Answered step by step

Verified Expert Solution

Question

1 Approved Answer

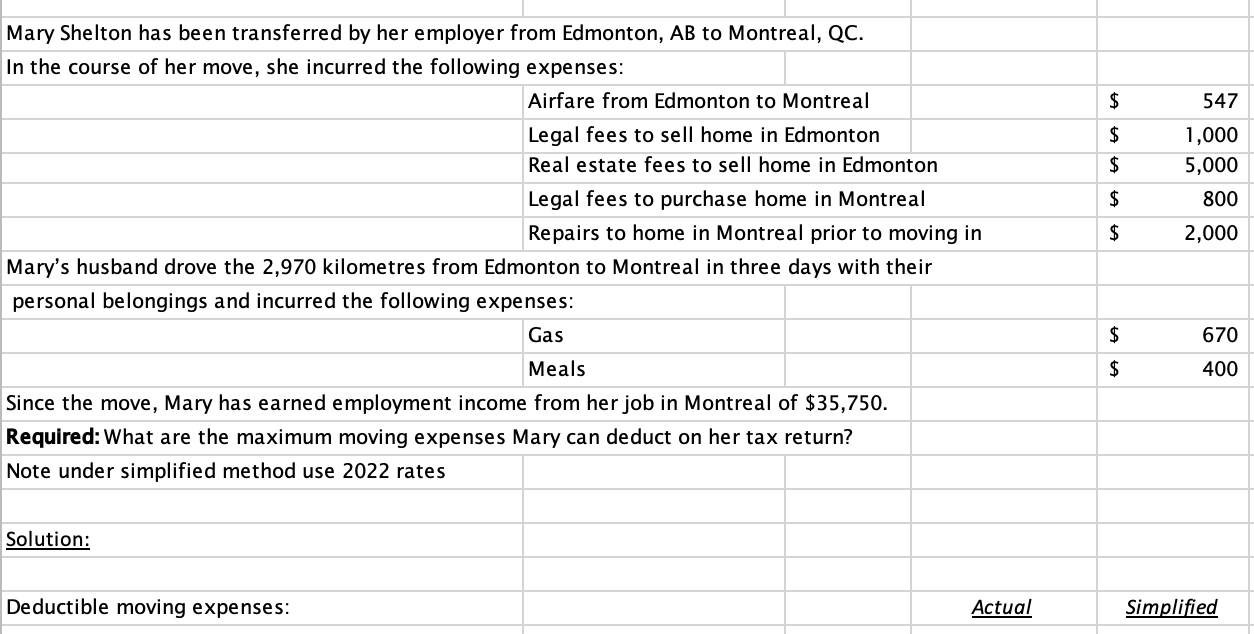

begin{tabular}{|c|c|c|c|c|} hline multicolumn{5}{|c|}{ Mary Shelton has been transferred by her employer from Edmonton, AB to Montreal, QC. } hline multicolumn{5}{|c|}{ In the course of

\begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Mary Shelton has been transferred by her employer from Edmonton, AB to Montreal, QC. } \\ \hline \multicolumn{5}{|c|}{ In the course of her move, she incurred the following expenses: } \\ \hline & Airfare from Edmonton to Montreal & & $ & 547 \\ \hline & Legal fees to sell home in Edmonton & & $ & 1,000 \\ \hline & \multicolumn{2}{|c|}{ Real estate fees to sell home in Edmonton } & $ & 5,000 \\ \hline & \multicolumn{2}{|c|}{ Legal fees to purchase home in Montreal } & $ & 800 \\ \hline & \multicolumn{2}{|c|}{ Repairs to home in Montreal prior to moving in } & $ & 2,000 \\ \hline \multicolumn{5}{|c|}{ Mary's husband drove the 2,970 kilometres from Edmonton to Montreal in three days with their } \\ \hline \multicolumn{5}{|c|}{ personal belongings and incurred the following expenses: } \\ \hline & Gas & & $ & 670 \\ \hline & Meals & & $ & 400 \\ \hline \multicolumn{5}{|c|}{ Since the move, Mary has earned employment income from her job in Montreal of $35,750. } \\ \hline \multicolumn{5}{|c|}{ Required: What are the maximum moving expenses Mary can deduct on her tax return? } \\ \hline \multicolumn{5}{|c|}{ Note under simplified method use 2022 rates } \\ \hline \multicolumn{5}{|l|}{ Solution: } \\ \hline Deductible moving expenses: & & Actual & & ified \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Mary Shelton has been transferred by her employer from Edmonton, AB to Montreal, QC. } \\ \hline \multicolumn{5}{|c|}{ In the course of her move, she incurred the following expenses: } \\ \hline & Airfare from Edmonton to Montreal & & $ & 547 \\ \hline & Legal fees to sell home in Edmonton & & $ & 1,000 \\ \hline & \multicolumn{2}{|c|}{ Real estate fees to sell home in Edmonton } & $ & 5,000 \\ \hline & \multicolumn{2}{|c|}{ Legal fees to purchase home in Montreal } & $ & 800 \\ \hline & \multicolumn{2}{|c|}{ Repairs to home in Montreal prior to moving in } & $ & 2,000 \\ \hline \multicolumn{5}{|c|}{ Mary's husband drove the 2,970 kilometres from Edmonton to Montreal in three days with their } \\ \hline \multicolumn{5}{|c|}{ personal belongings and incurred the following expenses: } \\ \hline & Gas & & $ & 670 \\ \hline & Meals & & $ & 400 \\ \hline \multicolumn{5}{|c|}{ Since the move, Mary has earned employment income from her job in Montreal of $35,750. } \\ \hline \multicolumn{5}{|c|}{ Required: What are the maximum moving expenses Mary can deduct on her tax return? } \\ \hline \multicolumn{5}{|c|}{ Note under simplified method use 2022 rates } \\ \hline \multicolumn{5}{|l|}{ Solution: } \\ \hline Deductible moving expenses: & & Actual & & ified \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started