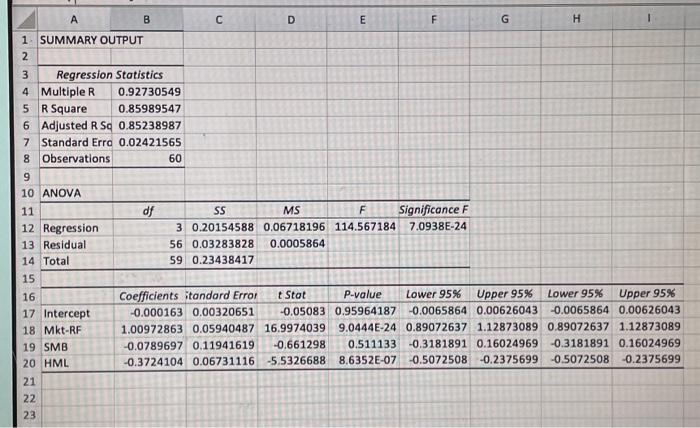

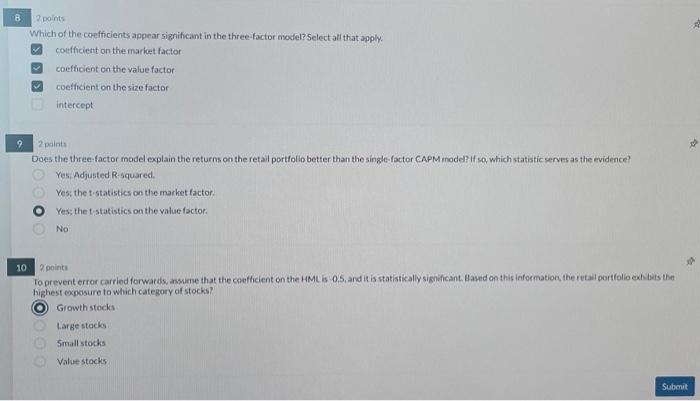

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & A & B & C & D & E & F & G & H & 1 \\ \hline 1. & \multicolumn{2}{|c|}{ SUMMARY OUTPUT } & & & 18 & & & & \\ \hline 2 & & & & t & & & & & \\ \hline 3 & \multicolumn{2}{|c|}{ Regression Statistics } & & & & & & & \\ \hline 4 & Multiple R & 0.92730549 & & & & & & & \\ \hline 5 & R Square & 0.85989547 & & & & & & & \\ \hline 6 & Adjusted R Sq & 0.85238987 & & & & & & & \\ \hline 7 & Standard Erro & 0.02421565 & & & & & & & \\ \hline 8 & Observations & 60 & & & & & & & \\ \hline 9 & & & 2 & & & & & & \\ \hline 10 & ANOVA & & & & & & & & \\ \hline 11 & & df & SS & MS & F & Significance F & & & \\ \hline 12 & Regression & 3 & 0.20154588 & 0.06718196 & 114.567184 & 7.0938E24 & & & \\ \hline 13 & Residual & 56 & 0.03283828 & 0.0005864 & & & & & \\ \hline 14 & Total & 59 & 0.23438417 & & & & & & \\ \hline 15 & & & & & & & & & \\ \hline 16 & & Coefficients : & itandard Error & t Stat & P-value & Lower 95\% & Upper 95\% & Lower 95\% & Upper 95\% \\ \hline 17 & Intercept & -0.000163 & 0.00320651 & -0.05083 & 0.95964187 & -0.0065864 & 0.00626043 & -0.0065864 & 0.00626043 \\ \hline 18 & Mkt-RF & 1.00972863 & 0.05940487 & 16.9974039 & 9.0444E24 & 0.89072637 & 1.12873089 & 0.89072637 & 1.12873089 \\ \hline 19 & SMB & -0.0789697 & 0.11941619 & -0.661298 & 0.511133 & -0.3181891 & 0.16024969 & -0.3181891 & 0.16024969 \\ \hline 20 & HML & -0.3724104 & 0.06731116 & -5.5326688 & 8.6352E07 & -0.5072508 & -0.2375699 & -0.5072508 & -0.2375699 \\ \hline 21 & & & & & & & & & \\ \hline 22 & & & & & & & & & \\ \hline 23 & & & & & & & & & \\ \hline \end{tabular} 2points Which of the coefficients appear significant in the three-factor model? Select all that apply. coefficient on the market factor coefficient on the value factor coefficient on the size factor intercept 2 paints Does the three-factor model explain the returns on the retail portfolio better than the single-factor CAPM inodel? if sa which statistic serves as the evidence? Yes, Adjusted R-squared. Yes: the t-statistics on the market factor. Yes; the t-statistics on the value factor. No 2 points To prevent error carried forwards, ansume that the coefficient on the HML is - 0.5 , and it is statistically significant. Based on this information, the retal portfolio exh ibits the highest exposure to which category of stocks? Growth stocks Larke stocks Small stocks Value stocks