Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|c|c|} hline multicolumn{6}{|c|}{SMOLIRAGOLFCORPORATION2020and2021BalanceSheets} hline Assets & 2020 & 2021 & Liabilities and Owners' Equity & 2020 & 2021 hline Current assets & &

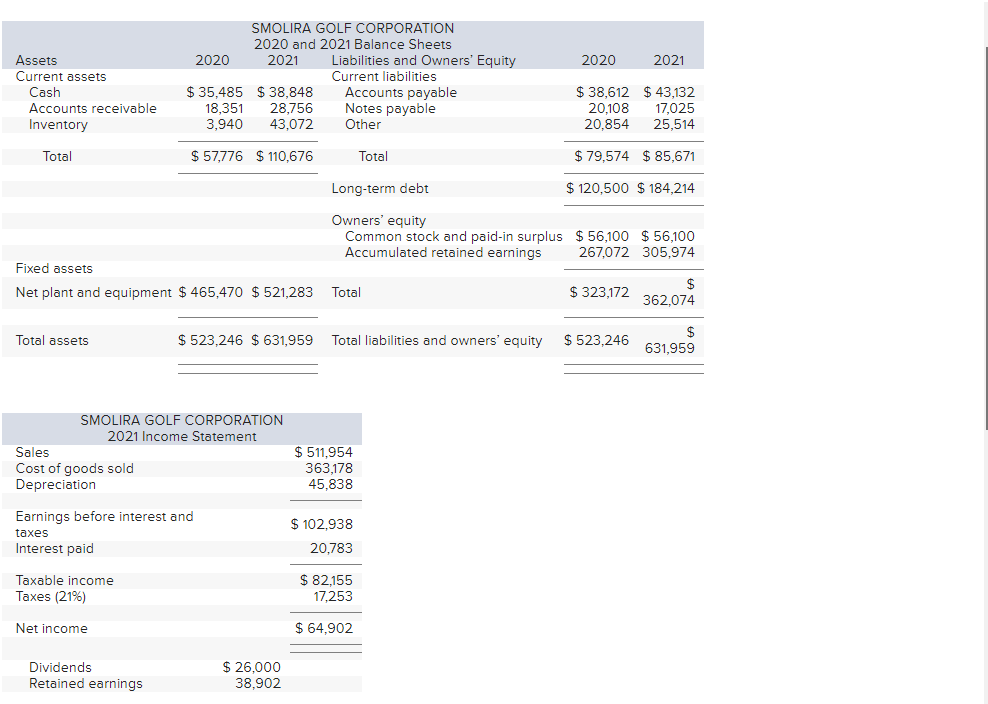

\begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{SMOLIRAGOLFCORPORATION2020and2021BalanceSheets} \\ \hline Assets & 2020 & 2021 & Liabilities and Owners' Equity & 2020 & 2021 \\ \hline Current assets & & & Current liabilities & & \\ \hline Cash & $35,485 & $38,848 & Accounts payable & $38,612 & $43,132 \\ \hline Accounts receivable & 18,351 & 28,756 & Notes payable & 20,108 & 17,025 \\ \hline Inventory & 3,940 & 43,072 & Other & 20,854 & 25,514 \\ \hline \multirow[t]{5}{*}{ Total } & $57,776 & $110,676 & Total & $79,574 & $85,671 \\ \hline & & & Long-term debt & $120,500 & $184,214 \\ \hline & & & Owners' equity & & \\ \hline & & & Common stock and paid-in surplus & s $56,100 & $56,100 \\ \hline & & & Accumulated retained earnings & 267,072 & 305,974 \\ \hline Fixed assets & & & & & \\ \hline Net plant and equipment & $465,470 & $521,283 & Total & $323,172 & $362,074 \\ \hline Total assets & $523,246 & $631,959 & Total liabilities and owners' equity & $523,246 & $631,959 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{SMOLIRAGOLFCORPORATION2021IncomeStatement} \\ \hline Sales & $511,954 \\ \hline Cost of goods sold & 363,178 \\ \hline Depreciation & 45,838 \\ \hline Earningsbeforeinterestandtaxes & $102,938 \\ \hline Interest paid & 20,783 \\ \hline Taxable income & $82,155 \\ \hline Taxes (21%) & 17,253 \\ \hline Net income & $64,902 \\ \hline Dividends & \\ \hline Retained earnings & \\ \hline \end{tabular} Prepare the 2021 statement of cash flows for Smolira Golf Corp. (Negative answers should be indicated by a minus sign.)

\begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{SMOLIRAGOLFCORPORATION2020and2021BalanceSheets} \\ \hline Assets & 2020 & 2021 & Liabilities and Owners' Equity & 2020 & 2021 \\ \hline Current assets & & & Current liabilities & & \\ \hline Cash & $35,485 & $38,848 & Accounts payable & $38,612 & $43,132 \\ \hline Accounts receivable & 18,351 & 28,756 & Notes payable & 20,108 & 17,025 \\ \hline Inventory & 3,940 & 43,072 & Other & 20,854 & 25,514 \\ \hline \multirow[t]{5}{*}{ Total } & $57,776 & $110,676 & Total & $79,574 & $85,671 \\ \hline & & & Long-term debt & $120,500 & $184,214 \\ \hline & & & Owners' equity & & \\ \hline & & & Common stock and paid-in surplus & s $56,100 & $56,100 \\ \hline & & & Accumulated retained earnings & 267,072 & 305,974 \\ \hline Fixed assets & & & & & \\ \hline Net plant and equipment & $465,470 & $521,283 & Total & $323,172 & $362,074 \\ \hline Total assets & $523,246 & $631,959 & Total liabilities and owners' equity & $523,246 & $631,959 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{SMOLIRAGOLFCORPORATION2021IncomeStatement} \\ \hline Sales & $511,954 \\ \hline Cost of goods sold & 363,178 \\ \hline Depreciation & 45,838 \\ \hline Earningsbeforeinterestandtaxes & $102,938 \\ \hline Interest paid & 20,783 \\ \hline Taxable income & $82,155 \\ \hline Taxes (21%) & 17,253 \\ \hline Net income & $64,902 \\ \hline Dividends & \\ \hline Retained earnings & \\ \hline \end{tabular} Prepare the 2021 statement of cash flows for Smolira Golf Corp. (Negative answers should be indicated by a minus sign.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started