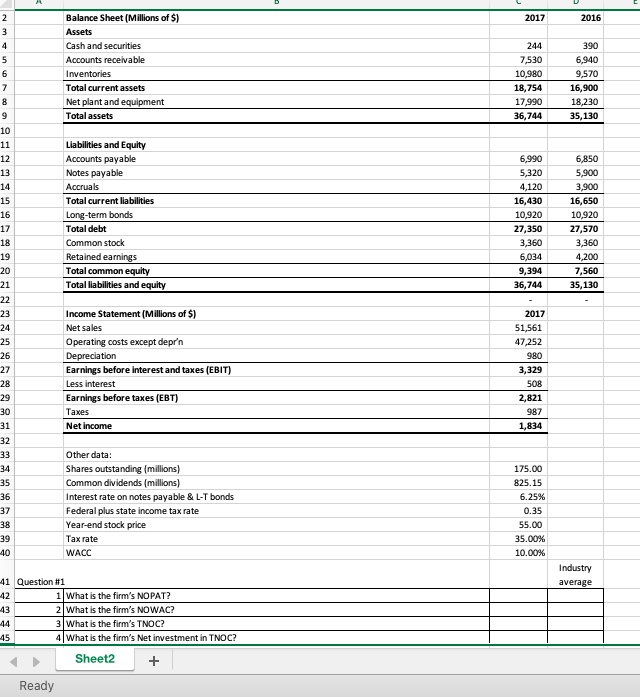

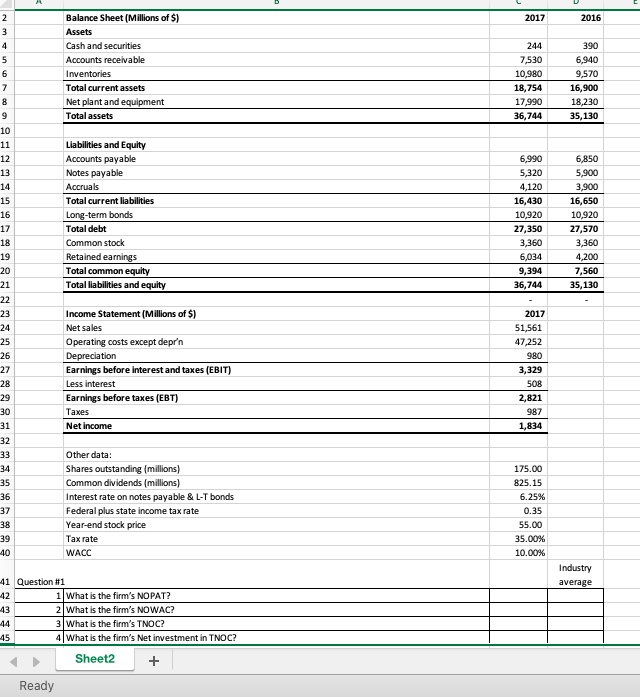

\begin{tabular}{|l|l|r|r|r|} \hline 2 & Balance Sheet (Millions of \$) & 2017 \\ \hline 3 & Assets \\ \hline 4 & Cash and securities & 2016 \\ \hline 5 & Accounts recelvable & 390 \\ \hline 6 & Inventories & 6,940 \\ \hline 7 & Total current assets & 9,570 \\ \hline 8 & Net plant and equipment & 10,980 & 18,900 \\ \hline Total assets & 18,230 \\ \hline 9 & & 35,130 \\ \hline \end{tabular} Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock Retained earnings Total common equity Total liabilities and equity Income Statement (Millions of \$) Net sales Operating costs except depr'n Depreciation Earnings before interest and taxes (EBIT) \begin{tabular}{|l|r|} \hline Less interest & 508 \\ \hline Earnings before taxes (EBT) & 2,821 \end{tabular} Taxes Net income Other data: Shares outstanding (millions) Common dividends (millions) Interest rate on notes payable \& L-T bonds Federal plus state income tax rate Year-end stock price Tax rate WACC Industry Question \#1 average \begin{tabular}{|l|l|l|l|} \hline 42 & What is the firm's NOPAT? & \\ \hline 43 & 2 & What is the firm's NOWAC? & \\ \hline 44 & 3 & What is the firm's TNOC? & \\ 45 & 4 & What is the firm's Net investment in TNOC? & \\ \hline \end{tabular} Sheet2 + Ready \begin{tabular}{|l|l|r|r|r|} \hline 2 & Balance Sheet (Millions of \$) & 2017 \\ \hline 3 & Assets \\ \hline 4 & Cash and securities & 2016 \\ \hline 5 & Accounts recelvable & 390 \\ \hline 6 & Inventories & 6,940 \\ \hline 7 & Total current assets & 9,570 \\ \hline 8 & Net plant and equipment & 10,980 & 18,900 \\ \hline Total assets & 18,230 \\ \hline 9 & & 35,130 \\ \hline \end{tabular} Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock Retained earnings Total common equity Total liabilities and equity Income Statement (Millions of \$) Net sales Operating costs except depr'n Depreciation Earnings before interest and taxes (EBIT) \begin{tabular}{|l|r|} \hline Less interest & 508 \\ \hline Earnings before taxes (EBT) & 2,821 \end{tabular} Taxes Net income Other data: Shares outstanding (millions) Common dividends (millions) Interest rate on notes payable \& L-T bonds Federal plus state income tax rate Year-end stock price Tax rate WACC Industry Question \#1 average \begin{tabular}{|l|l|l|l|} \hline 42 & What is the firm's NOPAT? & \\ \hline 43 & 2 & What is the firm's NOWAC? & \\ \hline 44 & 3 & What is the firm's TNOC? & \\ 45 & 4 & What is the firm's Net investment in TNOC? & \\ \hline \end{tabular} Sheet2 + Ready