Answered step by step

Verified Expert Solution

Question

1 Approved Answer

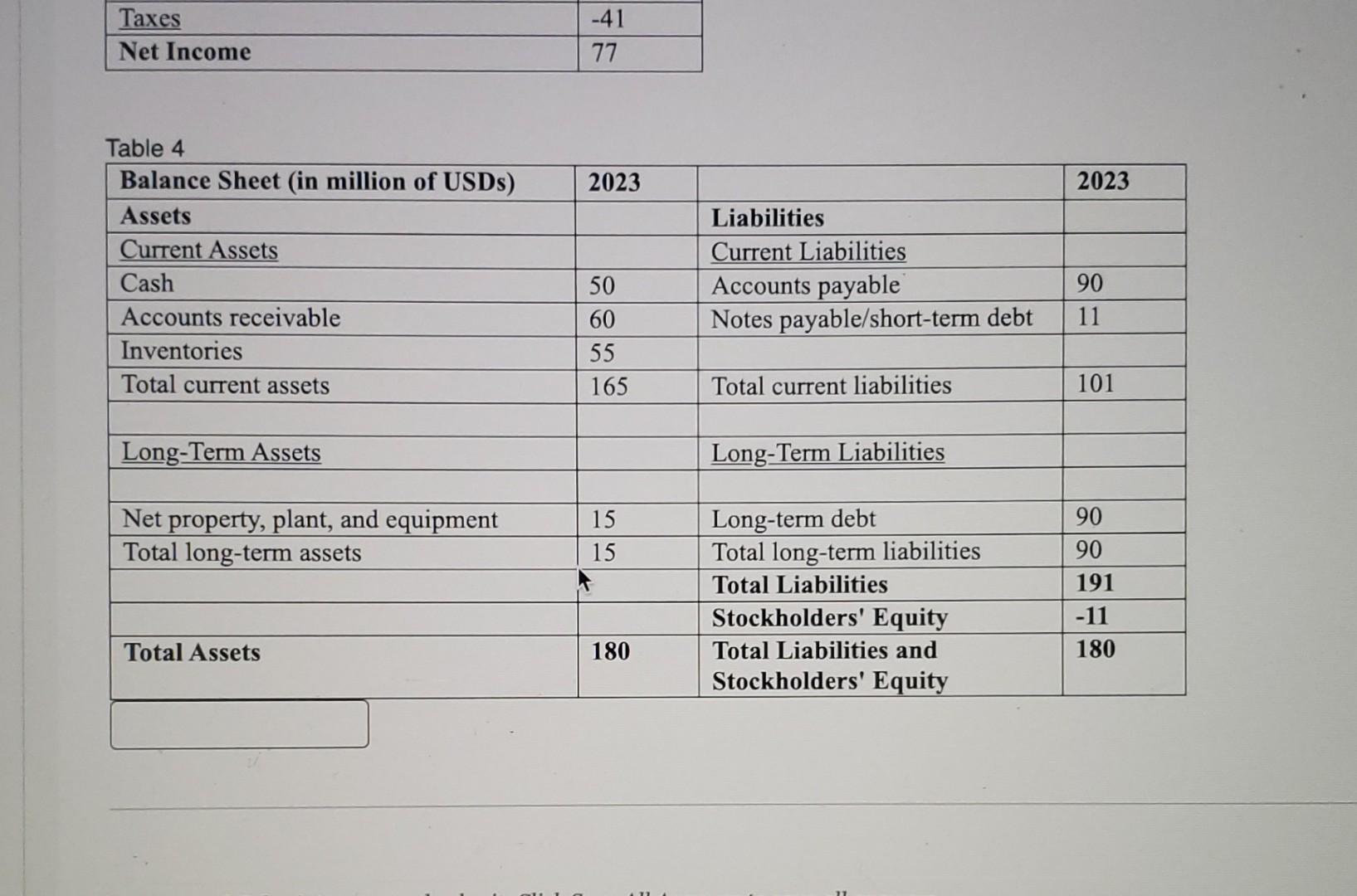

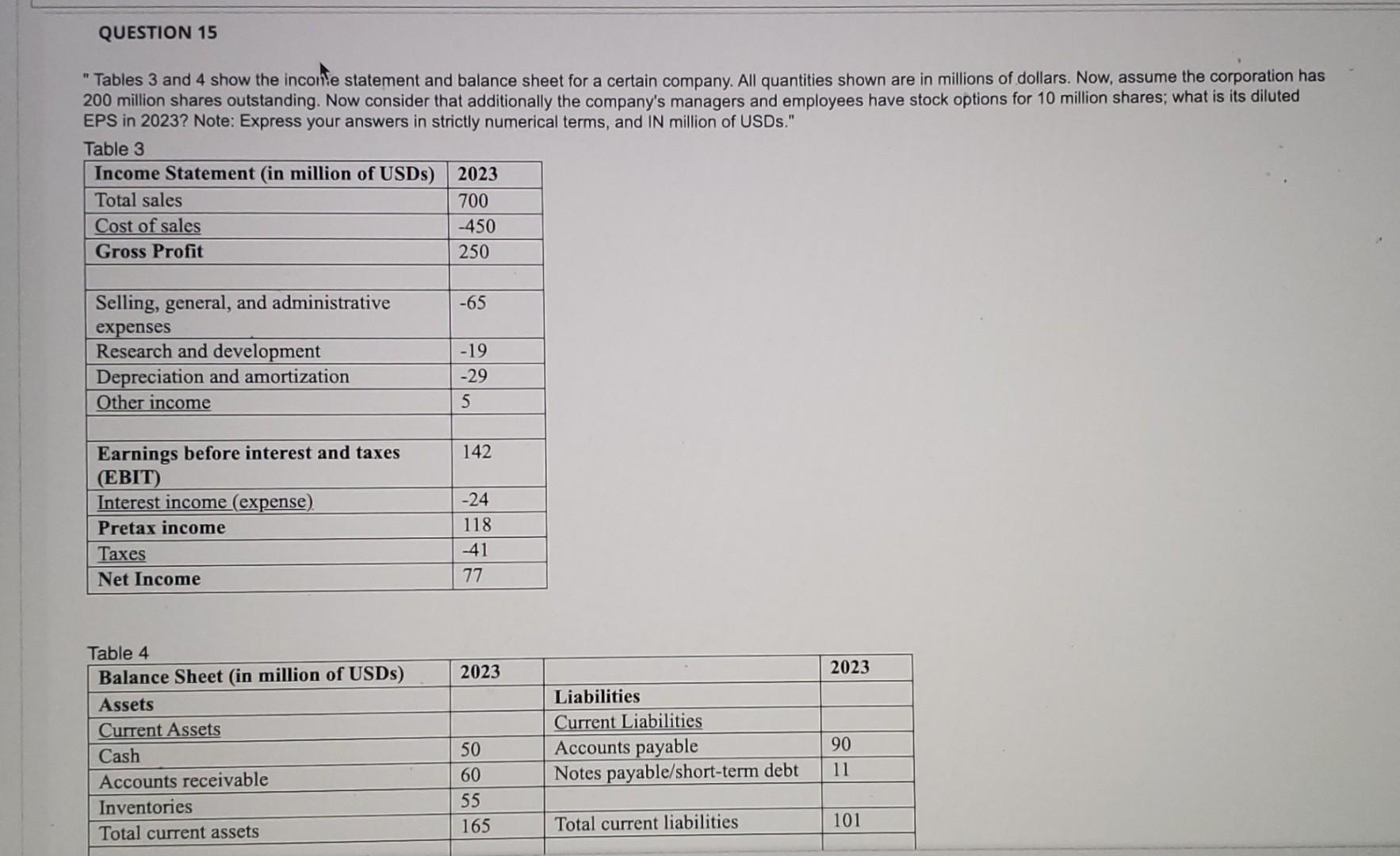

begin{tabular}{|l|l|} hline Taxes & -41 hline Net Income & 77 hline end{tabular} Table 4 begin{tabular}{|l|l|l|l|} hline Balance Sheet (in million of USDs) &

\begin{tabular}{|l|l|} \hline Taxes & -41 \\ \hline Net Income & 77 \\ \hline \end{tabular} Table 4 \begin{tabular}{|l|l|l|l|} \hline Balance Sheet (in million of USDs) & 2023 & & 2023 \\ \hline Assets & & Liabilities & \\ \hline Current Assets & & Current Liabilities & \\ \hline Cash & 50 & Accounts payable & 90 \\ \hline Accounts receivable & 60 & Notes payable/short-term debt & 11 \\ \hline Inventories & 55 & & \\ \hline Total current assets & 165 & Total current liabilities & 101 \\ \hline & & & \\ \hline Long-Term Assets & & Long-Term Liabilities & \\ \hline & & & \\ \hline Net property, plant, and equipment & 15 & Long-term debt & 90 \\ \hline Total long-term assets & 15 & Total long-term liabilities & 90 \\ \hline & & Total Liabilities & 191 \\ \hline & & Stockholders' Equity & 11 \\ \hline Total Assets & 180 & TotalLiabilitiesandStockholdersEquity & 180 \\ \hline \end{tabular} "Tables 3 and 4 show the incortie statement and balance sheet for a certain company. All quantities shown are in millions of dollars. Now, assume the corporation has 200 million shares outstanding. Now consider that additionally the company's managers and employees have stock options for 10 million shares; what is its diluted EPS in 2023? Note: Express your answers in strictly numerical terms, and IN million of USDs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started