Answered step by step

Verified Expert Solution

Question

1 Approved Answer

begin{tabular}{|c|c|c|c|c|c|c|c|} hline multirow{3}{*}{ COMPANY PERFORMANCE } & multirow{2}{*}{multicolumn{2}{|c|}{begin{tabular}{c} Current P2 end{tabular}}} & multicolumn{5}{|c|}{ Estimated Future Values [See Assumptions] } hline & & &

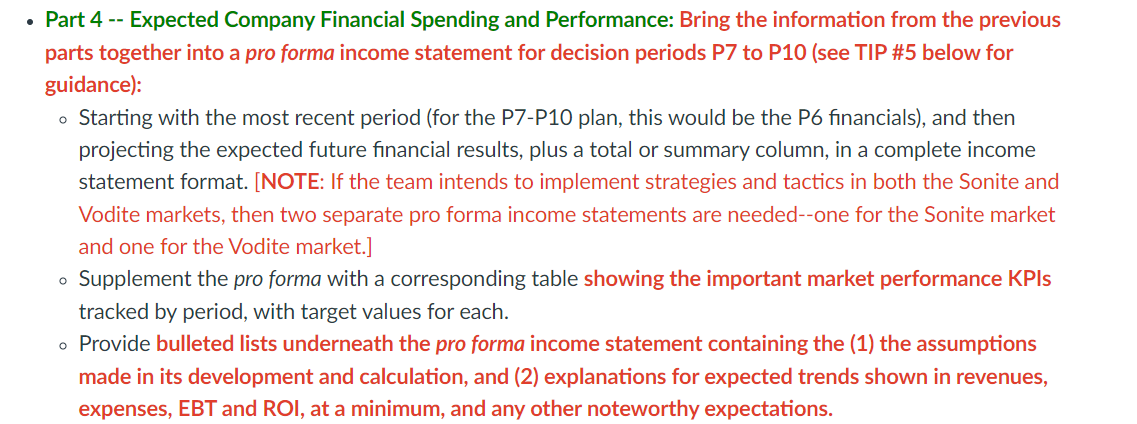

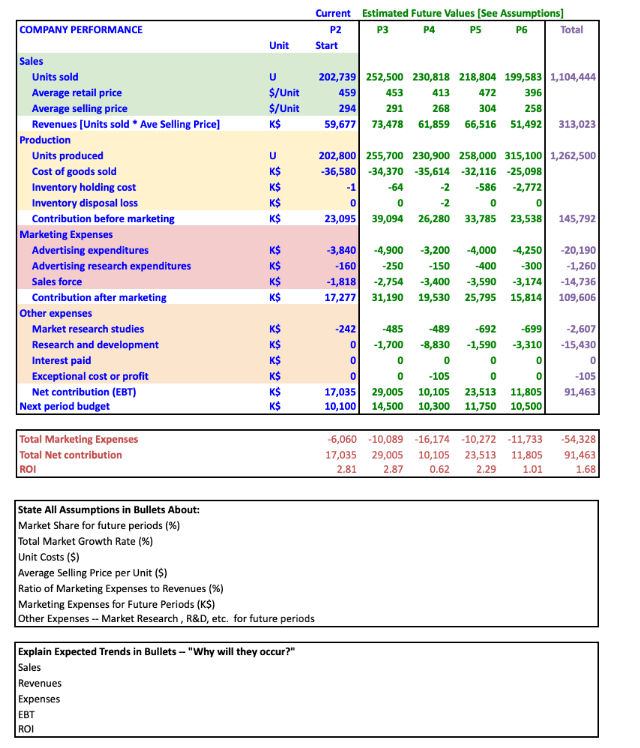

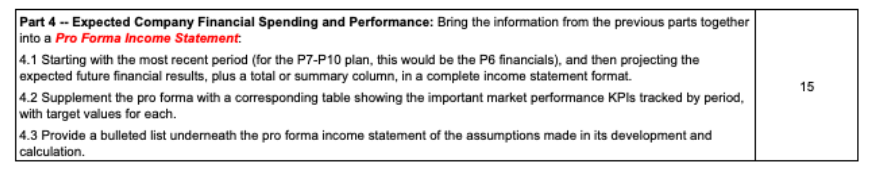

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multirow{3}{*}{ COMPANY PERFORMANCE } & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{c} Current \\ P2 \end{tabular}}} & \multicolumn{5}{|c|}{ Estimated Future Values [See Assumptions] } \\ \hline & & & P3 & P4 & P5 & P6 & Total \\ \hline & Unit & Start & & & & & \\ \hline \multicolumn{8}{|l|}{ Sales } \\ \hline Units sold & u & 202,739 & 252,500 & 230,818 & 218,804 & 199,583 & 1,104,444 \\ \hline Average retail price & $/ Unit & 459 & 453 & 413 & 472 & 396 & \\ \hline Average selling price & $/ Unit & 294 & 291 & 268 & 304 & 258 & \\ \hline Revenues [Units sold Ave Selling Price] & K\$ & 59,677 & 73,478 & 61,859 & 66,516 & 51,492 & 313,023 \\ \hline \multicolumn{8}{|l|}{ Production } \\ \hline Units produced & u & 202,800 & 255,700 & 230,900 & 258,000 & 315,100 & 1,262,500 \\ \hline Cost of goods sold & K\$ & 36,580 & 34,370 & 35,614 & 32,116 & 25,098 & \\ \hline Inventory holding cost & K\$ & -1 & -64 & -2 & -586 & 2,772 & \\ \hline Inventory disposal loss & K\$ & 0 & 0 & -2 & 0 & 0 & \\ \hline Contribution before marketing & K\$ & 23,095 & 39,094 & 26,280 & 33,785 & 23,538 & 145,792 \\ \hline \multicolumn{8}{|l|}{ Marketing Expenses } \\ \hline Advertising expenditures & K\$ & 3,840 & 4,900 & 3,200 & 4,000 & 4,250 & 20,190 \\ \hline Advertising research expenditures & K\$ & -160 & -250 & -150 & -400 & -300 & 1,260 \\ \hline Sales force & K\$ & 1,818 & 2,754 & 3,400 & 3,590 & 3,174 & 14,736 \\ \hline Contribution after marketing & K\$ & 17,277 & 31,190 & 19,530 & 25,795 & 15,814 & 109,606 \\ \hline \multicolumn{8}{|l|}{ Other expenses } \\ \hline Market research studies & K\$ & -242 & -485 & -489 & -692 & -699 & 2,607 \\ \hline Research and development & K\$ & 0 & 1,700 & 8,830 & 1,590 & 3,310 & 15,430 \\ \hline Interest paid & K\$ & 0 & 0 & 0 & 0 & 0 & 0 \\ \hline Exceptional cost or profit & K\$ & 0 & 0 & -105 & 0 & 0 & -105 \\ \hline Net contribution (EBT) & K\$ & 17,035 & 29,005 & 10,105 & 23,513 & 11,805 & 91,463 \\ \hline Next period budget & K\$ & 10,100 & 14,500 & 10,300 & 11,750 & 10,500 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Total Marketing Expenses & 6,060 & 10,089 & 16,174 & 10,272 & 11,733 & 54,328 \\ \hline Total Net contribution & 17,035 & 29,005 & 10,105 & 23,513 & 11,805 & 91,463 \\ \hline ROI & 2.81 & 2.87 & 0.62 & 2.29 & 1.01 & 1.68 \\ \hline \end{tabular} \begin{tabular}{|l|} \hline State All Assumptions in Bullets About: \\ Market Share for future periods (\%) \\ Total Market Growth Rate (\%) \\ Unit Costs (\$) \\ Average Selling Price per Unit (\$) \\ Ratio of Marketing Expenses to Revenues (\%) \\ Marketing Expenses for Future Periods (K\$) \\ Other Expenses - Market Research, R\&D, etc. for future periods \\ \hline \end{tabular} \begin{tabular}{|l|} \hline Explain Expected Trends in Bullets - "Why will they occur?" \\ Sales \\ Revenues \\ Expenses \\ EBT \\ ROI \end{tabular} Part 4 -- Expected Company Financial Spending and Performance: Bring the information from the previous parts together into a Pro Forma Income Statement: 4.1 Starting with the most recent period (for the P7-P10 plan, this would be the P6 financials), and then projecting the expected future financial results, plus a total or summary column, in a complete income statement format. 4.2 Supplement the pro forma with a corresponding table showing the important market performance KPIs tracked by period, 15 with target values for each. 4.3 Provide a bulleted list underneath the pro forma income statement of the assumptions made in its development and calculation. Part 4 -- Expected Company Financial Spending and Performance: Bring the information from the previous parts together into a pro forma income statement for decision periods P7 to P10 (see TIP \#5 below for guidance): - Starting with the most recent period (for the P7-P10 plan, this would be the P6 financials), and then projecting the expected future financial results, plus a total or summary column, in a complete income statement format. [NOTE: If the team intends to implement strategies and tactics in both the Sonite and Vodite markets, then two separate pro forma income statements are needed--one for the Sonite market and one for the Vodite market.] - Supplement the pro forma with a corresponding table showing the important market performance KPIs tracked by period, with target values for each. - Provide bulleted lists underneath the pro forma income statement containing the (1) the assumptions made in its development and calculation, and (2) explanations for expected trends shown in revenues, expenses, EBT and ROI, at a minimum, and any other noteworthy expectations

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multirow{3}{*}{ COMPANY PERFORMANCE } & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{c} Current \\ P2 \end{tabular}}} & \multicolumn{5}{|c|}{ Estimated Future Values [See Assumptions] } \\ \hline & & & P3 & P4 & P5 & P6 & Total \\ \hline & Unit & Start & & & & & \\ \hline \multicolumn{8}{|l|}{ Sales } \\ \hline Units sold & u & 202,739 & 252,500 & 230,818 & 218,804 & 199,583 & 1,104,444 \\ \hline Average retail price & $/ Unit & 459 & 453 & 413 & 472 & 396 & \\ \hline Average selling price & $/ Unit & 294 & 291 & 268 & 304 & 258 & \\ \hline Revenues [Units sold Ave Selling Price] & K\$ & 59,677 & 73,478 & 61,859 & 66,516 & 51,492 & 313,023 \\ \hline \multicolumn{8}{|l|}{ Production } \\ \hline Units produced & u & 202,800 & 255,700 & 230,900 & 258,000 & 315,100 & 1,262,500 \\ \hline Cost of goods sold & K\$ & 36,580 & 34,370 & 35,614 & 32,116 & 25,098 & \\ \hline Inventory holding cost & K\$ & -1 & -64 & -2 & -586 & 2,772 & \\ \hline Inventory disposal loss & K\$ & 0 & 0 & -2 & 0 & 0 & \\ \hline Contribution before marketing & K\$ & 23,095 & 39,094 & 26,280 & 33,785 & 23,538 & 145,792 \\ \hline \multicolumn{8}{|l|}{ Marketing Expenses } \\ \hline Advertising expenditures & K\$ & 3,840 & 4,900 & 3,200 & 4,000 & 4,250 & 20,190 \\ \hline Advertising research expenditures & K\$ & -160 & -250 & -150 & -400 & -300 & 1,260 \\ \hline Sales force & K\$ & 1,818 & 2,754 & 3,400 & 3,590 & 3,174 & 14,736 \\ \hline Contribution after marketing & K\$ & 17,277 & 31,190 & 19,530 & 25,795 & 15,814 & 109,606 \\ \hline \multicolumn{8}{|l|}{ Other expenses } \\ \hline Market research studies & K\$ & -242 & -485 & -489 & -692 & -699 & 2,607 \\ \hline Research and development & K\$ & 0 & 1,700 & 8,830 & 1,590 & 3,310 & 15,430 \\ \hline Interest paid & K\$ & 0 & 0 & 0 & 0 & 0 & 0 \\ \hline Exceptional cost or profit & K\$ & 0 & 0 & -105 & 0 & 0 & -105 \\ \hline Net contribution (EBT) & K\$ & 17,035 & 29,005 & 10,105 & 23,513 & 11,805 & 91,463 \\ \hline Next period budget & K\$ & 10,100 & 14,500 & 10,300 & 11,750 & 10,500 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Total Marketing Expenses & 6,060 & 10,089 & 16,174 & 10,272 & 11,733 & 54,328 \\ \hline Total Net contribution & 17,035 & 29,005 & 10,105 & 23,513 & 11,805 & 91,463 \\ \hline ROI & 2.81 & 2.87 & 0.62 & 2.29 & 1.01 & 1.68 \\ \hline \end{tabular} \begin{tabular}{|l|} \hline State All Assumptions in Bullets About: \\ Market Share for future periods (\%) \\ Total Market Growth Rate (\%) \\ Unit Costs (\$) \\ Average Selling Price per Unit (\$) \\ Ratio of Marketing Expenses to Revenues (\%) \\ Marketing Expenses for Future Periods (K\$) \\ Other Expenses - Market Research, R\&D, etc. for future periods \\ \hline \end{tabular} \begin{tabular}{|l|} \hline Explain Expected Trends in Bullets - "Why will they occur?" \\ Sales \\ Revenues \\ Expenses \\ EBT \\ ROI \end{tabular} Part 4 -- Expected Company Financial Spending and Performance: Bring the information from the previous parts together into a Pro Forma Income Statement: 4.1 Starting with the most recent period (for the P7-P10 plan, this would be the P6 financials), and then projecting the expected future financial results, plus a total or summary column, in a complete income statement format. 4.2 Supplement the pro forma with a corresponding table showing the important market performance KPIs tracked by period, 15 with target values for each. 4.3 Provide a bulleted list underneath the pro forma income statement of the assumptions made in its development and calculation. Part 4 -- Expected Company Financial Spending and Performance: Bring the information from the previous parts together into a pro forma income statement for decision periods P7 to P10 (see TIP \#5 below for guidance): - Starting with the most recent period (for the P7-P10 plan, this would be the P6 financials), and then projecting the expected future financial results, plus a total or summary column, in a complete income statement format. [NOTE: If the team intends to implement strategies and tactics in both the Sonite and Vodite markets, then two separate pro forma income statements are needed--one for the Sonite market and one for the Vodite market.] - Supplement the pro forma with a corresponding table showing the important market performance KPIs tracked by period, with target values for each. - Provide bulleted lists underneath the pro forma income statement containing the (1) the assumptions made in its development and calculation, and (2) explanations for expected trends shown in revenues, expenses, EBT and ROI, at a minimum, and any other noteworthy expectations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started