Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|c|c|c|c|} hline 1 & multicolumn{3}{|c|}{ PRICES FOR FORD AND GM } & multicolumn{3}{|c|}{ Returns } & hline 2 & Date & Ford & GM

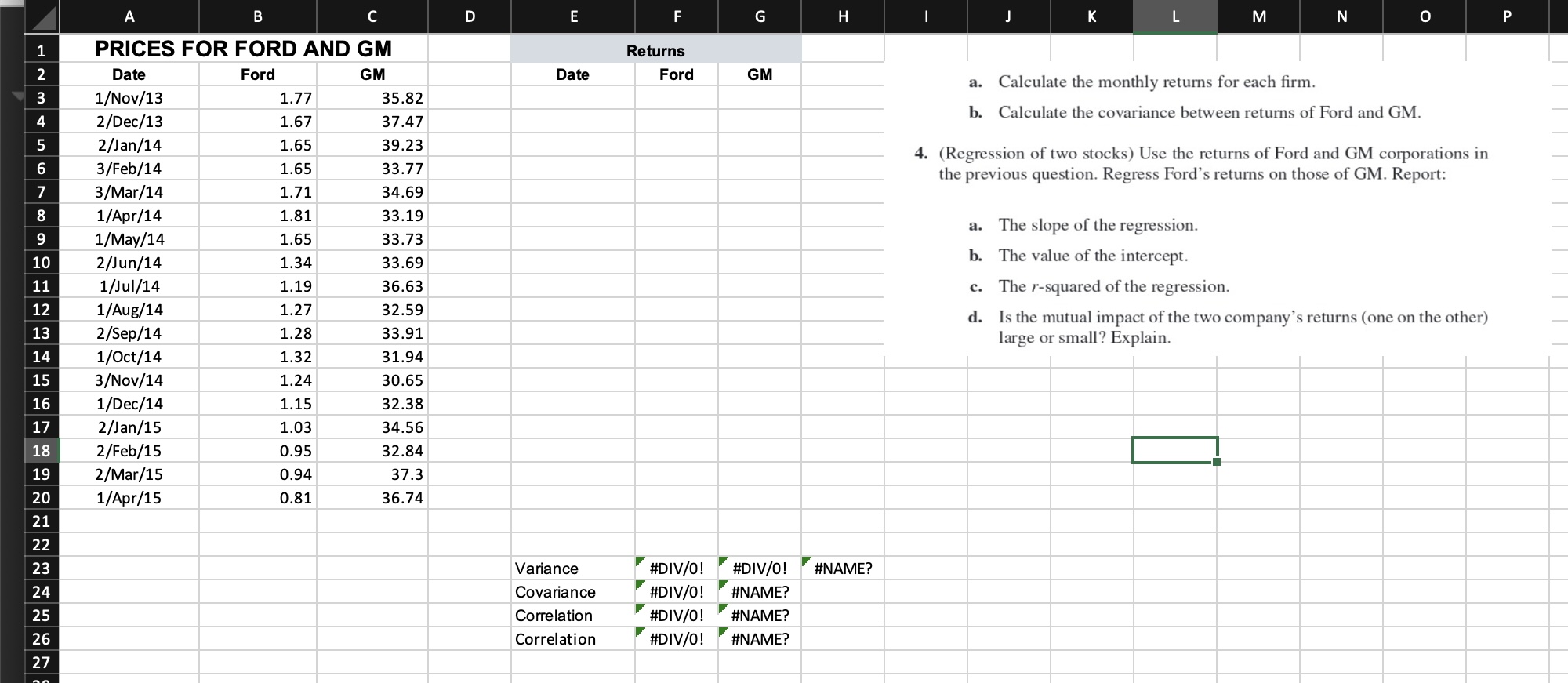

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline 1 & \multicolumn{3}{|c|}{ PRICES FOR FORD AND GM } & \multicolumn{3}{|c|}{ Returns } & \\ \hline 2 & Date & Ford & GM & Date & Ford & GM & \\ \hline 3 & 1/Nov/13 & 1.77 & 35.82 & & & & \\ \hline 4 & 2/Dec/13 & 1.67 & 37.47 & & & & \\ \hline 5 & 2/Jan/14 & 1.65 & 39.23 & & & & \\ \hline 6 & 3/Feb/14 & 1.65 & 33.77 & & & & \\ \hline 7 & 3/Mar/14 & 1.71 & 34.69 & & & & \\ \hline 8 & 1/Apr/14 & 1.81 & 33.19 & & & & \\ \hline 9 & 1/May/14 & 1.65 & 33.73 & & & & \\ \hline 10 & 2/Jun/14 & 1.34 & 33.69 & & & & \\ \hline 11 & 1/Jul/14 & 1.19 & 36.63 & & & & \\ \hline 12 & 1/Aug/14 & 1.27 & 32.59 & & & & \\ \hline 13 & 2/Sep/14 & 1.28 & 33.91 & & & & \\ \hline 14 & 1/Oct/14 & 1.32 & 31.94 & & & & \\ \hline 15 & 3/Nov/14 & 1.24 & 30.65 & & & & \\ \hline 16 & 1/Dec/14 & 1.15 & 32.38 & & & & \\ \hline 17 & 2/Jan/15 & 1.03 & 34.56 & & & & \\ \hline 18 & 2/Feb/15 & 0.95 & 32.84 & & & & \\ \hline 19 & 2/Mar/15 & 0.94 & 37.3 & & & & \\ \hline 20 & 1/Apr/15 & 0.81 & 36.74 & & & & \\ \hline 21 & & & & & & & \\ \hline 22 & & & & & & & \\ \hline 23 & & & & Variance & \#DIV/0! & \#DIV/0! & \#NAME? \\ \hline 24 & & & & Covariance & \#DIV/0! & \#NAME? & \\ \hline 25 & & & & Correlation & \#DIV/0! & \#NAME? & \\ \hline 26 & & & & Correlation & \#DIV/O! & \#NAME? & \\ \hline \end{tabular} a. Calculate the monthly returns for each firm. b. Calculate the covariance between returns of Ford and GM. 4. (Regression of two stocks) Use the returns of Ford and GM corporations in the previous question. Regress Ford's returns on those of GM. Report: a. The slope of the regression. b. The value of the intercept. c. The r-squared of the regression. d. Is the mutual impact of the two company's returns (one on the other) large or small? Explain

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline 1 & \multicolumn{3}{|c|}{ PRICES FOR FORD AND GM } & \multicolumn{3}{|c|}{ Returns } & \\ \hline 2 & Date & Ford & GM & Date & Ford & GM & \\ \hline 3 & 1/Nov/13 & 1.77 & 35.82 & & & & \\ \hline 4 & 2/Dec/13 & 1.67 & 37.47 & & & & \\ \hline 5 & 2/Jan/14 & 1.65 & 39.23 & & & & \\ \hline 6 & 3/Feb/14 & 1.65 & 33.77 & & & & \\ \hline 7 & 3/Mar/14 & 1.71 & 34.69 & & & & \\ \hline 8 & 1/Apr/14 & 1.81 & 33.19 & & & & \\ \hline 9 & 1/May/14 & 1.65 & 33.73 & & & & \\ \hline 10 & 2/Jun/14 & 1.34 & 33.69 & & & & \\ \hline 11 & 1/Jul/14 & 1.19 & 36.63 & & & & \\ \hline 12 & 1/Aug/14 & 1.27 & 32.59 & & & & \\ \hline 13 & 2/Sep/14 & 1.28 & 33.91 & & & & \\ \hline 14 & 1/Oct/14 & 1.32 & 31.94 & & & & \\ \hline 15 & 3/Nov/14 & 1.24 & 30.65 & & & & \\ \hline 16 & 1/Dec/14 & 1.15 & 32.38 & & & & \\ \hline 17 & 2/Jan/15 & 1.03 & 34.56 & & & & \\ \hline 18 & 2/Feb/15 & 0.95 & 32.84 & & & & \\ \hline 19 & 2/Mar/15 & 0.94 & 37.3 & & & & \\ \hline 20 & 1/Apr/15 & 0.81 & 36.74 & & & & \\ \hline 21 & & & & & & & \\ \hline 22 & & & & & & & \\ \hline 23 & & & & Variance & \#DIV/0! & \#DIV/0! & \#NAME? \\ \hline 24 & & & & Covariance & \#DIV/0! & \#NAME? & \\ \hline 25 & & & & Correlation & \#DIV/0! & \#NAME? & \\ \hline 26 & & & & Correlation & \#DIV/O! & \#NAME? & \\ \hline \end{tabular} a. Calculate the monthly returns for each firm. b. Calculate the covariance between returns of Ford and GM. 4. (Regression of two stocks) Use the returns of Ford and GM corporations in the previous question. Regress Ford's returns on those of GM. Report: a. The slope of the regression. b. The value of the intercept. c. The r-squared of the regression. d. Is the mutual impact of the two company's returns (one on the other) large or small? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started