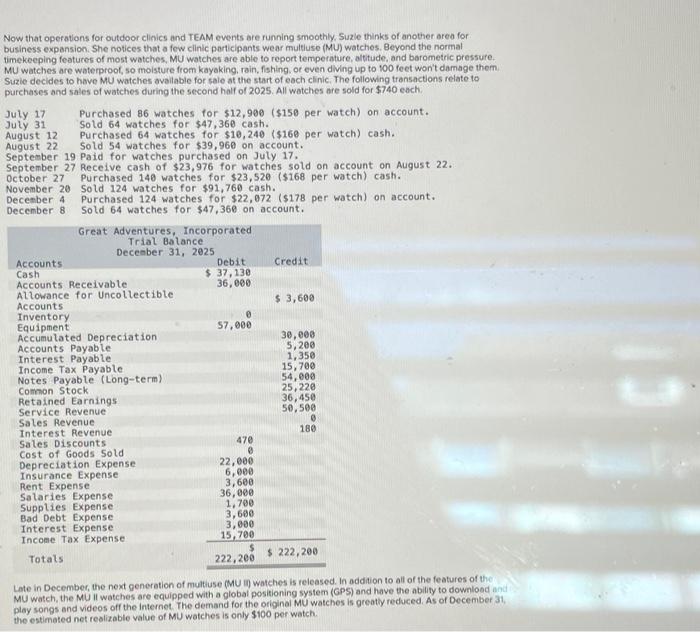

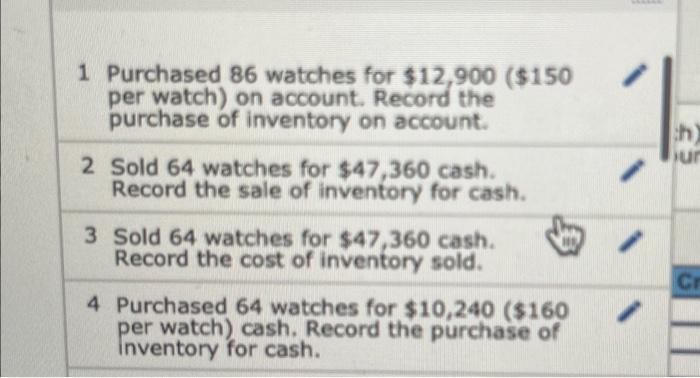

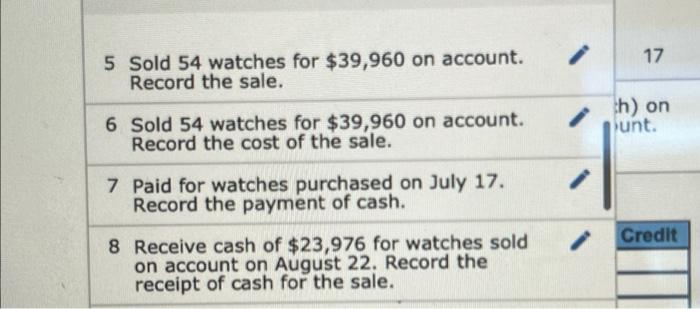

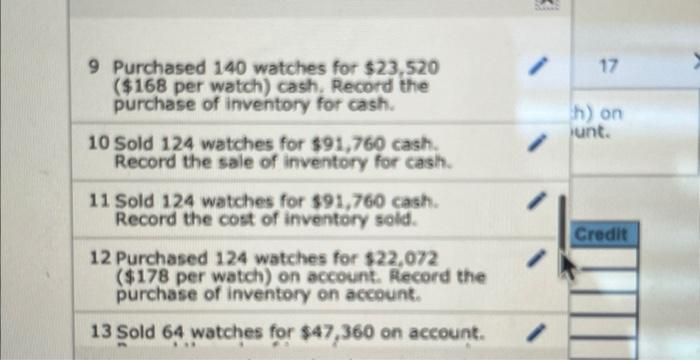

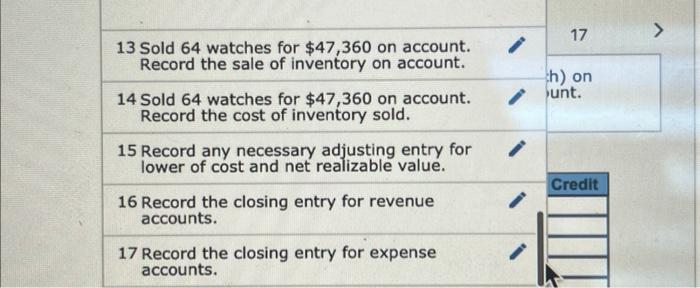

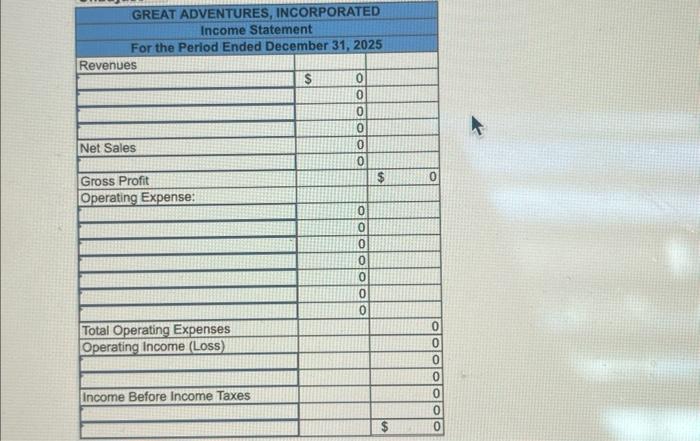

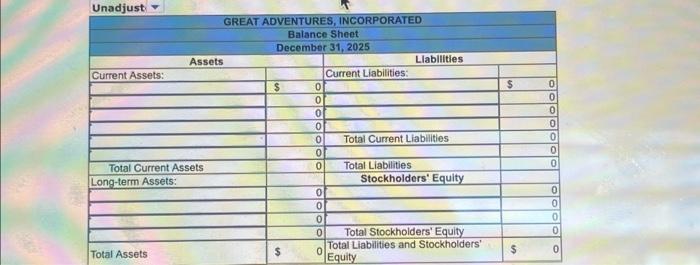

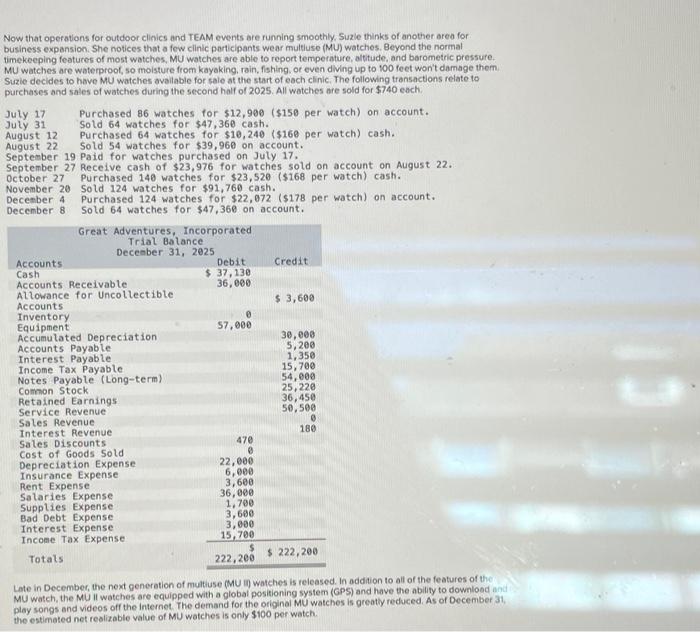

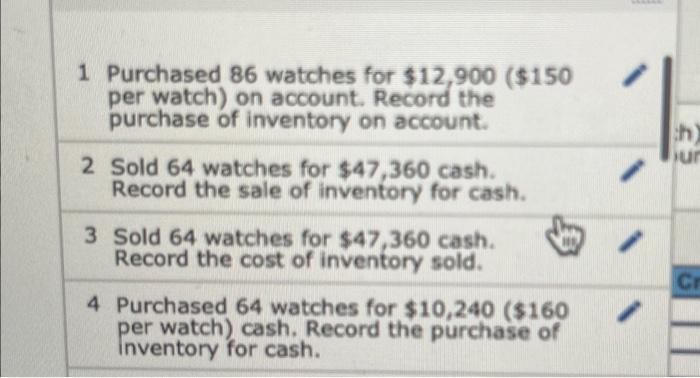

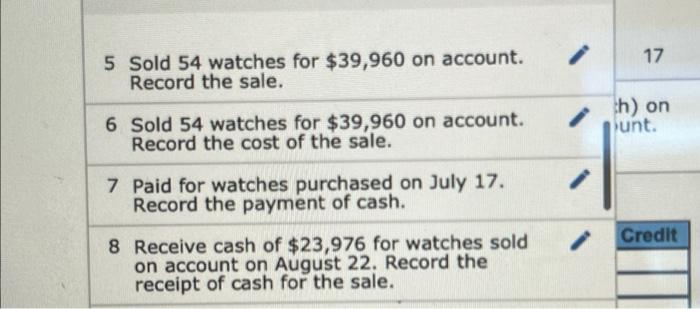

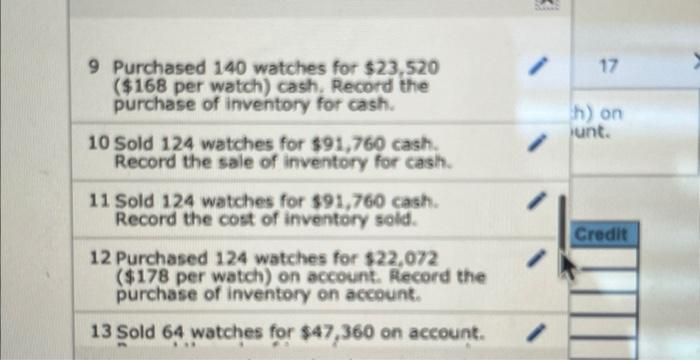

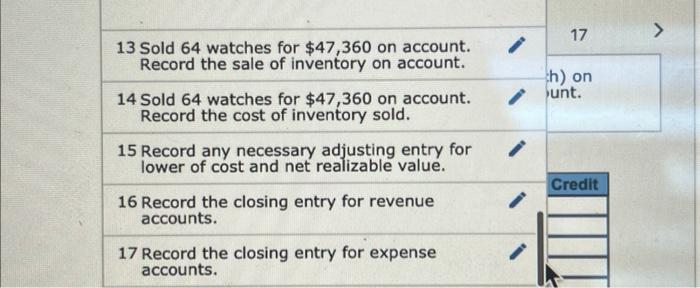

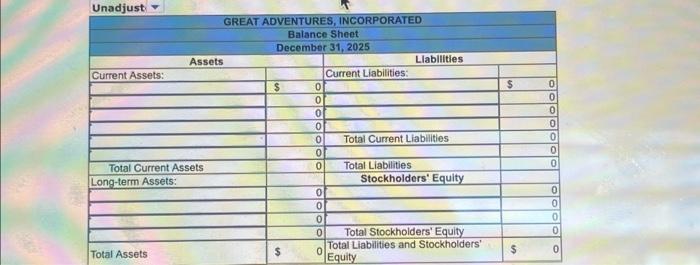

\begin{tabular}{|c|c|c|c|} \hline & Purchased140watchesfor$23,520($168perwatch)cash,Recordthepurchaseofinventoryforcash. & & h) on \\ \hline & Sold124watchesfor$91,760cash.Recordthesaleofinventoryforcash. & & h)onunt. \\ \hline \multicolumn{2}{|r|}{11Sold124watchesfor$91,760cash.Recordthecostofinventorysold.} & & \multirow{2}{*}{ Credit } \\ \hline & 2Purchased124watchesfor$22,072($178perwatch)onaccount.Recordthepurchaseofinventoryonaccount. & & \\ \hline & 3 Sold 64 watches for $47,360 on account. & 1 & \\ \hline \end{tabular} 13 Sold 64 watches for $47,360 on account. Record the sale of inventory on account. 14 Sold 64 watches for $47,360 on account. Record the cost of inventory sold. 15 Record any necessary adjusting entry for lower of cost and net realizable value. 16 Record the closing entry for revenue accounts. 17 Record the closing entry for expense accounts. 17 h) on unt. 1 Purchased 86 watches for $12,900 ( $150 per watch) on account. Record the purchase of inventory on account. 2 Sold 64 watches for $47,360 cash. Record the sale of inventory for cash. 3 Sold 64 watches for $47,360 cash. Record the cost of inventory sold. 4 Purchased 64 watches for $10,240 ( $160 per watch) cash. Record the purchase of inventory for cash. 5 Sold 54 watches for $39,960 on account. Record the sale. 6 Sold 54 watches for $39,960 on account. Record the cost of the sale. 7 Paid for watches purchased on July 17. Record the payment of cash. 8 Receive cash of $23,976 for watches sold on account on August 22. Record the receipt of cash for the sale. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ GREAT ADVENTURES, INCORPORATED } \\ \hline & Balance & Sheet & & \\ \hline \multirow{2}{*}{\multicolumn{2}{|c|}{ Decembe }} & 31,2025 & & \\ \hline & & \multicolumn{3}{|l|}{ Llabilities } \\ \hline Current Assets: & & Current Liabilities: & & \\ \hline & $ & & 5 & 0 \\ \hline & 0 & & & 0 \\ \hline & 0 & & & 0 \\ \hline & of & & & 0 \\ \hline & 0 & Total Current Liabilities & & 0 \\ \hline & & & & 0 \\ \hline Total Current Assets & 0 & Total Liabilities & & 0 \\ \hline Long-term Assets: & & Stockholders' Equity & & \\ \hline & 0 & & & 0 \\ \hline & 0 & & & 0 \\ \hline & 0 & & & 0 \\ \hline & 0 & Total Stockholders' Equity & & 0 \\ \hline Total Assets & $0 & TotalLiabilitiesandStockholdersEquity & $ & 0 \\ \hline \end{tabular} Now that operations for outdoor clinics and TEAM events are running smoothly, Suzle thinks of another area for: business expansion. She notices that a few clinic participants wear multiuse (MU) watches. Beyond the normal timekeeping features of most watches, MU watches are able to report temperature, altitude, and barometric pressure. MU watches are waterproof, so molsture from kayaking, rain, fishing. or even diving up to 100 feet won't damage them. Suzie decides to have MU watches available for sale at the start of each clinic. The following transactions relate to purchases and sales of watches during the second half of 2025. All watches are sold for $740 each. Juty 17 Juty 31 August 12 August 22 September 19 Paid for watches purchased on July 17 . September 27 Receive cash of $23,976 for watches sold on account on August 22. October 27 Purchased 140 watches for $23,520 ( $168 per watch) cash. November 20 Sold 124 watches for $91,760 cash. Decesber 4 Purchased 124 watches for $22,072 ( $178 per watch) on account. December 8 Sold 64 watches for $47,368 on account. Late in December, the next generation of multiuse (MU in watches is released. In addition to all of the features of the MU watch, the MU il watches are equipped with a global positioning system (GPS) and have the ability to download ans play songs and videes off the internet. The demand for the original MU watches is greatly reduced. As of December 31 . the estimated net realizable value of MU watches is only $100 per watch