Intangibles, net & 899 & 942 \\ \hline 18 & Goodwill & 2,916 & 3,076 \\ \hline 19 & Other assets & 1,750 & 2,410 \\ \hline \multicolumn{4}{|c|}{20} \\ \hline 21 & Total Assets & 49,623 & 49,086 \\ \hline \multicolumn{4}{|l|}{22} \\ \hline 23 & LIABILITIES & & \\ \hline 24 & Current liabilities & & \\ \hline 25 & Current portion of long-term debt including obligations under finance 1 & 1,310 & 555 \\ \hline 26 & Current portion of operating lease liabilities & 662 & 650 \\ \hline 27 & Trade accounts payable & 7,119 & 7,117 \\ \hline 28 & Accrued salaries and wages & 1,746 & 1,736 \\ \hline 29 & Other current liabilities & 6,401 & 6,265 \\ \hline 30 & Total current liabilities & 17,238 & 16,323 \\ \hline \multicolumn{4}{|l|}{31} \\ \hline 32 & Long-term debt including obligations under finance leases & 12,068 & 12,809 \\ \hline 33 & Noncurrent operating lease liabilities & 6,372 & 6,426 \\ \hline 34 & Deferred income taxes & 1,672 & 1,562 \\ \hline 35 & Pension and postretirement benefit obligations & 436 & 478 \\ \hline 36 & Other long-term liabilities & 1,823 & 2,059 \\ \hline \multicolumn{4}{|l|}{37} \\ \hline 38 & Total Liabilities & 39,609 & 39,657 \\ \hline \multicolumn{4}{|l|}{39} \\ \hline 40 & SHAREOWNERS' EQUITY & & \\ \hline 41 & Common shares & 1,918 & 1,918 \\ \hline 42 & Additional paid-in capital & 3,805 & 3,657 \\ \hline 43 & Accumulated other comprehensive loss & -632 & -467 \\ \hline 44 & Accumulated earnings & 25,601 & 24,066 \\ \hline 45 & Treasury stock & 20,650 & 19,722 \\ \hline \multicolumn{4}{|l|}{46} \\ \hline 47 & Total Shareowners' Equity - The Kroger Co. & 10,042 & 9,452 \\ \hline 48 & Noncontrolling interests & -28 & -23 \\ \hline \multicolumn{4}{|c|}{49} \\ \hline 50 & Total Equity & 10,014 & 9,429 \\ \hline \multicolumn{4}{|l|}{51} \\ \hline 52 & Total Liabilities and Equity & 49,623 & 49,086 \\ \hline 53 & & & \\ \hline \end{tabular} A B C D THE KROGER CO. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ CONSOLIDATED STATEMENTS OF OPERATIONS } \\ \hline & \multicolumn{3}{|c|}{ Fiscal Year Ended } \\ \hline & January 28, & January 29, & January 30, \\ \hline & 2023 & 2022 & 2021 \\ \hline (In millions of U.S. dollars) & (52 weeks) & (52 weeks) & (52 weeks) \\ \hline Sales & 148,258 & 137,888 & 132,498 \\ \hline \multicolumn{4}{|l|}{ Operating expenses } \\ \hline Cost of sales & 116,480 & 107,539 & 101,597 \\ \hline Operating, general and administrative & 23,848 & 23,203 & 24,500 \\ \hline Rent & 839 & 845 & 874 \\ \hline Depreciation and amortization & 2,965 & 2,824 & 2,747 \\ \hline Operating profit & 4,126 & 3,477 & 2,780 \\ \hline \multicolumn{4}{|l|}{ Other income (expense) } \\ \hline Interest expense & -535 & -571 & -544 \\ \hline Non-service component of company-sponsored pension plan benefits (costs) & 39 & -34 & 29 \\ \hline (Loss) gain on investments & -728 & -821 & 1,105 \\ \hline Net earnings before income tax expense & 2,902 & 2,051 & 3,370 \\ \hline Income tax expense & 653 & 385 & 782 \\ \hline Net earnings including noncontrolling interests & 2,249 & 1,666 & 2,588 \\ \hline Net income attributable to noncontrolling interests & 5 & 11 & 3 \\ \hline Net earnings attributable to The Kroger Co. & 2,244 & 1,655 & 2,585 \\ \hline \end{tabular} Suppose that Kroger uses the first-in, first-out (i.e., FIFO) cost-flow assumption. During the fiscal year that ended on January 28, 2023, what was the average number of days between the day Kroger purchased inventory and the day it sold the inventory to a customer? Your answer should be rounded to the first decimal place. For example, if your answer is 89.78 , you would enter 89.8. Question 11 2.5 pts During the three-year period that ended on January 28, 2023, what effect, if any, did LIFO liquidations have on Kroger's retained earnings? If the effect on retained earnings was positive (negative), enter your answer as a positive (negative) amount. If there was no effect, enter the number zero (i.e., type the number 0 into Canvas). Your answer should be in millions of dollars. It should be an integer and you should omit the dollar sign

\begin{tabular}{|c|c|c|c|} \hline & A & B & C \\ \hline 1 & \multicolumn{3}{|l|}{ THE KROGER CO. } \\ \hline 2 & \multicolumn{3}{|l|}{ CONSOLIDATED BALANCE SHEETS } \\ \hline 3 & & & \\ \hline 4 & & \multicolumn{2}{|c|}{ January 28.January 29} \\ \hline 5 & (In millions of U.S. dollars) & 2023 & 2022 \\ \hline 6 & ASSETS & & \\ \hline 7 & Current assets & & \\ \hline 8 & Cash and temporary cash investments & 1,015 & 1,821 \\ \hline 9 & Store deposits in-transit & 1,127 & 1,082 \\ \hline 10 & Receivables & 2,234 & 1,828 \\ \hline 11 & Inventories & 7,560 & 6,783 \\ \hline 12 & Prepaid and other current assets & 734 & 660 \\ \hline 13 & Total current assets & 12,670 & 12,174 \\ \hline \multicolumn{4}{|l|}{14} \\ \hline 15 & Property, plant and equipment, net & 24,726 & 23,789 \\ \hline 16 & Operating lease assets & 6,662 & 6,695 \\ \hline 17 & Intangibles, net & 899 & 942 \\ \hline 18 & Goodwill & 2,916 & 3,076 \\ \hline 19 & Other assets & 1,750 & 2,410 \\ \hline \multicolumn{4}{|c|}{20} \\ \hline 21 & Total Assets & 49,623 & 49,086 \\ \hline \multicolumn{4}{|l|}{22} \\ \hline 23 & LIABILITIES & & \\ \hline 24 & Current liabilities & & \\ \hline 25 & Current portion of long-term debt including obligations under finance 1 & 1,310 & 555 \\ \hline 26 & Current portion of operating lease liabilities & 662 & 650 \\ \hline 27 & Trade accounts payable & 7,119 & 7,117 \\ \hline 28 & Accrued salaries and wages & 1,746 & 1,736 \\ \hline 29 & Other current liabilities & 6,401 & 6,265 \\ \hline 30 & Total current liabilities & 17,238 & 16,323 \\ \hline \multicolumn{4}{|l|}{31} \\ \hline 32 & Long-term debt including obligations under finance leases & 12,068 & 12,809 \\ \hline 33 & Noncurrent operating lease liabilities & 6,372 & 6,426 \\ \hline 34 & Deferred income taxes & 1,672 & 1,562 \\ \hline 35 & Pension and postretirement benefit obligations & 436 & 478 \\ \hline 36 & Other long-term liabilities & 1,823 & 2,059 \\ \hline \multicolumn{4}{|l|}{37} \\ \hline 38 & Total Liabilities & 39,609 & 39,657 \\ \hline \multicolumn{4}{|l|}{39} \\ \hline 40 & SHAREOWNERS' EQUITY & & \\ \hline 41 & Common shares & 1,918 & 1,918 \\ \hline 42 & Additional paid-in capital & 3,805 & 3,657 \\ \hline 43 & Accumulated other comprehensive loss & -632 & -467 \\ \hline 44 & Accumulated earnings & 25,601 & 24,066 \\ \hline 45 & Treasury stock & 20,650 & 19,722 \\ \hline \multicolumn{4}{|l|}{46} \\ \hline 47 & Total Shareowners' Equity - The Kroger Co. & 10,042 & 9,452 \\ \hline 48 & Noncontrolling interests & -28 & -23 \\ \hline \multicolumn{4}{|c|}{49} \\ \hline 50 & Total Equity & 10,014 & 9,429 \\ \hline \multicolumn{4}{|l|}{51} \\ \hline 52 & Total Liabilities and Equity & 49,623 & 49,086 \\ \hline 53 & & & \\ \hline \end{tabular} A B C D THE KROGER CO. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ CONSOLIDATED STATEMENTS OF OPERATIONS } \\ \hline & \multicolumn{3}{|c|}{ Fiscal Year Ended } \\ \hline & January 28, & January 29, & January 30, \\ \hline & 2023 & 2022 & 2021 \\ \hline (In millions of U.S. dollars) & (52 weeks) & (52 weeks) & (52 weeks) \\ \hline Sales & 148,258 & 137,888 & 132,498 \\ \hline \multicolumn{4}{|l|}{ Operating expenses } \\ \hline Cost of sales & 116,480 & 107,539 & 101,597 \\ \hline Operating, general and administrative & 23,848 & 23,203 & 24,500 \\ \hline Rent & 839 & 845 & 874 \\ \hline Depreciation and amortization & 2,965 & 2,824 & 2,747 \\ \hline Operating profit & 4,126 & 3,477 & 2,780 \\ \hline \multicolumn{4}{|l|}{ Other income (expense) } \\ \hline Interest expense & -535 & -571 & -544 \\ \hline Non-service component of company-sponsored pension plan benefits (costs) & 39 & -34 & 29 \\ \hline (Loss) gain on investments & -728 & -821 & 1,105 \\ \hline Net earnings before income tax expense & 2,902 & 2,051 & 3,370 \\ \hline Income tax expense & 653 & 385 & 782 \\ \hline Net earnings including noncontrolling interests & 2,249 & 1,666 & 2,588 \\ \hline Net income attributable to noncontrolling interests & 5 & 11 & 3 \\ \hline Net earnings attributable to The Kroger Co. & 2,244 & 1,655 & 2,585 \\ \hline \end{tabular} Suppose that Kroger uses the first-in, first-out (i.e., FIFO) cost-flow assumption. During the fiscal year that ended on January 28, 2023, what was the average number of days between the day Kroger purchased inventory and the day it sold the inventory to a customer? Your answer should be rounded to the first decimal place. For example, if your answer is 89.78 , you would enter 89.8. Question 11 2.5 pts During the three-year period that ended on January 28, 2023, what effect, if any, did LIFO liquidations have on Kroger's retained earnings? If the effect on retained earnings was positive (negative), enter your answer as a positive (negative) amount. If there was no effect, enter the number zero (i.e., type the number 0 into Canvas). Your answer should be in millions of dollars. It should be an integer and you should omit the dollar sign Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started