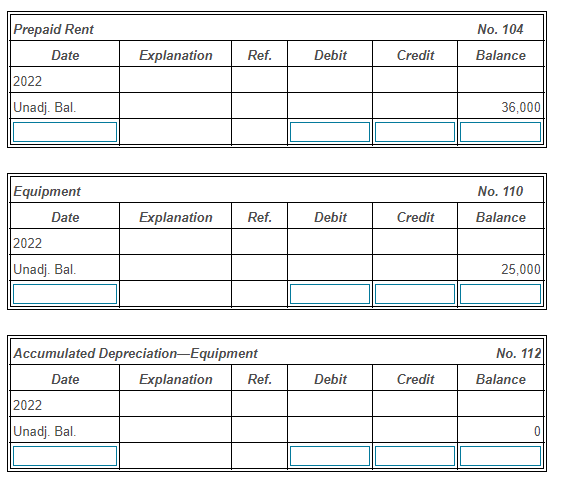

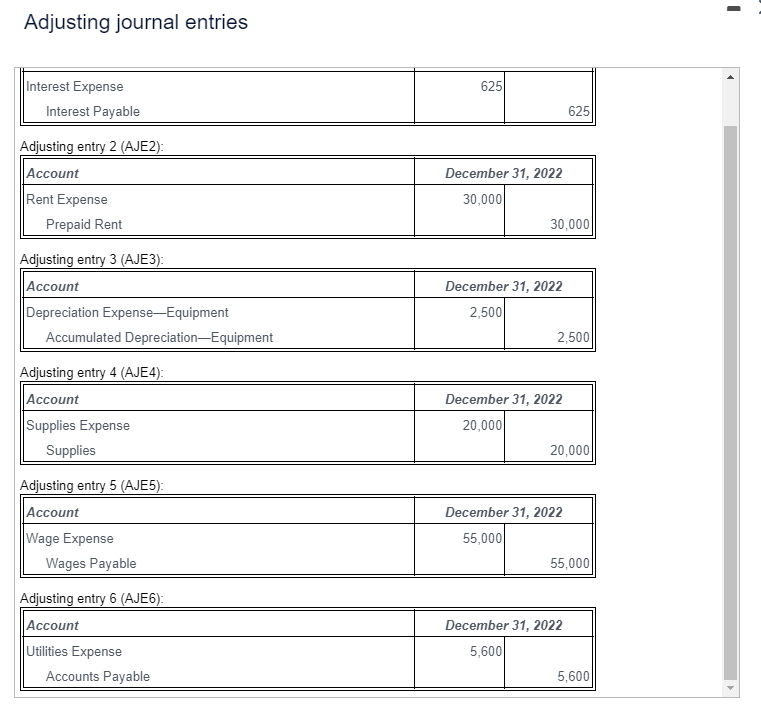

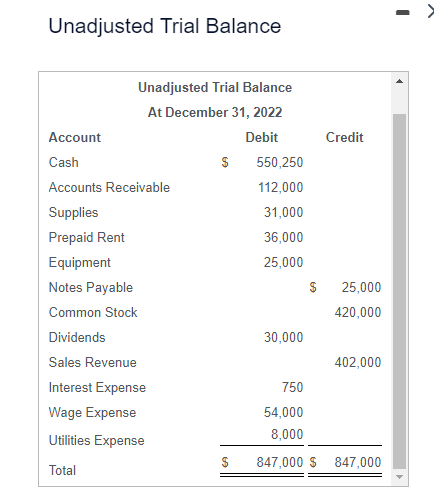

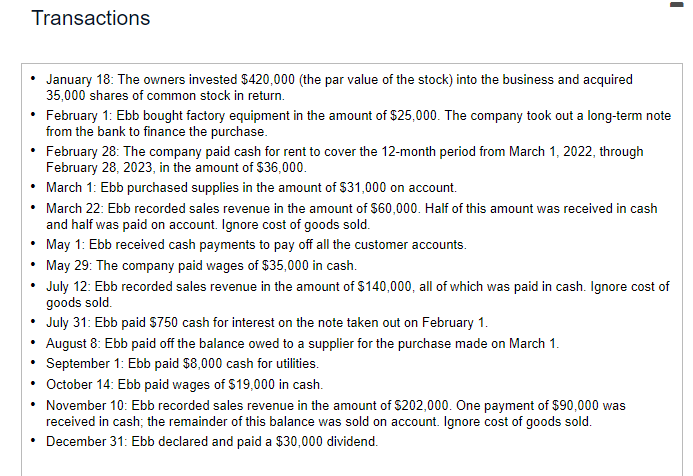

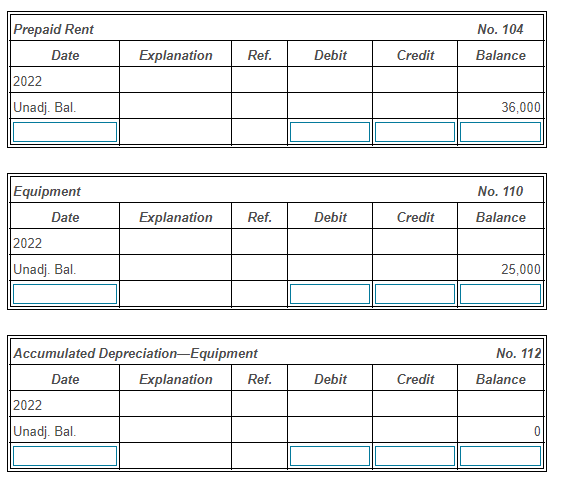

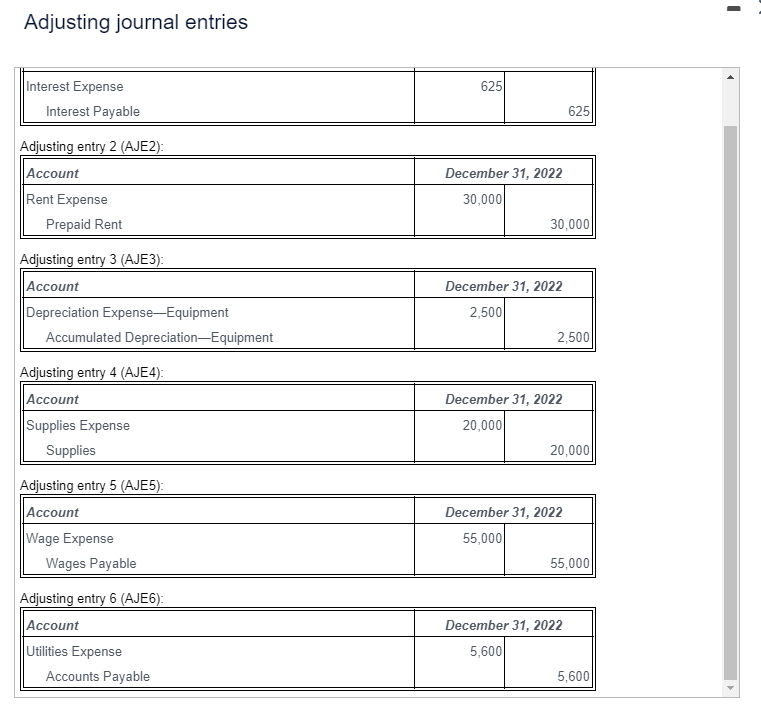

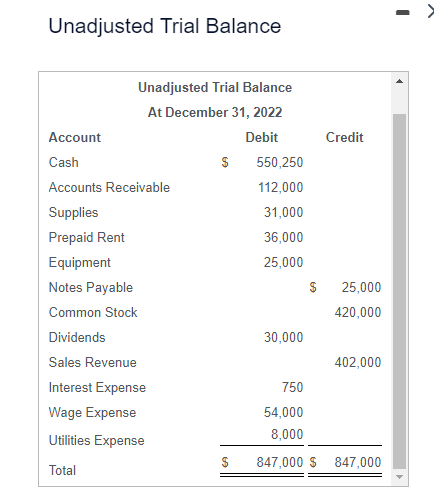

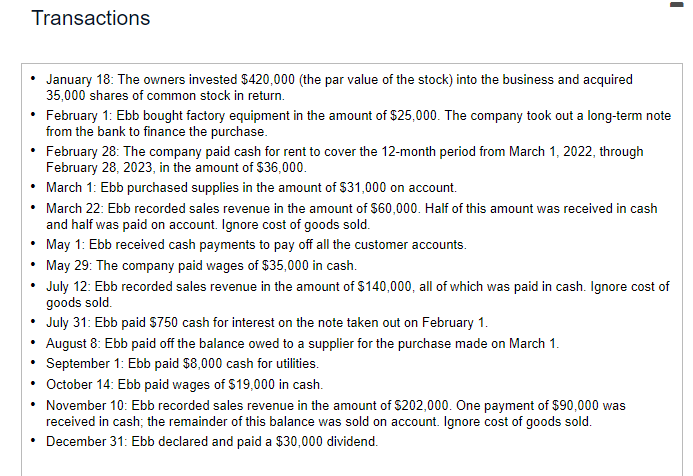

\begin{tabular}{||c|c|c|c|c|c||} \hline \hline \multicolumn{1}{||l|}{ Prepaid Rent } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline 2022 & & & & & \\ \hline Unadj. Bal. & & & & & 364 \\ \hline & & & & & \\ \hline \hline \end{tabular} \begin{tabular}{||c|c|c|c|c|c||} \hline \hline \multicolumn{1}{||l|}{ Equipment } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline 2022 & & & & & \\ \hline Unadj. Bal. & & & & & 25,000 \\ \hline & & & & & \\ \hline \hline \end{tabular} \begin{tabular}{||c|c|c|c|c|c||} \hline \hline \multicolumn{1}{||c|}{ Accumulated Depreciation-Equipment } & \multicolumn{1}{r||}{ No. 112 } \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline 2022 & & & & & \\ \hline Unadj. Bal. & & & & & 0 \\ \hline & & & & & \\ \hline \hline \end{tabular} Adjusting journal entries Adiustina entrv 2 (A.IF) - Adiustina entrv 3 (AJE3): Adlilatinn antry (A.IF ) Adiustina entrv 5 (A.IF5) Unadjusted Trial Balance Transactions - January 18: The owners invested $420,000 (the par value of the stock) into the business and acquired 35,000 shares of common stock in return. - February 1: Ebb bought factory equipment in the amount of $25,000. The company took out a long-term note from the bank to finance the purchase. - February 28: The company paid cash for rent to cover the 12-month period from March 1, 2022, through February 28,2023 , in the amount of $36,000. - March 1: Ebb purchased supplies in the amount of $31,000 on account. - March 22: Ebb recorded sales revenue in the amount of $60,000. Half of this amount was received in cash and half was paid on account. Ignore cost of goods sold. - May 1: Ebb received cash payments to pay off all the customer accounts. - May 29: The company paid wages of $35,000 in cash. - July 12: Ebb recorded sales revenue in the amount of $140,000, all of which was paid in cash. Ignore cost of goods sold. - July 31: Ebb paid $750 cash for interest on the note taken out on February 1. - August 8: Ebb paid off the balance owed to a supplier for the purchase made on March 1. - September 1: Ebb paid $8,000 cash for utilities. - October 14: Ebb paid wages of $19,000 in cash. - November 10: Ebb recorded sales revenue in the amount of $202,000. One payment of $90,000 was received in cash; the remainder of this balance was sold on account. Ignore cost of goods sold. - December 31: Ebb declared and paid a $30,000 dividend