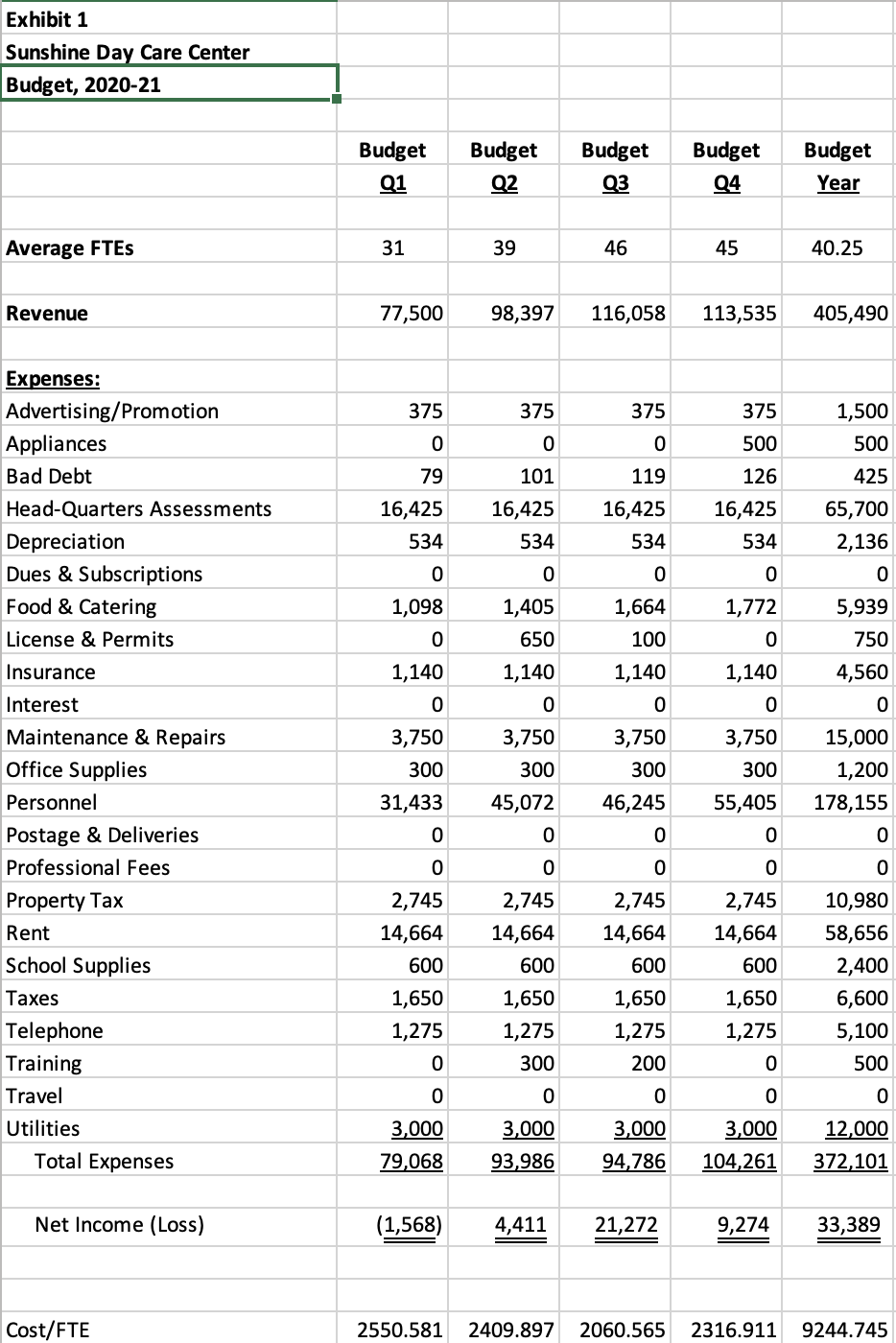

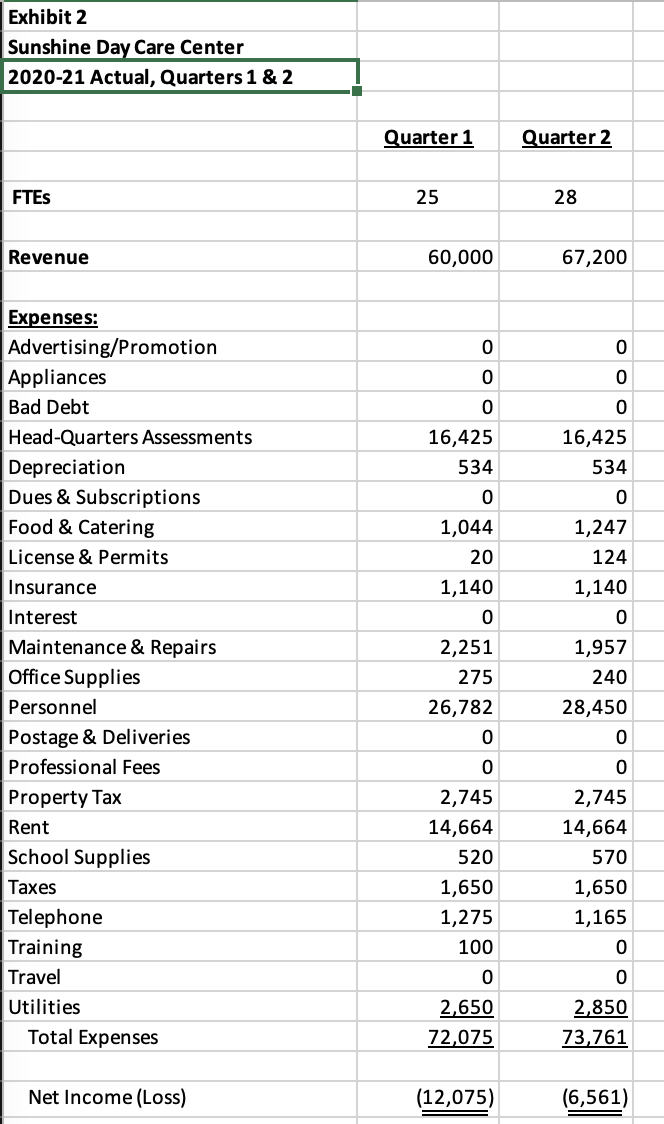

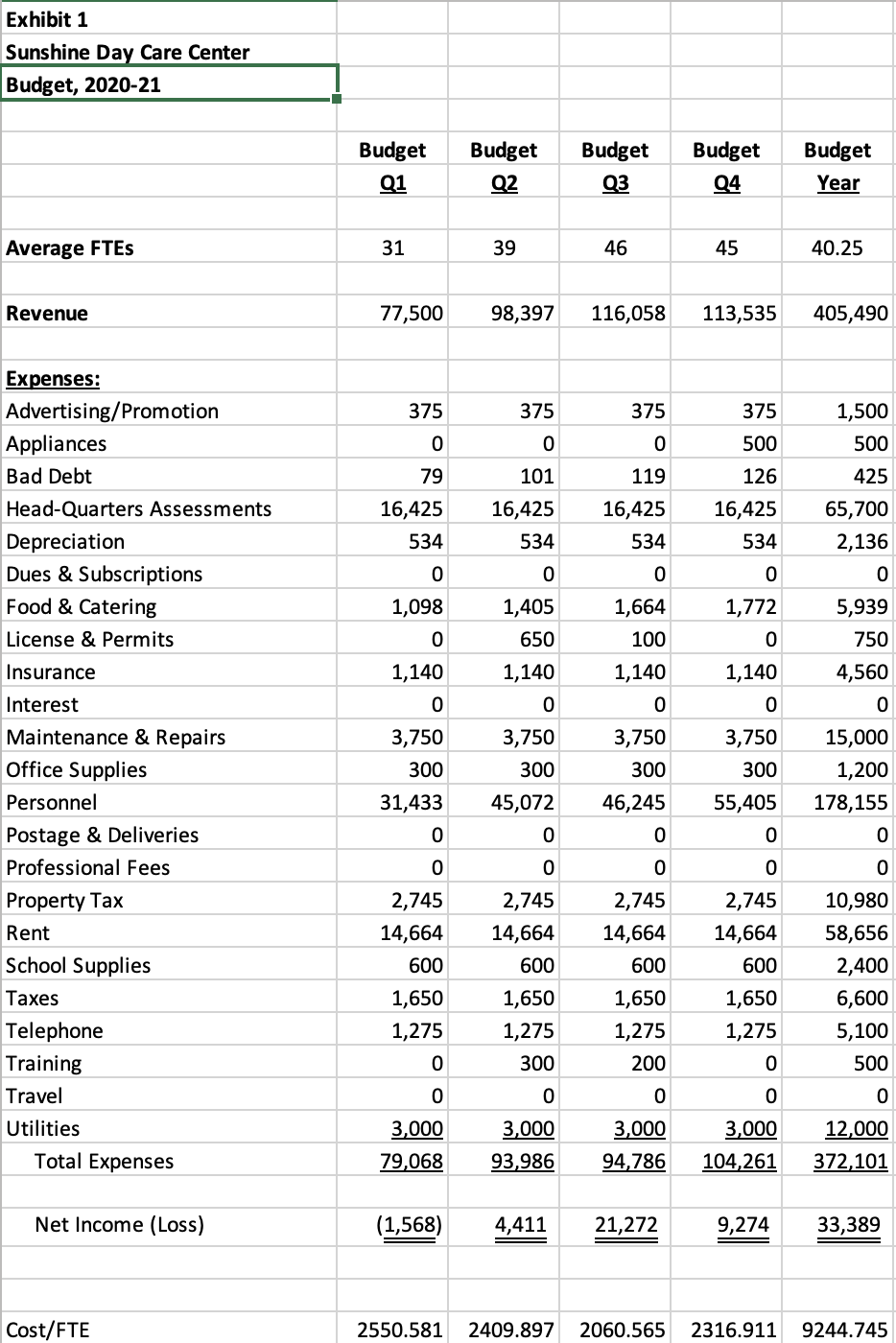

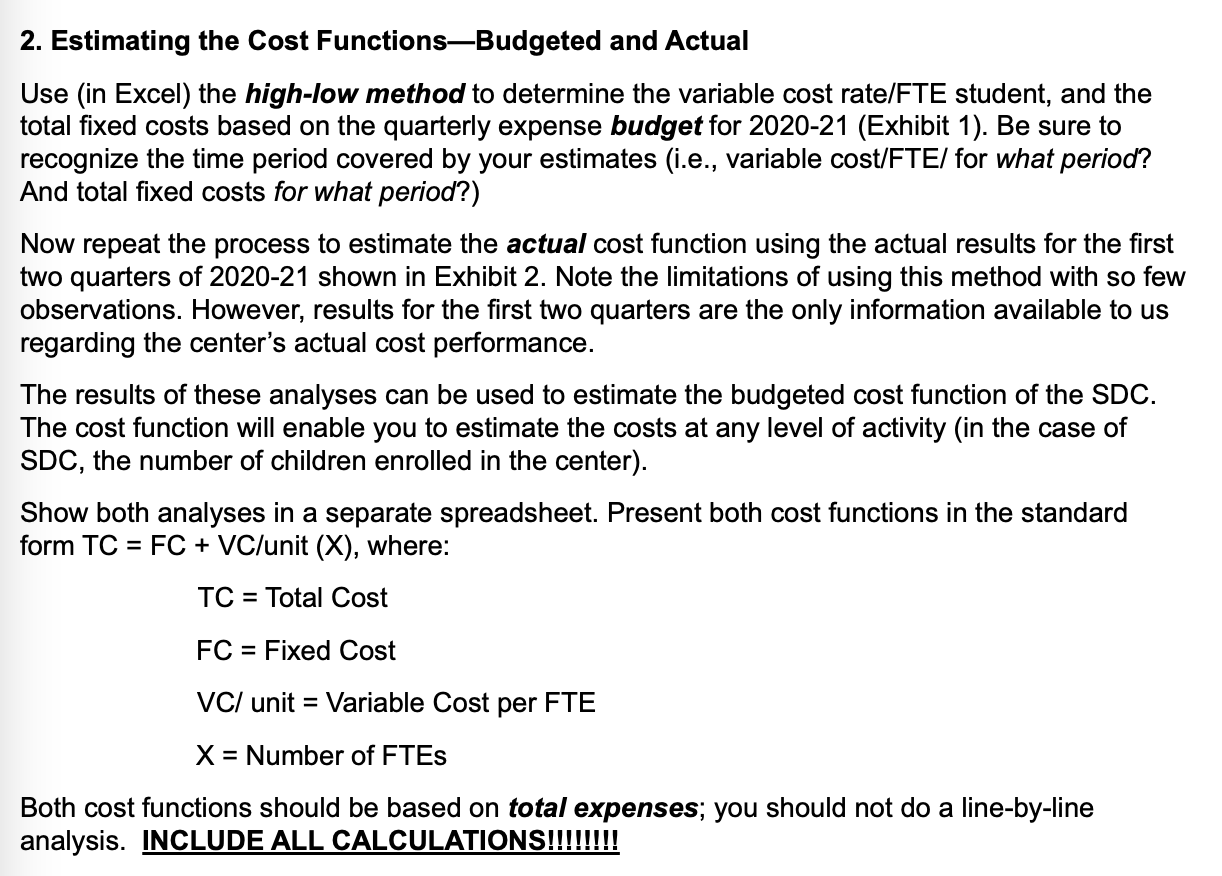

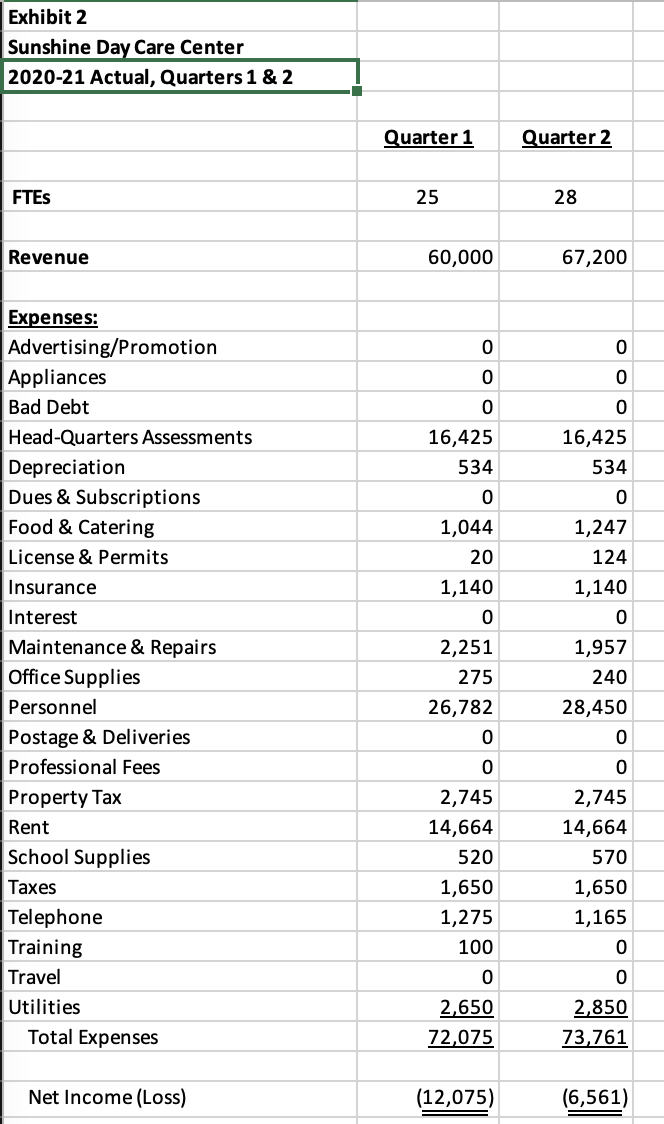

\begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|l|}{ Exhibit 1} \\ \hline \multicolumn{6}{|l|}{ Sunshine Day Care Center } \\ \hline \multicolumn{6}{|l|}{ Budget, 2020-21 } \\ \hline & Budget & Budget & Budget & Budget & Budget \\ \hline & Q1 & Q2 & Q3 & Q4 & Year \\ \hline Average FTEs & 31 & 39 & 46 & 45 & 40.25 \\ \hline Revenue & 77,500 & 98,397 & 116,058 & 113,535 & 405,490 \\ \hline \multicolumn{6}{|l|}{ Expenses: } \\ \hline Advertising/Promotion & 375 & 375 & 375 & 375 & 1,500 \\ \hline Appliances & 0 & 0 & 0 & 500 & 500 \\ \hline Bad Debt & 79 & 101 & 119 & 126 & 425 \\ \hline Head-Quarters Assessments & 16,425 & 16,425 & 16,425 & 16,425 & 65,700 \\ \hline Depreciation & 534 & 534 & 534 & 534 & 2,136 \\ \hline Dues \& Subscriptions & 0 & 0 & 0 & 0 & 0 \\ \hline Food \& Catering & 1,098 & 1,405 & 1,664 & 1,772 & 5,939 \\ \hline License \& Permits & 0 & 650 & 100 & 0 & 750 \\ \hline Insurance & 1,140 & 1,140 & 1,140 & 1,140 & 4,560 \\ \hline Interest & 0 & 0 & 0 & 0 & 0 \\ \hline Maintenance \& Repairs & 3,750 & 3,750 & 3,750 & 3,750 & 15,000 \\ \hline Office Supplies & 300 & 300 & 300 & 300 & 1,200 \\ \hline Personnel & 31,433 & 45,072 & 46,245 & 55,405 & 178,155 \\ \hline Postage \& Deliveries & 0 & 0 & 0 & 0 & 0 \\ \hline Professional Fees & 0 & 0 & 0 & 0 & 0 \\ \hline Property Tax & 2,745 & 2,745 & 2,745 & 2,745 & 10,980 \\ \hline Rent & 14,664 & 14,664 & 14,664 & 14,664 & 58,656 \\ \hline School Supplies & 600 & 600 & 600 & 600 & 2,400 \\ \hline Taxes & 1,650 & 1,650 & 1,650 & 1,650 & 6,600 \\ \hline Telephone & 1,275 & 1,275 & 1,275 & 1,275 & 5,100 \\ \hline Training & 0 & 300 & 200 & 0 & 500 \\ \hline Travel & 0 & 0 & 0 & 0 & 0 \\ \hline Utilities & 3,000 & 3,000 & 3,000 & 3,000 & 12,000 \\ \hline Total Expenses & 79,068 & 93,986 & 94,786 & 104,261 & 372,101 \\ \hline Net Income (Loss) & (1,568) & 4,411 & 21,272 & 9,274 & 33,389 \\ \hline Cost/FTE & 2550.581 & 2409.897 & 2060.565 & 2316.911 & 9244.745 \\ \hline \end{tabular} 2. Estimating the Cost Functions-Budgeted and Actual Use (in Excel) the high-low method to determine the variable cost rate/FTE student, and the total fixed costs based on the quarterly expense budget for 2020-21 (Exhibit 1). Be sure to recognize the time period covered by your estimates (i.e., variable cost/FTE/ for what period? And total fixed costs for what period?) Now repeat the process to estimate the actual cost function using the actual results for the first two quarters of 2020-21 shown in Exhibit 2. Note the limitations of using this method with so few observations. However, results for the first two quarters are the only information available to us regarding the center's actual cost performance. The results of these analyses can be used to estimate the budgeted cost function of the SDC. The cost function will enable you to estimate the costs at any level of activity (in the case of SDC, the number of children enrolled in the center). Show both analyses in a separate spreadsheet. Present both cost functions in the standard form TC=FC+VC /unit (X), where: TC=TotalCostFC=FixedCostVC/unit=VariableCostperFTEX=NumberofFTEs Both cost functions should be based on total expenses; you should not do a line-by-line analysis. INCLUDE ALL CALCULATIONS!!!!!!!!! \begin{tabular}{|c|c|c|} \hline Exhibit 2 & & \\ \hline Sunshine Day Care Center & & \\ \hline 2020-21 Actual, Quarters 1 \& 2 & & \\ \hline & Quarter 1 & Quarter 2 \\ \hline FTEs & 25 & 28 \\ \hline Revenue & 60,000 & 67,200 \\ \hline Expenses: & & \\ \hline Advertising/Promotion & 0 & 0 \\ \hline Appliances & 0 & 0 \\ \hline Bad Debt & 0 & 0 \\ \hline Head-Quarters Assessments & 16,425 & 16,425 \\ \hline Depreciation & 534 & 534 \\ \hline Dues \& Subscriptions & 0 & 0 \\ \hline Food \& Catering & 1,044 & 1,247 \\ \hline License \& Permits & 20 & 124 \\ \hline Insurance & 1,140 & 1,140 \\ \hline Interest & 0 & 0 \\ \hline Maintenance \& Repairs & 2,251 & 1,957 \\ \hline Office Supplies & 275 & 240 \\ \hline Personnel & 26,782 & 28,450 \\ \hline Postage \& Deliveries & 0 & 0 \\ \hline Professional Fees & 0 & 0 \\ \hline Property Tax & 2,745 & 2,745 \\ \hline Rent & 14,664 & 14,664 \\ \hline School Supplies & 520 & 570 \\ \hline Taxes & 1,650 & 1,650 \\ \hline Telephone & 1,275 & 1,165 \\ \hline Training & 100 & 0 \\ \hline Travel & 0 & 0 \\ \hline Utilities & 2,650 & 2,850 \\ \hline Total Expenses & 72,075 & 73,761 \\ \hline Net Income (Loss) & (12,075) & (6,561) \\ \hline \end{tabular}