Answered step by step

Verified Expert Solution

Question

1 Approved Answer

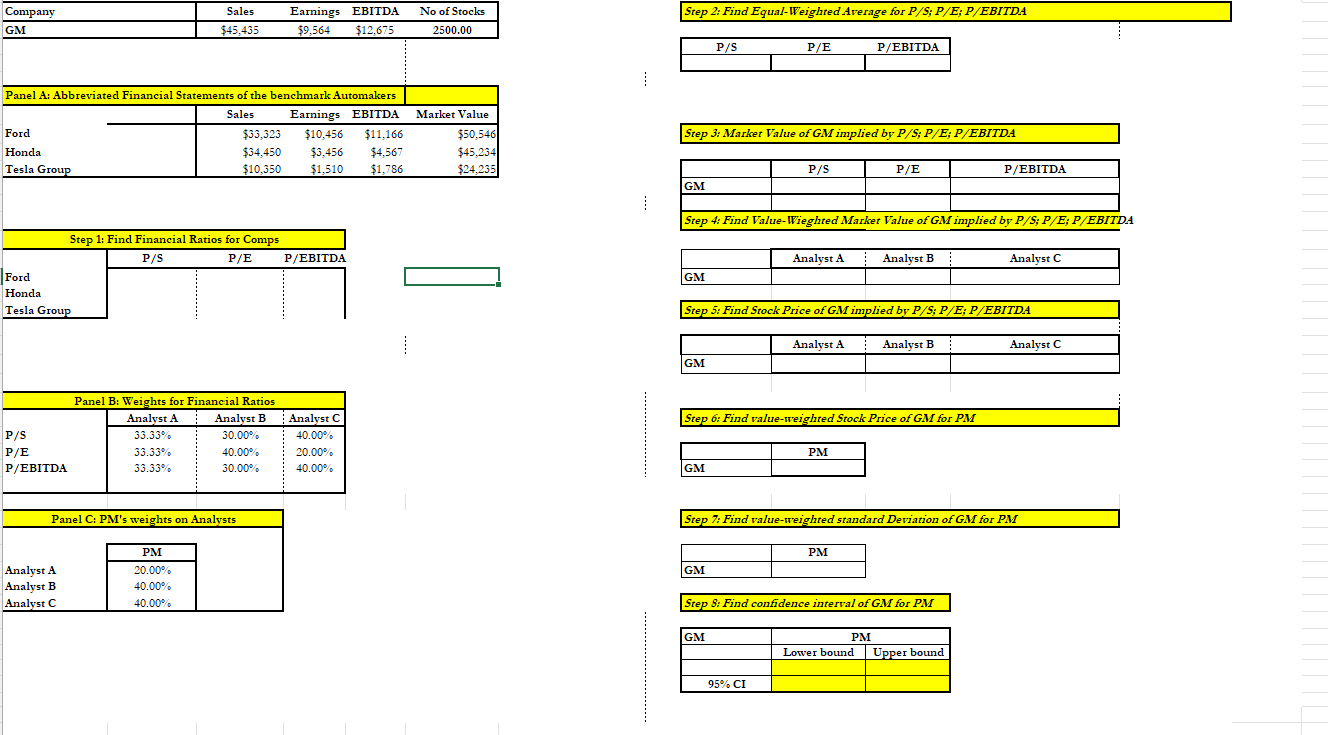

begin{tabular}{|l|cccc|} hline Company & Sales & Earnings & EBITDA & No of Stocks hline GM & $45,435 & $9,564 & $12,675 & 2500.00

\begin{tabular}{|l|cccc|} \hline Company & Sales & Earnings & EBITDA & No of Stocks \\ \hline GM & $45,435 & $9,564 & $12,675 & 2500.00 \\ \hline \end{tabular} Step 2: Find Equal-Weighted Average for P/S;P/E;P/EBITDA \begin{tabular}{|l|rrrr|} \hline Panel A: Abbreviated Financial Statements of the benchmark Automakers & \\ \hline & \multicolumn{1}{|c|}{ Sales } & Earnings & EBITDA & Market Value \\ \cline { 2 - 6 } Ford & $33,323 & $10,456 & $11,166 & $50,546 \\ Honda & $34,450 & $3,456 & $4,567 & $45,234 \\ Tesla Group & $10,350 & $1,510 & $1,786 & $24,235 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline P/S & P/E & P/ EBITDA \\ \hline & & \\ \hline \end{tabular} Step 3: Market Value of GM implied by P/S;P/E;P/EBITDA \begin{tabular}{|l|c|c|c|} \hline & P/S & P/E & P/EBITDA \\ \hline GM & & & \\ \hline \multicolumn{3}{|c|}{} \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{4}{|c|}{ Step 1: Find Financial Ratios for Comps } \\ \hline \multirow{3}{*}{FordHondaTeslaGroup} & P/S & P/E & P/EBITDA \\ \cline { 2 - 4 } & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline & Analyst A & Analyst B & Analyst C \\ \hline GM & & & \\ \hline \end{tabular} Step 5: Find Stock Price of GM implied by P/S;P/E;P/EBITDA \begin{tabular}{|l|c|c|c|} \hline & Analyst A & Analyst B & Analyst C \\ \hline GM & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{4}{|c|}{ Panel B: Weights for Financial Ratios } \\ \hline \multirow{3}{*}{ P/S } & Analyst A & Analyst B & Analyst C \\ \cline { 2 - 5 } P/E & 33.33% & 30.00% & 40.00% \\ P/EBITDA & 33.33% & 40.00% & 20.00% \\ & 33.33% & 30.00% & 40.00% \\ \hline \end{tabular} Step 6: Find value-wreighted Stock Price of GM for PM \begin{tabular}{|l|c|} \hline & PM \\ \hline GM & \\ \hline \end{tabular} Step 7: Find value-weighted standard Deviation of GM for PM \begin{tabular}{|l|c|} \hline & PM \\ \hline GM & \\ \hline \end{tabular} Step S: Find confidence interval of GM for PM \begin{tabular}{|l|l|l|} \hline GM & \multicolumn{2}{|c|}{ PM } \\ \hline & Lower bound & Upper bound \\ \hline & & \\ \hline 95% CI & & \\ \hline \end{tabular} \begin{tabular}{|l|cccc|} \hline Company & Sales & Earnings & EBITDA & No of Stocks \\ \hline GM & $45,435 & $9,564 & $12,675 & 2500.00 \\ \hline \end{tabular} Step 2: Find Equal-Weighted Average for P/S;P/E;P/EBITDA \begin{tabular}{|l|rrrr|} \hline Panel A: Abbreviated Financial Statements of the benchmark Automakers & \\ \hline & \multicolumn{1}{|c|}{ Sales } & Earnings & EBITDA & Market Value \\ \cline { 2 - 6 } Ford & $33,323 & $10,456 & $11,166 & $50,546 \\ Honda & $34,450 & $3,456 & $4,567 & $45,234 \\ Tesla Group & $10,350 & $1,510 & $1,786 & $24,235 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline P/S & P/E & P/ EBITDA \\ \hline & & \\ \hline \end{tabular} Step 3: Market Value of GM implied by P/S;P/E;P/EBITDA \begin{tabular}{|l|c|c|c|} \hline & P/S & P/E & P/EBITDA \\ \hline GM & & & \\ \hline \multicolumn{3}{|c|}{} \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{4}{|c|}{ Step 1: Find Financial Ratios for Comps } \\ \hline \multirow{3}{*}{FordHondaTeslaGroup} & P/S & P/E & P/EBITDA \\ \cline { 2 - 4 } & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline & Analyst A & Analyst B & Analyst C \\ \hline GM & & & \\ \hline \end{tabular} Step 5: Find Stock Price of GM implied by P/S;P/E;P/EBITDA \begin{tabular}{|l|c|c|c|} \hline & Analyst A & Analyst B & Analyst C \\ \hline GM & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{4}{|c|}{ Panel B: Weights for Financial Ratios } \\ \hline \multirow{3}{*}{ P/S } & Analyst A & Analyst B & Analyst C \\ \cline { 2 - 5 } P/E & 33.33% & 30.00% & 40.00% \\ P/EBITDA & 33.33% & 40.00% & 20.00% \\ & 33.33% & 30.00% & 40.00% \\ \hline \end{tabular} Step 6: Find value-wreighted Stock Price of GM for PM \begin{tabular}{|l|c|} \hline & PM \\ \hline GM & \\ \hline \end{tabular} Step 7: Find value-weighted standard Deviation of GM for PM \begin{tabular}{|l|c|} \hline & PM \\ \hline GM & \\ \hline \end{tabular} Step S: Find confidence interval of GM for PM \begin{tabular}{|l|l|l|} \hline GM & \multicolumn{2}{|c|}{ PM } \\ \hline & Lower bound & Upper bound \\ \hline & & \\ \hline 95% CI & & \\ \hline \end{tabular}

\begin{tabular}{|l|cccc|} \hline Company & Sales & Earnings & EBITDA & No of Stocks \\ \hline GM & $45,435 & $9,564 & $12,675 & 2500.00 \\ \hline \end{tabular} Step 2: Find Equal-Weighted Average for P/S;P/E;P/EBITDA \begin{tabular}{|l|rrrr|} \hline Panel A: Abbreviated Financial Statements of the benchmark Automakers & \\ \hline & \multicolumn{1}{|c|}{ Sales } & Earnings & EBITDA & Market Value \\ \cline { 2 - 6 } Ford & $33,323 & $10,456 & $11,166 & $50,546 \\ Honda & $34,450 & $3,456 & $4,567 & $45,234 \\ Tesla Group & $10,350 & $1,510 & $1,786 & $24,235 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline P/S & P/E & P/ EBITDA \\ \hline & & \\ \hline \end{tabular} Step 3: Market Value of GM implied by P/S;P/E;P/EBITDA \begin{tabular}{|l|c|c|c|} \hline & P/S & P/E & P/EBITDA \\ \hline GM & & & \\ \hline \multicolumn{3}{|c|}{} \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{4}{|c|}{ Step 1: Find Financial Ratios for Comps } \\ \hline \multirow{3}{*}{FordHondaTeslaGroup} & P/S & P/E & P/EBITDA \\ \cline { 2 - 4 } & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline & Analyst A & Analyst B & Analyst C \\ \hline GM & & & \\ \hline \end{tabular} Step 5: Find Stock Price of GM implied by P/S;P/E;P/EBITDA \begin{tabular}{|l|c|c|c|} \hline & Analyst A & Analyst B & Analyst C \\ \hline GM & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{4}{|c|}{ Panel B: Weights for Financial Ratios } \\ \hline \multirow{3}{*}{ P/S } & Analyst A & Analyst B & Analyst C \\ \cline { 2 - 5 } P/E & 33.33% & 30.00% & 40.00% \\ P/EBITDA & 33.33% & 40.00% & 20.00% \\ & 33.33% & 30.00% & 40.00% \\ \hline \end{tabular} Step 6: Find value-wreighted Stock Price of GM for PM \begin{tabular}{|l|c|} \hline & PM \\ \hline GM & \\ \hline \end{tabular} Step 7: Find value-weighted standard Deviation of GM for PM \begin{tabular}{|l|c|} \hline & PM \\ \hline GM & \\ \hline \end{tabular} Step S: Find confidence interval of GM for PM \begin{tabular}{|l|l|l|} \hline GM & \multicolumn{2}{|c|}{ PM } \\ \hline & Lower bound & Upper bound \\ \hline & & \\ \hline 95% CI & & \\ \hline \end{tabular} \begin{tabular}{|l|cccc|} \hline Company & Sales & Earnings & EBITDA & No of Stocks \\ \hline GM & $45,435 & $9,564 & $12,675 & 2500.00 \\ \hline \end{tabular} Step 2: Find Equal-Weighted Average for P/S;P/E;P/EBITDA \begin{tabular}{|l|rrrr|} \hline Panel A: Abbreviated Financial Statements of the benchmark Automakers & \\ \hline & \multicolumn{1}{|c|}{ Sales } & Earnings & EBITDA & Market Value \\ \cline { 2 - 6 } Ford & $33,323 & $10,456 & $11,166 & $50,546 \\ Honda & $34,450 & $3,456 & $4,567 & $45,234 \\ Tesla Group & $10,350 & $1,510 & $1,786 & $24,235 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline P/S & P/E & P/ EBITDA \\ \hline & & \\ \hline \end{tabular} Step 3: Market Value of GM implied by P/S;P/E;P/EBITDA \begin{tabular}{|l|c|c|c|} \hline & P/S & P/E & P/EBITDA \\ \hline GM & & & \\ \hline \multicolumn{3}{|c|}{} \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{4}{|c|}{ Step 1: Find Financial Ratios for Comps } \\ \hline \multirow{3}{*}{FordHondaTeslaGroup} & P/S & P/E & P/EBITDA \\ \cline { 2 - 4 } & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline & Analyst A & Analyst B & Analyst C \\ \hline GM & & & \\ \hline \end{tabular} Step 5: Find Stock Price of GM implied by P/S;P/E;P/EBITDA \begin{tabular}{|l|c|c|c|} \hline & Analyst A & Analyst B & Analyst C \\ \hline GM & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline \multicolumn{4}{|c|}{ Panel B: Weights for Financial Ratios } \\ \hline \multirow{3}{*}{ P/S } & Analyst A & Analyst B & Analyst C \\ \cline { 2 - 5 } P/E & 33.33% & 30.00% & 40.00% \\ P/EBITDA & 33.33% & 40.00% & 20.00% \\ & 33.33% & 30.00% & 40.00% \\ \hline \end{tabular} Step 6: Find value-wreighted Stock Price of GM for PM \begin{tabular}{|l|c|} \hline & PM \\ \hline GM & \\ \hline \end{tabular} Step 7: Find value-weighted standard Deviation of GM for PM \begin{tabular}{|l|c|} \hline & PM \\ \hline GM & \\ \hline \end{tabular} Step S: Find confidence interval of GM for PM \begin{tabular}{|l|l|l|} \hline GM & \multicolumn{2}{|c|}{ PM } \\ \hline & Lower bound & Upper bound \\ \hline & & \\ \hline 95% CI & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started