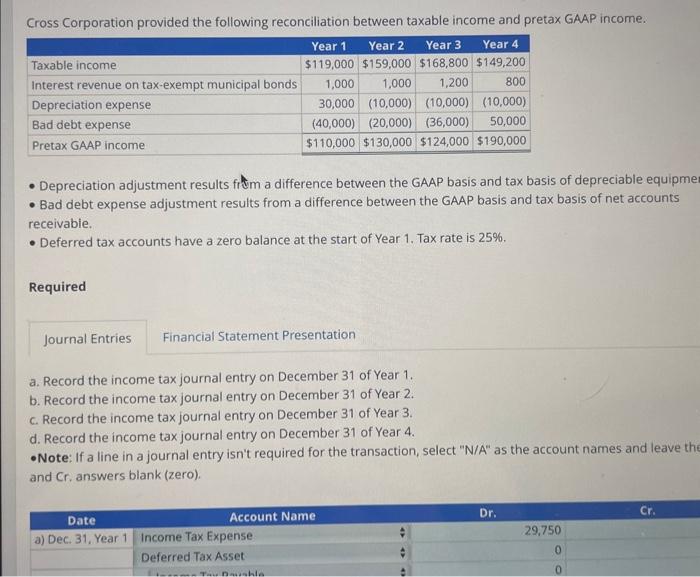

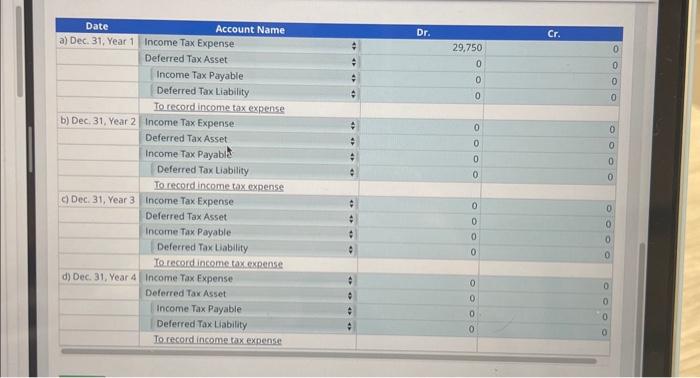

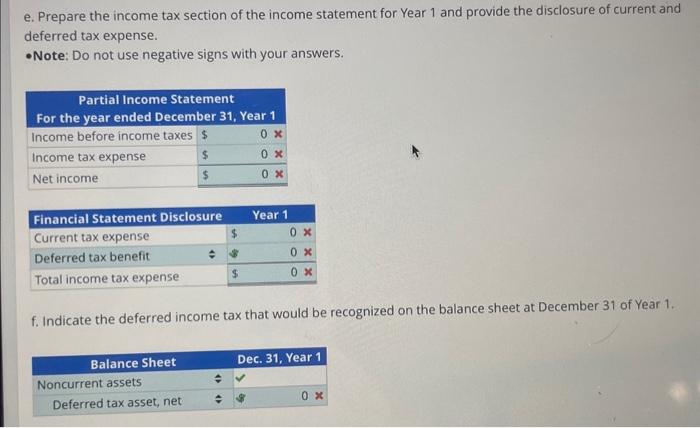

\begin{tabular}{|c|c|c|c|c|} \hline Date & Account Name & & Dr. & Cr. \\ \hline \multirow[t]{5}{*}{ a) Dec, 31, Year 1} & Income Tax Expense & & 29,750 & 0 \\ \hline & Deferred Tax Asset- & = & 0 & 0 \\ \hline & Income Tax Payable & & 0 & 0 \\ \hline & Deferred Tax Liability & & 0 & 0 \\ \hline & To record income tax expense & & & \\ \hline \multirow[t]{5}{*}{ b) Dec, 31 , Year 2} & Income Tax Expense & & 0 & 0 \\ \hline & Deferred Tax Asset & = & 0 & 0 \\ \hline & Income Tax Payable & = & 0 & 0 \\ \hline & Deferred Tax Liability & & 0 & 0 \\ \hline & To record income tax expense & & & \\ \hline \multirow[t]{5}{*}{ c) Dec. 31 , Year 3} & Income Tax Expense & F & 0 & 0 \\ \hline & Deferred Tax Asset & = & 0 & 0 \\ \hline & Income Tax Payable & t & 0 & 0 \\ \hline & Deferred Tax Liability & & 0 & 0 \\ \hline & To record income tax expense & & & \\ \hline \multirow[t]{5}{*}{ d) Dec. 31, Year 4} & Income Tax Expense & & 0 & 0 \\ \hline & Deferred Tax Asset & & 0 & 0 \\ \hline & Income Tax Payable & = & 0 & 0 \\ \hline & Deferred Tax Liability & = & 0 & 0 \\ \hline & To record income tax expense & & & \\ \hline \end{tabular} Cross Corporation provided the following reconciliation between taxable income and pretax GAAP income. - Depreciation adjustment results frum a difference between the GAAP basis and tax basis of depreciable equipme - Bad debt expense adjustment results from a difference between the GAAP basis and tax basis of net accounts receivabie. - Deferred tax accounts have a zero balance at the start of Year 1. Tax rate is 25%. Required a. Record the income tax journal entry on December 31 of Year 1. b. Record the income tax journal entry on December 31 of Year 2. c. Record the income tax journal entry on December 31 of Year 3. d. Record the income tax journal entry on December 31 of Year 4. - Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave th and Cr. answers blank (zero). e. Prepare the income tax section of the income statement for Year 1 and provide the disclosure of current and deferred tax expense. -Note: Do not use negative signs with your answers. f. Indicate the deferred income tax that would be recognized on the balance sheet at December 31 of Year 1