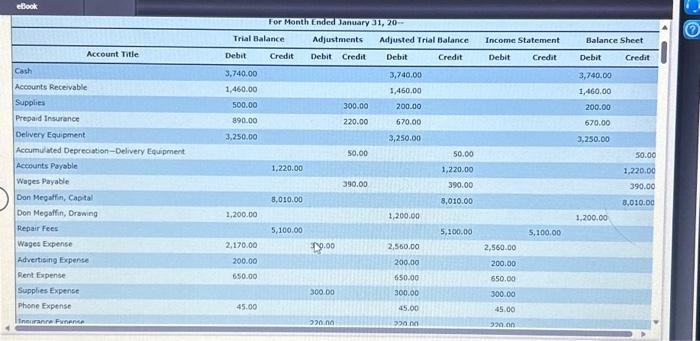

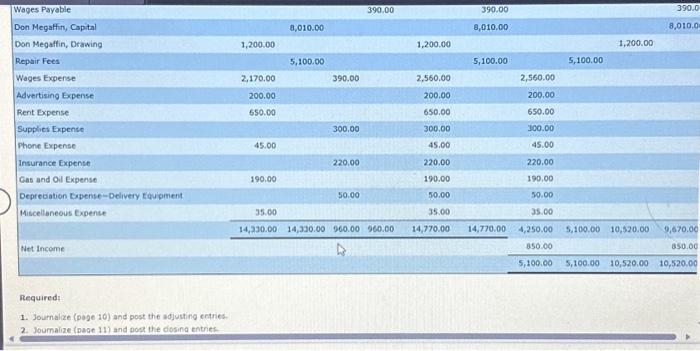

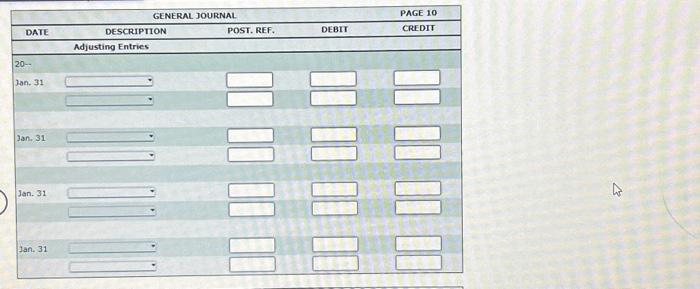

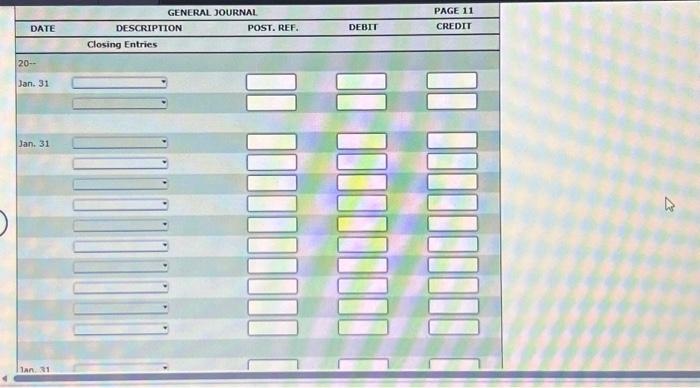

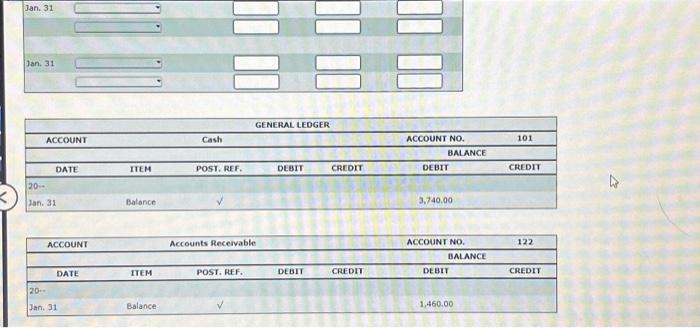

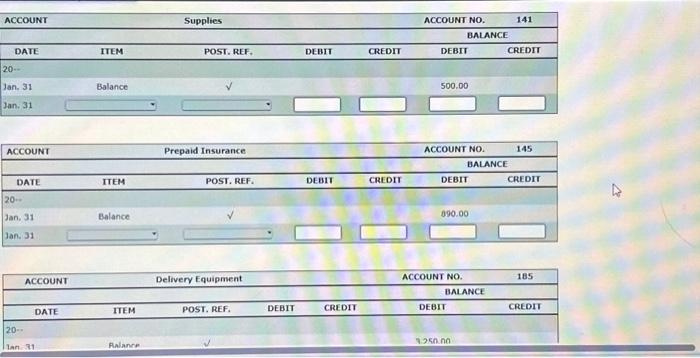

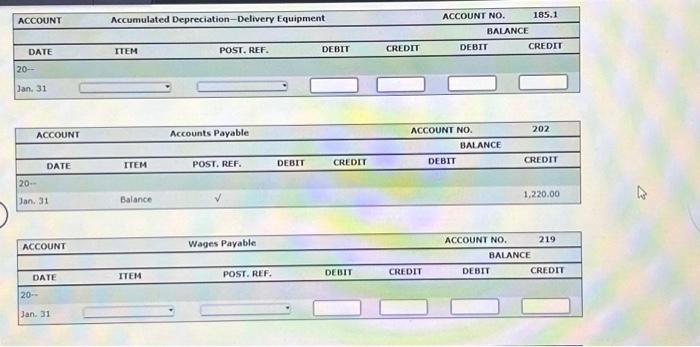

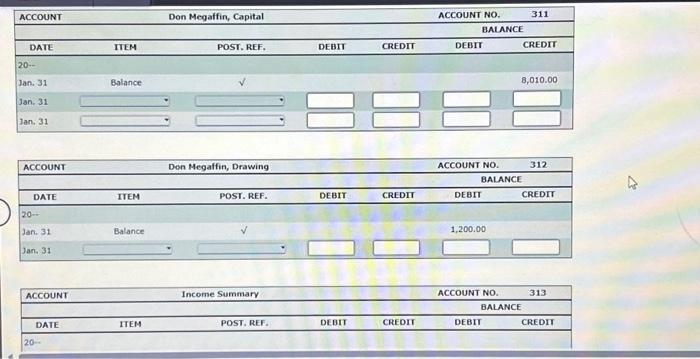

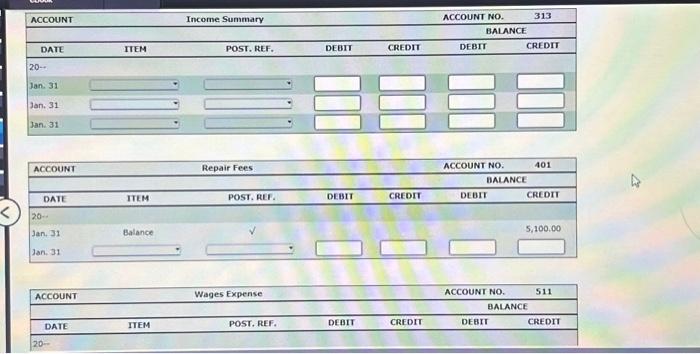

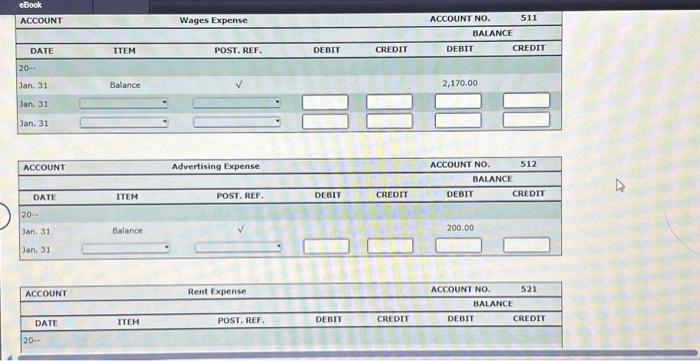

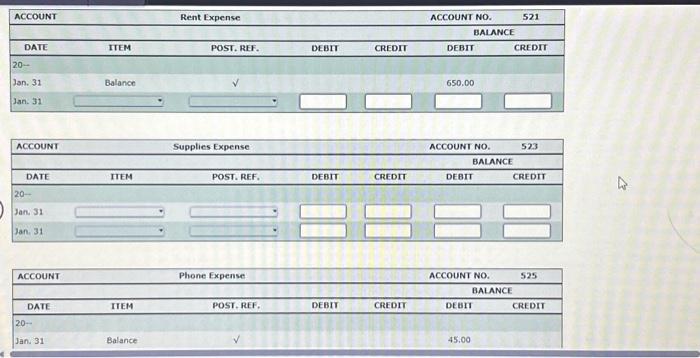

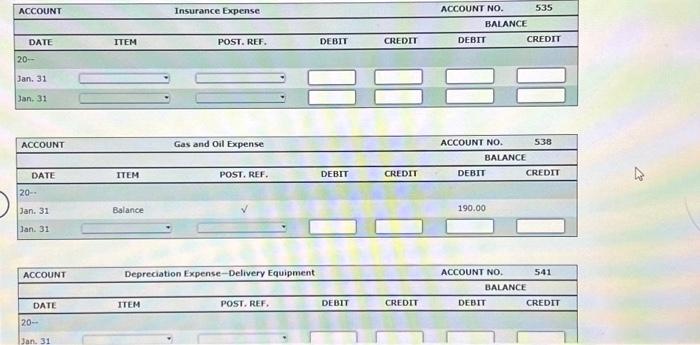

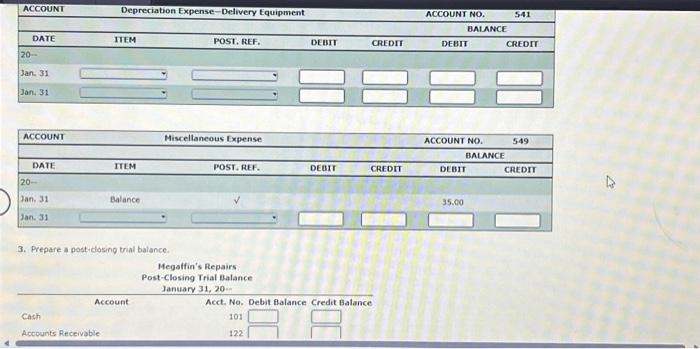

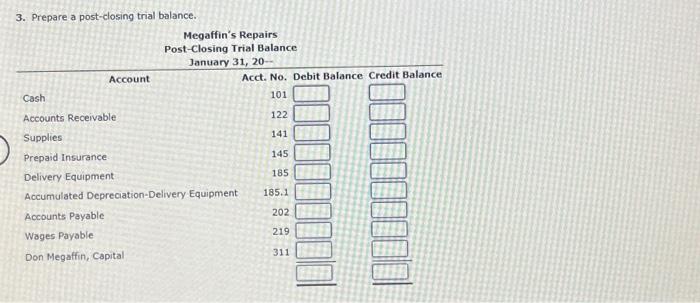

\begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{3}{*}{\begin{tabular}{c} ACCOUNT \\ DATE \\ \end{tabular}} & \multicolumn{4}{|c|}{ Accumulated Depreciation-Delivery Equipment } & ACCOUNT NO. & 185.1 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline & TIEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20} \\ \hline Jan, 31 & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Accounts Payable & & & ACCOUNT NO. & 202 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST, REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20} \\ \hline 3an.31 & Balance & & & & & 1,220.00 \\ \hline \end{tabular} 3. Prepare a post-closing trial balance. For Month Ended January 31,20= \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Account nile } & \multicolumn{2}{|c|}{ Trial Balance } & \multicolumn{2}{|c|}{ Mdjustments } & \multicolumn{2}{|c|}{ Adjusted Trial Balance: } & \multicolumn{2}{|c|}{ Income Statement } & \multicolumn{2}{|c|}{ Balance Sheet } \\ \hline & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit \\ \hline Cash & 3,740.00 & & & & 3,740,00 & & & & 3,740,00 & \\ \hline Accounts Recieivable & 1,460,00 & & & & 1,450.00 & & & & 1,460,00 & 4 \\ \hline Supplies & 500.00 & & & 300.00 & 200.00 & & & & 200.00 & \\ \hline Prepaid Insurance & 890.00 & & r & 220.00 & 670.00 & & & & 670.00 & \\ \hline Delivery Equipment & 3,250.00 & & & & 3,250,00 & & & & 3,250.00 & \\ \hline Accumulated Depreciation-Delivery Equipment & & & & $0,00 & & 50.00 & & & & 50.00 \\ \hline Accounts Paroble & & 1,220.00 & & & & 1,220.00 & & & & 1,220,00 \\ \hline Wages Payable & & & & 390.00 & & 390.00 & & & & 390.00 \\ \hline Don Megatfin, Captal & & 8,010.00 & & & & 8,010,00 & & & & 0,010,00 \\ \hline Don Megoffin, Orowing & 1,200.00 & & & & 1,200,00 & & & & 1,200,00 & \\ \hline Repair fees & & 5,100,00 & & & & 5,100.00 & & 5,100,00 & & \\ \hline Wages Expense & 2,170.00 & & & & 2,560,00 & & 2,560.00 & & & \\ \hline Advertising Expense & 200.00 & & & & 200.00 & & 200.00 & & & \\ \hline Rent Expense & 650.00 & & & & 650.00 & & 550,00 & & & \\ \hline Supplies Expense & & & 300.00 & & 300.00 & & 300.00 & & & \\ \hline Phone Exptnse & 45,00 & & & & 45.00 & & 45.00 & & & \\ \hline Innuranre Funerse. & & & 220 no & & 200ma & & & & & \\ \hline \end{tabular} Required: 1. Journalice (poge 10) and post the adjusting cetries. 2. Joumalize (page 11 ) and post the dosina entries. Jan. 31 Jan. 31 \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ GENERAL LEDGER } \\ \hline ACCOUNT & & Cash & & & ACCOUNT NO. & 101 \\ \hline & & & = & \multicolumn{3}{|c|}{ BALANCE } \\ \hline DATE & IIEM & POST, REF. & DEBIT & CREDTT & DEBIT & CEEDIT \\ \hline \multicolumn{7}{|l|}{20=} \\ \hline Jan. 31 & Balance & & & & 3,740,00 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & unts Receivabl & & & ACCOUNT NO. & 122 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POSI. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20=} \\ \hline Jan. 31 & Balance: & & 12 & & 1,460.00 & \\ \hline \end{tabular} 3. Prepare a post-closing trial balance. \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{|c|} ACCOUNT \\ DAIE \\ \end{tabular}} & \multicolumn{3}{|c|}{ Wages Expense } & \multirow{2}{*}{\multicolumn{3}{|c|}{BALANCEACCOUNTNO.511}} \\ \hline & & POST, REF & & & & \\ \hline & & & & & & \\ \hline Jan. 31 & Balance & v & & & 2,170.00 & \\ \hline san31 &. & . & & & & \\ \hline 320.31 & & & & & & 7 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Rent Expense & & & ACCOUNT NO. & 521 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & TIEM & POST, REF. & DEBT & CREDIT & DeEII & CREDT \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{3}{*}{\begin{tabular}{c} ACCOUNT \\ DATE \end{tabular}} & \multicolumn{2}{|c|}{ Income Summary } & \multirow[b]{3}{*}{ DEBIT } & \multirow[b]{3}{*}{ CREDIT } & ACCOUNT NO. & 313 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline & IIEM & POST. REF. & & & DEBT & CREDIT \\ \hline \multicolumn{7}{|l|}{20} \\ \hline Jan. 31 & & & & & & \\ \hline 3an, 31 & & ? & & & & \\ \hline Jan. 31 & + & ? & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Repair Fees & & & ACCOUNT NO. & 401 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & TIEM & Post. REF. & DEBIT & CREDIT & DEBT & CREDTI \\ \hline \multicolumn{7}{|l|}{20} \\ \hline Jan,31 & Balance & & & & & 5,100,00 \\ \hline Jan.31 & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Wages Expense & & & ACCOUNT NO. & 511 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST, REF. & DEAIT & CREDIT & DEBIT & CREDT \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{3}{*}{\begin{tabular}{|c|} ACCOUNT \\ DATE \\ \end{tabular}} & \multicolumn{3}{|c|}{ Insurance Expense } & & ACCOUNT NO. & 535 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline & ITEM & POST. REF. & DEBII & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20} \\ \hline Jan. 31 & & & & & & \\ \hline 3an31 & & & & & & \\ \hline \end{tabular} \begin{tabular}{|ccccccc|} \hline ACCOUNT & \multicolumn{2}{l}{ Depreciation Expense-Delivery Equipment } & & ACCOUNT NO. & 541 \\ \hline & & & & \multicolumn{2}{c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline 20 & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Supplies & & & ACCOUNT NO. & 141 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20} \\ \hline Jan. 31 & Balance & & & & 500.00 & \\ \hline Jan. 31 & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Insurance & & & ACCOUNT NO. & 145 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20} \\ \hline Jan,31 & Balance & & 1 & 4 & 090.00 & \\ \hline 3a. 31 & ? & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & ery Equipmen & & & ACCOUNT NO. & 185 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20=} \\ \hline lan81 & Aalance & & & & T.25n. & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & \multirow{2}{*}{\multicolumn{2}{|c|}{ Supplies Expense }} & & & ACCOUNT NO. & 523 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST. REF. & DEBIT & CREDIT & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20} \\ \hline Jan31 & 9 & & + & & & \\ \hline Jan. 31 & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ GENERAL JOURNAL } & \multirow{2}{*}{\begin{tabular}{l} PAGE 10 \\ CREDII \\ \end{tabular}} \\ \hline DATE & DESCRIPTION & POST. REF. & DEBIT & \\ \hline+2 & Adjusting Entries & & & \\ \hline \multicolumn{5}{|l|}{20} \\ \hline \multirow[t]{2}{*}{ 3an. 31} & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \multirow[t]{2}{*}{3an.31} & & & & \\ \hline & & & & \\ \hline \multirow[t]{2}{*}{ Jan. 31} & & & & +2 \\ \hline & & & & \\ \hline & 16 & & & \\ \hline \multirow[t]{2}{*}{ Jan. 31} & & & & \\ \hline & & & +2 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{3}{*}{\begin{tabular}{l} ACCOUNT \\ DATE \\ \end{tabular}} & \multicolumn{2}{|c|}{ Don Megalfin, Capital } & \multirow[b]{3}{*}{ DEBIT } & \multirow[b]{3}{*}{ CREDIT } & ACCOUNT NO. & 311 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline & ITEM & POST. REF. & & & DEBIT & CREDIT \\ \hline \multicolumn{7}{|l|}{20} \\ \hline Jan: 31 & Balance & & & & & 8,010.00 \\ \hline Jan. 31 & & & & & & \\ \hline tan,31 & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline ACCOUNT & & Income Summary & & & ACCOUNT NO. & 313 \\ \hline & & & & & \multicolumn{2}{|c|}{ BALANCE } \\ \hline DATE & ITEM & POST, REF. & DEBIT & CREDIT & DEBIT & CREDII \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ GENERAL JOURNAL. } & \multirow{2}{*}{CREDIIPAGE11} \\ \hline DATE & DESCRIPIION & POST. REF. & DEBIT & \\ \hline & Closing Entries & & & \\ \hline \multicolumn{5}{|l|}{20} \\ \hline \multirow[t]{2}{*}{ Jan. 31} & & & +2 & \\ \hline & & & & \\ \hline & & & & \\ \hline \multirow{10}{*}{Jan.31} & 4 & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & +2 & \\ \hline & & 1 & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & - & r & & \\ \hline \end{tabular}