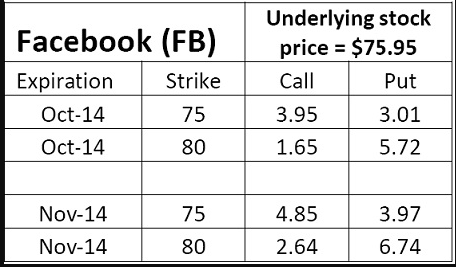

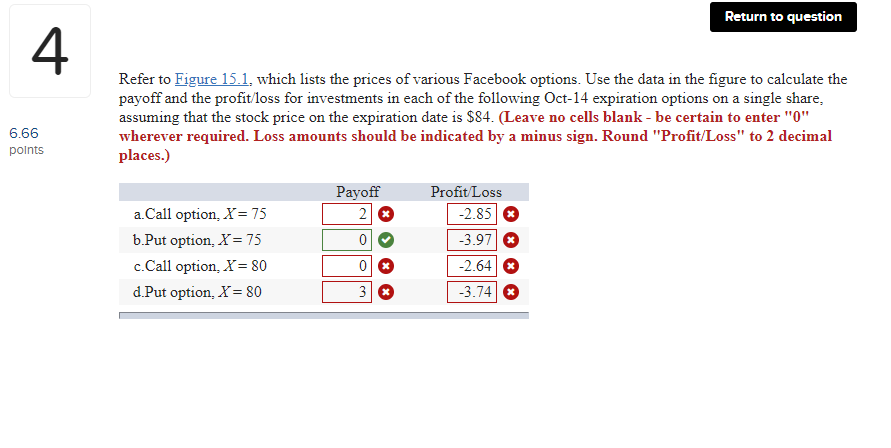

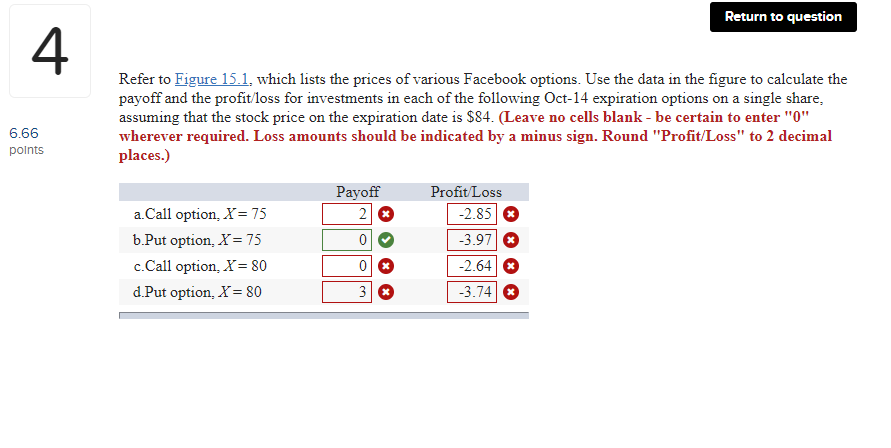

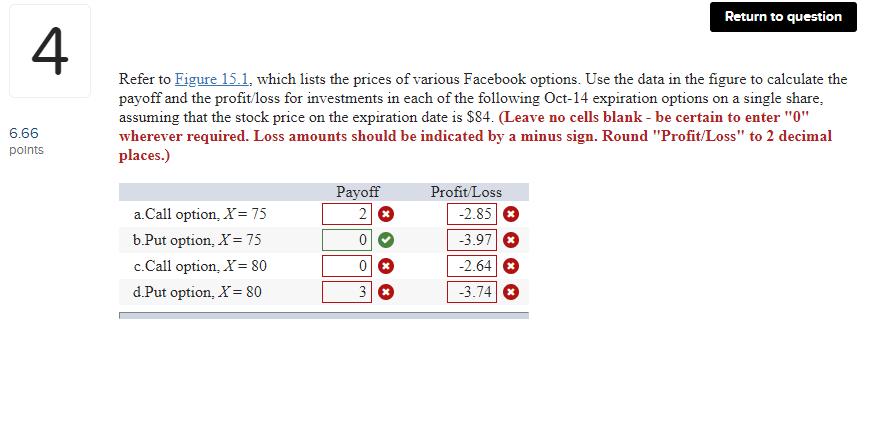

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Facebook } & \multicolumn{2}{c|}{ Underlying stock } \\ Expiration & Strike & Call & Put \\ \hline Oct-14 & 75 & 3.95 & 3.01 \\ \hline Oct-14 & 80 & 1.65 & 5.72 \\ \hline & & & \\ \hline Nov-14 & 75 & 4.85 & 3.97 \\ \hline Nov-14 & 80 & 2.64 & 6.74 \\ \hline \end{tabular} Refer to Figure 15.1, which lists the prices of various Facebook options. Use the data in the figure to calculate the payoff and the profit/loss for investments in each of the following Oct-14 expiration options on a single share, assuming that the stock price on the expiration date is $84. (Leave no cells blank - be certain to enter " 0 " wherever required. Loss amounts should be indicated by a minus sign. Round "Profit/Loss" to 2 decimal places.) Refer to Figure 15.1, which lists the prices of various Facebook options. Use the data in the figure to calculate the payoff and the profit/loss for investments in each of the following Oct-14 expiration options on a single share, assuming that the stock price on the expiration date is $84. (Leave no cells blank - be certain to enter " 0 " wherever required. Loss amounts should be indicated by a minus sign. Round "Profit/Loss" to 2 decimal places.) \begin{tabular}{|c|c|c|c|} \hline \multicolumn{2}{|c|}{ Facebook } & \multicolumn{2}{c|}{ Underlying stock } \\ Expiration & Strike & Call & Put \\ \hline Oct-14 & 75 & 3.95 & 3.01 \\ \hline Oct-14 & 80 & 1.65 & 5.72 \\ \hline & & & \\ \hline Nov-14 & 75 & 4.85 & 3.97 \\ \hline Nov-14 & 80 & 2.64 & 6.74 \\ \hline \end{tabular} Refer to Figure 15.1, which lists the prices of various Facebook options. Use the data in the figure to calculate the payoff and the profit/loss for investments in each of the following Oct-14 expiration options on a single share, assuming that the stock price on the expiration date is $84. (Leave no cells blank - be certain to enter " 0 " wherever required. Loss amounts should be indicated by a minus sign. Round "Profit/Loss" to 2 decimal places.) Refer to Figure 15.1, which lists the prices of various Facebook options. Use the data in the figure to calculate the payoff and the profit/loss for investments in each of the following Oct-14 expiration options on a single share, assuming that the stock price on the expiration date is $84. (Leave no cells blank - be certain to enter " 0 " wherever required. Loss amounts should be indicated by a minus sign. Round "Profit/Loss" to 2 decimal places.)