Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|c|} hline multirow{2}{*}{4950} & multicolumn{3}{|c|}{ 2. Determine the transfer price that maximizes Global Sound Company's consolidated net income (after-tax) per unit } & hline

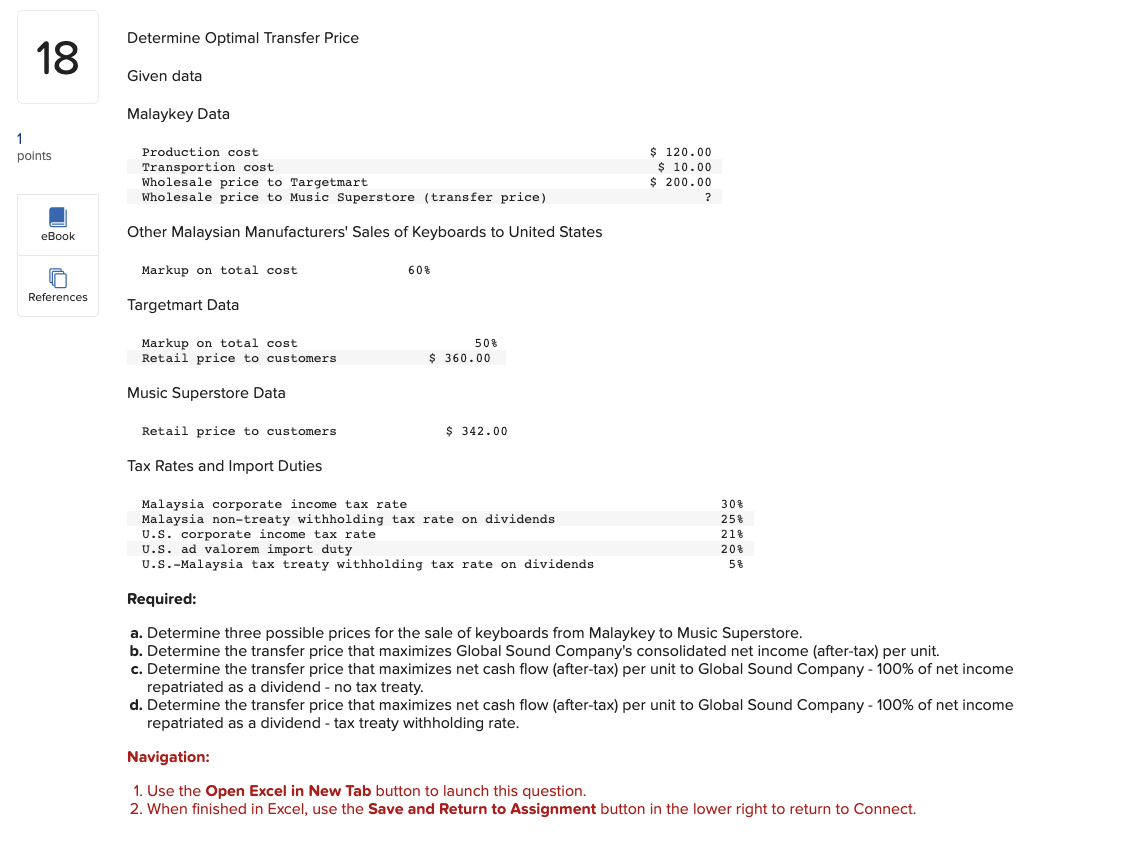

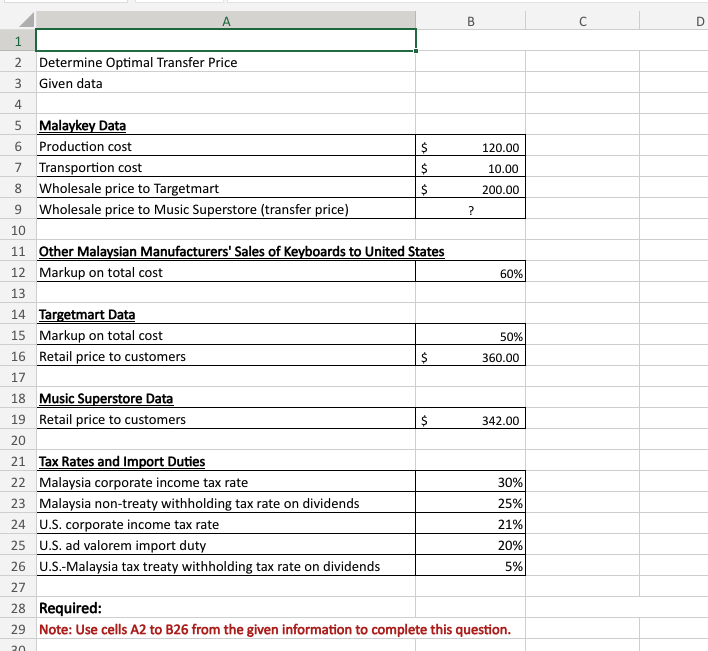

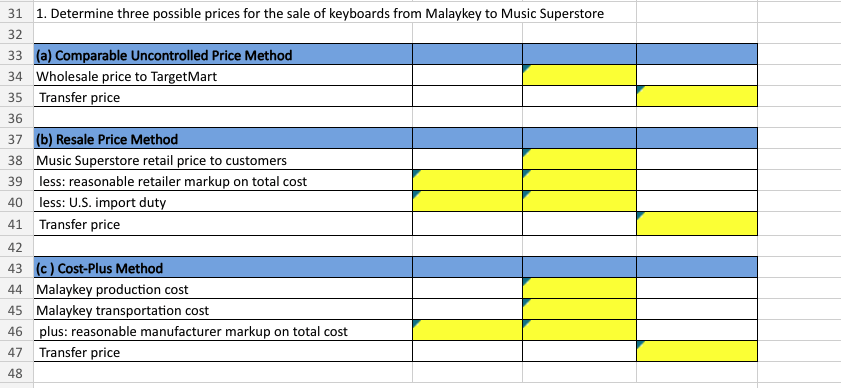

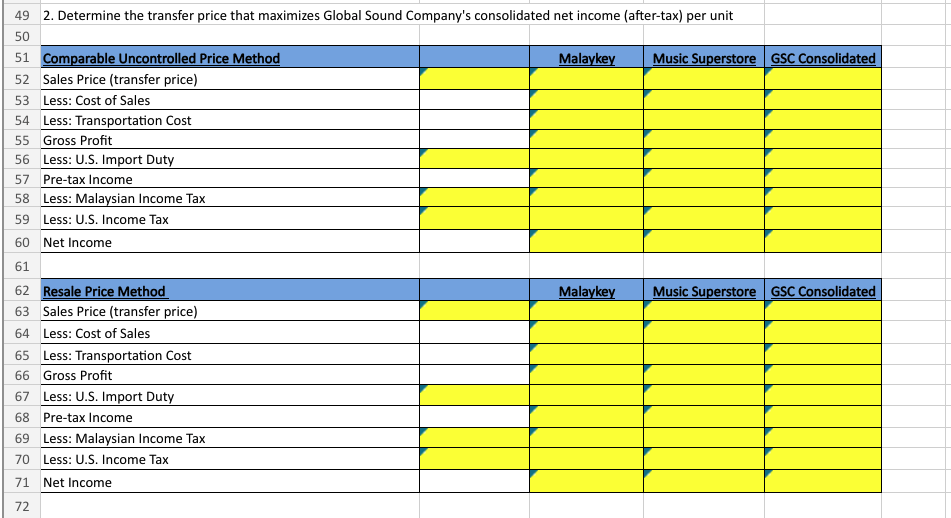

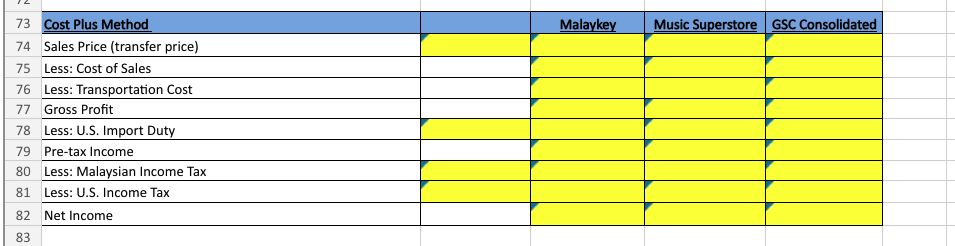

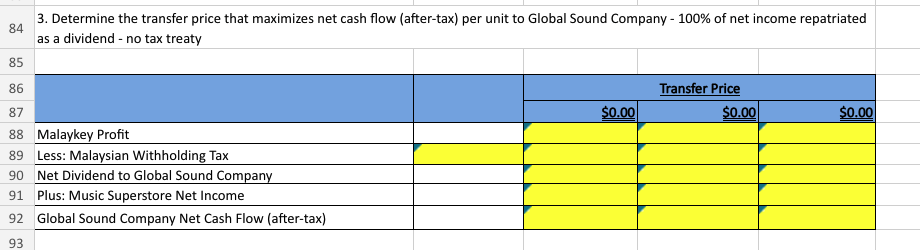

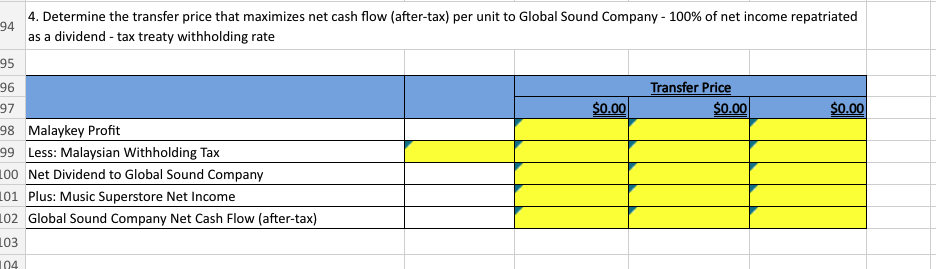

\begin{tabular}{|c|c|c|c|c|} \hline \multirow{2}{*}{4950} & \multicolumn{3}{|c|}{ 2. Determine the transfer price that maximizes Global Sound Company's consolidated net income (after-tax) per unit } & \\ \hline & \multirow[b]{2}{*}{ Comparable Uncontrolled Price Method } & \multirow[b]{2}{*}{ Malaykey } & \multirow[b]{2}{*}{ Music Superstore } & \\ \hline 51 & & & & GSC Consolidated \\ \hline 52 & Sales Price (transfer price) & & & \\ \hline 53 & Less: Cost of Sales & & & \\ \hline 54 & Less: Transportation Cost & & & \\ \hline 55 & Gross Profit & & & \\ \hline 56 & Less: U.S. Import Duty & & & \\ \hline 57 & Pre-tax Income & & & \\ \hline 58 & Less: Malaysian Income Tax & & & \\ \hline 59 & Less: U.S. Income Tax & & & \\ \hline 60 & Net Income & & & \\ \hline \multicolumn{5}{|l|}{61} \\ \hline 62 & Resale Price Method & Malaykey & Music Superstore & GSC Consolidated \\ \hline 63 & Sales Price (transfer price) & & & \\ \hline 64 & Less: Cost of Sales & & & \\ \hline 65 & Less: Transportation Cost & & & \\ \hline 66 & Gross Profit & & & \\ \hline 67 & Less: U.S. Import Duty & & & \\ \hline 68 & Pre-tax Income & & & \\ \hline 69 & Less: Malaysian Income Tax & & & \\ \hline 70 & Less: U.S. Income Tax & & & \\ \hline 71 & Net Income & & & \\ \hline 72 & & & & \\ \hline \end{tabular} 4. Determine the transfer price that maximizes net cash flow (after-tax) per unit to Global Sound Company-100\% of net income repatriated as a dividend - tax treaty withholding rate \begin{tabular}{|c|c|c|c|} \hline & & rice & \\ \hline & $0.00 & $0.00 & $0.00 \\ \hline Malaykey Profit & & & \\ \hline Less: Malaysian Withholding Tax & & & \\ \hline Net Dividend to Global Sound Company & & & \\ \hline Plus: Music Superstore Net Income & & & \\ \hline Global Sound Company Net Cash Flow (after-tax) & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & D \\ \hline \multicolumn{5}{|l|}{1} \\ \hline 2 & Determine Optimal Transfer Price & & & \\ \hline 3 & Given data & & & \\ \hline \multicolumn{5}{|l|}{4} \\ \hline 5 & Malaykey Data & & & \\ \hline 6 & Production cost & 120.00 & & \\ \hline 7 & Transportion cost & 10.00 & & \\ \hline 8 & Wholesale price to Targetmart & 200.00 & & \\ \hline 9 & Wholesale price to Music Superstore (transfer price) & ? & & \\ \hline \multicolumn{5}{|l|}{10} \\ \hline 11 & \multicolumn{2}{|c|}{ Other Malaysian Manufacturers' Sales of Keyboards to United States } & & \\ \hline 12 & Markup on total cost & 60% & & \\ \hline \multicolumn{4}{|c|}{\( 1 3 \longdiv { 1 } \)} & \\ \hline 14 & Targetmart Data & & & \\ \hline 15 & Markup on total cost & 50% & & \\ \hline 16 & Retail price to customers & 360.00 & & \\ \hline \multicolumn{5}{|l|}{17} \\ \hline 18 & Music Superstore Data & & & \\ \hline 19 & Retail price to customers & 342.00 & & \\ \hline \multicolumn{5}{|l|}{20} \\ \hline 21 & Tax Rates and Import Duties & & & \\ \hline 22 & Malaysia corporate income tax rate & 30% & & \\ \hline 23 & Malaysia non-treaty withholding tax rate on dividends & 25% & & \\ \hline 24 & U.S. corporate income tax rate & 21% & & \\ \hline 25 & U.S. ad valorem import duty & 20% & & \\ \hline 26 & U.S.-Malaysia tax treaty withholding tax rate on dividends & 5% & & \\ \hline \multicolumn{5}{|l|}{27} \\ \hline 28 & Required: & & & \\ \hline 29 & \multicolumn{2}{|c|}{ Note: Use cells A2 to B26 from the given information to complete this question. } & & \\ \hline \end{tabular} 3. Determine the transfer price that maximizes net cash flow (after-tax) per unit to Global Sound Company - 100% of net income repatriated as a dividend - no tax treaty \begin{tabular}{|l|l|l|l|} \hline & & & \multicolumn{2}{|c|}{ Transfer Price } \\ \cline { 2 - 5 } Malaykey Profit & & & \\ \hline Less: Malaysian Withholding Tax & & & \\ \hline Net Dividend to Global Sound Company & & & \\ \hline Plus: Music Superstore Net Income & & & \\ \hline Global Sound Company Net Cash Flow (after-tax) & & & \\ \hline \end{tabular} Other Malaysian Manufacturers' Sales of Keyboards to United States Tax Rates and Import Duties Required: a. Determine three possible prices for the sale of keyboards from Malaykey to Music Superstore. b. Determine the transfer price that maximizes Global Sound Company's consolidated net income (after-tax) per unit. c. Determine the transfer price that maximizes net cash flow (after-tax) per unit to Global Sound Company - 100% of net income repatriated as a dividend - no tax treaty. d. Determine the transfer price that maximizes net cash flow (after-tax) per unit to Global Sound Company - 100% of net income repatriated as a dividend - tax treaty withholding rate. Navigation: 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect

\begin{tabular}{|c|c|c|c|c|} \hline \multirow{2}{*}{4950} & \multicolumn{3}{|c|}{ 2. Determine the transfer price that maximizes Global Sound Company's consolidated net income (after-tax) per unit } & \\ \hline & \multirow[b]{2}{*}{ Comparable Uncontrolled Price Method } & \multirow[b]{2}{*}{ Malaykey } & \multirow[b]{2}{*}{ Music Superstore } & \\ \hline 51 & & & & GSC Consolidated \\ \hline 52 & Sales Price (transfer price) & & & \\ \hline 53 & Less: Cost of Sales & & & \\ \hline 54 & Less: Transportation Cost & & & \\ \hline 55 & Gross Profit & & & \\ \hline 56 & Less: U.S. Import Duty & & & \\ \hline 57 & Pre-tax Income & & & \\ \hline 58 & Less: Malaysian Income Tax & & & \\ \hline 59 & Less: U.S. Income Tax & & & \\ \hline 60 & Net Income & & & \\ \hline \multicolumn{5}{|l|}{61} \\ \hline 62 & Resale Price Method & Malaykey & Music Superstore & GSC Consolidated \\ \hline 63 & Sales Price (transfer price) & & & \\ \hline 64 & Less: Cost of Sales & & & \\ \hline 65 & Less: Transportation Cost & & & \\ \hline 66 & Gross Profit & & & \\ \hline 67 & Less: U.S. Import Duty & & & \\ \hline 68 & Pre-tax Income & & & \\ \hline 69 & Less: Malaysian Income Tax & & & \\ \hline 70 & Less: U.S. Income Tax & & & \\ \hline 71 & Net Income & & & \\ \hline 72 & & & & \\ \hline \end{tabular} 4. Determine the transfer price that maximizes net cash flow (after-tax) per unit to Global Sound Company-100\% of net income repatriated as a dividend - tax treaty withholding rate \begin{tabular}{|c|c|c|c|} \hline & & rice & \\ \hline & $0.00 & $0.00 & $0.00 \\ \hline Malaykey Profit & & & \\ \hline Less: Malaysian Withholding Tax & & & \\ \hline Net Dividend to Global Sound Company & & & \\ \hline Plus: Music Superstore Net Income & & & \\ \hline Global Sound Company Net Cash Flow (after-tax) & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & D \\ \hline \multicolumn{5}{|l|}{1} \\ \hline 2 & Determine Optimal Transfer Price & & & \\ \hline 3 & Given data & & & \\ \hline \multicolumn{5}{|l|}{4} \\ \hline 5 & Malaykey Data & & & \\ \hline 6 & Production cost & 120.00 & & \\ \hline 7 & Transportion cost & 10.00 & & \\ \hline 8 & Wholesale price to Targetmart & 200.00 & & \\ \hline 9 & Wholesale price to Music Superstore (transfer price) & ? & & \\ \hline \multicolumn{5}{|l|}{10} \\ \hline 11 & \multicolumn{2}{|c|}{ Other Malaysian Manufacturers' Sales of Keyboards to United States } & & \\ \hline 12 & Markup on total cost & 60% & & \\ \hline \multicolumn{4}{|c|}{\( 1 3 \longdiv { 1 } \)} & \\ \hline 14 & Targetmart Data & & & \\ \hline 15 & Markup on total cost & 50% & & \\ \hline 16 & Retail price to customers & 360.00 & & \\ \hline \multicolumn{5}{|l|}{17} \\ \hline 18 & Music Superstore Data & & & \\ \hline 19 & Retail price to customers & 342.00 & & \\ \hline \multicolumn{5}{|l|}{20} \\ \hline 21 & Tax Rates and Import Duties & & & \\ \hline 22 & Malaysia corporate income tax rate & 30% & & \\ \hline 23 & Malaysia non-treaty withholding tax rate on dividends & 25% & & \\ \hline 24 & U.S. corporate income tax rate & 21% & & \\ \hline 25 & U.S. ad valorem import duty & 20% & & \\ \hline 26 & U.S.-Malaysia tax treaty withholding tax rate on dividends & 5% & & \\ \hline \multicolumn{5}{|l|}{27} \\ \hline 28 & Required: & & & \\ \hline 29 & \multicolumn{2}{|c|}{ Note: Use cells A2 to B26 from the given information to complete this question. } & & \\ \hline \end{tabular} 3. Determine the transfer price that maximizes net cash flow (after-tax) per unit to Global Sound Company - 100% of net income repatriated as a dividend - no tax treaty \begin{tabular}{|l|l|l|l|} \hline & & & \multicolumn{2}{|c|}{ Transfer Price } \\ \cline { 2 - 5 } Malaykey Profit & & & \\ \hline Less: Malaysian Withholding Tax & & & \\ \hline Net Dividend to Global Sound Company & & & \\ \hline Plus: Music Superstore Net Income & & & \\ \hline Global Sound Company Net Cash Flow (after-tax) & & & \\ \hline \end{tabular} Other Malaysian Manufacturers' Sales of Keyboards to United States Tax Rates and Import Duties Required: a. Determine three possible prices for the sale of keyboards from Malaykey to Music Superstore. b. Determine the transfer price that maximizes Global Sound Company's consolidated net income (after-tax) per unit. c. Determine the transfer price that maximizes net cash flow (after-tax) per unit to Global Sound Company - 100% of net income repatriated as a dividend - no tax treaty. d. Determine the transfer price that maximizes net cash flow (after-tax) per unit to Global Sound Company - 100% of net income repatriated as a dividend - tax treaty withholding rate. Navigation: 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started